vicnt/iStock via Getty Images

Viatris Inc. (NASDAQ:VTRS) is a stock that has tempted us often. It is rare to find something that appears so cheap and at the same time comes with real, though manageable, risks. We have been sidelined and have stayed on the fence as we just did not see an edge to the bull or the bear case. When we last covered it post the epic selloff, we left a little for the bulls to chew on. Specifically, we said,

We think the odds are far more favorable at $11.30 and we maintain our price target of $15.00. Color us slightly bullish here though it is not enough for us to buy the stock considering the sheer abundance of opportunities in today’s markets.

Source: Perhaps An Overreaction

The stock has gone essentially sideways since then and is trading at $10.95 as we write this. We look today at the three key risks for 2022 which are likely pressing on the valuation, despite the positive deleveraging news from the Biocon deal.

1) Inflation

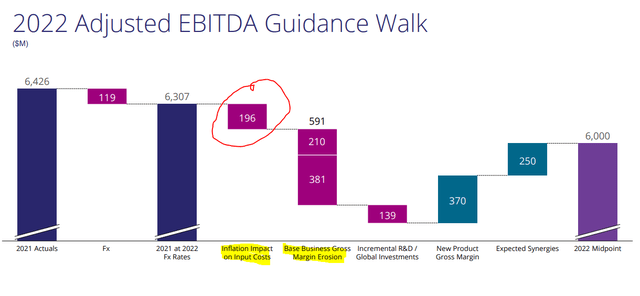

Investors would have to be living on Mars to have not noticed the havoc inflation is wreaking across portfolios. In this regard, it is our belief that VTRS is substantially underestimating the impact on its own business. Now it has identified $196 million of impact from direct inflation. There is also the other $591 million which it refers to as gross margin erosion. The latter is likely a pricing power issue rather than a direct inflation impact.

VTRS Adjusted EBITDA Guidance (VTRS Q4-2021 Presentation)

Ok, so we have $196 million from inflation effects. VTRS is using that to reduce its 2022 estimated EBITDA, so everything should work out right? We don’t think so. The $196 million is just a shade over 1.1% of the revenue base.

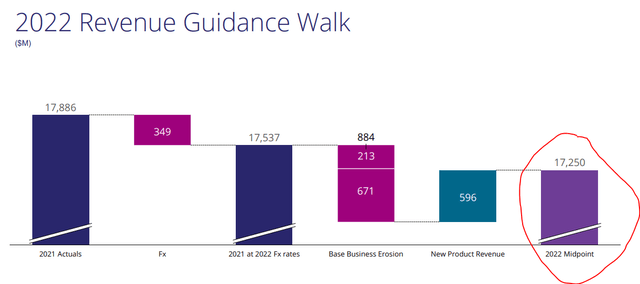

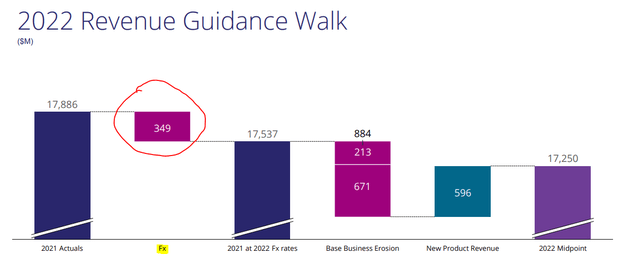

VTRS 2022 Revenue Guidance (VTRS Q4-2021 Presentation)

It is 1.75% of the expense base ($17.25 billion of revenue minus $6.00 billion of EBITDA). That is likely to be laughably low in the face of what we have seen in terms of cost pressures. Wages, which are the biggest component of expenses, are rising at 6%.

Wage Inflation (Atlanta Fed)

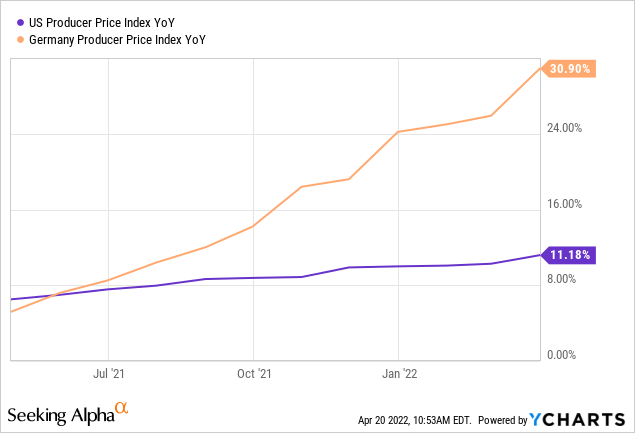

Producer price indices are rising at double-digit rates in US and in Europe.

None of this appears remotely compatible with a 1.7% cost pressure. It is possible that some extra amounts are buried in the “base business erosion” section. But on the whole, this is a very huge risk which could permanently break the bull thesis.

