Justin Sullivan

Snap (NYSE:SNAP) faces a combination of headwinds from Apple’s (AAPL) ATT initiative, increasing competition for ad dollars and deteriorating macro conditions. Management appears to have been completely caught out by this, shifting from extremely bullish guidance to no guidance at all in a matter of months. Advertisers are likely to reduce spending and favor more proven platforms (like Facebook (META)) during a recession, creating further downside risk for Snap.

Despite this, user metrics remain positive and Snap continues to develop measurement solutions to improve ad performance. There are still significant opportunities for Snap to further monetize its user base and margins are likely to continue improving as the business scales. For investors that believe in Snap’s long-term augmented reality vision, this presents an attractive entry point, albeit one with large near-term risks.

Q2 Results

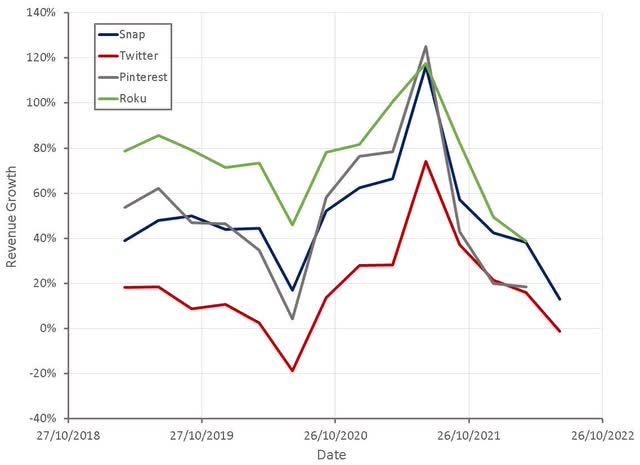

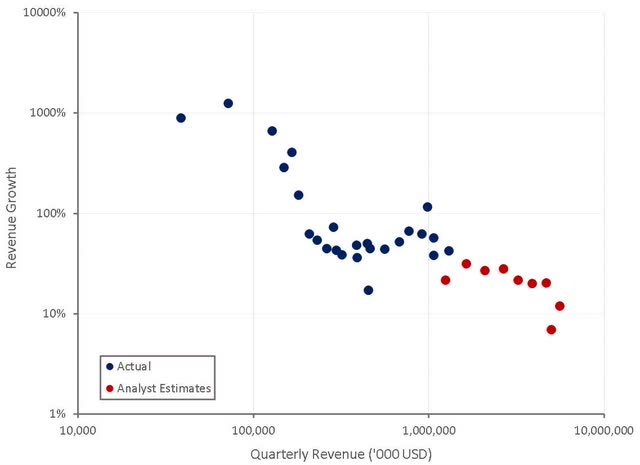

Snap’s revenue growth has rapidly deteriorated from high to low double digits, and could well be negative later in the year. This slowdown appears to be broad based, with Snap’s direct response and brand businesses both affected across a range of industry verticals. Snap has pointed to supply chain issues, inflation and the war in Ukraine as potential culprits for the slowdown, but it should be recognized that there are also likely Snap specific issues.

Management has admitted that Apple’s policy changes, which were implemented in Q3 last year, continue to have a negative impact. This is not surprising, but until recently Snap had been optimistic, and the sudden shift has likely undermined credibility in the eyes of investors. Snap had previously appeared pleased with the rollout of their first-part measurement solutions, which are enabled for advertisers representing more than 90% of Snap’s direct response advertising revenue. Management now appears far less optimistic about their ability to thrive in a privacy-first landscape, and specifically pointed to issues with direct response advertising and advertisers targeting lower funnel objectives, like in-app purchases.

Management pointed to low friction on their platform allowing advertisers to easily ramp up or down spending. This is an issue that most digital advertising platforms face though, meaning it is not clear that it is a valid excuse for Snap’s poor performance. There may be particular issues facing Snap’s advertiser base or their core user demographics, but outside of this, competition for advertising dollars is likely to be the culprit.

Figure 1: Snap Revenue Growth (source: Created by author using data from company reports)

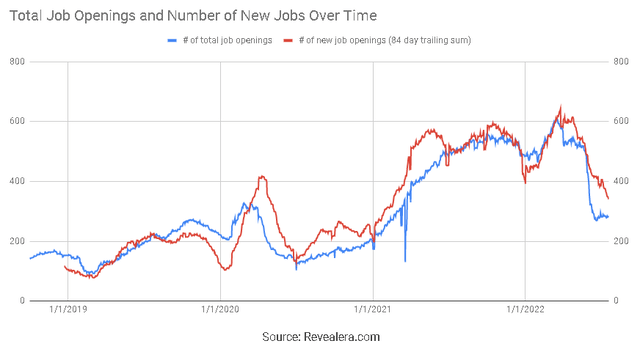

Snap plans to significantly slow their pace of hiring, but has stated that this is a period of significant investment for the business. Given the company’s strong balance sheet, it makes sense for Snap to continue investing in the platform, although an ongoing lack of profits will likely hurt the share price in the short-term.

Figure 2: Snap Hiring Trend (source: Revealera.com)

Snap has also authorized stock repurchases of up to 500 million USD of its Class A common stock, which may be made on a discretionary basis either through open market or privately negotiated transactions. This repurchase program has been designed to offset some of the dilution caused by stock-based compensation, which totaled 594 million USD in the first half of the year. This move has been criticized by many due to the fact that Snap is yet to consistently generate positive free cash flows. Given Snap’s relatively large cash holdings and the fact the company is currently close to breakeven, repurchases aren’t necessarily bad if management believes the stock is undervalued.

Beyond the issues with short-term financial performance, the more important questions are how healthy is usage of Snap’s platform and whether Snap offers advertisers a viable solution. Snap also has a history of aggressive spending, and in the current environment investors expect to see results from this type of spending.

Innovation

A large part of Snap’s stock performance in 2020 and 2021 was driven by the narrative around their innovation in augmented reality. Given their large R&D investments (40% of revenue over the past 12 months) and ongoing losses, Snap should have a healthy pipeline of new products to drive future growth. This is not clear though, as Snap has a tendency to invest in a wide range of projects that are not directly related to the platform and have questionable value.

Desktop

Snap is making Snapchat available for access through Chrome and Edge web browsers. Users will be able to initiate and receive video and voice calls, as well as send text-based Snaps. The service is currently limited to Snapchat+ subscribers, but will eventually be rolled out to all users. Given the dominance of mobile in social media, this is likely to be a low impact initiative.

Snapchat+

Snap recently introduced a paid subscription service (Snapchat+) that offers early access to features like Snapchat for Web. Snapchat+ is targeted at a subset of power users and will continue to serve up ads. This is a similar concept to Twitter Blue (TWTR), which appears to have had limited adoption so far. The service will cost 3.99 USD by month, and hence would need to see significant uptake to impact Snap’s financials.

Stories

Like most social media platforms, short-form video has become a focus area for Snap. Stories enable users to share snaps with friends in narrative form and watch content from professional publishers and influencers in Discover. Despite growing competition, Stories remain the largest driver of revenue for Snap.

Spotlight aims to showcase entertaining snaps created by the community (user created or content publisher), and appears to be an attempt to create more viral content, a la TikTok. Response to Spotlight has reportedly been overwhelmingly positive so far, but there is a risk that Snap loses some of its differentiation. Although, Snap is far from the only social media company pursuing this path.

Content is also becoming increasingly important for Snap, with more than 500 million users watching shows on Discover, and daily time spend for users 25 and above increasing by 25% year-over-year in Q1.

Maps

Maps is an area of Snapchat that is currently lightly monetized, but Snap appears to be in the process of changing this. For example, users can now browse Ticketmaster’s upcoming events on the Map, a feature that is likely either already monetized or going to be monetized. Snap has also introduced a Map Layer from restaurant review site The Infatuation, allowing users to discover restaurants and read reviews from the Map.

