Ian Tuttle

Roblox (NYSE:RBLX) has been beaten down in recent months as growth prospects deteriorated, but as shown in its recent investor day the company’s business fundamentals remain sound and it has an attractive upside potential over the next two years.

Background

As I’ve covered in a previous article, I’m bullish on Roblox over the long term as the company has good growth prospects in the gaming sector, and the metaverse can be an additional source of upside on a longer time frame.

However, in recent months its stock has not performed well, like most growth stocks, as valuation has been de-rated considerably from its highs reached in November 2021. Moreover, the company benefited greatly from the pandemic, but operating momentum slowed down in recent quarters as kids returned to their ‘normal’ life and spent less time on gaming.

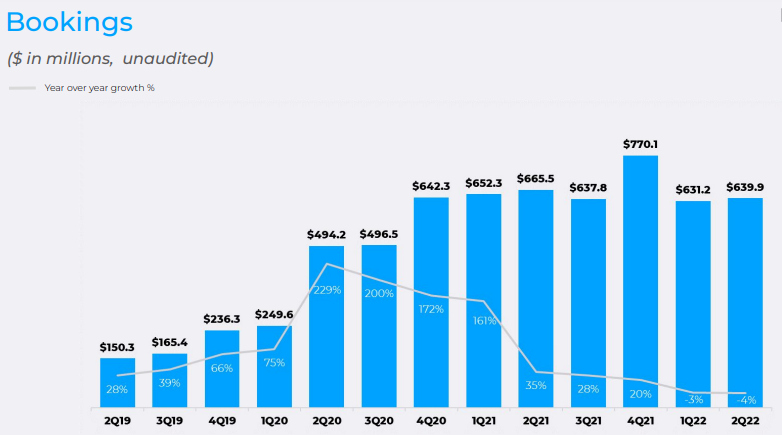

This trend is clearly visible on bookings, which had reported strong growth during 2020 but have been basically flat at about $650 million over the past few quarters, with the only exception being the 4Q 2021 as shown in the next graph.

Bookings (Roblox)

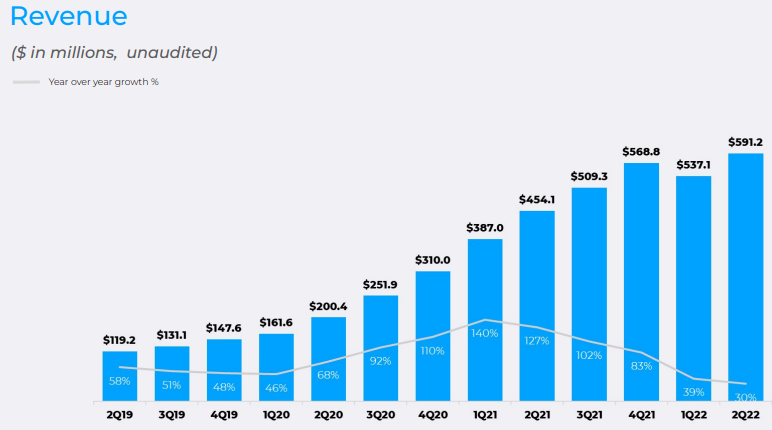

Investors should note that due to Roblox’s revenue recognition policy, as the company reports revenue throughout the user’s average expected lifetime, this means that bookings can be considered a leading indicator of Roblox’s revenue and is therefore a key factor to analyze its future growth prospects. Indeed, as shown in the next graph, while bookings were flat since Q2 2021, Roblox’s revenues continued to increase until the last quarter of the year and exhibit a much more gradual growing path than bookings.

Revenue (Roblox)

In my opinion, Roblox’s lack of bookings growth in recent quarters has been a disappointment and a key reason why its shares have performed badly in recent months. Therefore, I had some expectations about Roblox’s recent investor day to see how the company intends to boost growth in the next few years and if it considers this slowdown to be a temporary thing or not.

Roblox Investor Day

Roblox presented its second Investor Day since it became a public company yesterday, providing a deep overview of its business through several presentations. Despite that, this event was not a game changer as the company maintains its organic growth strategy and did not provide any long-term targets, except a 1 billion monthly active-user goal, or about four times higher than its existing level.

To achieve this the company is betting that the market for 3D content will enlarge beyond the gaming category, for instance to other categories such as education, e-commerce, or social media. As I’ve analyzed previously, Roblox’s platform is very well-positioned for the development of these types of experiences, of which ultimately the metaverse can be a real game changer, but will certainly take several years to develop.

Another positive factor for higher monetization and revenue growth is Roblox’s push beyond its core group of 9-13-year-olds, which are more likely to perform transaction-based purchases in its platform and lead to higher revenue per active user over the medium to long term.

Beyond a growing base of active users, Roblox also wants to increase its revenues from ads, which nowadays have a limited weight on revenue. Indeed, Roblox generates the vast majority of its revenue from the sale of virtual items on its platform, which means that ad revenue is still a revenue source that is to some extent underdeveloped.

