Jose Martinez Calderon

Axie Infinity (AXS-USD) is one of the original play-to-earn crypto games. Fundamentally, Axie Infinity is a Pokémon-like game that utilizes public-blockchain NFTs and the AXS currency; both can be used as in-game assets or swapped outside of the Axie Infinity ecosystem. Axie Infinity is notable because of its immense success during the 2021 crypto bull run. It has also served as something of a proof of concept model for other play to earn projects like STEPN (GMT-USD), among others. In this article, we’ll explore what has likely caused the price increase in AXS, the supply dynamics of the AXS currency, and the market activity for the in-game NFTs.

Why Is Axie Infinity Rallying?

AXS isn’t the only metaverse/NFT coin that has been rallying over the last week. There is some element of excitement in the market because of ApeCoin (APE-USD) staking going live this month. I’ve detailed why I think APE is a sell here. But beyond just rallying with other metaverse coins, Axie Infinity has created some buzz in the crypto market because of an update to the project’s future roadmap. On Monday, the Axie Infinity team detailed the vision for “Axie Core.” The roadmap for the future included details on character accessories, breeding, and avatar pictures with an emphasis on collectability to generate an emotional attachment to what is essentially the Axie Infinity brand:

Only by harnessing unique game loops and mechanisms, that merge collectibility, ownership, and economics with amazing and immersive gameplay can we once again define the path forward for this nascent industry.

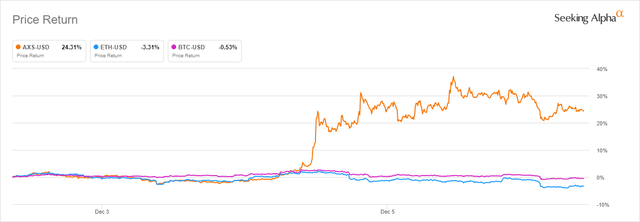

5 Day performance (Seeking Alpha)

The market response to this news was very favorable and saw AXS rally from $7 on Sunday to over $9 Tuesday. While the market took the opportunity to bid the coin, the actual NFTs used for the gameplay have seen very little action.

Network Demand

One of the things that I generally look for in any crypto token is strong supply/demand dynamics. Because AXS is used as an in-game currency, it’s important that there is demand for the in-game NFTs to justify a bid on the AXS coin. Despite the Axie Core roadmap update and AXS price pop, we’ve yet to see that excitement reflected in the actual in-game assets:

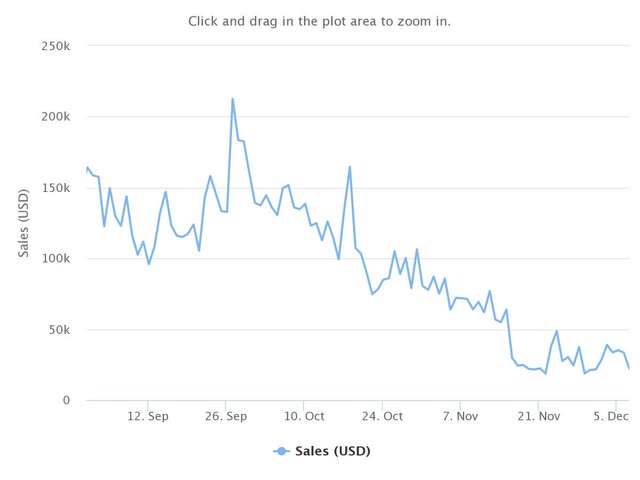

Axie sales September to Now (CryptoSlam)

Measured in USD the daily sales volume for the Axie NFTs is still nearly at the basement. On Tuesday, there was $33,500 in total sales volume for the day. That was actually below the volume from Sunday and well beneath the average from the last three months. And to be clear, the above chart is zoomed for a reason. I want to actually show the short term trend of the sales volume. When we look at the bigger picture, we can really get a sense for how depressed the Axie Infinity NFT market actually is:

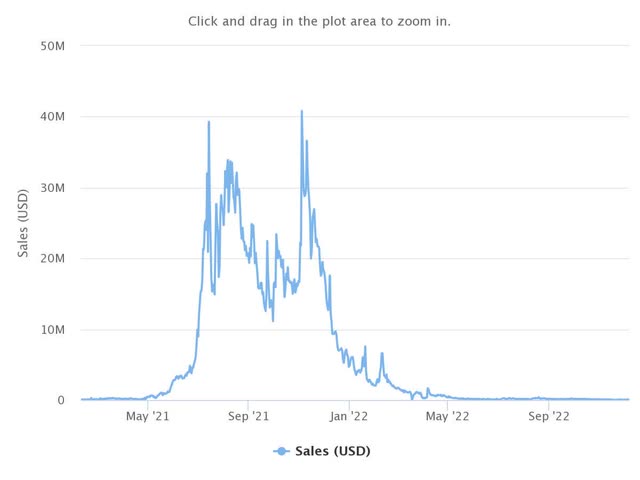

Axie sales Since Feb 2021 (CryptoSlam)

There were times during the bull run when Axie Infinity was doing 8 figures in daily sales. On November 4th 2021, Axie did nearly $41 million in sales in one day. Axie hasn’t cumulatively done that much in sales in the last 7 months and hasn’t produced more than $41 million in a single month since February 2022. The demand for the NFTs is simply not there any longer.