There is significant potential to combine the social nature of Snapchat with geographic services, but investors should question why so little progress has made so far when Snap spends so much money on R&D.

Augmented Reality

Augmented reality appears to be the focus of Snap’s R&D efforts, and is likely crucial to the company’s future value. These efforts are also making Snap a more difficult company to assess, as they shift from a pure-play social media company to social media plus an augmented reality technology platform.

Lens Studio is an application designed for artists and developers to build augmented reality experiences for Snapchat users. Snap recently introduced new features which improve capabilities around ray tracing, lighting, shadows, reflections, and depth and expand their API library and Lens Analytics offerings.

Lens Cloud is a collection of backend services that enable developers to create new types of AR experiences. This includes:

- Multiuser Services – enables a group of users to interact with the same AR experience

- Location-Based Services – allows developers to anchor lenses to places

- Storage – developers can store assets on Snap’s servers and access them on demand

Snap has also introduced Camera Kit, an SDK that allows developers to integrate Snap’s capabilities into other apps.

Adoption appears to be reasonably robust, with more than 250,000 creators having built over 2.5 million Lenses. Snap’s AR efforts are interesting and have significant long-term potential, but Snap is up against competitors with far more resources. Meta had expected to spend approximately 10 billion USD on AR, VR and related hardware in 2021, with little expectation of near-term returns.

Some of Snap’s AR initiatives have a tenuous link to Snap’s core platform, and their monetization potential is unclear. Snap has introduced AR functionality which improves the monetization potential of Snapchat though, including technology that transforms product photographs into AR ready assets and a content management platform for businesses to manage their 3D product catalog.

Hardware

As part of their hardware efforts, Snap has developed a small drone with a camera (PIXY). This is obviously an effort to expand the type of content on the Snapchat platform, rather than profit from hardware sales. The strategic logic of these types of moves is not clear though, and it is particularly questionable given Snap’s lack of free cash flow.

Snap’s hardware efforts extend back to 2017, when they introduced the first version of Spectacles. Sales were disappointing though, with only 150,000 pairs sold after eight months, and Snap had to take a 40 million USD write-down on unsold inventory.

Snap was undeterred by this initial failure, as they felt hardware would eventually become an integral part of the business and they had to invest early to develop competency. Snap now offers Spectacle 3 for 380 USD, with functionality upgraded from a basic camera to two HD cameras, which capture 3D photos and videos, and four microphones.

Snap has also developed a pair of next-generation Spectacles for developers, which are not currently available for sale. These Spectacles enable AR and are fully integrated with Lens Studio. They are designed to help developers create AR experiences.

Return on Ad Spend

Apple has forced apps to give users an option to opt-out of tracking in a manner that ensures most users do not opt-in, which has undermined the ability of advertisers to optimize advertising campaigns and measure conversions. Further privacy enhancing measures are also likely coming in iOS 16, like limiting access to IP addresses and preventing fingerprinting techniques.

Snap is enabling privacy-preserving measurement solutions to combat this and continues to improve their first-party solutions. Snap utilizes data collected from opt-in users to model the opt-out audience. This first-party solution has been enabled by advertisers representing more than 90% of Snap’s direct response ad revenue. Third-party solutions, such as SKAdNetwork, have also been widely enabled by advertisers on Snapchat.

Advertisers leveraging lower-funnel goals (i.e. in-app purchases) have been the most impacted by Apple’s privacy changes. These advertisers are migrating to mid-funnel goals where visibility is greater, but returns are also likely lower.

Snap is also offering solutions like conversion API and the Snap Pixel to help advertisers better measure the return on investment of their advertising campaigns.

Conversion API

Snap’s Conversion API allows advertisers to pass web, app, and offline events to Snap in a privacy preserving manner. This helps to optimize ad campaigns, and improve targeting and measurement of conversions.

Snap Pixel

The Snap Pixel is a piece of JavaScript code that is added to advertiser websites to help measure the cross-device impact of campaigns. The Snap Pixel is best suited to direct response goals, such as driving leads, subscriptions, or product sales.

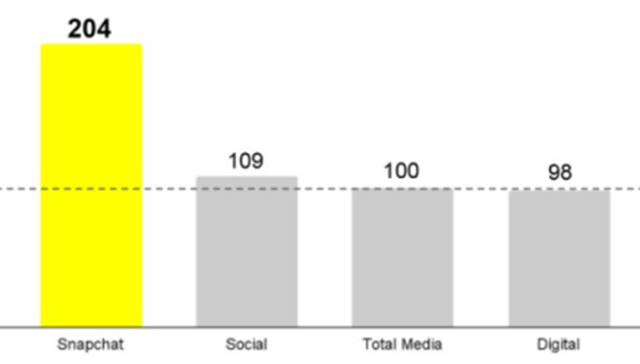

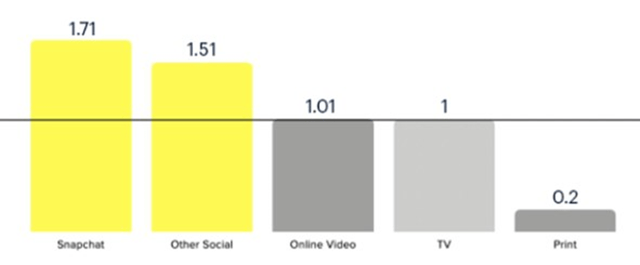

Even prior to the introduction of ATT, it would have been reasonable to question Snap’s advertising capabilities relative to peers. Snap’s adtech is less mature than Facebook’s and Snap is more dependent on brand advertising. It can be difficult to tie the impact of advertising across channels, particularly for top of the funnel advertising that is not directly trying to drive immediate sales. Snap’s data points to high returns on ad spend in a number of categories, but the extent to which this generalizes or has been affected by a loss of signal is unknown.

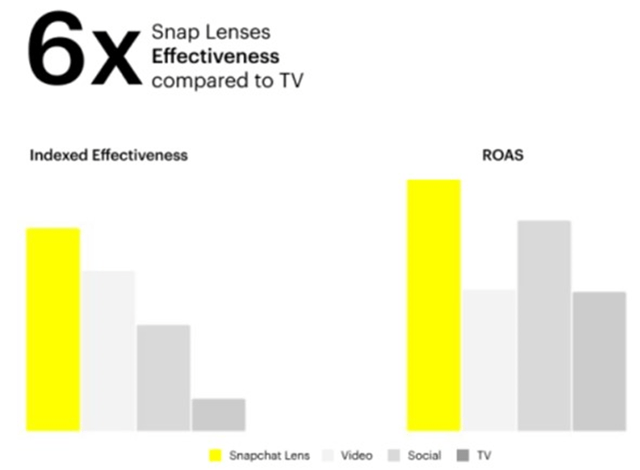

Figure 3: CPG ROI by Digital Channels (Indexed versus Total Media) (source: Snap) Figure 4: ROAS per Media Channel Indexed to TV (US Personal Care & Beauty) (source: Snap) Figure 5: Indexed Effectiveness of AR on Snapchat for Personal Care and Beauty (source: Snap)

It is likely that advertisers break their social media budgets into established (Facebook) and experimental buckets (Snapchat). While all advertising spend is likely to be viewed as discretionary during a downturn, spending on platforms in the experimental bucket is likely to be cut first.

It is also likely that Snap’s user and advertiser base has left them vulnerable relative to peers. Snap has stated that they have relatively low exposure to brick-and-mortar SMBs, but they are likely to be relatively highly exposed to direct-to-consumer, ecommerce and app developers.

