Brian Ach/Getty Images Entertainment

Daktronics, Inc. (NASDAQ:DAKT) appears to have accumulated a lot of know-how in the Global Outdoor LED Display market, which seems to grow at a CAGR of 9%. In my view, further expansion into the advertising industry, airports, public transport, and military establishments could bring further sales growth. Under normal circumstances, I believe that the stock is a buy at the current market valuation. Even considering inflation, lack of demand, or supply chain issues, Daktronics, Inc. stock appears undervalued.

Daktronics Reports A Significant Amount Of Know-How Accumulated

When it comes to electronic scoreboards, giant screens for sporting events, and solutions for the production of massive events, Daktronics Inc. appears to be one of the biggest references in the U.S. market.

Founded in 1968 by Drs. Aelred Kurtenbach and Duane Sander, both engineers in the state of South Dakota, the company began to offer services for manufacturing electronic voting systems for legislative elections.

Daktronics’ first patented product was the Matside in 1971, a board designed to display the scoreboard for fight sports. In sum, I believe that Daktronics has accumulated over the decades a lot of know-how, which will likely help the company enter new markets.

Significant Target Market Growth And Amortization Strategies

Daktronics’ products expand to all types of electronic solutions related to different mass events, public roads, and private facilities in closed areas. Among them, in addition to the well-known scoreboard screens in sports stadiums, are LED signage, for both open and closed spaces, video screens for informational or advertising purposes, the installation and provision of multimillion-dollar sound systems, and, of course, the development of software to manage these devices.

The company is not only dedicated to the commercialization of its products but also works permanently in the electronic engineering parts as well as the design and development of digital programs for their management. Its services extend to the production of sporting events as well as advertising services for companies and agreements with governments for the installation of screens in airports, public transport, and military establishments.

Experts believe that the Global Outdoor LED Display market could grow at a CAGR of close to 9%, so in my financial models, sales growth is close to this figure.

The Global Outdoor LED Display Market Size was estimated at USD 2162.60 million in 2021 and is projected to reach USD 3953.20 million by 2028, exhibiting a CAGR of 9% during the forecast period. Source: Digital Journal

In relation to its commercial assets, the company has amortization strategies when it comes to the variation in the price of the products, the supply of the products, and the delay in the international transport of electronic micro-components. In my view, knowing that management plays several D&A mechanisms is relevant for the design of the discounted cash flow model.

Recent Results Include Positive 2022 EBITDA Margin And Positive Median FCF Margin

