peshkov/iStock via Getty Images

Investment Thesis

Cenovus Energy (NYSE:CVE) has definitely benefited from the massive demand for oil and gas in the past year, given its enormous revenue growth and robust FCF generation. However, those looking for steady dividend returns similar to Chevron Corporation (CVX) and Exxon Mobil Corporation (XOM) would likely be disappointed, given the management’s short-term guidance for share repurchase programs and variable dividends instead.

Nonetheless, all hope is not lost, since CVE is looking to expand its productions and potentially boost its decelerating revenue growth from FY2023 and FY2026 onwards, through the Sunrise oil sands project and West White Rose Project, amongst others. In addition, the management has proved prudent in its capital management, given the wise decision to deleverage down to $4B of net debt in the current high-interest rate environment. Therefore, investors looking to add CVE would be wise to look for attractive entry points, since the stock has the potential to become a multi-bagger in the long run.

CVE Has Benefited From The Massive Consumer Demand

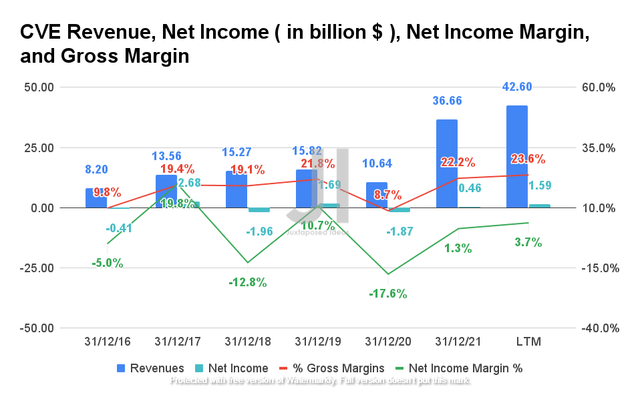

CVE Revenue, Net Income, Net Income Margin, and Gross Margin

CVE reported an impressive jump in revenue in the last twelve months (LTM), with revenues of $42.6B and gross margins of 23.6%, representing an increase of 269.2% and 1.8 percentage points from FY2019 levels, respectively. In addition, the company also recorded decent net income profitability of $1.59B, broadly in line with FY2019 levels.

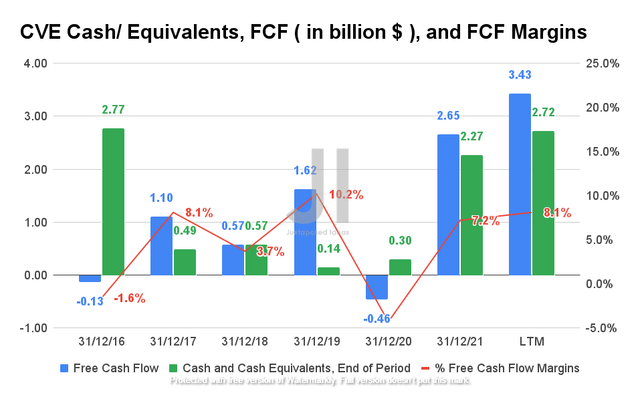

CVE Cash/Equivalents, FCF, and FCF Margins

Given the recent windfall, it is apparent that CVE also reported improved Free Cash Flows (FCF) of $3.43B and FCF margins of 8.1% in the LTM, representing an increase of 211.7%, though a decline of -2.1 percentage points, respectively.

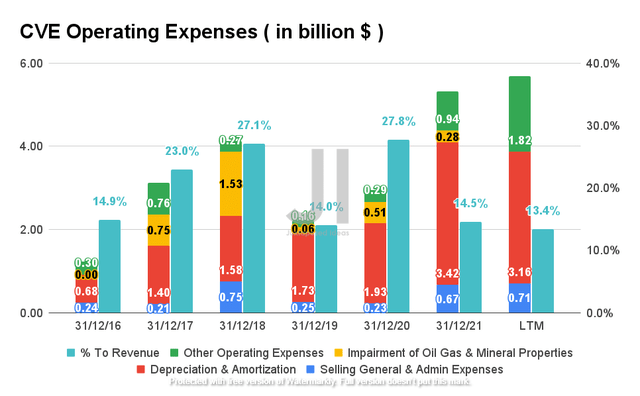

CVE Operating Expense

If we were to study its expenses, CVE has also been ramping up its operations in the past two years, with a total of $5.69B of operating expenses in the LTM. However, the company has also maintained it to a reasonable level of 13.4% in regard to its growing revenues. Regardless, given the potential normalization of consumer demand in the next few years, it would be prudent for investors to observe this segment keenly as the company balances its positive net income margins with the elevated operating costs.

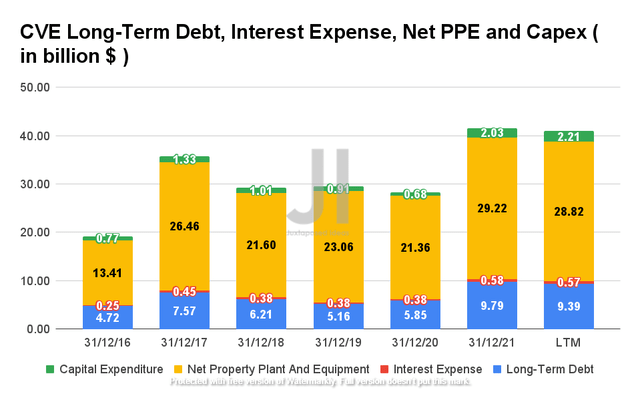

CVE Long-Term Debt, Interest Expense, Net PPE, and Capex

In the meantime, CVE had taken up more long-term debts in the LTM at a total of $9.39B, though we are encouraged to see only $0.57B in interest expenses as well. Nonetheless, given the current demands, it made sense to see the company report net PPE assets of $28.82B with an increasing capital expenditure of $2.21B in the LTM and up to $2.63B by the end of the year.