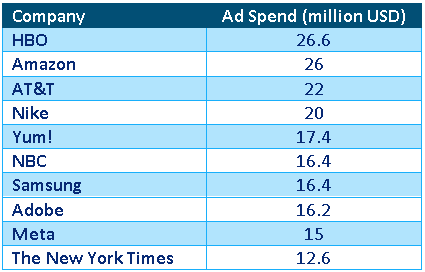

Between January and May 2022, the top 10 advertisers on Snapchat spent over 189 million USD on ads in the US in aggregate and accrued nearly 31 billion impressions. This is somewhere in the vicinity of 20% of Snap’s total ad revenue in the US for this period, showing that Snap’s advertising revenue base is modestly concentrated. Media and retail both appear to be important industries for Snap.

Table 1: US Ad Spend on Snapchat Platform (source: Created by author using data from Pathmatics)

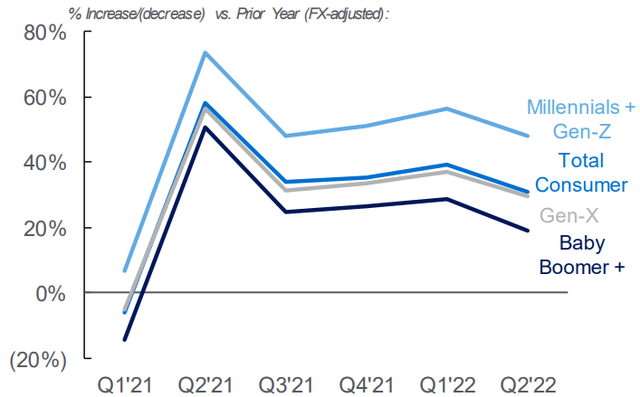

It also needs to be kept in mind that Snap’s audience skews young, which could potentially be impacting performance. Data shows that younger generations were strong spenders through the pandemic, which may be beginning to moderate slightly. Any shifts that impact younger people will have an outsized effect on Snap relative to peers.

Figure 6: American Express Volume Growth by Age Cohort (source: American Express)

Financial Analysis

Snap has a history of impressive revenue growth, and given the continued growth of the user base and potential for further monetization, this growth is likely to continue absent the effects of macroeconomic fluctuations. Growth is moderating as the company scales though, and Snap’s previously stated ambitions of 50% annual revenue growth may be difficult to achieve.

Figure 7: Snap Revenue Growth (source: Created by author using data from Snap)

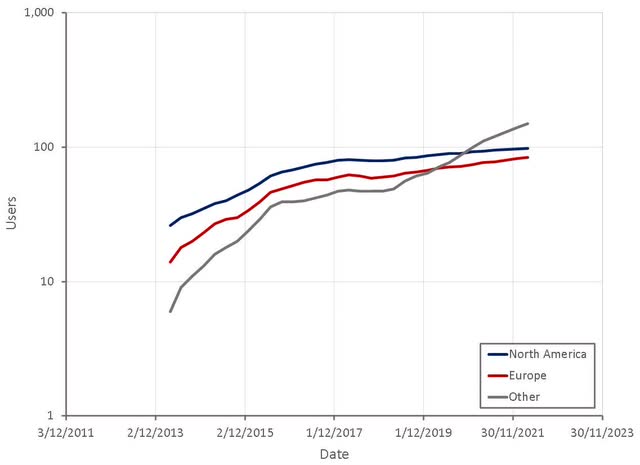

User growth is broad-based across geographies and doesn’t show any influence from the pandemic. Growth is primarily coming outside of North America and Europe, which is a headwind to ARPU growth.

Figure 8: Snap Users (source; Created by author using data from Snap)

