Justin Sullivan

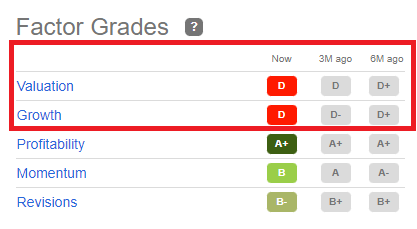

Surprisingly or not, the negative sentiment towards consumer staples and Coca-Cola (NYSE:KO) in particular, has been on the rise in the past months. The predominant narrative is that as we entered a period of higher inflationary pressures, consumer staples will have a harder time dealing with rising costs.

Another line of thought is that the largest multinational companies will be most at risk in a world market by deglobalization. In this simplistic bearish thesis, Coca-Cola’s premium valuation is yet another ‘red flag’.

After all, if you have a company that scores poorly on relative valuation and its growth prospects, while at the same time is facing inflationary pressures, then how can you not be bearish on it?

Seeking Alpha

The Set Up

About two years ago, I first wrote about my reasons for being optimistic about Coca-Cola’s future. At the time, the pandemic was raging across the globe and lockdowns were still in place. The sentiment around KO was similar to that today, with many market commentators telling us that Coke’s business model is now well-positioned for such an environment.

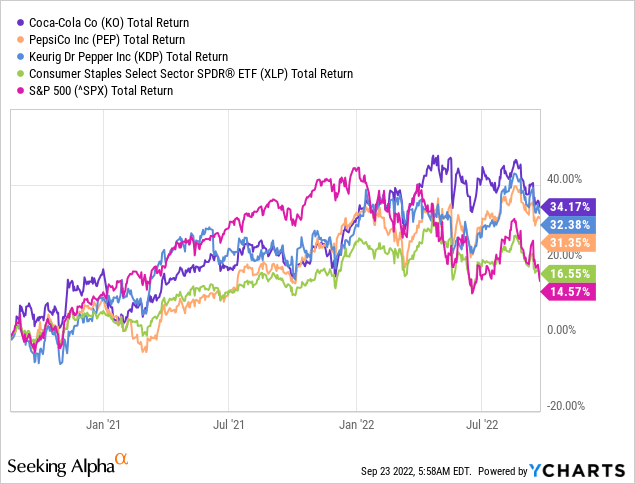

As it turns out, however, since my first thought piece on the company, KO outperformed on an absolute basis (not to mention risk-adjusted), both its major peers – PepsiCo (PEP) and KDP (KDP), the consumer staples sector and the broader market as measured by the S&P 500.

So what happened?

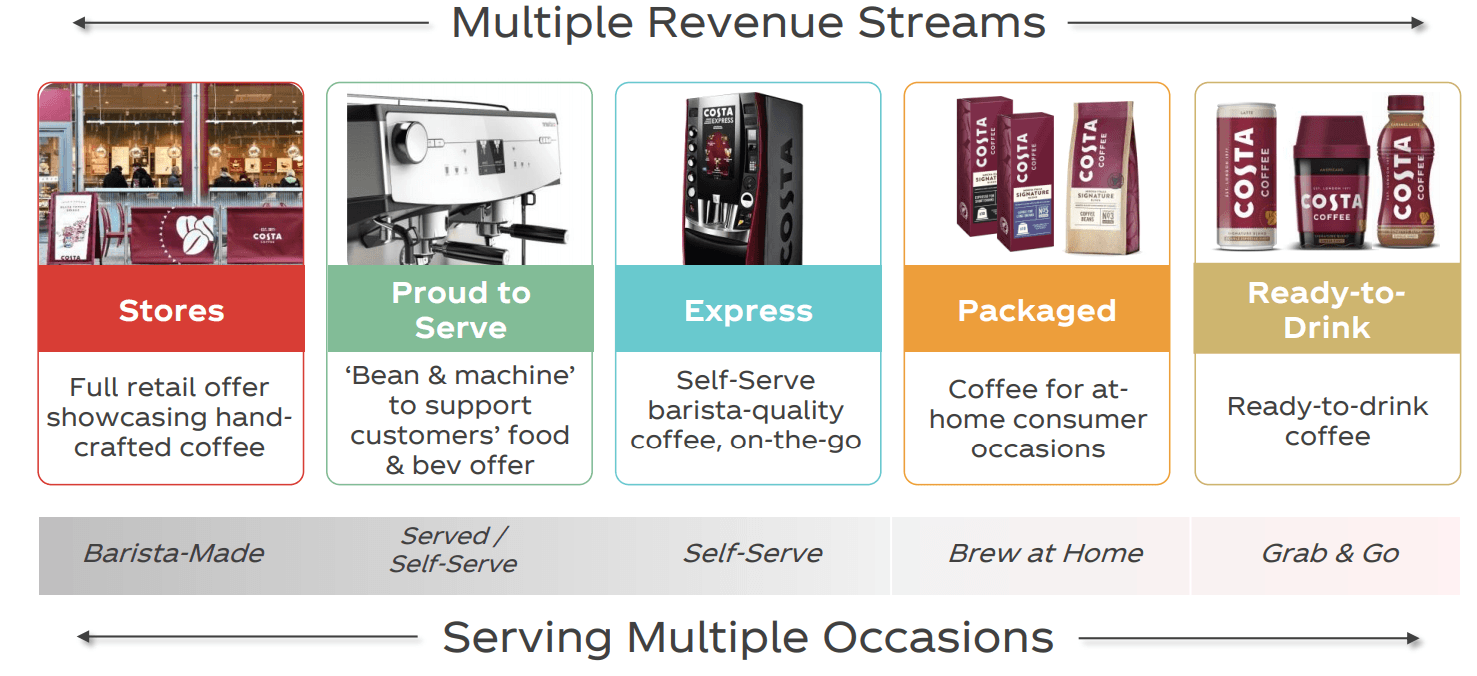

As many investors were focusing on elevated price-to-earnings multiples and the outside risks, Coca-Cola’s management has made an excellent capital allocation move by acquiring Costa Coffee. Of course, all the positives of this acquisition were not plain to see in the short-term, especially with all the lockdowns in place.

Coca-Cola Investor Presentation

But for anyone with a longer investment horizon, Coca-Cola’s capital allocation decisions seemed superior to those of its peers.

I go into further detail on all that in the analysis titled ‘Coca-Cola: Why Transforming The Business Will Have Profound Implications On Returns‘. If you haven’t read it, I would highly encourage you to do so at it goes deeper into the topic of capital allocation.

Is There Really An Issue?

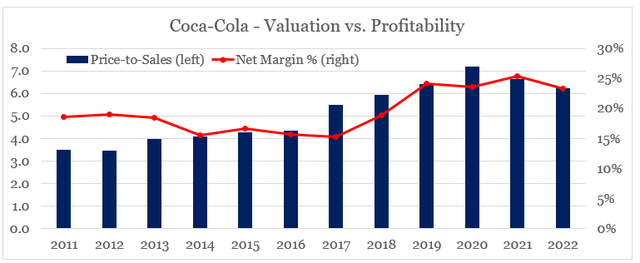

Coca-Cola’s premium valuation is largely supported by its industry-leading profitability. That is why, as we see in the graph below, on a historical basis KO price-to-sales multiple moves in unison with the company’s net income margin.

prepared by the author, using data from SEC Filings

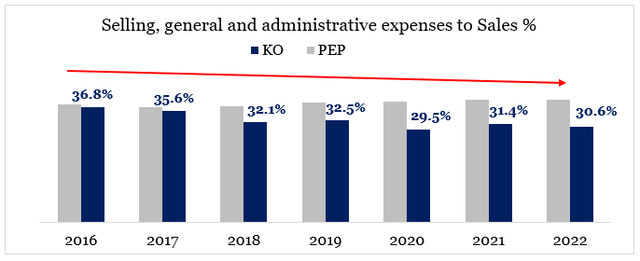

In terms of fixed costs, Coke is still way ahead of its peers due to its large international exposure and asset-light business. Even when compared to PepsiCo, Coca-Cola’s competitive advantage is obvious.

prepared by the author, using data from SEC Filings

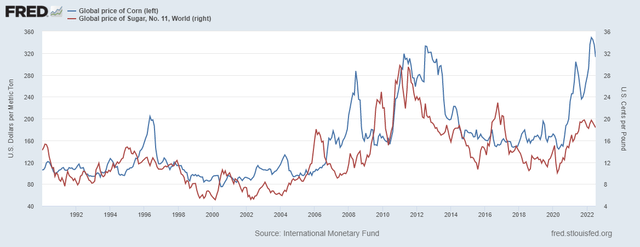

So far inflation is having a profound impact on margins, however, we should not forget that inflationary readings are backwards looking and prices of key raw materials for KO seem to have already peaked.

FRED

Of course, it is largely speculative what the future holds, however, Coca-Cola has already partially offset the inflationary hit on margins through pricing actions.

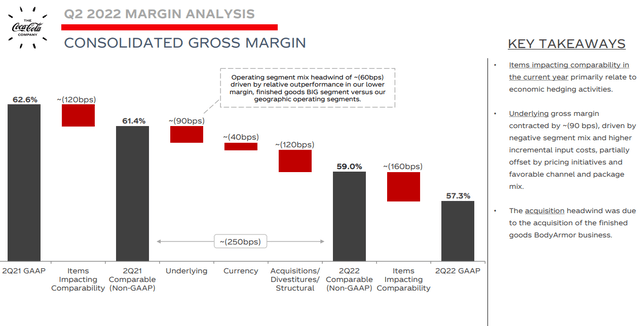

Our price/mix of 12% was primarily driven by strategic pricing actions across markets, along with revenue growth management initiatives, further improvement in away-from-home channels in most markets and positive segment mix. Comparable gross margin for the quarter was down approximately 250 basis points versus the prior year, primarily due to the impact of 3 items: one, an upsized increase in costs in the business due to the inflationary environment; two, currency headwinds driven by the volatile macro backdrop; and three, the mechanical effect of consolidating the BODYARMOR finished goods business.

