Presley Ann/Getty Images Entertainment

Our view

Diageo plc (NYSE:DEO) is a UK-listed global manufacturer of spirits and other alcoholic beverages. Its brands include a number of global iconic drinks including Johnnie Walker, Guinness and Captain Morgan. Like many of its top-shelf offerings, the company’s shares attract a premium price.

We are big fans of Diageo for a whole host of reasons:

- its truly global scale with operations in more than 180 countries;

- an unrivaled portfolio of over 200 brands which include Johnnie Walker, Smirnoff, and Guinness;

- a resilient business with recession-resistant revenues and profit margins; and

- a reliable and growing dividend.

In the interests of full disclosure, we held a significant proportion of our investment portfolio in the company until early 2022. We originally acquired the shares through Q2 and Q3 of 2020 taking full advantage of the Covid-19 discount on offer to pay an average of £26.42 per share. As the price neared all-time highs at the end of 2021, we felt the valuation was unjustified and offloaded our entire holdings for an average of £40.18 per share – 2% below the all-time high but 4% above the current market price. Our total return – including dividends – was 55.6%.

As much as Diageo is a premium business and should command a premium valuation, we don’t feel that it provides us with adequate prospective returns and/or a sufficient margin of safety at the current valuation of over 30x adjusted net income. For that reason, we maintain our “sell” rating.

Our recent analysis (including McDonald’s: Great Business, Poor Value) indicates that high quality businesses are commanding resiliently stiff valuations as a result of investors paying a premium for relative stability amidst the ongoing economic uncertainty. For investors whose only concern is capital preservation, these premiums may be a price worth paying. But for value investors like ourselves, we see benefit in retaining capital to deploy elsewhere if and, ultimately, when the right opportunities arise.

Our current overall sentiment is best summed up by the following words from Charles T Munger: “The big money is not in the buying and selling … but in the waiting”. With that in mind, we continue to wait safe in the knowledge that we will be rewarded for our patience.

Note: Diageo is listed on both the London Stock Exchange (“LSE”) and the New York Stock Exchange (“NYSE”). Any reference to the stock price in this article refers to the shares listed on the LSE. The ADRs listed on the NYSE represent 4 underlying shares in the company meaning any reference to the stock price in this article should be multiplied by a factor of 4.

Business Review

Background

Diageo is an international manufacturer and distributor of premium drinks – mainly Spirits and Beers. The company has over 25,000 employees, more than 200 brands and operates in more than 180 countries worldwide.

