ktasimarr

The iShares Exponential Technologies ETF (NASDAQ:XT) might seem broadly interesting at first, but we have some misgivings about the concept of investing in ETFs of higher risk businesses. Moreover, we are surprised by how well the ETF has done all things considered, and worry that some latent effects might still hit it. Otherwise, we are pretty convinced of the appeal of tech in the current market, and feel that in general it should be studied by retail investors. But we would think twice about XT.

Quick Breakdown

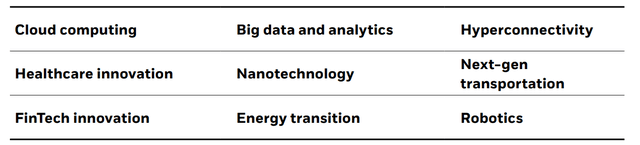

First let’s discuss some of the features of XT. The mandate is to build a portfolio that weights towards a decent amount of emerging markets and emerging technologies that follow nine key themes.

XT Nine Areas of Focus (iShares.com)

The themes listed above are pretty basic to be honest. We all know of the potential in these fields, and in the majority of cases the value of things like cloud computing have already been realised, at least in terms of priced in value, by large corporations through already profitable operations. Essentially, what XT is doing is allocating to all the sexiest ideas in investing that VCs would typically be focusing on.

As mentioned it’s not all US markets with only 62% allocation, which is nice because foreign markets typically don’t value tech nearly as highly as the US does, and it’s mostly tech but also some healthcare exposures, especially biotechs. The fee is below 0.5%, which isn’t bad relative to some of these more ‘exciting’ ETFs. The fact sheet says that it’s cheaper than 91% of ETFs in its category, but this should be taken with a grain of salt because they decide the categories. What matters is many iShares ETFs are around 0.4%, so just below 0.5% isn’t bad relatively.

ETFs and Exponential Technologies

However, we have some comments about the ETF. The first is that the kinds of businesses it invests in, especially in healthcare, are stocks that depend reflexively on the equity capital market conditions. If their stocks decline, the cost of their financing rises. This is obviously bad because in unstable markets like the current one, where rates will have to rise a lot more to deal with inflation, because it causes vicious spirals.

Secondly, we disagree in some key ways with the idea of having a portfolio of moonshot ideas. A VC portfolio usually isn’t very big, and it depends meaningfully on the study of business plans, on believing in the credentials of the founders and in witnessing their execution. Moreover, it depends on a lot of expert advice from people who can assess the promise of the targets’ technologies. They do have a portfolio of ideas because risk in venture is enough to tank even a great concept, and there is the need to diversify for that reason, but the picks are with conviction. When talking about exponential technologies, there are usually winner take all dynamics, and in VC opposite to mid to large cap investing, picking specific champions within a sector matters way more than sector allocation. ETFs are too broad to benefit meaningfully from higher risk and earlier stage companies such as many of those contained in the XT, even though the XT profile is quite a bit later stage than a typical VC portfolio.

Conclusions

We are also surprised by the performance of XT. It declined only 19% YTD. This seems too little to us and is difficult to understand. The main explanation we can think of is that while consumer demand is falling, enterprise exposures in XT might be managing to stay up, because enterprise tech is still performing well. However, we are looking for latent declines in corporate optimism to come from the already evident declines in consumer optimism. It could be bad timing for XT.

Overall, we think that with so many specific consumer tech ideas trading down heavily over the last couple of months, many suffering from the fallout of the SPAC bust, investors might want to consider making specific picks. XT probably isn’t suitable for a large allocation in your portfolio anyway. Just reserve your mad money allocation for some actively chosen champions, which is the model that VCs have to follow to get returns anyway. They’re all risky stocks that suffer from a fair deal for reflexivity, might as well know what you own more than having a very spread out portfolio where only a tiny portion of it will be responsible for returns, perhaps an under-allocated portion of it. Moreover, your specific VC-style pick is anyway likely to follow most tech bucket movements anyway, so ETFing it and having 200 holdings through XT is of limited value add.

Be the first to comment