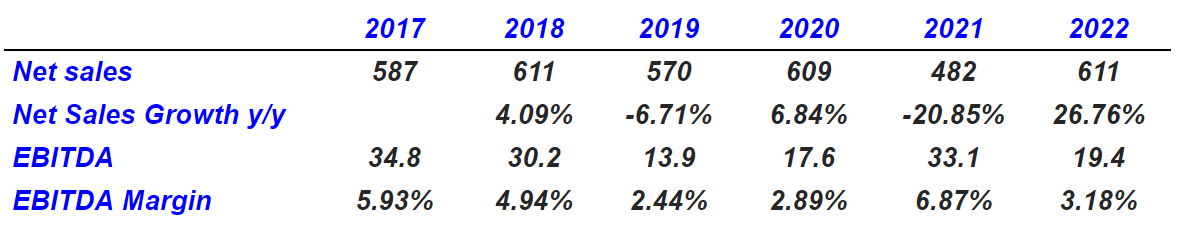

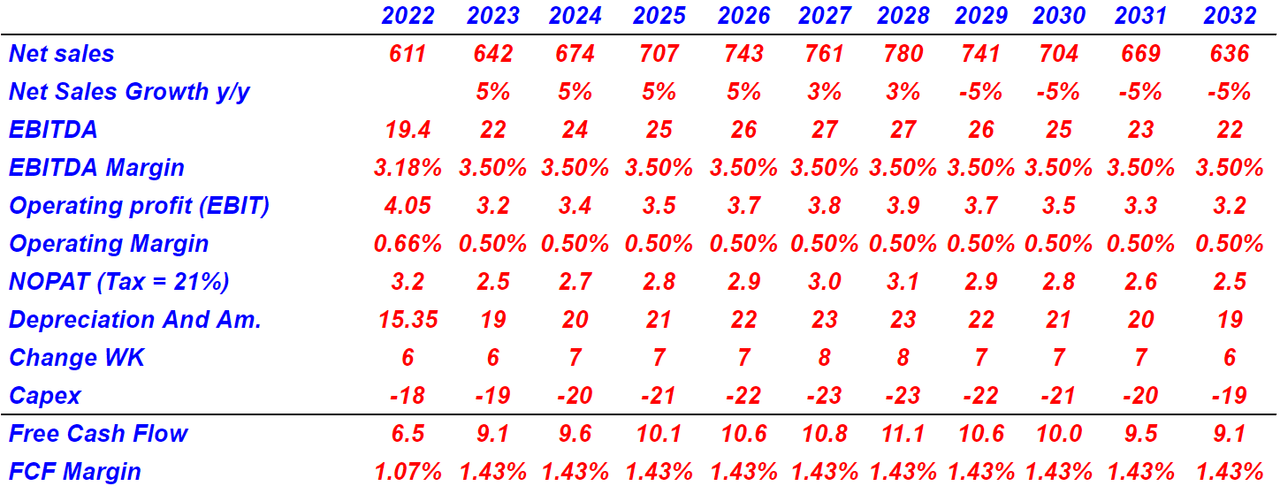

My financial models include certain financial ratios from previous financial statements, which investors may want to consult. 2022 net sales stand at $611 million with a net sales growth of 26.76%. In addition, EBITDA stands at $19.4 million with 2022 EBITDA margin of 3%.

marketscreener.com

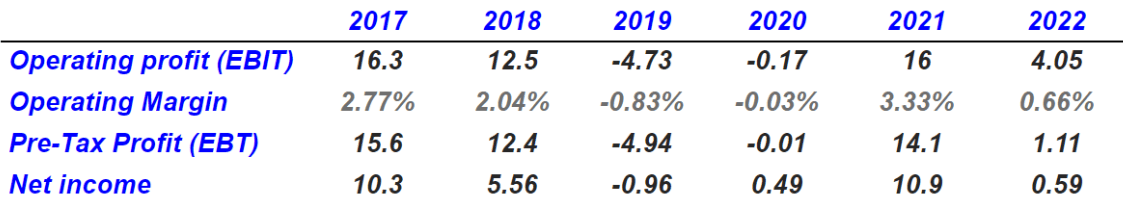

2022 operating profit stands at $4.05 million, which implies an operating margin of 0.66%. 2022 pre-tax profit was equal to $1.11 million, and the net income stood at $0.59 million.

marketscreener.com

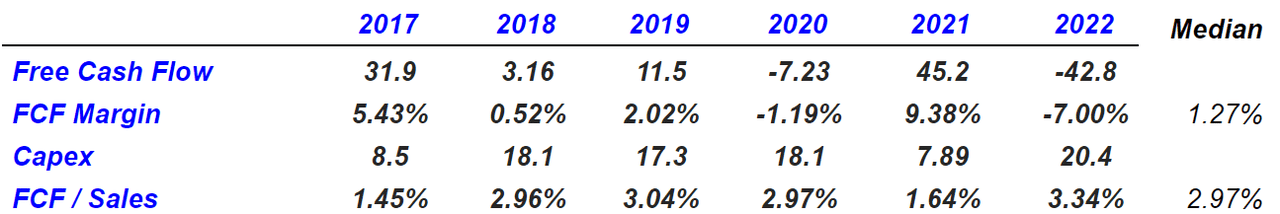

2022 free cash flow was equal to -$42.8 million, with a free cash flow (“FCF”) margin of -7%. 2022 capex was equal to $20.4 million, with an FCF/sales of 3.34%. With that, the median FCF margin from 2017 to 2022 was equal to 1.27%.