Nowadays, Roblox generates almost all of its revenue from the sale of virtual items on the Roblox platform, which users can purchase through Robux. Payments from users are non-refundable and Roblox recognizes initially these payments as deferred revenue, which are then recognized as users’ purchase items. Roblox intends to increase the monetization of time spent by layering ads in its platform, which has the potential to become an important revenue stream over the coming years.

In addition to its investor day, Roblox also reported yesterday key metrics related to daily active users regarding the month of August, which amounted to 59.9 million (up by 24% YoY), while estimated bookings for the month were between $233-237 million (+7 YoY, but -4% from the previous month and below market expectations), and estimated revenue was between $208-211 million in the last month (+22-24% YoY). Even though booking’s growth has not improved much from previous months, the company continues to grow its active users at a healthy pace which should lead to higher growth in the near future if engagement improves.

RBLX Stock Valuation

Regarding its most recent earnings, Roblox has reported mixed financial figures recently, considering that revenue increased to $591 million in Q2 2022, up by 30% YoY, but total expenses also increased to $761 million (+27% YoY), which led to an operating loss of $170 million in the quarter (vs. loss of $143 million in Q2 2021).

According to analysts’ estimates, Roblox is expected to report total revenue in 2022 of about $2.7 billion (+42% YoY), which is still a very good growth rate but much lower than its 108% YoY growth achieved in 2021. In the following years, Roblox’s revenue growth is expected to slow down considerably, a trend that seems sensible considering the recent development of its bookings. Indeed, revenue growth is only forecasted to be about 15.5% during 2023-25, to reach some $4.2 billion in revenue by 2025.

Throughout this period, Roblox’s earnings should remain in the red, as the company continues to invest in business growth and expenses are also expected to increase in the coming years (namely R&D and developers payments), thus break even (in GAAP numbers) is not expected to be achieved in the next three to four years.

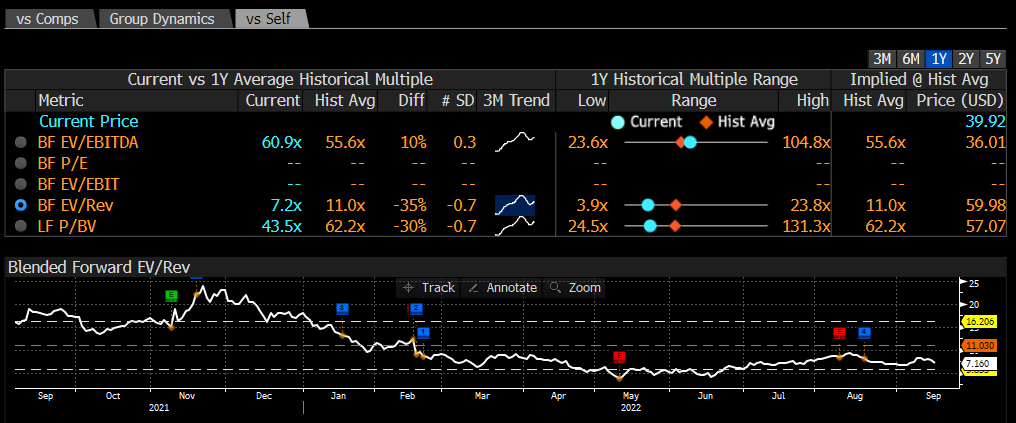

Therefore, considering that Roblox’s growth has clearly decelerated in recent months and recent trends don’t show any sign of a turnaround in the near term, its valuation de-rating is understandable and a return to valuation levels achieved during 2021 aren’t likely. As shown in the next graph, Roblox’s valuation based on forward revenue has declined from a peak of more than 20x revenue in the last few months of 2021 to a current valuation of about 7x revenue.

Valuation (Bloomberg)

While this trend has happened to many growth stocks, Roblox’s growth prospects have clearly deteriorated in recent months and expectations regarding its revenue growth and potential earnings were revised downwards in recent months, justifying a much lower valuation and share price.

Nevertheless, its correction over the past few months seems to be too harsh, as assuming the same valuation multiple of about 7x revenue to estimated revenue of $4.2 billion by 2025, leads to a price target of about $53 per share by end-2024 (upside potential of 33% compared to its current share price). Assuming a slightly higher multiple, which is likely as current valuations are quite depressed, of 10x forward revenue leads to a price target of around $76 per share, or 90% higher than its current share price, which shows that Roblox’s shares are currently undervalued.

Conclusion

Roblox’s growth prospects are weaker than they were some quarters ago, but despite that its fundamentals remain sound, and the company is well positioned to gain from several growth sources in the coming years. While its investor day was not a game changer, its increased focus on diversifying its revenue stream through higher monetization of ads is a positive step over the long term.

While investors remain more focused on short-term trends, that remain relatively weak, Roblox offers value for long-term investors that are willing to hold for some time and don’t worry too much about short-term price volatility.

Be the first to comment