DNY59

A Cottage Industry of Fed Critique

An informal cottage industry exists for critiquing the Federal Reserve. When the Fed was slow to respond to inflationary signals last year, I joined a chorus of critics. After the Fed finally got inflation-fighting religion, an even louder chorus of critics now complain that the Fed’s monetary tightening is excessive or even unnecessary. Whether up or down, left or right, a common thread exists in this cottage industry. Authors and pundits have a habit of staking a claim to greater abilities for forecasting or keener abilities for generating insight from economic data than the hundreds of economists across the Federal Reserve system. For example, the Fed gets accused of making policy looking in the rearview mirror of lagging indicators. As another example, someone insists that some key dataset that the Fed is ignoring should lead monetary policy at the moment. This kind of strident criticism is perhaps epitomized by Cathie Wood’s October “Letter to the Fed” which pleaded for easier monetary policy. I explained why the Fed would not read that letter:

“…the Fed recognizes the layers of distortions it helped to create in the economy, and it desperately wants to hit the reset button. From the purview of neutral to slightly restrictive policy, it can THEN observe the impact and assess whether the economy can sustain the resulting damage. I also guess that the Fed fully recognizes that the very minute markets sniff a peak in monetary tightening, speculative forces will roar away…

In this environment where financial markets have become accustomed to easy money and have little experience dealing with inflationary pressures, the Fed is forced to err on the side of being aggressively hawkish as long as it dares possible… As long as employment remains robust and resilient, the Fed can maintain political support for its actions even as support from market participants plummets.”

I concluded this section with a cheeky claim: “pundits can throw all the macroeconomic tomatoes they want, the Fed is in over-correction mode for now.” This over-correction is by design and not from a lack of knowledge of the data.

Some of the Fed critique ignores or chooses not to believe Fed statements contrary to the critique. In early October, San Francisco Fed President Mary Daly insisted that the Fed is forward-looking and knows how to identify lagging indicators. While a bit late for my tastes, the Fed was forward-thinking in publishing research demonstrating housing’s significant impact on inflationary pressures. The SF Fed published a research piece last week cautiously acknowledging a peak in inflation. In other words, the Fed constantly wrestles with a wide array of rich data to assess the future direction for monetary policy.

As last week’s surprise post-Powell rally demonstrated, it is investors and traders who can easily get fixated on select slices of data, phrases, or words. Last week, Powell used familiar themes in reiterating the Fed’s commitment to fighting inflation. Yet, at the moment, market participants chose to focus on the notion of the inevitable slowing in the pace of rate hikes. A strong November jobs report and then the Institute for Supply Management (ISM) reporting a 30th straight month of expansion for the service economy provided validation for the Fed’s approach, much to the disappointment of the market. Business activity even hit an 11-month high. Only those with the best crystal balls should claim that the Fed needs to maintain accommodative monetary policy under these conditions.

Spoiled by the Mid-Cycle Adjustment

Back in July 2019, murmurs of economic trouble were brewing despite a massive stimulus recently delivered to the economy from significant tax cuts to households and businesses. With inflation low, the Fed felt free to look forward and act against an anticipated economic slowdown. The Fed looked forward and justified a rate cut as a “mid-cycle adjustment.” For those of us who thought the economy was just fine, the rate cut was mystifying. Yet, the episode confirmed the Fed’s post-GFC bias to do everything it can to avert economic weakness. Perhaps efforts like this mid-cycle adjustment spoiled markets. In today’s inflationary environment, the Fed’s proactive behavior is not designed to avert a recession with rate cuts. Instead, the Fed is managing the lingering risks of high inflation becoming entrenched in the economy even as it anticipates future slowing in the economy.

By Design, It’s the Framework

In the immediate aftermath of the pandemic, the Fed announced an important policy shift at that year’s Jackson Hole gathering. Going forward, the Fed would target average inflation of 2% instead of 2% as a point destination. Moreover, the Fed crystalized its goal to drive unemployment as low as possible via “assessments of the shortfalls of employment from its maximum level.” Years and decades of deflationary drags facilitated this shift, and the economic crisis from the pandemic seemed at the time to further entrench these deflationary forces. Interest rates seemed destined to stay lower for longer. In telling fashion, the S&P 500 (SPY) soared in response to this policy shift. I claim this policy framework encouraged the Fed to be overly optimistic about the transitory nature of pandemic-era inflation, and subsequently compelled the Fed to move late toward normalizing monetary policy.