marketscreener.com

Healthy Balance Sheet

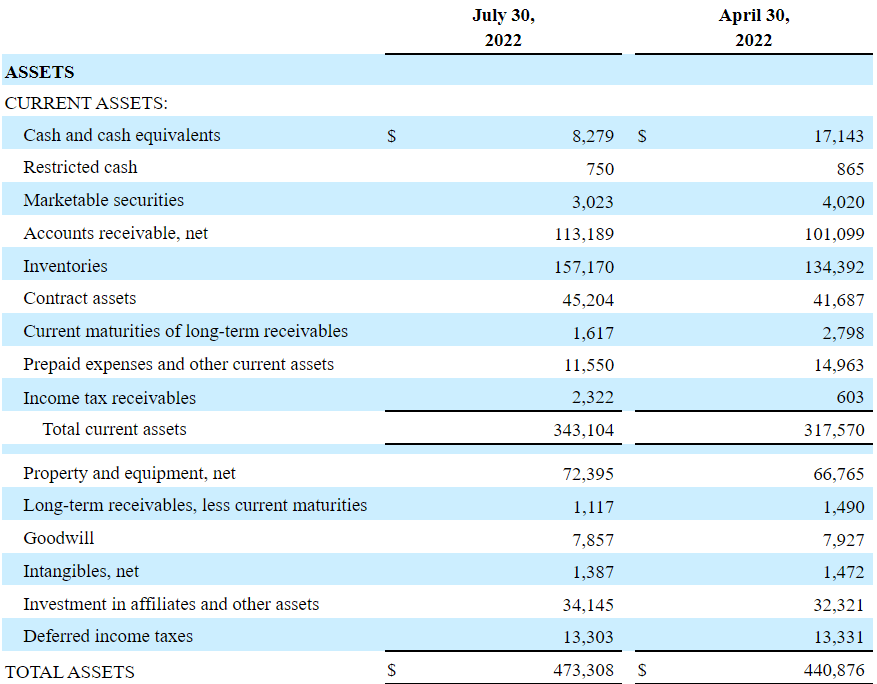

As of July 30, 2022, cash and cash equivalents were equal to $8.279 million, with accounts receivables worth $113.189 million and inventories of $157.170 million. Contract assets stood at $45.204 million, and the total current assets were equal to $343.104 million. Current assets/current liabilities stood at more than 1x, so liquidity does not seem to be an issue here.

Daktronics also reports property and equipment of $72.395 million, investment in affiliates worth $34.145 million, and total assets of $473.308 million. The asset/liability ratio stands at more than 1x. I do believe that the company could have more cash. With that, in my view, the balance sheet appears quite healthy.

10-Q

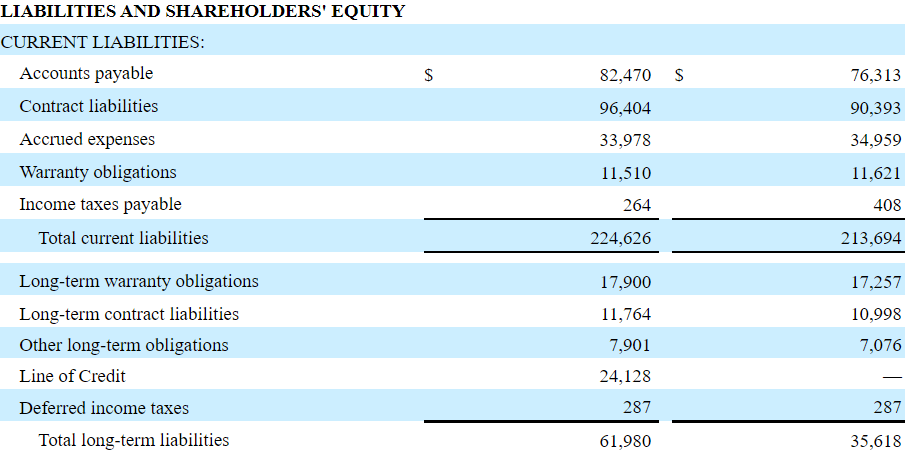

Daktronics’ liabilities include accounts payable worth $82.470 million, contract liabilities of $96.404 million, and accrued expenses of $33.978 million. Total current liabilities are equal to $224.626 million.

Long-term warranties were equal to $17.900 million, with long-term contract liabilities of $11.764 million and a line of credit of approximately $24.128 million. Finally, total long-term liabilities are equal to $61.980 million.

10-Q

Internationalization And More Production Capabilities Would Imply A Valuation Of $8.24 Per Share

With lots of know-how accumulated in the United States, in my view, internationalization could bring significant revenue growth. Let’s keep in mind that Daktronics is signing relevant agreements with large sports organizations like the Real Madrid in Europe.

Thanks to this agreement with Daktronics, the new Santiago Bernabéu Stadium will have iconic advertising devices with the highest quality and technology available that will allow us to offer a unique experience to our fans and visitors through the contents. Source: Press Release.

Besides, I believe that the company’s financial position will likely help the company increase its production capabilities in the United States and abroad. In line with these words, let’s note the recent expansion of Surface Mount Device LED product lines.

The company’s current expansion project, which completes this summer, will double Daktronics’ production capabilities for SMD product lines and create job opportunities across all factory locations. The project will increase production space in the Brookings factory by 90,000 square feet. Source: Daktronics Expands Factories to Support Demand for LED Displays

Daktronics is expanding production capabilities in multiple factory locations to support increased demand, including the doubling of Surface Mount Device LED product lines. Source: Daktronics Expands Factories to Support Demand for LED Displays.

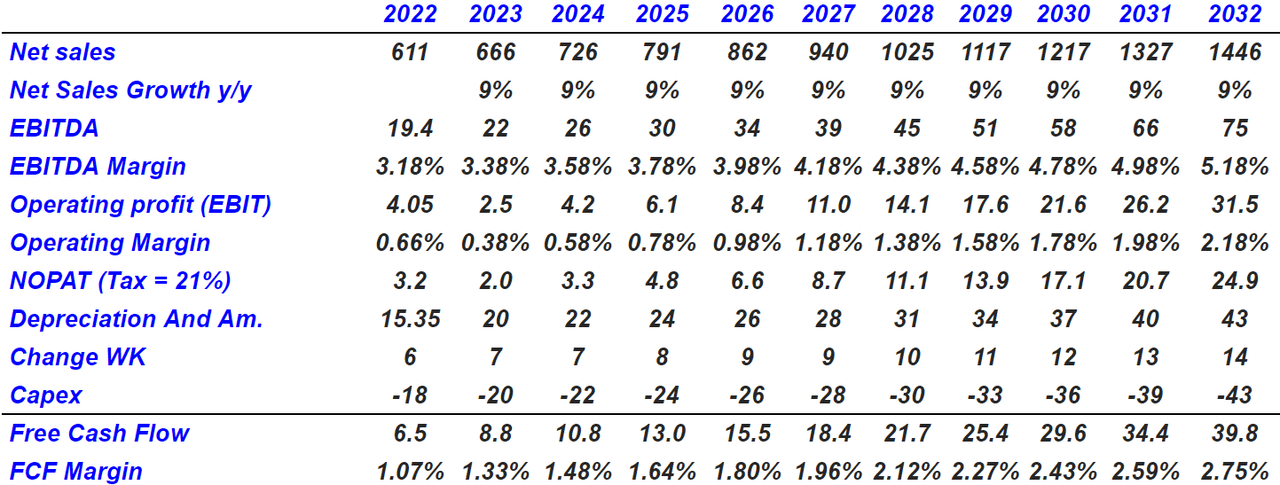

Under my base case scenario, I included 2032 net sales of $1.446 billion and net sales growth of 9%. 2032 EBITDA would be $75 million with an EBITDA margin of 5.18%, an operating profit of $31.5 million, and an operating margin of 2.18%. 2032 NOPAT would be $24.9 million.

