1715d1db_3/iStock via Getty Images

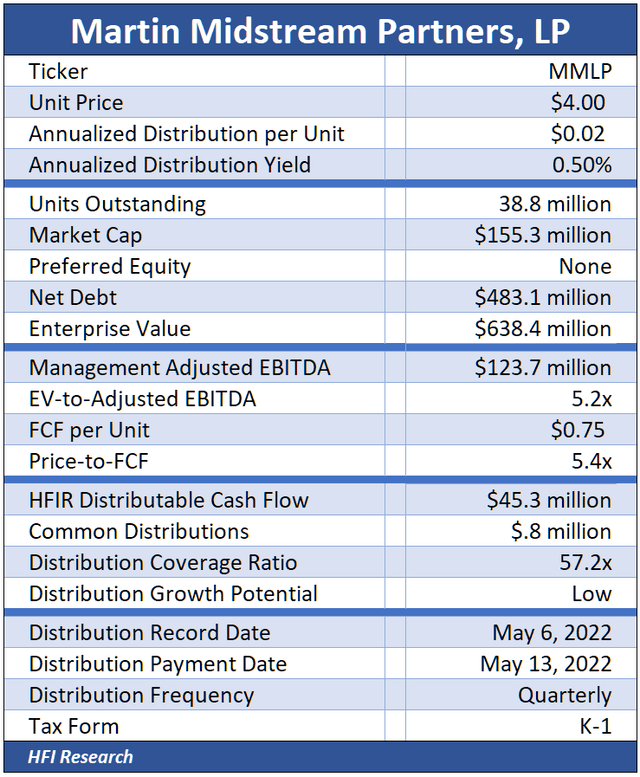

Martin Midstream Partners L.P. (NASDAQ:MMLP) units are trading in extreme bargain territory. We believe the market fails to appreciate the company’s long-term prospects once it refinances its senior notes. A refinancing will be pivotal in allowing MMLP to deleverage at an accelerated pace and eventually increase distributions to unitholders. We believe it will also set the stage for a doubling of MMLP units’ market price.

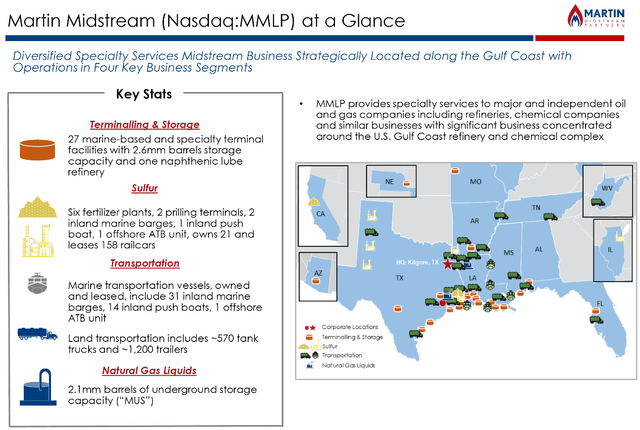

MMLP’s Assets and Operations

MMLP operates in diverse midstream lines that are more downstream-oriented than the typical public midstream operator. Its four business segments are shown in the graphic below.

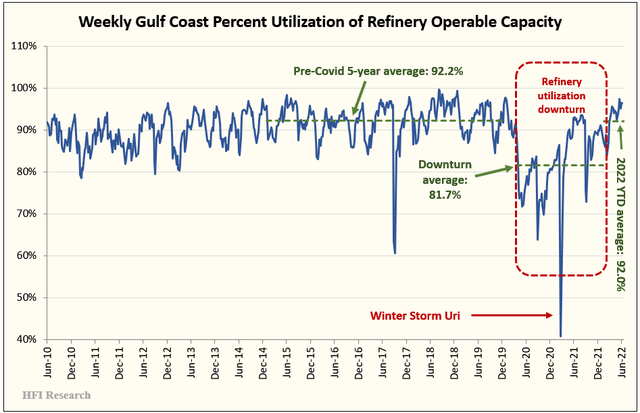

These business lines make MMLP’s business performance heavily dependent on Gulf Coast refinery capacity utilization. Overall, its business is seasonal, with its strongest quarters typically being the first and fourth quarters of each year.

