Adrian Vidal/iStock via Getty Images

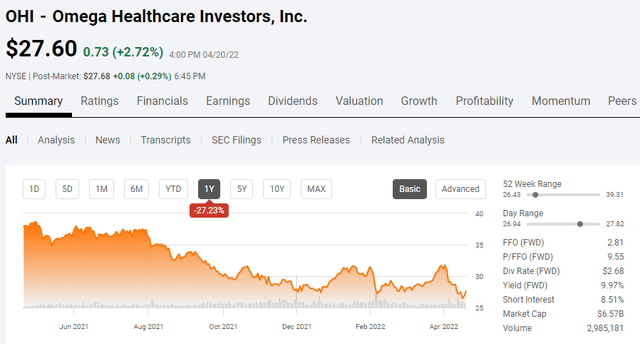

Shares of Omega Healthcare Investors (NYSE:OHI) have been decimated over the past year. Coming off the Covid-Crash, OHI hovered in the upper $30 range from December 2020 thru July 2021 before their downward descent occurred. Plagued with tenant non-payments and continued tenant issues, investors have watched shares of OHI decline to the mid to upper $20s. Every time it seems like progress is being made and shares enter the low $30s, a sell-off occurs, and it’s back to the upper $20s. In the most recent decline, shares slid by -16.62% ($5.28) from $31.77 on 4/1/22 to $26.49 on 4/18/22. Overall the past year hasn’t been good for shareholders as OHI is down by -27.23%.

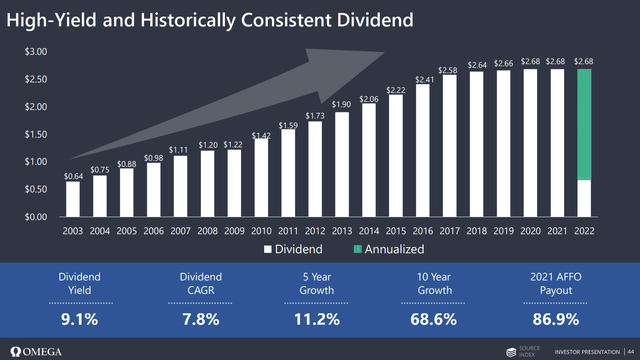

OHI’s shares continue to be under pressure, and speculation about the dividend being reduced has surfaced again. The people doing the speculating should really look at OHI’s numbers as the dividend is fully covered. The decline in share price is the only reason why OHI’s yield crossed over the 10% mark this week. Management released a new investor presentation on 4/4/22, and it clearly indicates that OHI is projecting to pay its full dividend of $2.68 per share. Management also issued a press release back on 1/27/22, which outlined a stock repurchase program of up to $500 million of OHI’s common stock through March of 2025. OHI will likely go ex-dividend at the end of April or beginning of May as their dividend is usually paid around May 15th for Q2. If there was going to be a dividend cut, I believe shareholders would have been notified already. I have been a shareholder of OHI since 2017, and I have ridden the price fluctuation in both directions. I believe these levels shall pass and that now is a great entry point as OHI looks cheap compared to its competitors.

Omega Healthcare Investors looks inexpensive from a valuation standpoint

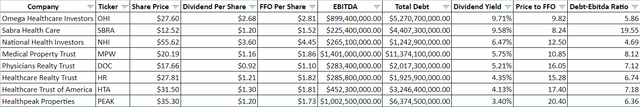

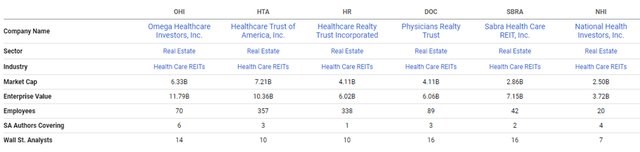

According to Seeking Alpha, OHI’s peer group consists of Healthcare Trust of America (HTA), Healthcare Realty Trust (HR), Physicians Realty Trust (DOC), Sabra Health Care (SBRA), and National Health Investors (NHI). I will also add Healthpeak Properties (PEAK) and Medical Properties Trust (MPW).

