Blue Planet Studio/iStock via Getty Images

Introduction

Software is Eating the World…

In 2011 Marc Andreessen wrote an op-ed where he described how important the role of software has become in our lives and how much more important he believed it will become in the future.

My own theory is that we are in the middle of a dramatic and broad technological and economic shift in which software companies are poised to take over large swathes of the economy. – Marc Andreessen

And boy, was he right!

There’s truly no shortage of examples of just how ingrained software has become in our daily lives, whether it’s the making of a PowerPoint for work, accessing legal records online, or just checking the weather on your phone, software is everywhere, and we are using it almost all the time.

It seems that since Marc Andreessen posted his article these trends have only accelerated, just look at how COVID-19 and work from home supercharged enterprise software and e-commerce.

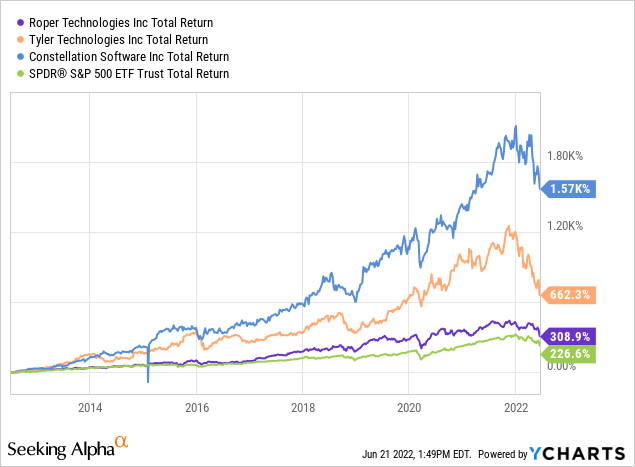

There’s multiple ways of running a software company, some like Unity (U) and Palantir (PLTR) invest billions of dollars to build new innovative solutions from the ground up. Other companies like Roper (ROP), Tyler Technologies (TYL), and Constellation (OTCPK:CNSWF) use their cash flow to acquire growth instead.

Both strategies have their merits, but as a shareholder, I’m merely concerned about earning a return on my capital. I couldn’t care less if my profit comes from acquired growth or internal growth.

The reality is some companies waste money on lousy M&A and others waste it on lousy internal projects. It all comes down to execution, both strategies can work, and both can fail, it all depends on the company and its management.

In this article I’ll be focusing on comparing three companies who’ve been successful in acquiring growth, so-called ‘serial acquirers’: Constellation Software, Tyler Technologies, and Roper Technologies by providing:

- An overview of all three companies and what makes them unique, with an emphasis on Constellation Software

- A comparison of their financial performance across a few key metrics

- A Forward P/E valuation comparison and a Discounted Cash Flow Analysis for Constellation Software

Constellation

The primary company I’ll be focusing on in this article is Constellation Software, the Canadian tech company founded by the semi-secretive Mark Leonard.

Constellation, like Roper and Tyler, is a serial acquirer of VMS businesses, what makes Constellation unique is the sort of companies they go after. Which is to say, essentially any small software company, anywhere in the world.

Each year Constellation, through its subsidiaries, acquires hundreds of companies usually for just a few million dollars. Constellation targets the extremely small end of the spectrum because of the relatively low competition from private equity for VMS businesses that are this small because they either are too low growth or have too low of a TAM for them to consider.

The result is an incredibly wide pool of potential acquisition targets that can be purchased at very low multiples

Constellation continually redeploys its capital into more and more small businesses. Unlike Roper, which has a small M&A team in its head office, Constellation enlists its business managers to perform M&A too and find small new software companies for Constellation to absorb. Managers’ bonuses are tied to both revenue growth and returns on their capital ensuring the desire for growth is balanced with profitability and valuation.

Constellation is an especially unique company

Constellation doesn’t make investor presentations, there are no quarterly conference calls, and like Buffett, their IR website is clearly dated. No media, no management interviews. Nothing. And Constellation appears to like it that way.

Mark Leonard used to put out a Warren Buffett-style annual letter where he candidly updated shareholders on the business performance, but that too is gone as Mark Leonard likely grew fearful of competitors stealing their ideas to replicate the businesses.