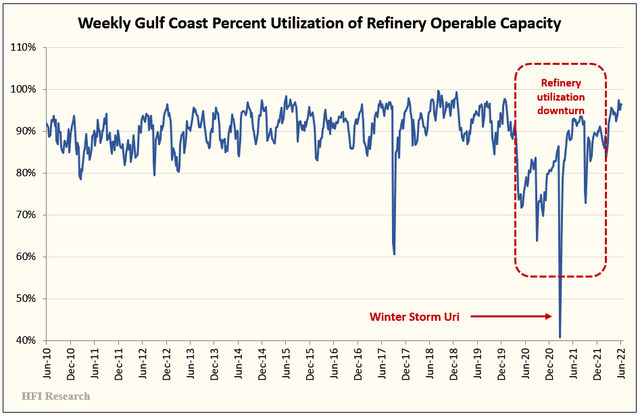

Each of MMLP’s four business segments was adversely impacted by a brutal downturn in refinery utilization that began in mid-2020 and continued through year-end 2021. MMLP’s Terminalling & Storage segment and its Transportation segment depend on activity in the Gulf Coast refinery complex. Its Natural Gas Liquids segment sources butane and propane feedstock from Gulf Coast refineries and counts Gulf Coast refineries among its major customers. Lastly, its Sulfur Services segment sources its molten sulfur feedstock from Gulf Coast refineries. All these business lines suffered as Gulf Coast refinery activity plunged relative to historical norms.

The following chart shows the downturn in Gulf Coast refinery capacity utilization, which occurred on an unprecedented scale.

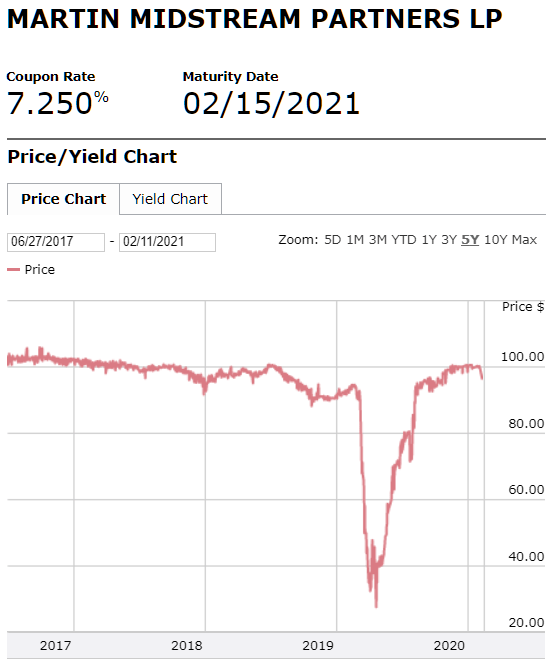

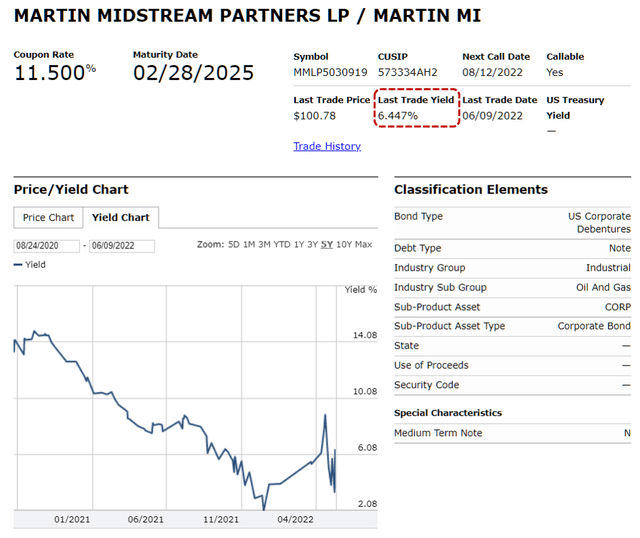

The mid-2020 downturn in MMLP’s operations precipitated a financial crisis for the company. At the time, it had a $365.5 million issue of senior notes coming due in February of 2021. The notes’ market price plunged amid fear that MMLP would default. Their price decline is shown in the following chart.

FINRA

MMLP management, under the leadership of Chairman and then-CEO Ruben Martin, successfully tendered for the notes through an exchange that offered holders newly issued 10.0% senior secured 1.5-lien notes due 2024 and 11.5% second-lien notes due 2025. The successful tender probably saved MMLP equity owners from being wiped out.

MMLP emerged from the debt exchange with $54 million of 10.0% 1.5-lien notes due 2024 and $292 million of 11.5% second-lien notes due 2025. The notes saddled the company with restrictive covenants and prohibited distribution increases until its adjusted leverage ratio was reduced to 3.75-times.

In the quarters since the debt exchange, MMLP’s higher interest costs have burdened its Adjusted EBITDA and cash flow. The company’s businesses also continued to perform below their potential. Increasing debt and lower Adjusted EBITDA sent MMLP’s leverage ratio to worrisome levels.

The fourth quarter of 2020 and the first quarter of 2021 were particularly challenging, as Adjusted EBITA fell well below historically normal levels. During those quarters, MMLP’s leverage ratio surged from 4.9-times to 5.3-times, which was potentially disastrous because the company was entering its seasonally weak second and third quarters with a high debt load. Moreover, the numerator of MMLP’s leverage ratio is the sum of the previous four quarters’ Adjusted EBITDA, so the seasonally weak quarters risked sending its leverage ratio to levels that risked triggering covenants in its revolving credit facility if Adjusted EBITDA failed to recover to historically normal levels.

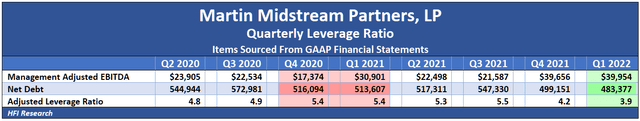

The table below shows MMLP’s quarter leverage ratio over the past eight quarters, with the most concerning quarters shaded in red.

The Recovery Begins

Since those challenging days, MMLP’s fortunes have turned for the better. We first purchased our MMLP units on July 15, 2021, at $2.92, as we expected that debt reduction and a recovery in Adjusted EBITDA would reduce the company’s leverage ratio.

Fortunately, things have turned out better than we expected. In the first quarter of 2022, MMLP’s leverage ratio fell to 3.87-times. This was the first quarter that MMLP’s leverage ratio was below 4.0-times since the second quarter of 2013, when the ratio stood at 3.99-times. Since then, MMLP’s leverage had always run on the high side, typically in the mid-4-times range.

MMLP’s first-quarter performance was aided after the terrible fourth quarter 2020 Adjusted EBITDA result rolled off from its leverage ratio calculation.

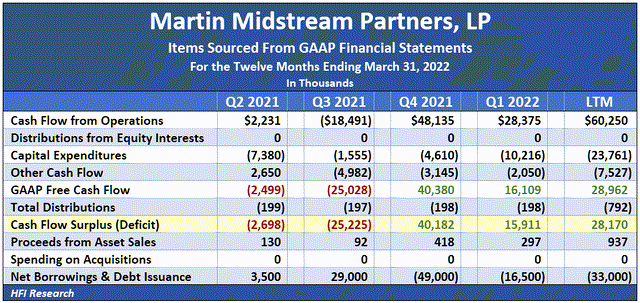

Aside from Adjusted EBITDA, cash flow performance has been similarly impressive. A string of two strong quarters enabled MMLP to generate a $28.2 million cash flow surplus over the past four quarters. Management allocated excess cash toward paying down debt, as shown in the table below.

Looking Ahead

Going forward, we expect the leverage ratio to benefit from stronger Adjusted EBITDA. Recent macro conditions have been as bullish as ever for Gulf Coast refiners, with refined product margins hitting all-time highs. The extent of the recovery in Gulf Coast refinery capacity utilization is shown in the chart below.

Improved financial performance will make it easier for MMLP to refinance its 2024 and 2025 maturities after they become callable in mid-August of this year. Despite recent turmoil that has sent bond prices lower and yields higher, MMLP’s second-lien notes currently trade to yield 6.5%, indicating that the bond market is confident in an MMLP refinancing.