Remarkable Resilience

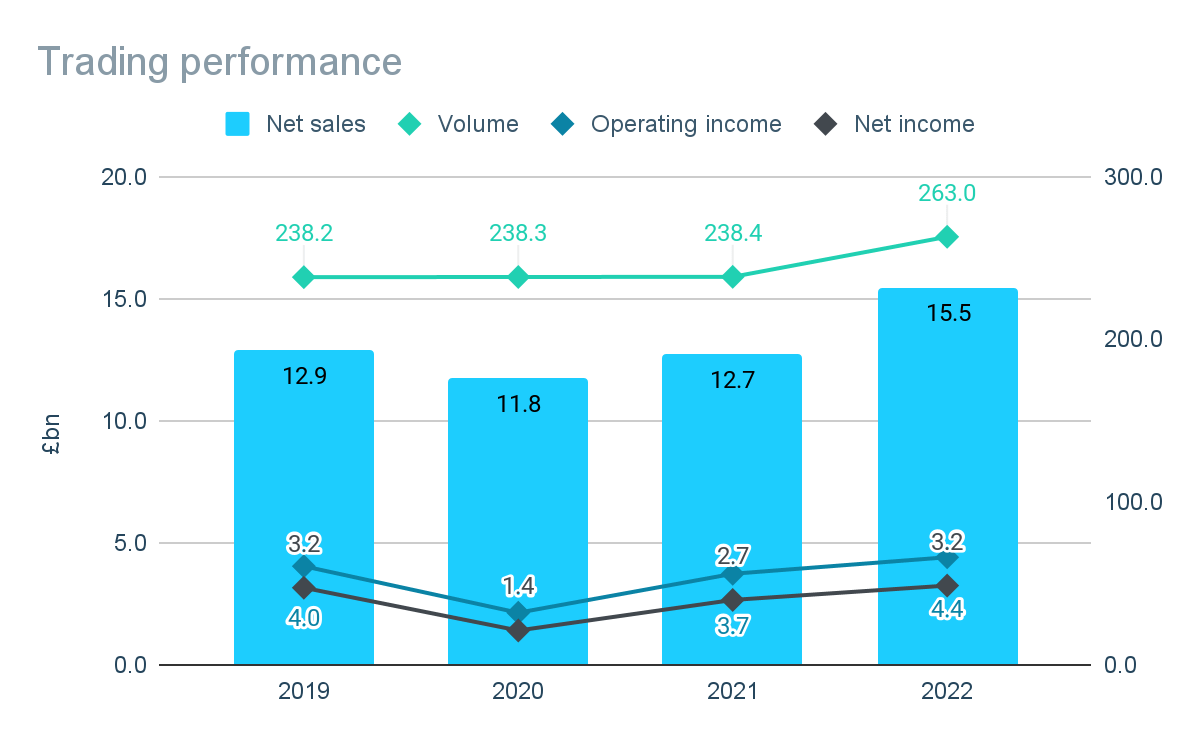

Author. Data from company reports.

The resilience of Diageo was showcased for all during FY20. Even as the pandemic took hold, net sales – total sales less excise duty – held up remarkably well falling by only 9% in FY20 despite the disruption caused by lockdowns and bar closures.

Whilst operating profits fell by almost half to £1.4 billion, a large part of the decline was due to non-cash impairments and other exceptional costs. Excluding these, profits were robust, declining only 14%.

The company’s performance continued to be hampered by Covid-19 related disruptions into 2021. In spite of this, reported net sales actually grew by 8% to £12.7 billion. Net sales growth when measured on an organic basis – which excludes exceptionals and exchange rate movements – was actually twice the reported rate. Operating profits grew by almost 75% on a reported basis, albeit this largely reflected that large non-cash exceptional items in the prior year comparatives. On an organic basis, operating profit growth was in line with organic net sales growth at 17%.

The positive momentum continued into the company’s latest full year ending 30 June 2022. As reported in the company’s most recent earnings release, net sales growth accelerated to 21% on both a reported and organic basis.

The strong growth was driven by both volume growth – which had been flat for many years – as well as continued positive changes in the price/mix as the company continued to benefit from “premiumisation” i.e., the transition to brands and/or products with a higher price point. Products at the highest end of the pricing range have done particularly well in FY22, with net sales of super-premium-plus brands growing by 31%.

Operating profit growth was broadly in line with net revenue growth as the company maintained its margins in spite of the decision taken to suspend operations in Russia in March 2022, and later taking the decision to commence a complete wind down of its Russian operations. Excluding the impact of these closures, operating profit outpaced net sales growth as organic operating margin improved by 77 bps.

All About spirits

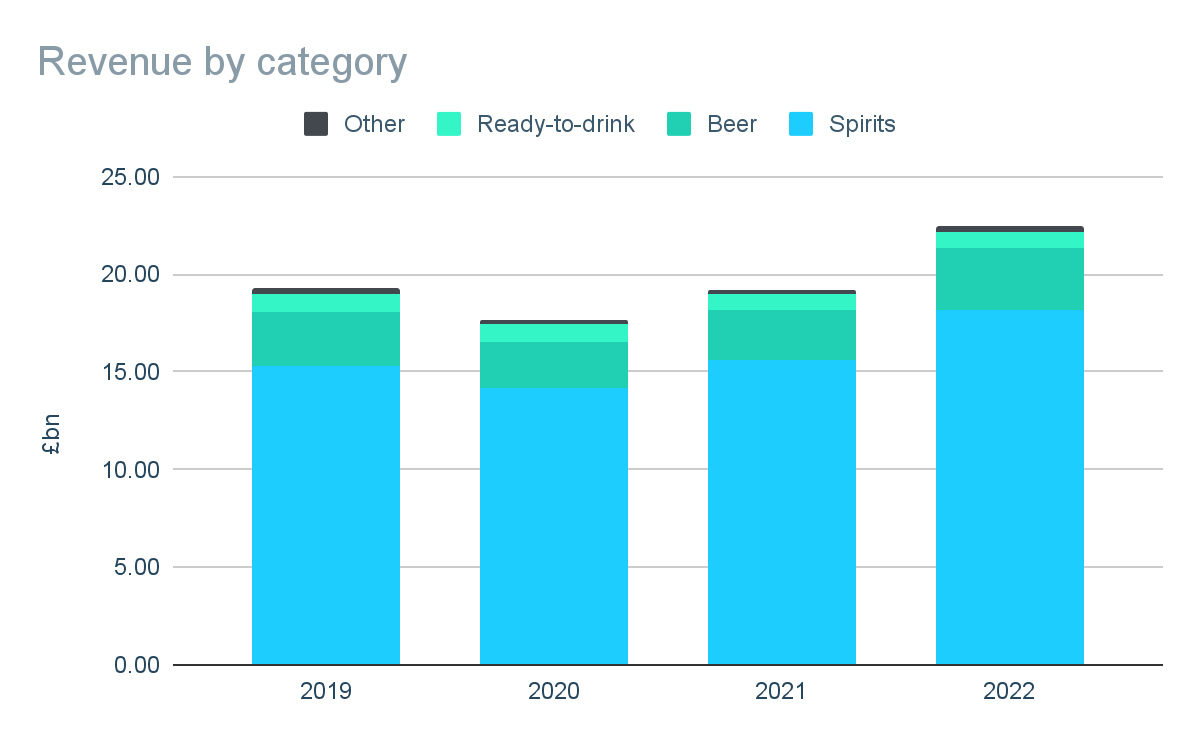

Author. Data from company reports.

Spirits is by far the most significant product category for the company, particularly Scotch which accounts for a quarter of the company’s entire net sales. This is followed by Tequila and Vodka which each roughly account for 10% of net sales. As well as being the most significant category by size, Spirits has also been the strongest contributor of growth in recent years, with net sales up almost 20% since 2019.

The company’s Beer category – which is dominated by Guinness but also includes flavored malt beverages such as Smirnoff Ice – is significantly smaller accounting for only 14% of net sales. The Ready-to-Drink category is currently insignificant in the context of the company’s operations but should be a driver of future growth as the category is expected to account for 8% of total beverage alcohol sales worldwide by 2025.

The company also has exposure to the luxury wine market through a 34% interest in Moët Hennessy, a subsidiary of LVMH Moët Hennessy – Louis Vuitton SA (OTCPK:LVMHF). The brands owned by Moët Hennessy include Moët & Chandon, Dom Perignon, and Hennessey. For context, Diageo’s share of Moët Hennessy profits in FY21 were about £340 million, equivalent to less than 10% of Diageo’s net profits in the same year.

King of Booze

Author. Data from company reports.

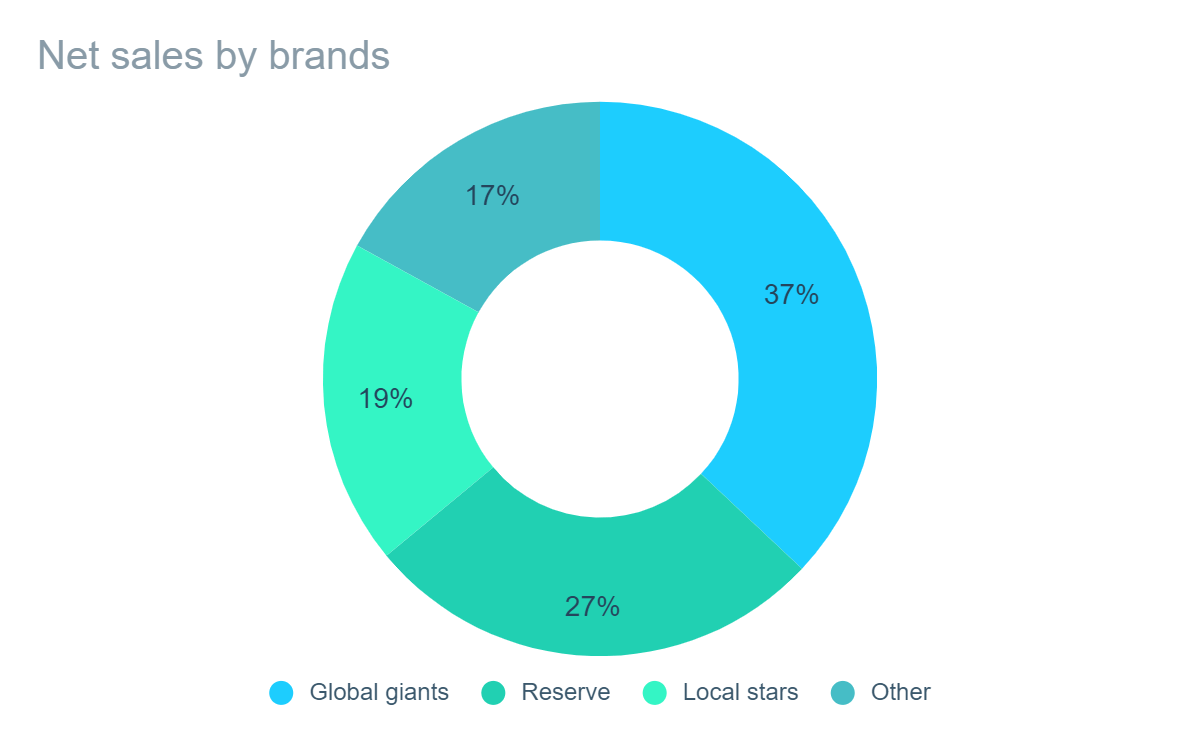

The company owns a large and impressive portfolio of more than 200 brands, most of which are grouped into the following categories: Global giants; Reserve; and Local stars.

The majority of the Diageo business is based around six of their largest global brands which are: Johnnie Walker, Guinness, Smirnoff, Baileys and Captain Morgans, and Tanqueray. These are the Global giants. Johnnie Walker and Smirnoff are two of the world’s four largest international spirits brands by retail sales value, according to IWSR (as reported in the company’s 2021 annual report).

The Reserve brands are the company’s exclusive brands which command a premium price point. Brands in this category include single malt Scotch whisky brands, Don Julio, Casamigos, and Ciroc Vodka among others. These brands will play a key part in the future growth story, with premiumisation trends set to continue – especially in non-traditional categories such as agave-based spirits and whisky produced outside of Scotland.

The third and final category are brands which are lesser known than the Global giants counterparts and less luxurious than the Reserve brands. However, they have a dominant position in one or more of their home markets, quite often emerging markets with the potential for significant future growth.

Serving Good Times Globally

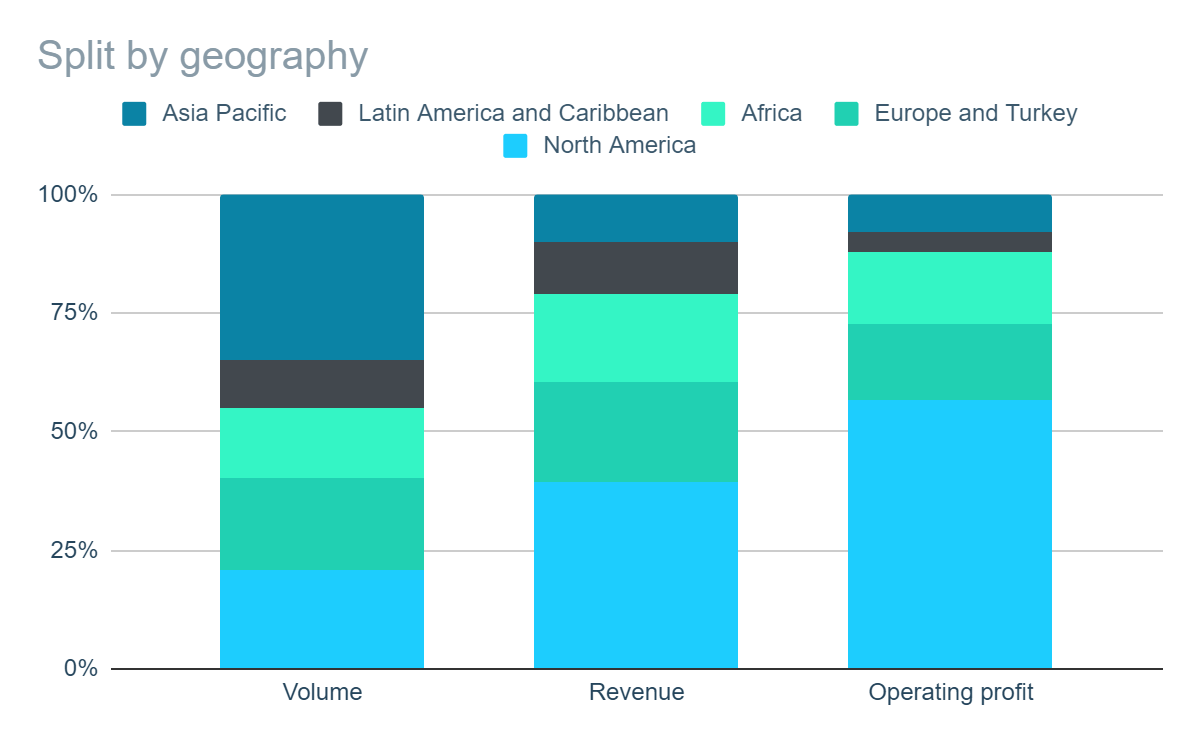

Author. Data from company reports.