Steven Fiorillo / Seeking Alpha

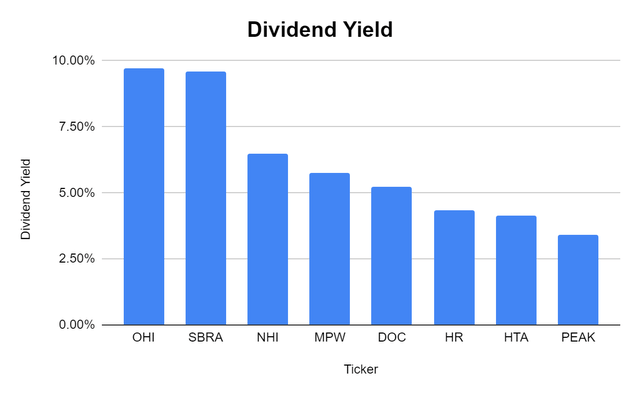

From OHI’s expanded peer group, they have the largest dividend yield at 9.71%. SBRA comes in 2nd at 9.58%; then there is a significant drop in NHI at 6.47%.

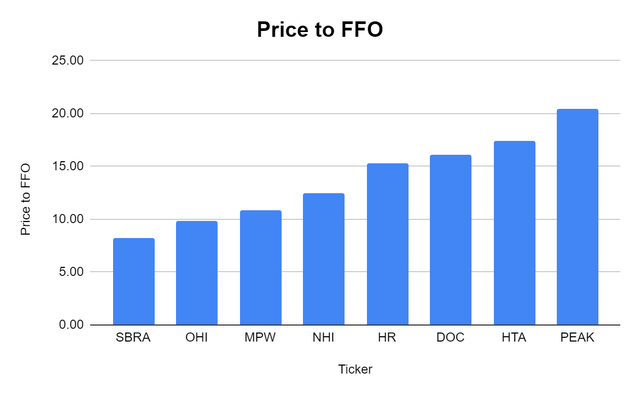

I always like to look at how cheap I can pay for a company’s Free Cash Flow (FCF) or EPS. Since these are REITs, their Funds From Operations (FFO) is the metric I will be looking at. The price to FFO is a REITs version of a P/E which can become a useful tool for comparing valuations across several REITs. Due to the depreciation of assets as a form of a business expense looking at earnings or net income doesn’t always provide the clearest picture.

There are currently two REITs in this group trading under a 10x Price to FFO. SBRA trades at an 8.24x ratio while OHI trades at 9.82x. The other companies in the group trade between 10.85x and 20.4x. So far, OHI has a 9.71% dividend yield and trades under 10x its FFO. These are very enticing metrics so far.

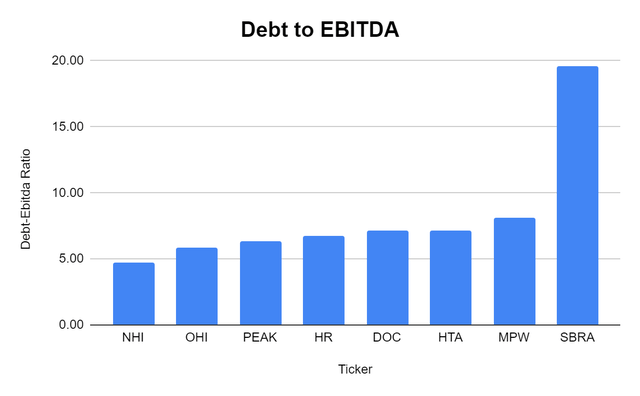

I like to evaluate companies based on the total debt to EBITDA ratio as well. This allows me to see the amount of income generated and available to pay down debt before covering interest, taxes, depreciation, and amortization expenses. When REITs, in particular, have a high ratio, it could mean they are too leveraged, and they have taken on too much debt building their asset base. The main reason for this is the REIT structure doesn’t allow them to take large portions of their profits and invest them back into the business, as they are required to pay out at least 90% of their taxable income as dividends to their investors. To grow, REITs must take on debt to grow their business.