A Management Aligned With Unitholders

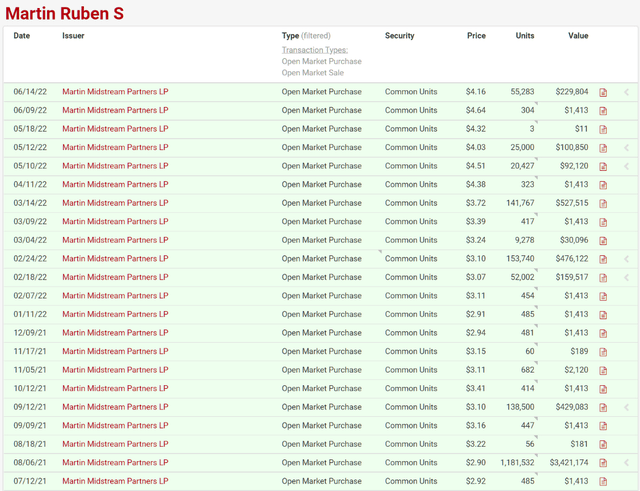

MMLP’s management is very much aligned with public unitholders. Its Chairman, Ruben Martin, has aggressively bought units in the open market after he and his team staved off bankruptcy in 2020.

Martin’s unit purchases are shown below. The most recent occurred on June 14 of this year.

In MMLP’s 2021 10-K, Martin is listed as the beneficial owner of 22.9% of MMLP’s outstanding common units.

We’d note that MMLP has a symbiotic relationship with Martin Resource Management Corp., which is controlled and majority-owned by Ruben Martin and his affiliates. Martin Resource Management owns MMLP’s general partner and 15.7% of MMLP’s outstanding common units. A bankruptcy or other serious financial problem at MMLP could have a negative impact on Martin Resource Management.

Management recently made the unitholder-friendly move to eliminate MMLP’s incentive distribution rights ((IDRs)) for no consideration. The move makes sense because the IDRs are far out of the money, but given the shoddy corporate governance that afflicts MLPs in general, Martin-controlled entities could have probably made a quick buck through the transaction. We appreciate the fact that they put unitholder interests first.

Liabilities and Risks

MMLP equity is not without risk. The equity’s prospects revolve around the company’s ability to refinance its high-yield debt. If it fails to refinance, the equity is at risk of being wiped out. For this reason, we consider MMLP equity to be speculative, despite its large potential upside.

The equity’s prospects also depend on the terms MMLP obtains in any refinancing. Clearly, it will have to secure a lower borrowing rate than the 10.0% and 11.5% it is currently paying in order to reduce interest expense, boost free cash flow, and facilitate an accelerated pace of deleveraging. It will also have to avoid significant unitholder dilution, which could take the form of a convertible security.

The company has a few operational risks, as well. For instance, over the past eighteen months, it has experienced price increases in the price it pays for raw materials and parts. The company’s margins could come under pressure if it can’t offset higher costs through increased revenues. While MMLP should be able to withstand inflation, its operations are nowhere near as inflation resistant as high-quality pipeline operators.

Another risk arises from MMLP’s hedging activities. Depending on commodity prices, anywhere from 30% to 40% of the company’s revenues are margin-based, with the remainder being fee-based. In its margin businesses, it manages price risks through hedging, which involves its own set of risks. However, management has been consistently prudent with its hedging activities in the past, and we expect that to continue. We might also note that MMLP’s brush with a potential bankruptcy is probably still fresh in management’s minds. A management that has been chastened by such an experience is unlikely to do anything to put the company or its equity at risk.

Valuation

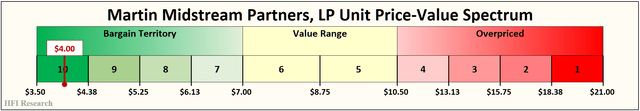

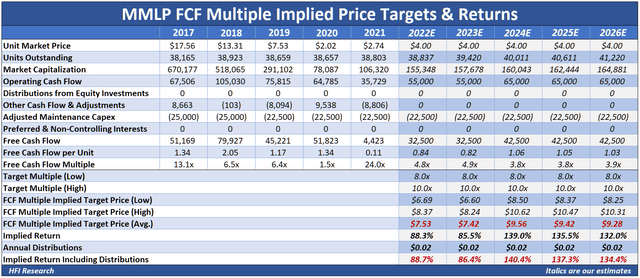

We value MMLP units in the range of $7.00 and $10.50. Our price target is $8.75, the middle of the range. The units—currently trading around $4.00—are in deep bargain territory and would have to appreciate by more than 100% upside to reach our price target.