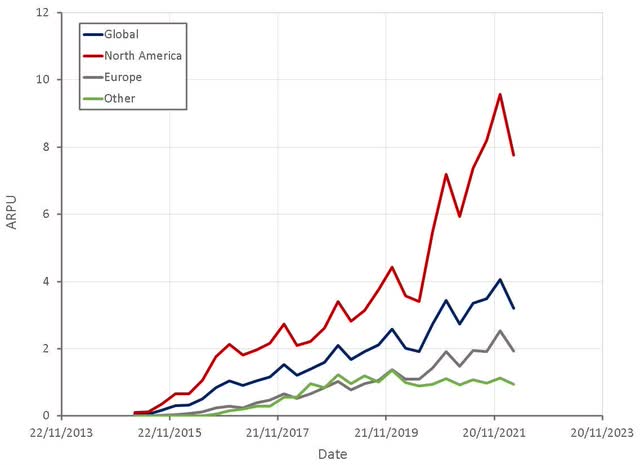

Snap’s average revenue per user trails more mature peers like Facebook, and is even less than the much-maligned Twitter. Spiegel has indicated that monetization is a demand issue (from advertisers) though, and hence this gap is likely to take time to close. Significant progress was made on this front in North America over the past two years, but it is not clear how much of this was influenced by the pandemic. At a global level, Snap faces headwinds as the majority of user growth is coming from developing markets.

Figure 9: Snap ARPU (source: Created by author using data from Snap)

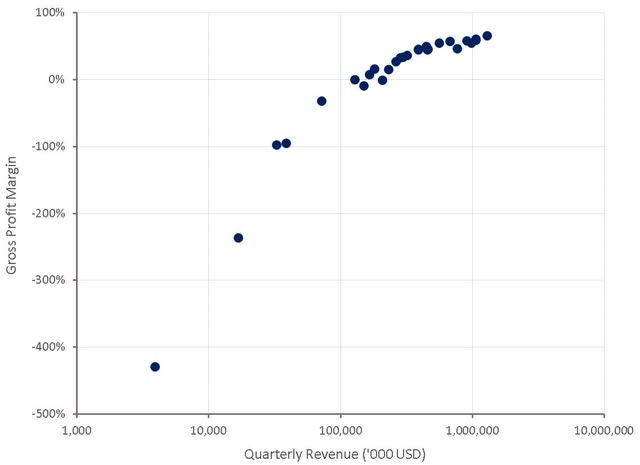

One of the largest uncertainties surrounding Snap is their continued losses and long-term ability to drive meaningful free cash flow. Gross profit margins are improving, although still significantly trail peers like Facebook.

Figure 10: Snap Gross Profit Margins (source: Created by author using data from Snap)

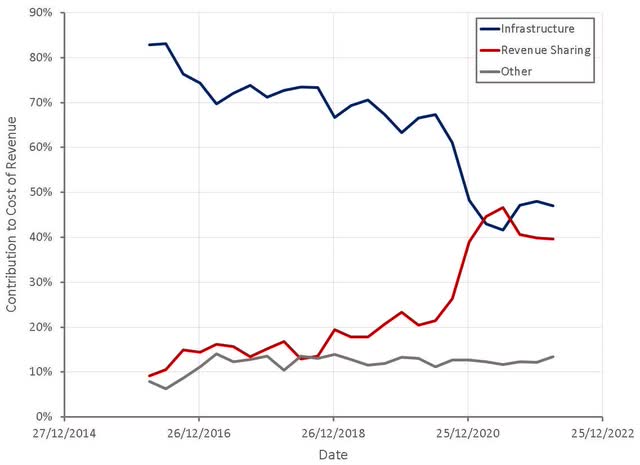

In the past, Snap’s cost of revenue has been dominated by infrastructure costs, but this has changed as content has become more important to the platform.

Figure 11: Snap Cost of Revenue by Component (source: Created by author using data from Snap)

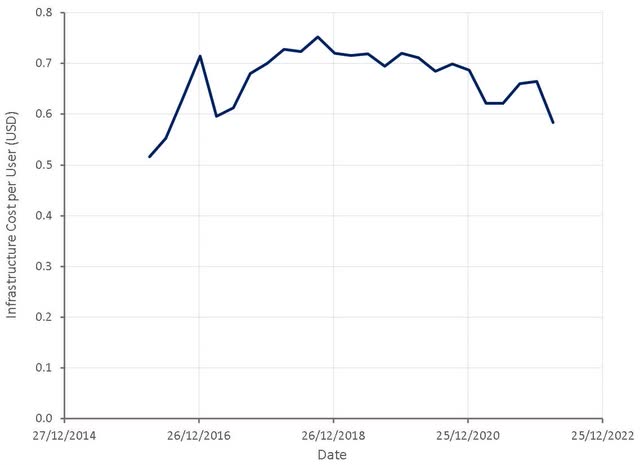

Snap recently completed new multi-year agreements with their infrastructure providers, which has driven an improvement in cost per DAU. It should be noted that these infrastructure costs are high relative to ARPU outside North America and Europe, and a substantial portion of Snap users likely have negative gross profit margins.