So far, SBRA and OHI have looked great from the dividend yield and price to FFO perspectives. When you look at the debt to EBITDA ratio, it’s a much different story. SBRA is trading at a 19.55x ratio while OHI trades at 5.86. NHI is the lowest in the group with a 4.69x ratio, while the majority of the peer group trades between 6-8.25x debt to EBITDA.

After looking at an expanded peer group, OHI looks inexpensive. You’re getting the largest yield at the 2nd lowest price to FFO ratio and the 2nd lowest debt to EBITDA ratio. SBRA was looking very interesting until their debt-EBITDA ratio. At OHI’s current prices, you’re paying under 10x its FFO, and based on these metrics, OHI looks undervalued. If I was looking for a yield monster, it would be between OHI and SBRA, but the debt to EBITDA would eliminate SBRA from my decision. If I was looking for the best deal for a dividend play, it’s hard to develop a supporting argument for any other companies other than OHI.

Omega Healthcare’s dividend is fully covered

Many investors look at FFO as the main metric to evaluate REITs and while it is an important metric, when it comes to the dividend, using the adjusted funds from operations (AFFO) is a better measure. In 2021 OHI paid $637.6 million in common dividends while generating $655.2 million in AFFO. Speculation about a dividend cut really kicked up throughout the 2nd half of 2021 and early 2022 as we learned more about some of OHI’s tenant troubles. In OHI’s Q4 financial measures, they clearly indicated that they generated $190.38 million in AFFO, equivalent to $0.771 per share. As OHI pays $0.67 per share on a quarterly basis, this amount is fully covered. If you go through the Q4 financial measures on page 5, OHI indicates their funds available for distribution (FAD). From OHI’s AFFO, there was $178.78 million in FAD, which works out to $0.724 of FAD per share. These numbers are from OHI’s most recent financials and indicate that OHI is still generating enough to cover its dividend.

People can speculate about a dividend reduction, but OHI’s management team knows the numbers, and if a dividend cut was looming, I would think they would have announced it in the recent investor presentation with some commentary. Why would OHI keep the $2.68 number for 2022’s dividend in the recent investor presentation if they were going to announce a dividend cut on the next earnings call? OHI is going ex-dividend in several weeks, and due to the lack of communication on the dividend side from management, the Q4 AFFO & FAD, and the recent presentation, I don’t see a dividend reduction on the horizon. This will mark the second year without a dividend increase if we finish 2022 at $2.68. If anything, I would think that toward the end of 2022, OHI will reinstate its dividend growth trajectory if its headwinds subside.

Conclusion

I think the recent decline has pushed OHI into a pricing level that won’t last long. How many investments are there with a 10% yield that is fully covered? The past several times OHI has reached these levels, it rebounded to over $30. The sharp decline didn’t occur from a missed earnings report; it occurred just as the latest investor presentation was released, and it wasn’t a bearish report. OHI’s board has also authorized a $500 million share buyback program over the next 3 years. I think this is bullish news for long-term investors as management clearly feels OHI’s headwinds will dissipate, and they will be in a stronger position down the road. OHI looks undervalued compared to its peers and has the most attractive overall metrics from a valuation standpoint.

We’re 2 weeks away from OHI’s earnings call. I am going to be looking for management to speak about their tenant issues, the dividend, the overall business, and the buyback plan. I would like to see an indication that we will get back to previous levels of FFO in the near future. This will be an important earnings report, and if OHI can provide some positive color, it could eliminate the speculation around the dividend and its business, making shares attractive to a larger audience. I don’t think shares will stay at this level for too long, and if management delivers a halfway decent quarterly report, we should go right back to the low $30s.

Be the first to comment