Diageo is a truly global giant with sales or operations in over 180 countries worldwide. North America is the company’s most significant market in terms of net sales and operating profits. Due to the strong pricing dynamics in North America, both in terms of average prices as well as the demand for premium brands, the region contributes almost 40% of operating margin despite accounting for less than 20% of net sales.

The European and African regions are somewhat average in that they contribute roughly proportionate shares of volumes, net sales and profits. Taken together, these markets contribute about as much in net sales as North America, but are half as profitable.

On a volume basis, the Asia Pacific region is actually Diageo’s largest market accounting for around 30% of total volume. Whilst this doesn’t convert well into profits, the large volume highlights the extent of the company’s penetration in the Asian market and is a strong indicator of the company’s ability to benefit from the continued rapid economic development in that region.

Attractive But Unsustainable Returns

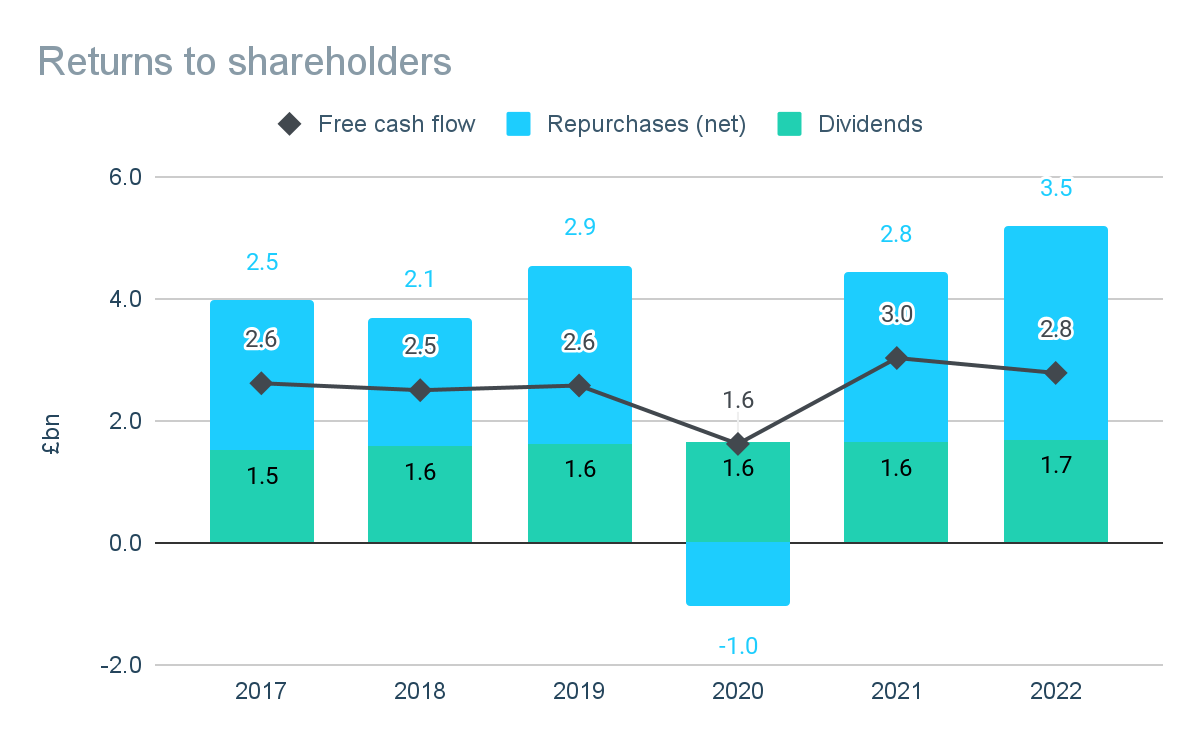

Author. Data from company reports.

The company has a history of strong and consistent free cash flow generation, converting around 80% of net profits to free cash flow allowing the company to pay consistent returns to shareholders through dividends and share repurchases. For many years, the company has been able to make over-sized payments to shareholders as it re-balances its capital structure and increases borrowings in line with its growing earnings (see Levering Up below).

The company has a progressive dividend policy, aiming to increase its dividend payment year on year. In FY22, increased its dividend by 5%, a payout ratio of 55% of net profits. Or equivalent to a dividend coverage ratio 2.0x net profits (excluding exceptional items) – right in line with the company’s 1.8x – 2.2x target ratio. At this level, the current dividend is sustainable, but future increases will be contingent on future profit growth if the ratio is to be maintained.

The current return of capital program was announced in 2019 and seeks to return up to £4.5 billion to shareholders by 30 June 2023. In FY22, the company spent £2.25 billion taking total repurchases under the program so far to £3.6 billion. Once completed, investors can expect payouts – particularly repurchases – to revert to sustainable levels, albeit continued growth should provide headroom in the company’s leverage ratio enabling potential repurchases in future.

Whilst we are completely in favor of returning surplus capital to shareholders by way of repurchases, we do not endorse them at all costs. The cost at which shares are repurchased matters to the remaining shareholders and should be repurchased when management are confident they are at or preferably below intrinsic value. Since 2019, the company has spent around £3.6 billion in share purchases at an average cost of £36.46 per share. It is unclear to what extent management consider share price as a factor in repurchases. And we are not entirely convinced that this represents value for money.

Levering Up

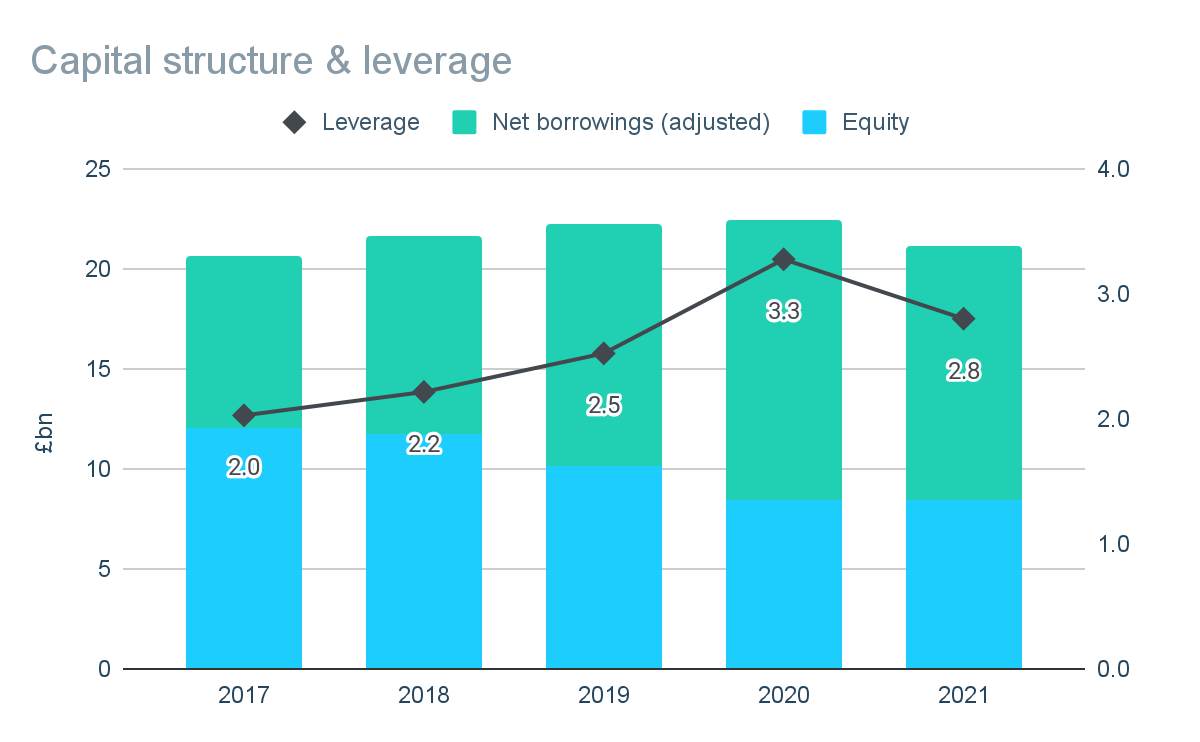

Author. Data from company reports.