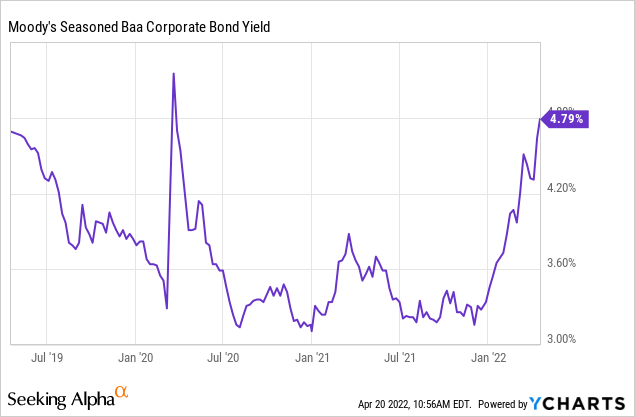

2) Interest Rates

VTRS has done some modest deleveraging in 2021 and the Biocon deal will be at least credit neutral if not credit positive. But what is happening on interest rates is outside its control. Baa bonds yields (last rung of investment grade) are spiking hard.

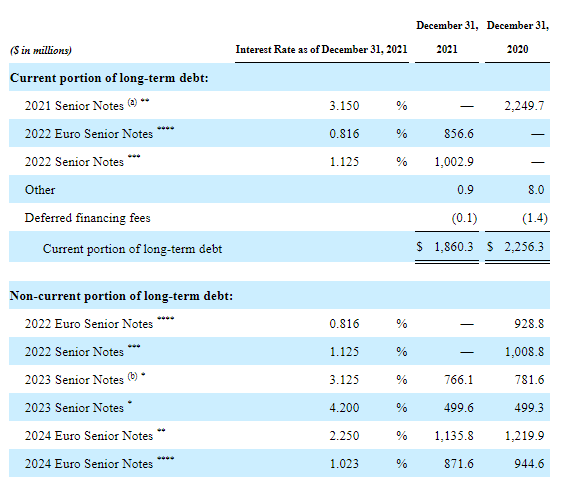

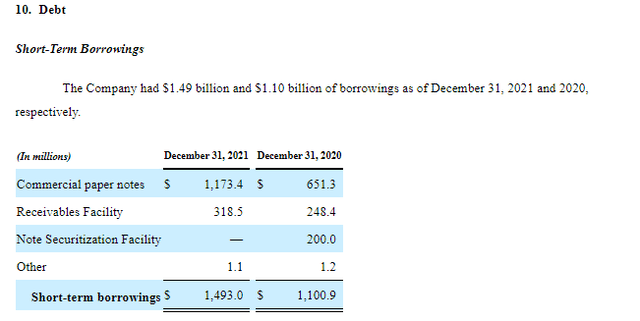

VTRS has $1.5 billion of commercial paper outstanding and rates on this will rise rapidly.

It has another $1.86 billion to be refinanced within a year and $3.5 billion in two years after that.

VTRS Debt (VTRS 10-K)

VTRS had $636 million of interest expense in 2021 and we see that moving up despite some deleveraging in 2023.

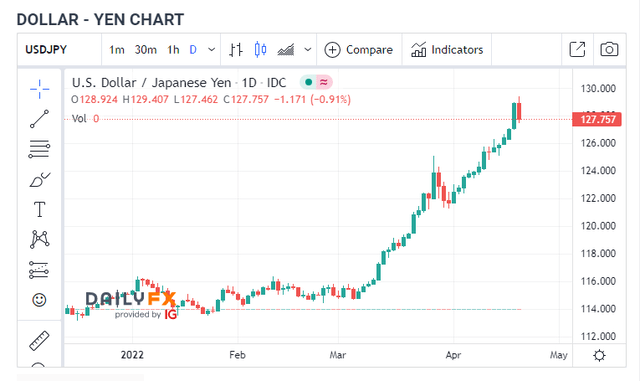

3) Forex Headwinds

Just like the inflation guidance, VTRS has taken into account currency headwinds.

Just like the former case, we remain unconvinced that it has really got the numbers right. USD-YEN, for example, has moved up 10% since that presentation.

USD-YEN Chart aka, Who Can Devalue Faster (DailyFX)

The Euro has also weakened, although less remarkably. This will hurt the cash flow, though there will be offset from the Euro and Yen denominated debt.

Verdict

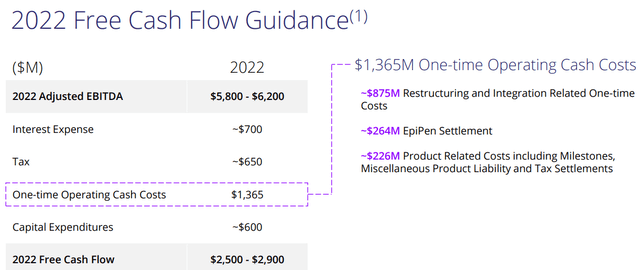

The three headwinds are material in our opinion and likely break the adjusted EBITDA well below the $6.0 billion mark. Based on VTRS’s walk-through, we see free cash flow coming in under $2.3 billion when we add our estimates in.

VTRS FCF Guidance (VTRS Q4-2021 Presentation)

Of course, there also remains that eyesore of perpetual “one-time” costs coming in at $1.365 billion. This may also turn out to be the biggest bull weapon and a potential gamechanger in 2023. If these costs disappear at some point, it becomes easier to buy the bull thesis. That is our strongest counterargument as to why nobody should get excessively bearish. We are still refusing to take position here and waiting for a perfect setup.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment