Scott Olson/Getty Images News

This year, we have published already two articles on Best Buy (NYSE:BBY), titled:

Both times we have rated Best Buy’s stock as a “hold”. The main reasons for our rating were:

+ According to the traditional price multiples, BBY appears to be undervalued.

+ The firm has a strong track record of returning value to its shareholders through dividend payments and through share buybacks.

– Macroeconomic headwinds are likely to put downward pressure on sales and margins in the near term.

– Best Buy’s enterprise comparable sales have been declining.

In today’s article, we will revisit Best Buy and provided and updated view on the stock, taking the recent macro- and microeconomic developments into account.

Let us start with the firm’s latest quarterly earnings report.

Quarterly earnings report

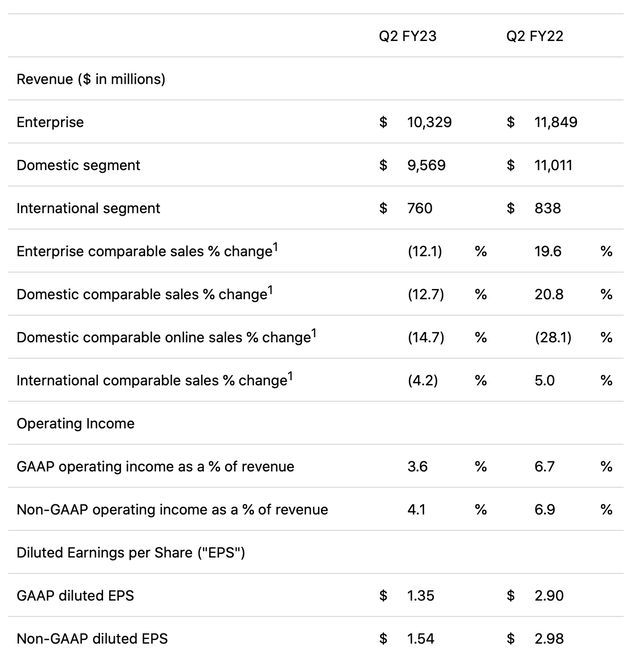

Just like in the first quarter, in the second quarter the comparable sales figures have kept falling.

Sales have been trending lower across all segments, together with contracting margins. While these results are not particularly pleasing for the shareholders, they do not come as a surprise. We have highlighted in our previous article that the low levels of consumer confidence are likely to lead to declining demand for durable, non-essential goods. This trend is clearly apparent now in the firm’s results. In the press release, the management has also elaborated on the softer than expected demand, compared to the prior years:

Our comparable sales were down 12.1% as we lapped strong comparable sales growth last year of 19.6%. […] As we entered the year, we expected the consumer electronics industry to be softer than last year following two years of elevated growth driven by unusually strong demand for technology products and services and fueled partly by stimulus dollars. The macro environment has been more challenged due to several factors and that has put additional pressure on our industry.

On the other hand, the company has kept its latest guidance (released in July) unchanged, which foresees a comparable sales decline in a range around 11% and a non-GAAP operating income rate of approximately 4%.

On a segment basis, there has been more information provided on the driving factors of decline sales and contracting margins:

Domestic

From a merchandising perspective, the company had comparable sales declines across almost all categories, with the largest drivers on a weighted basis being computing and home theatre. Domestic gross profit rate was 22.0% versus 23.7% last year. The lower gross profit rate was primarily due to: (1) lower services margin rates, including pressure associated with the Best Buy Totaltech membership offering; (2) lower product margin rates, including increased promotions; and (3) higher supply chain costs.

All of the reasons mentioned here have been to some extent anticipated in our first two articles.

International

International revenue of $760 million decreased 9.3% versus last year. This decrease was primarily driven by a comparable sales decline of 4.2% in Canada and the negative impact of approximately 420 basis points from foreign currency exchange rates. International gross profit rate was 23.4% versus 24.3% last year. The lower gross profit rate was primarily driven by lower product margin rates.