Figure 12: Snap Infrastructure Costs per User (source: Created by author using data from Snap)

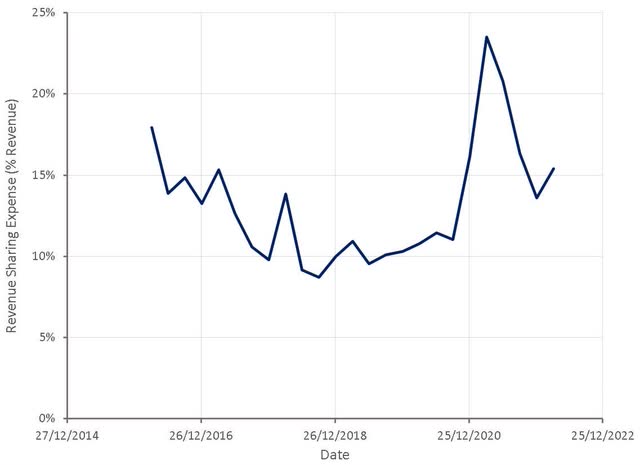

Revenue sharing expenses for content are becoming the primary driver of Snap’s gross margins. Snap’s bargaining power with content providers will ultimately determine at what levels these expenses settle out.

Figure 13: Snap Revenue Sharing Expense (% Revenue) (source: Created by author using data from Snap)

Assuming ARPU continues to increase, infrastructure costs per user remain flat, revenue sharing expenses increase to 20% of revenue and other expenses increase modestly, it is possible that Snap’s gross margins will reach the high 60% range.

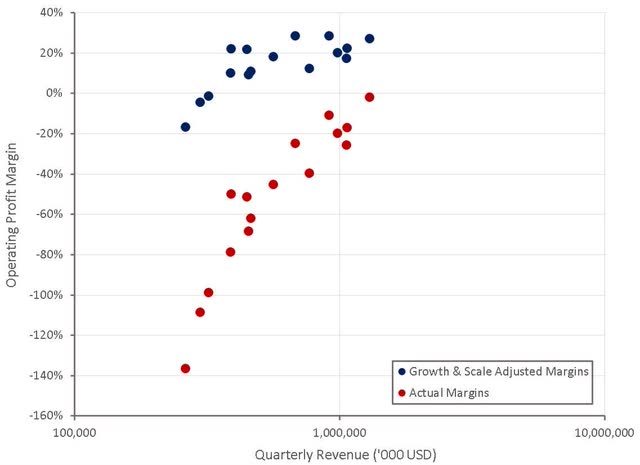

Snap’s operating profit margins have been improving over time, but are relatively large given the company’s size and growth. Operating costs were somewhat depressed during the pandemic (travel, events, etc.), which temporarily boosted the company’s profitability. Rising operating costs along with revenue growth trailing expectations are likely to be a drag on margins going forward. Snap has also mentioned investing more in sales and sales support in priority markets, which may weigh on margins in the short-term. Operating profit margins could be around 20% at scale, once growth has normalized.

Figure 14: Snap Operating Profit Margins (source: Created by author using data from Snap)

Conclusion

Based on a discounted cash flow valuation I estimate that Snap’s stock is worth approximately 25 USD per share. There are questions about Snap’s profitability potential, ongoing dilution caused by SBC and the wisdom of some of their strategic initiatives though. In addition, investors now appear to be uncertain about the long-term strength of the social media business model. Social media stocks are unlikely to rebound until the macro-outlook improves and the full impact of Apple’s privacy efforts are understood.

Be the first to comment