The out-sized returns to shareholders have increased the company’s debt burden and leverage is now in line with management’s target leverage ratio of 2.5x – 3.0x (adjusted net debt to adjusted EBITDA).

A key benefit of increasing debt relative to equity capital is that it boosts the returns earned on shareholders’ equity. Re-balancing the capital structure helped leverage the company’s return on equity from 22% in FY17 to 34%, despite returns on invested capital being increasing from 14% – 17%.

Another benefit of the debt issuance has been the timing, locking in long-term funding at extremely low interest rates. The company’s latest issues in April 2022, for example, were at fixed rates of 1.50% – 2.75% for bonds with maturities ranging from 2029 – 2038.

Whilst debt comes with benefits, it also comes with additional risk at a certain point. Debt levels which appear manageable under normal trading conditions can quickly become unmanageable under adverse trading conditions – particularly if this is prolonged – or at a future date when rates rise. However, in the case of Diageo, a leverage ratio of 3.0x doesn’t worry us given the resilience of the company’s revenues and profits.

Outlook: Positive But Uncertain

In the company’s full-year preliminary results for FY22, management indicate that they expect a challenging operating environment in FY23. There are a number of causes for concern and uncertainty: ongoing Covid-19 disruptions (presumably in Asia); significant cost inflation and a potential weakening of consumer spending power; and global geopolitical and macroeconomic uncertainty.

On a regional basis, mature markets such as North America and Europe are expected to continue to grow but at slower rates than achieved in 2022, reflecting strong comparatives in the prior period. However, less developed markets are expected to continue growth.

The outlook for operating margins is mixed. An inflationary environment may increase costs and/or reduce demand, but profits are expected to benefit from the continuing premiumisation trend and increased efficiencies. As a UK headquartered company, the current strength of the dollar relative to the pound indicates a foreign exchange headwind for the company in the year ahead.

Medium-Term Guidance

Management reiterated their medium term guidance in the full year results for FY22. In the next three years through FY25, management expects mid single digit organic net sales growth of 5% – 7%. p.a. and improved margins resulting in profits growing at 6% – 9% p.a.

Capex is expected to continue at the elevated rate of £1 billion – £1.2 billion p.a. for the next 3 years as the company invests for long-term growth, including increasing production capacity, digital capabilities and sustainability agenda.

Risks

We see the key risks to investors to include:

-

Inflation / macroeconomic conditions – Highly inflationary or other adverse economic conditions may reduce demand and/or profitability. However the company’s performance through Covid-19 highlights its ability to weather challenging trading environments.

-

Climate change, sustainability & responsibility – Climate change may impact the company’s profitability through the direct impact changes in climate or adverse weather or indirectly through changes in regulation of consumer behavior in response to the climate-related issues. The company is taking steps to address key climate issues which could affect the business through its ‘Society 2030: Spirit of Progress’ program, with progress against targets included as a metric in its long-term incentive plan.

Valuation

Our valuation approach centers around determining the true underlying earnings power of the business – or “owner earnings”.

As of 27 July 2022, the company’s shares trade at approximately £48 giving the company a total market cap of around £109 billion, equivalent to a price-to-earnings multiple of 31x based on FY22 net profits (excluding exceptionals).

We have prepared valuation scenarios based on management’s own medium-term guidance. For the purposes of our analysis, we have assumed that these are achieved over a 10 year period. Our key assumptions include:

| Lower | Mid | Upper | |

| Operating profit growth | 6.0% | 7.5% | 9.0% |

| Terminal valuation multiple | 18 | 20 | 22 |

These scenarios imply a total annual compound return of between 3% – 8% (including dividends) over the next 10 years. These returns are underwhelming given the fairly optimistic assumptions, particularly at the upper end of the range.

We provide no view on the probability of these scenarios, but rather consider the potential returns under each in reaching a conclusion on the attractiveness of the current valuation. Given the returns are in the low-to-mid single digit range even if the company achieves management’s medium-term guidance, we do not see the level of return / margin of safety to be sufficient at the current valuation.

Conclusion

Diageo is a global giant with renowned brands, immense scale and a resilient business. Whilst the business remains strong, its current lofty valuation means it is likely to provide underwhelming returns in the medium-term.

We have owned the shares before and were rewarded nicely. We expect that we will own them again in the future – but only if and when the valuation makes them an attractive prospect. Until then, we will be waiting patiently.

Be the first to comment