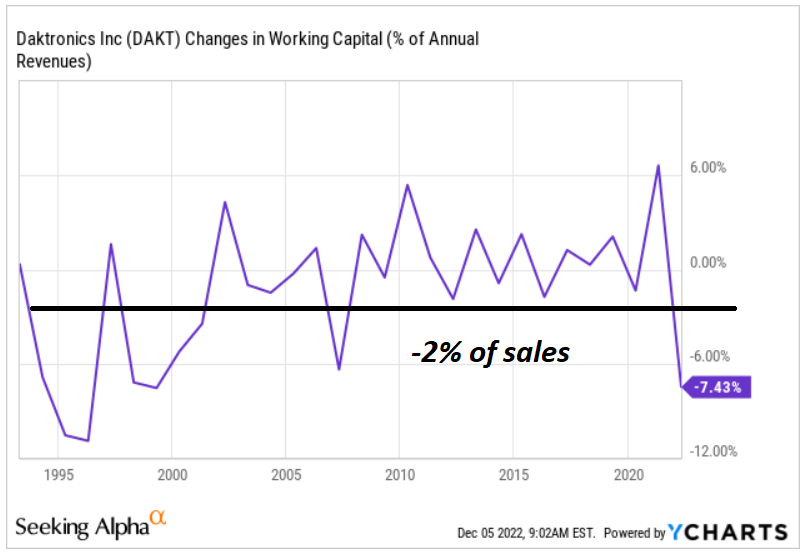

I also assumed depreciation and amortization of $43 million, changes in working capital of $14 million, and capex of -$43 million. The FCF would stand at $39.8 million, with an FCF margin of 2.75%. Notice that I used figures that are close to the financial statistics seen in the past. For instance, changes in working capital/sales were close to -2%.

YCharts

Author’s Work

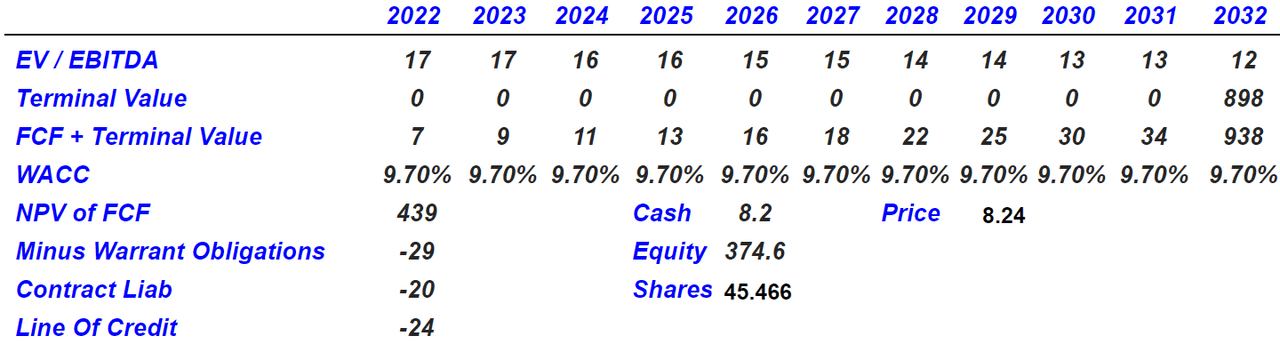

With terminal EV/EBITDA multiple close to 12x and a WACC of 9.70%, the implied enterprise value would stand at $439 million. My equity valuation would be $374.6 million, and the fair price would be close to $8.24 per share.

Author’s Work

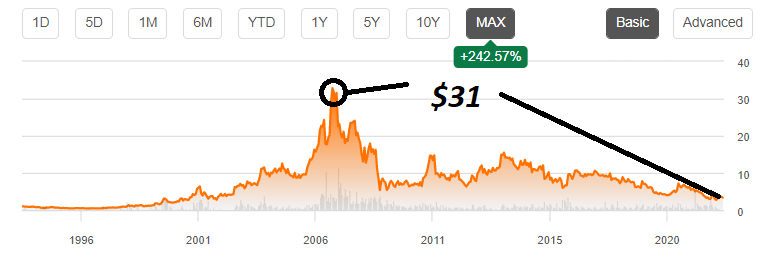

The company traded at more than $29 per share, and it is currently trading at its minimum level in many years. Considering the company’s chart and the current fair price, I do believe that the company is undervalued.

SA

Risks: Supply Chain Risks, Lack Of Certain Components, Or Lack Of Demand Would Imply A Valuation Of $1.65 Per Share

When working with a large number of digital components, long supply chains, and an extensive logistics network for the coordination of deliveries and receipts to suppliers, there are different risks in the operation of the company. Under very dramatic circumstances, supply chain challenges may affect the company’s FCF margins and net income growth. As a result, the company’s fair value would decline.

The company also depends on certain raw materials for the development of its products. For instance, changes in the price of gasoline may affect transportation services required by Daktronics. Some necessary components may also suffer inflation. Management discussed these risks in the annual report:

Electronic and other components and materials used in our products are sometimes in short supply, which may impact our ability to meet customer demand. Transportation costs and availability can fluctuate due to fluctuations in oil prices and other social, economic, and geopolitical factors.

We cannot control all of the various factors that might affect our suppliers’ timely and effective delivery of raw materials and components to our manufacturing facilities or the availability of freight capacity for us to deliver products to our customers. Source: 10-K

Finally, let’s note that Daktronics offers multimillion-dollar sound and screen installations for unique events. It could happen that the demand for Daktronics’ installations lowers for multiple reasons. As a result, I would be expecting diminishing sales growth.

Under this scenario, I included 2032 net sales of $636 million with net sales growth of -5%. 2032 EBITDA would be $22 million with an EBITDA margin of 3.50%. 2022 operating profit would stand at $3.2 million with an operating margin of 0.5%. With these figures, the implied 2032 NOPAT would be $2.5 million.

Finally, if we assume depreciation and amortization of close to $20 million and changes in working capital of around $5.5 million, FCF would be almost $9.5 million.

Author’s Work

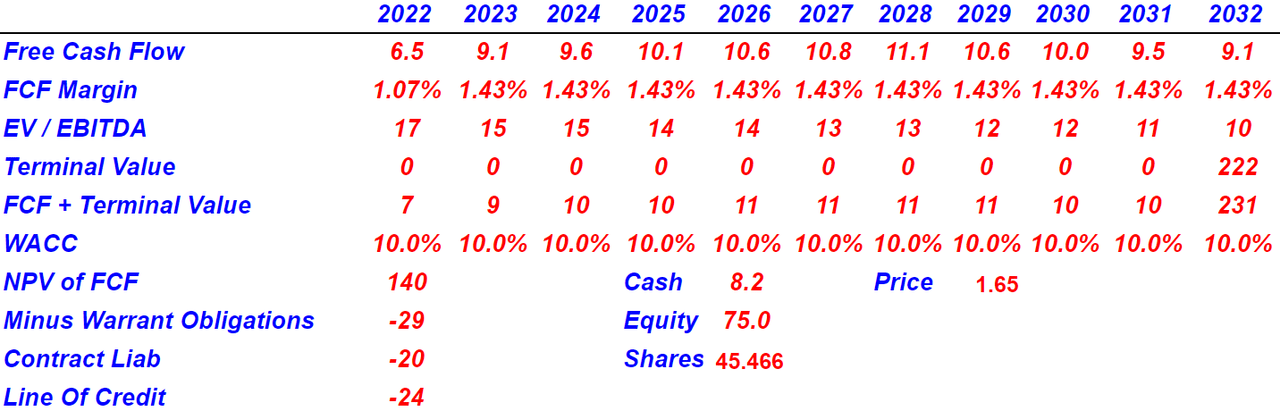

With an EV/EBITDA of 10x and a WACC of 10%, the NPV of future FCF would stand at $140 million. Besides, the equity would stand at $75 million, and the fair price would be $1.65 million.

Author’s Work

Conclusion

With a combination of accumulated know-how in the development of scoreboard screens in sports stadiums among other services, Daktronics, Inc. will likely see demand for its services. We are talking about a target market that could be growing at a CAGR of 9% as well as other revenue from advertising services in airports, public transport, and military establishments.

Under normal circumstances, I believe that Daktronics’ stock could be valued at $8.24 per share. Even considering risks from inflation, lack of demand, and supply chain issues, in my view, Daktronics appears very undervalued.

Be the first to comment