For competitive reasons we are limiting the information that we disclose about our acquisition activity. We believe that sharing our tactics and best practices with a host of Constellation emulators is not in our best interest. We have discussed the matter with many of the large Constellation shareholders, all of whom (despite grumbling) eventually agreed. – 2017 President’s Letter

All that’s left is an annual meeting for shareholders to field questions to the executive management team. Which, as a shareholder, feels like a treat.

Constellation just does things differently.

Recent Transactions

Constellation has made some changes to its portfolio, but unlike Roper, a company I’ll be discussing next, it was not done through selling off businesses. Within the last two years Constellation has:

- Partially spun out a business to shareholders: Topicus.com (OTCPK:TOITF)

- Begun to acquire larger businesses

- Launched a VC fund to acquire stakes in earlier-stage VMS companies

- Begun to research other investment ideas outside of VMS (led by Mark Leonard)

Topicus Spin Out: In early 2021 Constellation spun out its Dutch businesses Topicus and TSS into a new publicly listed entity called Topicus.com. When Constellation acquired Topicus and TSS both sellers demanded a continuing equity stake in their respective businesses. Constellation always prefers to buy companies outright, but they have permitted non-controlling interests in special cases, as was done for Topicus and TSS.

Topicus.com is essentially focused on recreating what Constellation did across the European continent. Constellation, after spinning off most of the business to shareholders, retained roughly 30% ownership in Topicus and, more or less, controls the company through its one super-voting share.

At some point, I will write an entire article on Topicus, so I’ll leave you with just this as a primer for now, but suffice it to say, I’m excited about its prospects.

Larger Businesses: In early 2021 Mark Leonard released another letter essentially canceling their special dividend arguing that the company would better serve its shareholders if they could keep the excess capital to acquire larger companies, even if the hurdle rate was lower.

This year Constellation acquired Allscripts hospital business for $700mm. To make this larger acquisition work, Constellation employed a debt component to juice their projected returns and meet their hurdle.

As an aside, taking on debt for larger purchases is also a significant change for the company which has almost no debt on its balance sheet.

VC Fund: I’ll keep this one brief because there is not yet much to report but last year Constellation launched a $200mm VC fund. The goal of the VC fund is to invest in companies at an earlier stage that are not yet ready to sell but may be a good fit for Constellation down the line. Yet, according to Mark Leonard in this year’s investors conference, the fund has not yet made its first investment, citing difficulty in getting these companies to accept what Mark Leonard refers to as “permanent capital” versus the business-flipping/fast-returns money offered by PE and VC investors. Mark Leonard, in this year’s annual meeting, suggested he wants Constellation’s capital to be invested in those companies forever.

Non-VMS Acquisitions: At this stage, there is nothing to report as Constellation has not yet gone down this route, but it’ll be interesting to see how this develops over time and which businesses Mark Leonard identifies as strong acquisition candidates.

Roper Technologies

Next up, Roper Technologies, an IT conglomerate based in Sarasota Florida. Roper is known for its array of businesses that design, develop and acquire vertical software and application-specific products for a variety of niche markets.

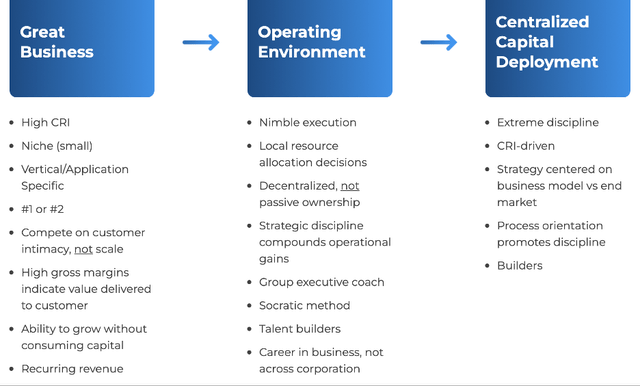

Roper’s businesses are highly decentralized and acquired through an analytical, process-driven approach to redeploy excess free cash flow:

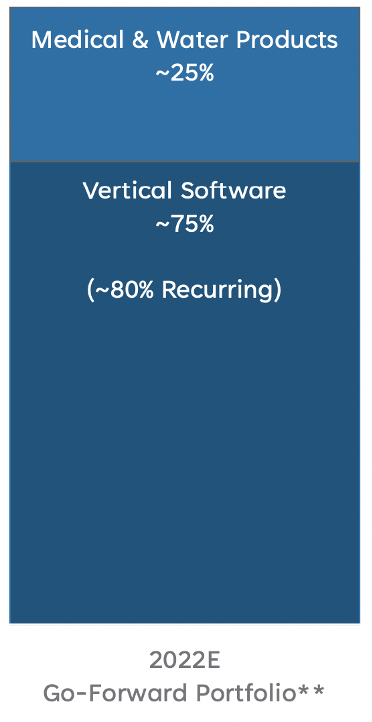

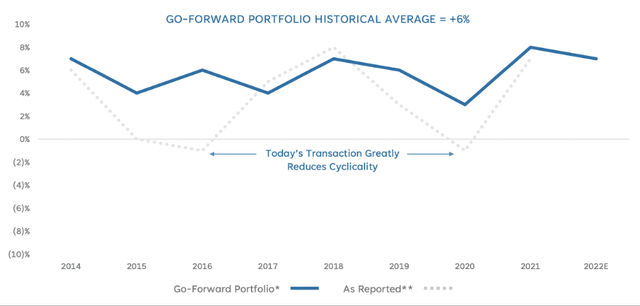

Roper acquires resource-light businesses that can return significant sums of cash flow to the parent company, thus enabling more acquisitions, a strategy shared by both Tyler and Constellation. But Roper, unlike Constellation, targets relatively larger companies (~$200mm-~$3B) and is much more active in divesting underperforming assets.

Recent Transactions

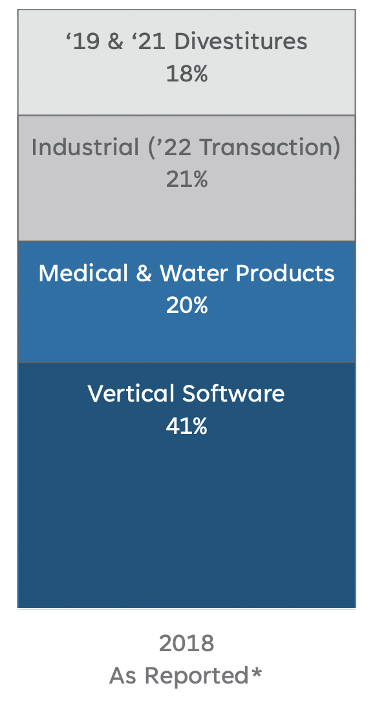

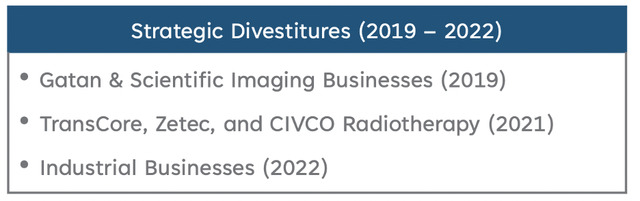

In the past Roper was active across many industries, including Software, Pumps, Engineering Equipment, and Water Technologies. But through a series of divestments between 2019 and 2022, Roper has transformed itself into a company primarily focused on software (with water as a distant second focus). These divestments freed up billions of dollars in capital, now Roper has $7B of capital at their disposal ready to go on short notice.

The next couple of charts below shows just how much Roper has changed its portfolio since 2019:

Roper Investor Presentation Roper Investor Presentation Roper Investor Presentation

Tyler Technologies

Tyler Technologies is another vertical software company, but it is focused solely on serving the public sector. The company was founded in 1966 and they started focusing on government software in 1998, so it’s fair to say they’ve been at the VMS game for a while.