John Murphy – CFO

Source: Coca-Cola Q2 2022 Earnings Transcript

As a matter of fact, the underlying drop in gross profitability due to the unprecedented jump in raw materials has been relatively low.

Coca-Cola Q2 2022 Investor Presentation

Of course, this does not represent the full impact of the current spot price in commodities as input costs are hedged. Moreover, the truly international nature of KO gives it a significant advantage over its peers that are focused on North America or Europe as inflationary impact varies significantly from country to country.

Moreover, Coca-Cola’s strong brand portfolio also allows the management to pass a significant proportion of these higher costs on the consumer.

We anticipate more cost increases will come through on a broad-based set of inputs. And we will continue locally in each country because it’s very different. We will continue to pass those through.

James Quincey – Chairman and CEO

Source: Coca-Cola Q2 2022 Earnings Transcript

Therefore, Coke’s profitability and overall valuation are not at significant risk going forward and even if inflationary pressures continue, Coca-Cola’s business will not be impacted as bad as lower value-added consumer staples.

The Cash Flow Perspective

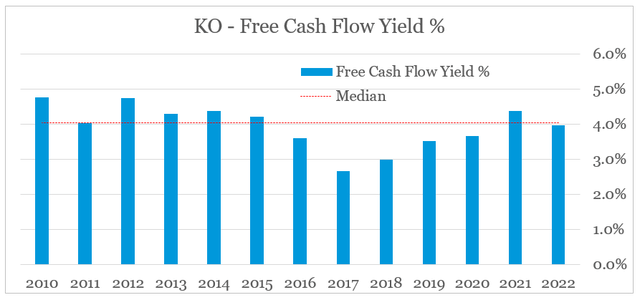

On a cash flow basis, Coca-Cola trades at its long-term median free cash flow yield which does not point to a significant overpricing.

prepared by the author, using data from SEC Filings and Seeking Alpha

Indeed, bond yields are near their 10-year highs at the moment which could make fixed income securities more attractive at this point, but that’s a separate topic.

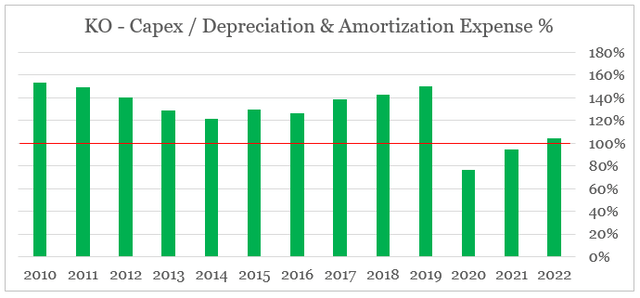

We should also note that Coca-Cola has also reduced its overall capital expenditure following the pandemic, however, for the past 12-month period, KO is once again spending more on capex than its depreciation & amortization expense. This is the case even as the company has divested its capital intensive bottling operations.

prepared by the author, using data from SEC Filings

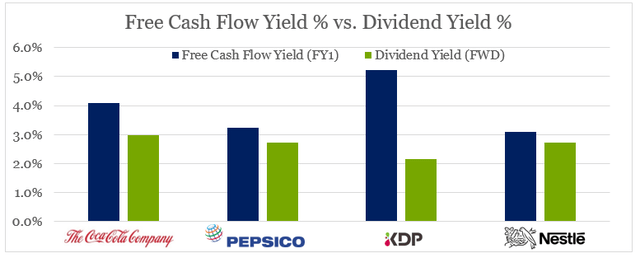

Relative to its direct peers, Coca-Cola also trades at more attractive free cash flow and dividend yields. The only exception is Keurig Dr Pepper, which has been yet another attractive opportunity in the consumer staples space in my view.

prepared by the author, using data from Seeking Alpha

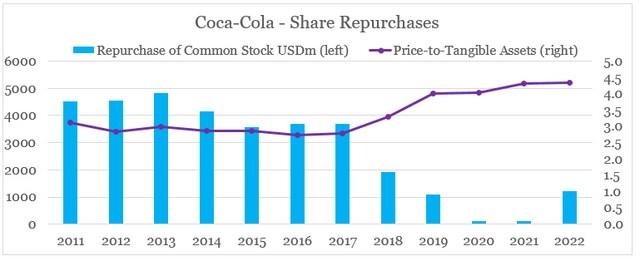

Last but not least, Coca-Cola’s management seems to have been making very good capital allocation decisions. Apart from becoming asset-light business focused exclusively on beverages and the decision to enter the highly profitable and branded coffee space, Coca-Cola has also significantly reduced its share repurchases during this transition period.

Over the past 12-months, however, this has been changing, even as the price-to-tangible assets remains high.

prepared by the author, using data from SEC Filings

Conclusion

Coca-Cola is among those businesses that are unlikely to make anyone rich quickly, however, KO is in excellent position to continue to beat the market just as it did for the past 2-year period. Coke’s share price is by no means a bargain at this level, however, such a high quality business that is also exceptionally well-managed is unlikely to trade at a discount anytime soon. Fears of inflation are also largely overblown as Coca-Cola is among the best-positioned consumer staple businesses to cope with the rising costs of raw materials.

Be the first to comment