Not only Best Buy, but many firms operating internationally have seen significant currency exchange headwinds in the latest quarters, due to the historically strong USD against other currencies. Due to the rising interest rates in the United States, we expect this trend to continue in the near future, and keep negatively impacting BBY’s financial performance overseas.

Returning value to shareholders

Best Buy has shown strong commitment in the last 18 years to return value to its shareholder in the form of dividend payments. On the 31st of August, the firm has announced that the board of directors has authorised a quarterly dividend of $0.88 per share, in-line with the previous amount. This amount corresponds to a forward yield of approximately 4.7%.

On the other hand, the company paused share repurchases during Q2 FY23. While we previously stated that we like companies that are buying back their shares, we understand the reason for the current decision. In our opinion, in the current challenging macroeconomic environment, it is important that the firm adjusts its capital allocation priorities to make sure that they have enough financial flexibility, in case the headwinds persist longer than anticipated.

Valuation

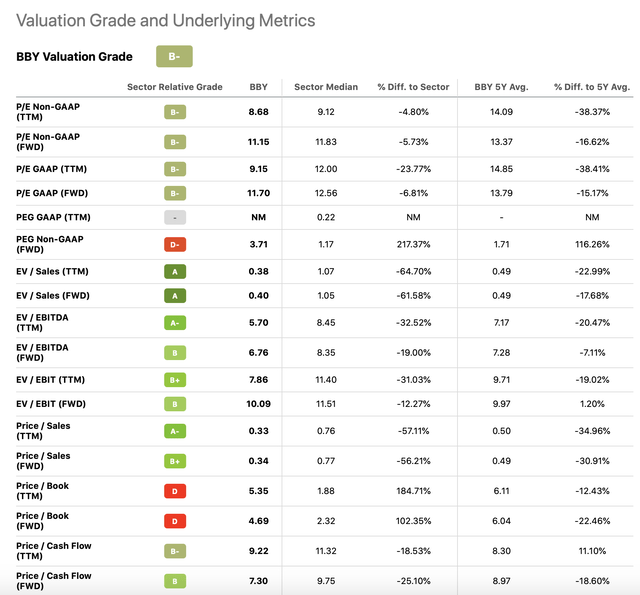

In our previous articles, we have mentioned that we find BBY’s stock attractive from a valuation point of view.

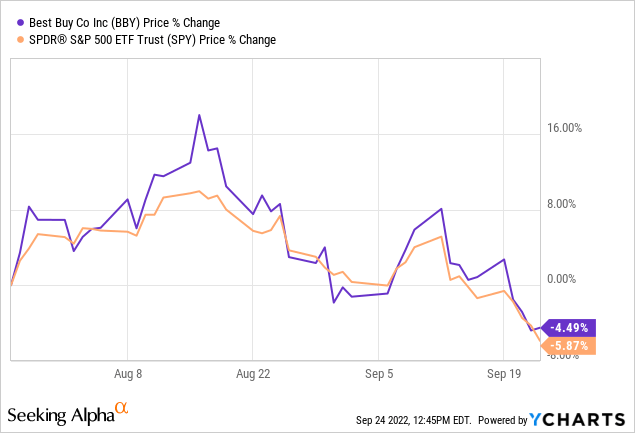

Since then, the stock price has declined by about 5%, about in line with the decline of the broader market. Despite the declining earnings, we believe that at these price levels BBY’s stock remains attractive. Most of the valuation metrics show that the firm is still trading at a discount compared to both its 5Y average and the consumer discretionary sector median.

Key takeaways

There has been no material improvement in the macroeconomic environment. The low consumer confidence, the declining demand, the supply chain disruptions, the elevated input and freight costs keep negatively impacting Best Buy’s financial performance. We believe that these headwinds are temporary, however are likely to last for the rest of the year, potentially till mid-2023.

Despite the relatively large decline in sales and the contracting margins, management has not changed their previous guidance for the year, provided in July.

Although BBY paused its share repurchase program for understandable reasons, they keep paying quarterly dividends to their shareholders.

From a valuation perspective, in our opinion, BBY is still attractive.

For these reasons we maintain our “hold” rating on the stock.

Be the first to comment