In the short term, we also expect to see a certain impact on CVE’s cash flow, given the recent asset swap with BP (BP) in the Sunrise oil sands project. In addition, the company would incur higher capital expenditure in the intermediate term, given its commitment to restart the West White Rose Project offshore Newfoundland and Labrador, of up to $2.3B by FY2026. Nonetheless, we are not concerned, given that these would eventually be top and bottom line accretive by the decade’s end.

However, given CVE’s plans to aggressively deleverage and boost its production capacity, there would be a lower chance for steady dividend payouts in the near future. Nonetheless, investors should be encouraged to see the company laser-focused on lightening its debt load, capacity expansion, and growth opportunities during this “high commodity pricing” environment.

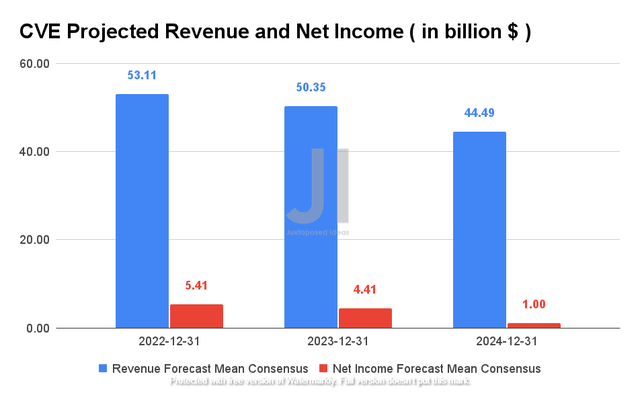

CVE Projected Revenue and Net Income

CVE is expected to report an apparent deceleration of revenue and net income growth over the next three years. Nonetheless, we must also highlight that it still represents a tremendous revenue growth at an impressive CAGR of 22.99% from FY2019 to FY2024. As a result, we believe that CVE has a massive runway for growth and expansion, given the upcoming three years of windfall.

For FY2022, consensus estimates that CVE will report revenues of $53.11B, representing an impressive increase of 44.9% YoY and 335.9% from FY2019 levels. In addition, the company is expected to report a much improved net income profitability of $5.41B and a net income margin of 10.1% for FY2022, representing a remarkable increase of 82.1% YoY and 470.4% from FY2019 levels while also improving its margins by 8.8 percentage points YoY. For FQ2’22, analysts will be closely watching CVE’s performance, with consensus revenue estimates of $13.88B and EPS of $0.77, representing YoY growth of 53.3% and 320.8%, respectively. We shall see.

So, Is CVE Stock A Buy, Sell, Or Hold?

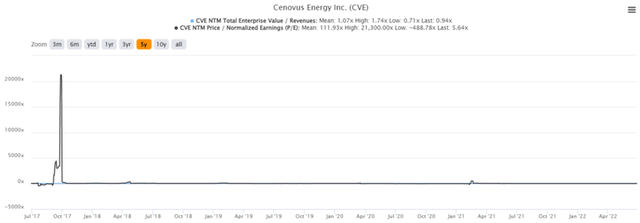

CVE 5Y EV/Revenue and P/E Valuations

CVE is currently trading at an EV/NTM Revenue of 0.94x and NTM P/E of 5.64x, lower than its 5Y mean of 1.07x and 111.93x, respectively. The stock is also trading at $20.33, down 18.1% from its 52-week high of $24.85, though at a premium of 282.3% from its 52-week low of $7.20. It is evident that CVE was also affected by the “perceived reduced consumer demand” affecting the oil and gas industry, given the recent stock price weakness since 07 June 2022.

CVE 5Y Stock Price

However, we believe the potential recession fears are overblown, given the robust demand and limited supply for oil and gas globally. In addition, despite the projected moderation in demand by FY2024, the oil and gas industry will remain the backbone of the global economy for easily this and the coming century. As a result, we do not believe in the perceived “demand destruction,” but rather a temporary reduction in the times of inflation.

Nonetheless, we also think that CVE looks relatively pricey now, despite the recent correction. It is evident that the stock had been on a tear since March 2020, significantly boosted by the Ukraine war. Though the stock is trading slightly lower than its 50-day moving average of $26.32, it is still slightly above its 100-day average of $23.30, with minimal upside and margin of safety to consensus estimates price target of $24.67. Given the Fed’s hike in interest rates to 3.4% by the year-end and a further hike to 3.8% by FY2023, we believe a moderate retracement is also on the horizon.

As a result, we encourage investors with lower risk tolerance to wait for a deeper retracement before adding to their portfolio. However, speculative investors with an eye for long-term growth may want to take a nibble now.

Therefore, we rate CVE stock as a Hold for now.

Be the first to comment