During the Q&A at last week’s Brookings Institution conference, Powell suggested that he would not repeat the “mistake” of counting on the long history of low inflation as a basis for making policy. Powell noted that policy must take into consideration tail risks and their costs. Such acknowledgement forms the foundation of today’s risk management framework. However, Powell remained consistent with earlier Fed claims that starting monetary tightening earlier would not have materially impacted the path for inflation. He insisted that the mistake from two years ago has nothing to do with today’s inflation; he relegated the mistake to a footnote.

Exactly two years after the framework shift, Powell essentially reversed course on the attitude toward inflation. Likely weary of the market’s proclivity to mine for dovish hints in between the lines of Fedspeak, Powell gave terse and direct inflation-fighting speech that sent the stock market reeling. The stock market has yet to fully recover from its shock and disappointment. Still, in just 4 months, the S&P 500 nearly roundtripped from Jackson Hole 2022; resistance held at a converged 200DMA and the important May 2021 low. The overall relative resilience helps to reassure the Fed it still has sufficient runway for its hawks to fly.

![The S&P 500 [SPY] stopped just short of reversing all its Jackson Hole losses.](https://static.seekingalpha.com/uploads/2022/12/7/29389-16703985060369458.png)

The S&P 500 [SPY] stopped just short of reversing all its Jackson Hole losses. (TradingView.com)

I expect the Fed to stay as hawkish as possible as long as possible. The Fed does not refer to the strong labor market out of an unawareness of the lagging signals from the jobs market. Today’s numbers give today’s tightening “air cover.” I do not expect the Fed to ease up on its hawkish language until unemployment has clearly started a sustained uptrend. By that point, financial markets will start pricing in an easing in monetary policy and a subsequent economics recovery. This is a familiar cycle with a playbook the Fed has at the ready.

The Trade

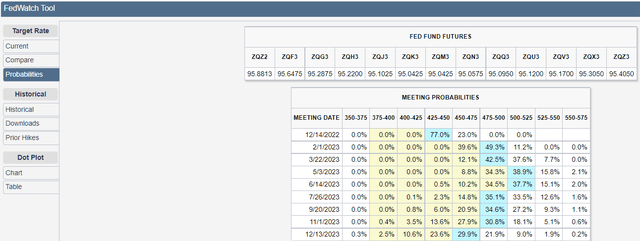

The S&P 500 swings with every shift in expectations over monetary policy. Key market pivots have occurred on the heels of monetary news and action. Currently, the CME FedWatch tool shows Fed Fund futures project a peak in rates in May 2023, a rate cut in July and another rate cut in December.

The blue cells indicate the market’s expectation for the most likely interest rate outcome of each Fed meeting. (CME FedWatch Tool)

Presumably, this contour projects an economic slowdown significant enough to move the Fed by April. If all goes according to plan, the S&P 500 will churn at best through Q1 of 2023 as Fed hawkishness continues to cap desires to price in a rate cut cycle. Of course, with volatility in the economic environment, even the Fed Fund futures rest on precarious ground. During this time, traders and investors may be tempted to follow every blip up and down in the market’s manic interpretations of how the latest data will impact the next round of Fedspeak.

I prefer to stay as focused as the Fed. As long as the Fed is delivering an inflation-fighting message, the S&P 500 will remain at risk for new lows in this tightening cycle. The pressures of lower earnings prospects and valuation compression will loom heavy over the market. When the Fed finally relents to the market’s desire for lift-off, the telegraphing of a final(-ish) rate hike should generate a strong rally almost no matter where the S&P 500 trades at that time. Since the market will try to anticipate that moment, I am currently pivoting on two months before the peak in rates expected by Fed Fund futures as a sustained bottom for the stock market. All else being equal (and static), March 2023 becomes my magic crystal ball of monetary relief from a designed over-correction for inflation.

Be careful out there!

Be the first to comment