In our valuations, we assume MMLP successfully refinances its 1.5-lien and second lien notes. If it can lower its borrowing cost to 7.5%, it will generate an incremental $13 million of free cash flow on an annual basis. We assume that a refinancing occurs in late 2023 or early 2024 and that it results in an additional $10 million in free cash flow in 2024 and beyond. Other than that, we assume Adjusted EBITDA and free cash flow remain flat from what we believe are conservative 2022 estimates. We also assume the company reduces debt by $15 million in 2022 and 2023 and by $25 million in 2024 and thereafter. We assume no dilution from a capital raise, and we assume distributions remain at their current level.

Our valuation using free cash flow multiples estimates the units’ value to be $7.53 in 2022. The valuation increases to $9.28 in 2026, which is 134% above today’s unit price, primarily due to increasing free cash flow.

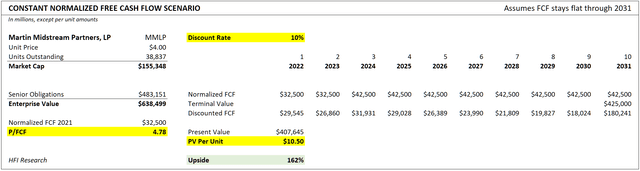

Our discounted cash flow valuation assumes our estimate of MMLP’s 2022 free cash flow remains flat but gets a one-time $10 million bump in 2024 from a successful refinancing. It indicates the units are worth $10.50, which equates to upside of 162%.

We could instead assume that management decides against allocating free cash flow toward paying down debt and that after refinancing it decides to pay out 75% of MMLP’s free cash flow. By our estimates, doing so would result in an annual distribution of $0.82 per unit in 2024. If we apply a 7.5% yield to that $0.82 distribution, we calculate an equity price of $10.67.

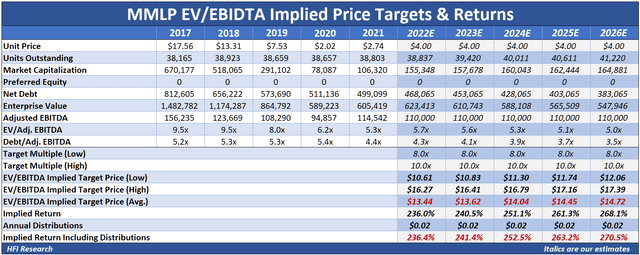

Lastly, our EV/EBITDA valuation generates a significantly higher valuation as the multiple increases from its current EV/EBITDA multiple of 5.7-times to 9.0-times and as debt gets paid down at an accelerated pace over the next five years. It implies a value of $13.44 for the units in 2022, which represents a 236.4% return from the current unit price. The implied value increases to $14.72 by 2026, for 270.5% implied upside.

We believe the free cash flow valuation is more appropriate for MMLP, so we applied a much lower weighting to the EV/EBITDA valuation in estimating a range of intrinsic value.

Conclusion

We like MMLP mostly for its appreciation potential and for the prospect of significant distribution increases several years out. MMLP serves the further purpose of diversifying our income portfolio, which has heavy exposure to upstream-facing activities performed by the midstream sector. We also like the fact that MMLP is not as strongly tied to energy commodity cycles as most of our other energy equities. Instead, its performance will track Gulf Coast refinery activity, which we expect to remain robust and relatively stable for decades.

So we see a lot to like in MMLP, understanding that risks loom large. But we believe the huge margin of safety between MMLP unit price and our estimate of the units’ intrinsic value tilts the odds in our favor of achieving a positive investment result. A refinancing will turn MMLP units into a bona fide investment with attractive long-term capital appreciation and income potential.

We reserve one position in our HFI Research MLPs portfolio for a speculative holding that we believe has a high probability of paying off. At the moment MMLP occupies that position. We recommend that investors similarly buy MMLP equity for the long-term with the speculative portion of their funds.

Be the first to comment