Michael M. Santiago

Rivian Automotive Inc. (NASDAQ:RIVN) made a big announcement earlier this month about a new partnership with premium automaker Mercedes-Benz.

The announcement followed some setbacks in 2022, including a botched announcement of higher electric-vehicle prices due to inflation, a lower production forecast due to supply-chain challenges, and a general shift in sentiment in the EV industry.

I believe Rivian Automotive’s deal with Mercedes-Benz is a significant milestone achievement, and the recent pullback provides investors with a new opportunity to consider purchasing the EV maker’s stock at a lower price.

Details About The Rivian Automotive-Mercedes-Benz Deal

Rivian Automotive is collaborating with Mercedes-Benz, a premium-focused automaker, to scale and share the risks of commercial van production in Europe.

According to the Memorandum of Understanding, Rivian Automotive and Mercedes-Benz will establish a joint venture manufacturing company in Europe, which will essentially help Rivian Automotive establish a production footprint.

The joint venture is being formed with the intention of sharing costs and production risks while also providing Rivian Automotive with a high-quality production facility outside of the United States that will allow it to produce electric commercial vans on a large scale. It is important to note that the joint venture is focused on vans and will propel Rivian Automotive’s commercial van expansion plans forward.

Rivian Automotive is currently collaborating with Amazon to deliver100,000 electric vans that the retailer requires to upgrade its commercial delivery fleet. Deliveries are scheduled to continue until 2030.

The Mercedes-Benz joint venture will produce two vans, one based on Mercedes-electric Benz’s architecture, called VAN.EA, and the other on Rivian’s RLV platform.

The most important takeaway from the Memorandum of Understanding is that the joint venture would assist Rivian Automotive in expanding its commercial van footprint and diversifying away from serving only Amazon as an anchor customer.

Rivian Automotive and Mercedes-Benz have not specified the location of the production facility, only mentioning Central/Eastern Europe.

Rivian Automotive Will Be Driven By Production Guidance

The Memorandum of Understanding does not specify specific production targets and is based on a multi-year time frame. Having said that, Rivian Automotive’s stock price will be primarily determined by the company’s 2022 production guidance, which is centered on the U.S. market.

Rivian Automotive expects to produce approximately 50,000 electric-vehicles, and as long as this production quota is met, the stock could break out to the upside.

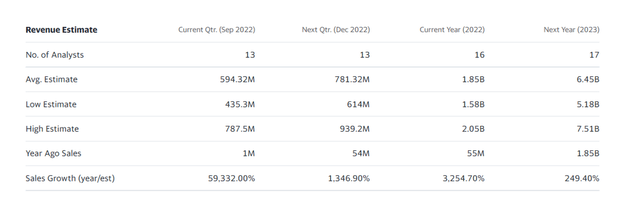

Rivian Automotive’s sales potential has increased slightly (from $6.44 billion to $6.45 billion) since I last wrote about the EV maker’s upside potential.

Rivian Automotive’s stock price has recently dropped from $40 to $35 as a result of the central bank’s decision to raise interest rates. Rivian Automotive is trading at a 2.9x sales multiple based on my 2023 anticipated sales estimate of $6.0 billion, based on a current (cash-corrected) market value of $17.3 billion.

I am slightly more conservative in my estimate than the market because I believe Rivian Automotive will need to execute exceptionally well in order to meet this aggressive $6.45 billion sales target.

Revenue Estimate (Rivian Automotive)

Why Rivian Automotive Might See A Lower Valuation

The valuation of Rivian Automotive is primarily determined by two factors: sentiment in the electric-vehicle industry (which has soured in 2022) and Rivian Automotive’s progress in scaling production and deliveries of the R1T and R1S.

Rivian Automotive reaffirmed its 2022 production forecast in the second quarter, implying that the electric-vehicle manufacturer expects to produce 50,000 vehicles this year.

I believe that this is a reasonable production target, but if Rivian Automotive fails to meet its production target, shareholders may face significantly lower stock prices.

My Conclusion

The Rivian Automotive-Mercedes-Benz agreement expands Rivian Automotive’s European footprint while also boosting the commercial van business.

Rivian Automotive’s expansion to continental Europe in a cost-sharing and risk-sharing agreement with one of the region’s leading luxury automakers is a significant development and a watershed moment for the company.

While the joint venture will take years to begin joint production, Rivian Automotive is displaying the kind of ambitious and bold thinking that I expect from a pioneering EV startup.

Be the first to comment