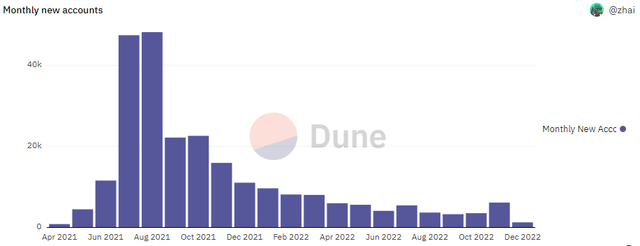

Axie Infinity (Dune Analytics/Zhai)

However, November did produce a noticeable bump in new user accounts. There were 6,078 new Axie accounts in November – up from 3,449 in October. Still a far cry from the 48k during the 2021 summer months.

Token Supply And Valuation

The market demand for the in-game Axie Infinity assets is concerning enough. Taken with the token supply metrics, I think AXS is a serious avoid even with the recent rise. I don’t think we’ve found a bottom yet in this coin.

- Circulating supply: 100.5 million

- Max supply: 270 million

- Circulating percent: 37%

Not all crypto coins have a maximum supply, AXS is one that does. But there is a substantial amount of dilution remaining.

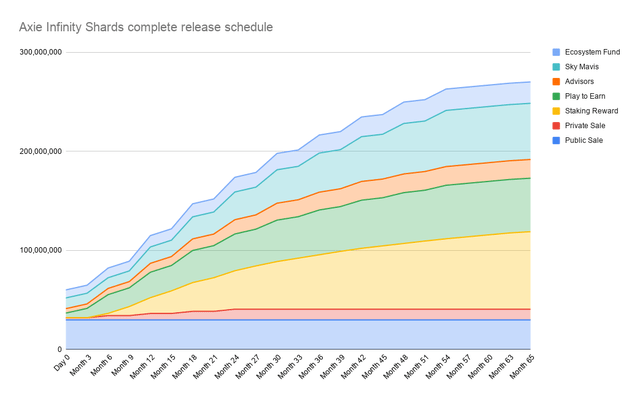

AXS Release Schedule (Axie Infinity)

According to the Axie whitepaper, the dilution will continue until all coins have been dispersed 65 months from the public token sale. That would put the max supply being reached in early 2026. Token supply metrics aren’t necessarily the most important metric when trying to value a crypto coin. For tokens that live in specific applications like Axie Infinity, a good way to attempt to measure a token’s valuation is through Token Terminal’s price to fees ratio – or P/F ratio:

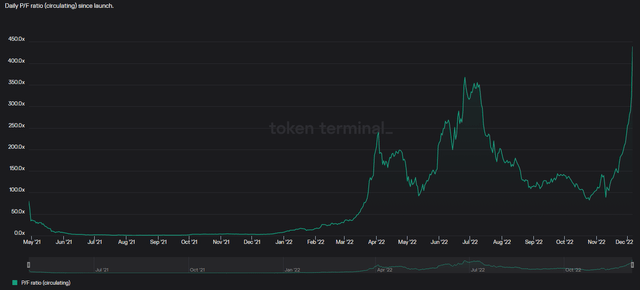

Axie P/F Ratio (Token Terminal)

The P/F ratio can be viewed sort of like a crypto-native price to sales ratio for a traditional market equity. The P/F ratio can be expressed either through the fully diluted market cap ratio or the circulating market cap ratio. The figure in the chart above is the circulating market cap of the token divided by the annualized fees of the Axie Infinity platform. This takes the activity on the network into consideration when valuing a coin. For Axie Infinity, it’s a bad story. The current circulating P/F ratio is 438. This makes the circulating supply of the AXS token now trading at the most overvalued P/F ratio in the coin’s history.

Summary

Like many other cryptocurrencies, AXS experiences large rallies and big busts. What makes AXS unique from some of the other crypto coins in the market is its ties to a specific ecosystem application – in this case a game. Unlike base layer or layer 2 blockchain native coins, cryptos that are dependent on one central application are far riskier than native currencies like Ethereum (ETH-USD) or Solana (SOL-USD). Those networks can go through highs and lows but the best blockchain networks aren’t dependent on one application or DeFi protocol to survive.

Application-based tokens like AXS require perpetual user interest in whatever crypto protocol the token represents. In this case, AXS is benefiting from news in the short term but the long term trend of the coin’s ecosystem network is still very negative. AXS only has value if there are market participants who want to use it to play the Axie Infinity game. Given the lack of interest in the game currently, this recent spike in the price of the AXS coin has created a scenario where AXS is arguably more overvalued now than it has ever been even though it is still 95% below its all time high price of $164. If I were holding it, I’d sell this news-related price pop.

Be the first to comment