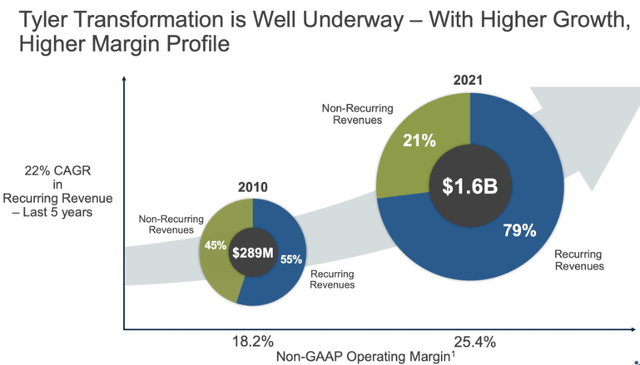

79% of Tyler’s revenue is recurring, and roughly 120% of their non-GAAP net income is converted to free cash flow. Some of Tyler’s software products include web-based solutions for real-time public record access, electronic solutions for traffic tickets, and tax collection software.

Tyler, like Roper, has focused on acquiring companies with strong recurring revenue. Through a series of smart acquisitions and business improvements, Tyler grew its share of recurring revenues from 55% to 79% over the last 5 years.

Tyler is supported by three secular tailwinds:

- Governments updating antiquated IT systems to meet new requirements (e.g., Mobile Access & Compliance)

- Governments shifting IT processes to the cloud to improve security and reduce costs

- Governments prefer subscriptions services due to their lower up-front costs

Recent Transactions

Between 2017 and 2021 Tyler generated $1.4B in cash flow from operations (1.3x non-GAAP Net Income); Tyler took that capital and invested across three different areas: Organic Growth, Acquisitions, and Stock Repurchases. The bulk of the cash ($935mm) was spent on acquisitions.

In the past 5 years, Tyler acquired 16 different businesses at an average purchase price of around $58mm. This places them in the middle of the pack between Roper and Constellation both in terms of size and frequency of deals.

Tyler’s largest recent acquisition was NIC a leading provider of digital services to state and federal governments, which it took over for $2.3B in 2021. Like Roper, Tyler runs a relatively decentralized model, but perhaps a bit less so than Constellation, in the case of NIC, Tyler mentioned their deployment of Tyler’s low-code software programming tools inside of NIC and implementing their fintech services.

Running a more centralized operation can give a company an increased ability to cross-sell and cut down on shared costs like HR & Accounting, but it can also create additional operating risks. As far as scale goes, the NIC acquisition was a bit larger than Tyler’s historical target but is, as of this moment, the exception, not the rule. Should Tyler tilt more towards larger acquisitions and consolidation vs. being a decentralized operator I would reexamine my thesis on the company.

A more typical example of the sort of companies Tyler acquires might be eDirect which Tyler bought this February.

Through this acquisition, Tyler will add US eDirect’s Recreation Dynamics product to its digital government and payment services. Recreation Dynamics is a large-scale, enterprise-grade cloud transaction management system focused on the government recreation and tourism industry. Powered by Amazon Web Services (AWS), the solution manages transactions related to campground accommodations, tours and events, passes and memberships, recreation rentals, outdoor licenses, and parking and entry.

That’s a rather specific niche of software… state-park recreation software.

One of the reasons why a VMS business can be so successful overtime is due to the low competition many of them experience. For example, perhaps another giant software company could build a superior product given the resources at their disposal, but often the market is so small it’s probably not worth it for giant tech companies.

Scenarios like these create opportunities for serial VMS acquirers like Roper, Tyler, and Constellation because, seemingly, the “big guys” are just not interested.

M&A Target Breakdown by Company

|

Company |

Roper |

Tyler |

Constellation |

|

Size: |

Medium Sized – Multiple Billions (Plus Bolt-Ons) |

Small – Multiple Billions |

Micro-Sized Acquisitions ($1mm-$100mm), Occasional Large Purchases (Up to $1B) |

|

Region: |

Primarily the USA |

Primarily the USA |

Global |

|

Other: |

Water-Related Businesses, Divestments |

N/A |

Spin-Offs, VC Fund, Possible Non-VMS Acquisitions |

Source: Created by Author based on Company Presentations and Filings

Financials Comparison

While the strategies differ, it’s within these companies’ financials that the differences become even more apparent.

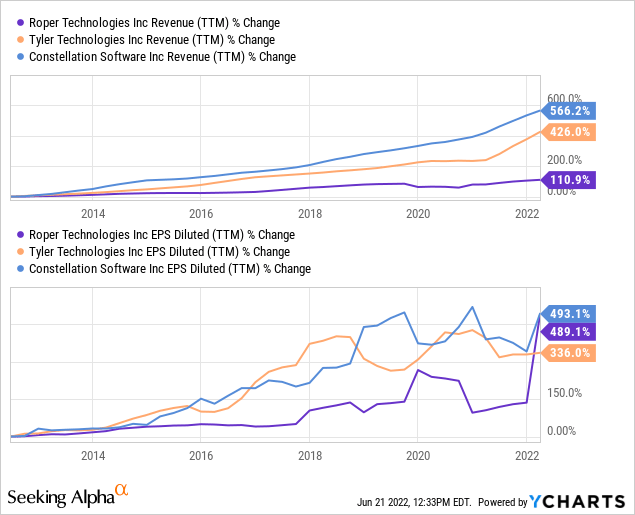

Revenue And EPS Growth

As you can in the chart above all three companies have had no problems growing their revenues and EPS over time.

Constellation had the strongest growth over the past decade followed by Tyler, but even Roper doubled their revenues over the decade.

Because Roper is more active in divesting businesses than Constellation or Tyler, they’ve seen choppier EPS growth due to the capital gains/losses from divested businesses. Due to the size of companies they target and their history of actively disposing of non-strategic businesses I consider Roper to be more similar to a private equity fund than either Tyler or Constellation is.

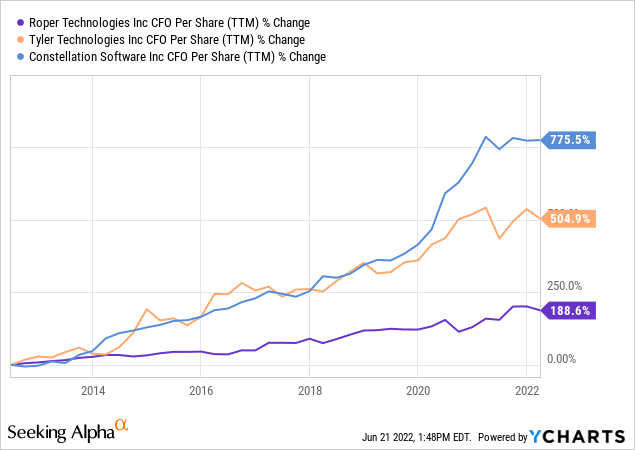

Cash Flow from Operations per Share

Looking at a company’s earnings potential through the lens of per-share cash flow helps to clear up some of the choppiness caused by divestments and share count changes. As you can see the cash flow from operations chart looks quite like the revenue growth, except for the little fact it’s growing much faster.

As I discussed in an earlier article, software companies can be highly cash-generative businesses as initial one-time investments can create streams of cash flow for years. Given the nature of the VMS industry, and its low capital requirements, it’s no surprise to me that Roper, Tyler, and Constellation have had such strong cash flow growth.

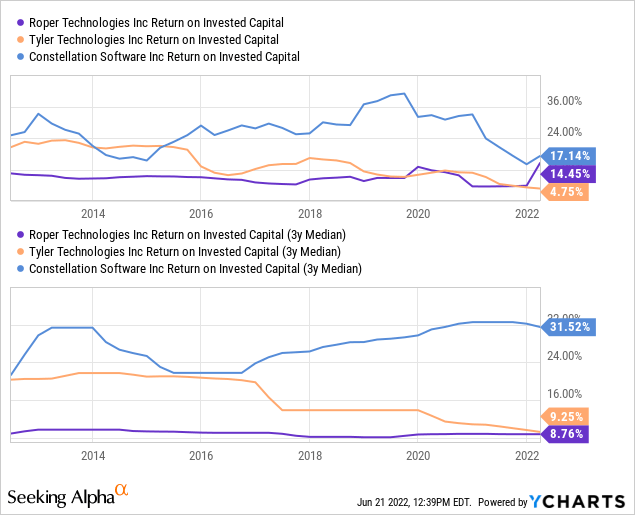

Return on Invested Capital

With a ROIC ranging from the high-teens to 30s, Constellation has clearly been the strongest capital allocator over the past decade. This, in my view, is likely due to the size of the companies they target and the value they acquire companies for because of this. Adding to the benefit of acquiring small companies, Constellation, Unlike Roper, is unrestrained by which VMS verticals they can target.

Tyler and Roper’s lower ROICs are a bit concerning to me, especially in the case of Tyler which has significantly deteriorated over the last decade. In the case of Roper, I can attribute the lower ROIC to the business segments they previously operated in, but in the case of Tyler, I can only imagine it might be a scale issue.

Tyler and Roper’s relatively lower ROICs are also not the end of the world for me, given both their strong cash flow per share growth, so I’m willing to grant an exception. Constellation’s high teen’s ROIC is quite frankly astounding, it’s one of the highest sustained ROICs I’ve seen.

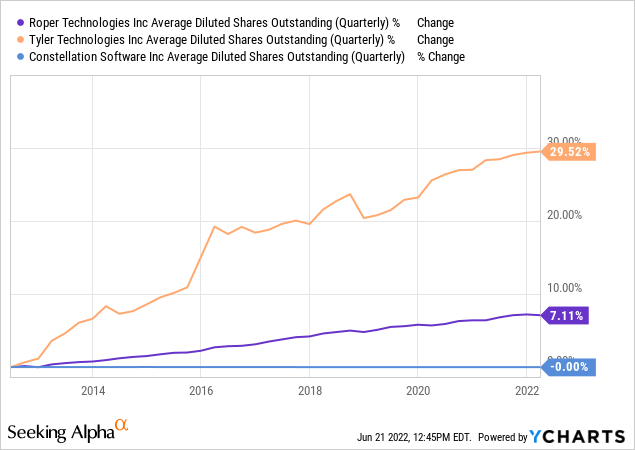

Share Count Changes

Another difference between these companies is their varied approaches to share issuances. Tyler has taken a liberal view on share issuance, opting to use shares to acquire companies, and pay employees. Roper has taken a more moderate approach, increasing its share count by less than 1% annually primarily to pay its employees.

Constellation is on the opposite end of the spectrum as Tyler, choosing to issue no shares, nor buyback any, that’s another unique approach these days given the prevalence of stock-based compensation and buybacks.

At Constellation employee bonuses are paid in cash but required to be invested in Constellation’s stock, another unique choice meant to instill a sense of ownership in their employees without diluting current shareholders.

Valuation

Forward PE Relative Valuation

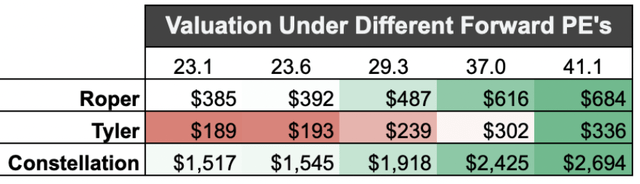

The first method I used to value these companies was to compare their forward PE ratios.

| Company | Current Stock Price | EPS 2023 Est. | 2023 P/E |

| ROP | $392 | $16.7 | 23.6 |

| TYL | $336 | $8.2 | 41.1 |

| CNSWF | $1,517 | $65.5 | 23.1 |

| IGV | $91 | $2.4 | 37.0 |

|

Average PE (excl. IGV) |

29.3 |

Source: Yahoo Finance and Author’s Calculations

As you can see in the first table, Constellation has the lowest multiple, followed by Roper, with Tyler being the most expensive. For the sake of comparison, I also included iShares’ software ETF (IGV) which has a forward PE of 37 based on my estimate.

Implied Valuation

I then took the forward PE ratios of all these companies and created another table that assesses what each company’s stock price would be under a variety of forward PE ratios, including peers, the average PE of the group, and iShares ETF. Based on the forward PE comparison Roper and Constellation appear to be good values, while Tyler looks overvalued.

Constellation’s Discounted Cash Flow

Typically, I will employ a discounted cash flow model to value all the companies I consider investing into but in the case of Roper and Tyler I don’t believe this method is particularly useful due to the significant dilution Tyler employs and Roper’s preference to acquire and divest large businesses.

So, for this article, I will be solely examining Constellation through the lens of a DCF and assume their future success will be somewhat like their past growth.

|

Base Case Assumptions: |

|

|

Growth rate for next 7 Years (excl. 2022 & 2023) |

15.0% |

|

Terminal Growth Rate |

3.0% |

|

Discount Rate |

9.0% |

|

Share Count Change |

0% |

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

Revenue $CAD |

$8,400 |

$9,930 |

$11,420 |

$13,132 |

$15,102 |

|

Net Income $CAD |

$1,437 |

$1,816 |

$2,089 |

$2,402 |

$2,762 |

|

Cash Flow $CAD |

$1,350 |

$1,706 |

$1,962 |

$2,256 |

$2,595 |

Source: Yahoo Finance and Author’s Calculations

| Intrinsic Value per Share ($USD) | $1,492 |

| Current Share Price ($USD) | $1,524 |

| Upside Potential | -2.1% |

In my base case scenario, Constellation’s shares are fairly valued, but this could change in the future should the business’s growth rate change or the macro-economic factors shift a further change to interest rates.

Sensitivity Analysis

|

8% Discount Rate |

9% Discount Rate |

10% Discount Rate |

|

|

Bull Case: 20% Revenue Growth |

$2,203 |

$1,793 |

$1,503 |

|

Base Case: 15% Revenue Growth |

$1,824 |

$1,491 |

$1,256 |

|

Bear Case: 10% Revenue Growth |

$1,504 |

$1,236 |

$1,046 |

Source: Yahoo Finance and Author’s Calculations

To account for the potential changes to interest rates and/or business developments I performed a sensitivity analysis to value the company under different scenarios. The results varied from $2203 to $1046 per share. Personally, I think 20% revenue growth is quite a stretch, but it could potentially be unlocked if Mark Leonard identifies other attractive industries to deploy excess capital into.

Risks

In my view, Roper, Tyler, and Constellation share the same primary risk: their ability to sustainably deploy capital towards accretive M&A targets.

As these companies continue to grow it’ll just become that much more difficult to put all their capital into M&A. Some companies, like Constellation, have been able to find new ways to deploy the capital (VC Fund, Larger Businesses). But others, like Roper, are sitting on billions of cash waiting for a home.

Luckily for these three companies, they primarily fund their acquisitions using internal capital meaning they stand to benefit from the increase of interest rates vis-a-vis less competition from financial buyers like PE firms hopefully resulting in lower valuations for acquired companies.

Conclusion

Roper, Tyler, and Constellation are excellent VMS software companies. All three companies are serial acquires of VMS businesses, but their approaches and results have varied.

In terms of financial performance, Constellation is the leader of the pack with a sustained high teens ROIC, best-in-class operating cash flow growth, and lack of shareholder dilution.

But Roper and Tyler are by no means, poor performers. Roper and Tyler have had great success too in acquiring VMS companies and driving cash flow higher, albeit at a slower pace compared to Constellation.

I own a stake in each of these companies but if I were to rank them, I think Constellation is both the best value and fastest grower (hard to beat that combo). In second place, I place Roper. After its divestments, Roper has become laser-focused on software, and its cash pile has the potential to supercharge its transformation and rapidly increase earnings. I’ll place Tyler in third place, no disrespect to Tyler, it’s just not growing as fast, but is somehow the most richly valued.

These rankings also mirror my own allocation to these stocks, Constellation is my largest holding and Tyler is one of my smallest.

I rate Roper a “Buy” with a 1-year price target of $440

I rate Tyler a “Hold” with a 1-year price target of $350

I rate Constellation a “Buy” with a 1-year price target of $1600

Unfortunately, their valuation keeps all of these companies away from earning a “strong-buy” recommendation from me, but I think that all three should earn their spot on a watchlist for any investor looking to hold companies for the long haul.

If you like profitable tech companies keep an eye on these three companies.

Thank You

As always thank you for reading. What do you think about these VMS companies? I make an effort to engage with all my readers, so if something has interested you, or if you have a question, please feel free to comment. I will do my best to get back to all of you with a response!

Be the first to comment