peterschreiber.media

Axsome

The future is never clear. – Warren Buffett.

In the investing world, investors despise uncertainty. After all, uncertainty creates fear that, in and of itself, is the most powerful human emotion. As such, it can cause a highly intelligent investor like yourself to make imprudent decisions. That is to say, you tend to sell prematurely when you should be buying. Now, uncertainty resides in the land of mega profitability. Precisely speaking, uncertainty suppresses your stock’s share price far below its intrinsic value. By having the courage/wisdom to conquer uncertainty, you can gain tremendous profits once clarity returns to your stock.

That being said, I’d like to feature a fundamental analysis of Axsome Therapeutics, Inc. (NASDAQ:AXSM) — a stock that was clobbered by uncertainty relating to its lead medicine. As AXS05 recently gained FDA approval to treat major depressive disorder, Axsome has enjoyed a huge resurgence. Nevertheless, I believe that there are substantial upsides. In this article, I’ll share with you my forward expectation of this stellar equity.

Figure 1: Axsome chart

About The company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. I noted in the prior research,

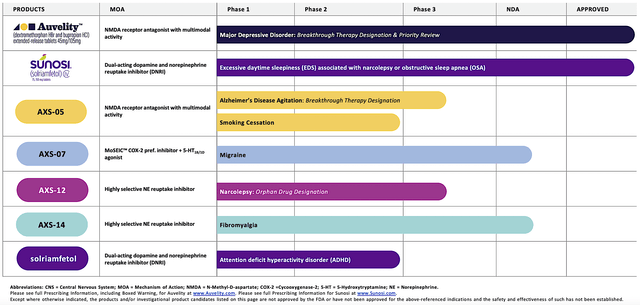

Operating out of New York, Axsome dedicates its efforts to the innovation and commercialization of novel medicines to fulfill the unmet needs in psychiatry. Powering the pipeline are four promising molecules in development, including AXS05, AXS07, AXS12, and AXS14. As the crown jewel of this pipeline, AXS05 is either being assessed or approved for various disorders such as major depressive disorder (“MDD”), agitation associated with Alzheimer’s disease (“AD”), and smoking cessation. By experimenting with multiple uses for a single drug, Axsome can maximize the value of its innovation. That is to say, it increases the chances at least one indication would become a bonanza. That aside, there is also another new and commercialized drug (i.e., the Sunosi acquisition).

Figure 2: Therapeutic pipeline

Tracking Axsome Investment Thesis

Shifting gears, let us analyze the latest development of the crown jewel, AXS05 (i.e., Auvelity). After all, success of the crown jewel directly translates into success for your stocks. As you know, Auvelity was in a period of uncertainty in the past year. That is to say, Axsome disclosed in August 2021 that the FDA would not complete its review of Auvelity for MDD before the former Prescription User Drug Fee Act (PDUFA) date of August 22, 2021. Interestingly, the FDA did not request any additional information while stating that the review of the application was ongoing.

Facing such an event, the market interpreted that as either a non-approval or delayed approval. With the stellar Auvelity data for MDD, I know that this is only a temporary negative development. It’s likely that the FDA is more cautious in granting approval nowadays. Therefore, I believed that it’s a matter of “when” rather than “if” the agency would approve Auvelity.

AXS05 – Background & Obstacle

Shifting gears, let us analyze the latest development of the crown jewel, AXS05 (i.e., Auvelity). After all, success of crown jewel directly translates into the success for your stocks. As you know, Auvelity was in a period of uncertainty in the past year. That is to say, Axsome disclosed on August 2021 that the FDA would not complete its review of Auvelity for MDD before the former Prescription User Drug Fee Act (PDUFA) date of August 22, 2021. Interestingly, the FDA did not request any additional information while stating that the review of the application was ongoing.

Facing such an event, the market interpreted that as either a non-approval or delayed approval. With the stellar Auvelity data for MDD, I know that this is only a temporary negative development. It’s likely that the FDA is more cautious in granting approval nowadays. Therefore, I believed that it’s a matter of “when” rather than “if” the agency would approval Auvelity.

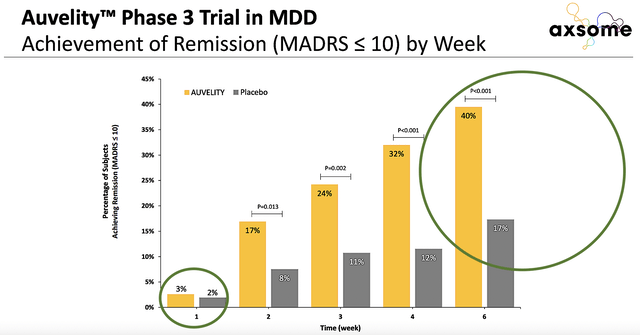

Figure 3: Auvelity’s stellar efficacy

Here’s my rationale. Auvelity demonstrated robust clinical outcomes for its Phase 3 trials for MDD. More importantly, Auvelity delivered robust data for treatment-resistant depression (i.e., TRD) which is much more difficult to treat than MDD. In other words, patients suffering from TRD have to go to the last resort, electro-convulsive therapy (i.e., ECT). Accordingly, the physician sends a low voltage electrical current through the brain to jolt it out of the depressive state.

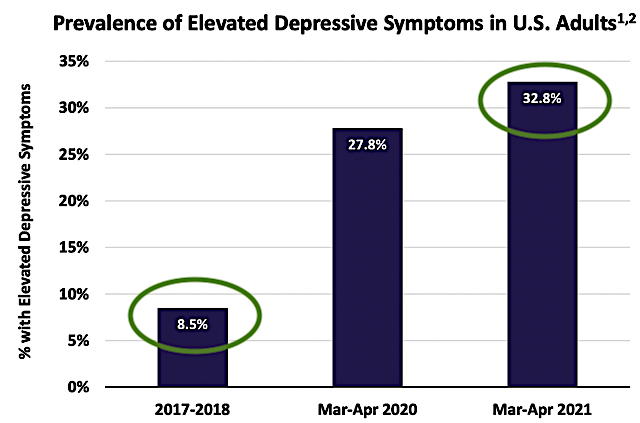

As Auvelity can do what ECT does (and coupled with the rising prevalence of MMD), you can bet that there is no reason that the FDA would deny approval. For those of you who have not read my prior coverage on Axsome, don’t shoot the messenger here. Notably, I’m not bragging after approval. In fact, I went against the conventional wisdom to forecast approval in my prior research before approval came. I simply want to share with you my decision-making process for you to use a similar approach to forecast approval.

Axsome

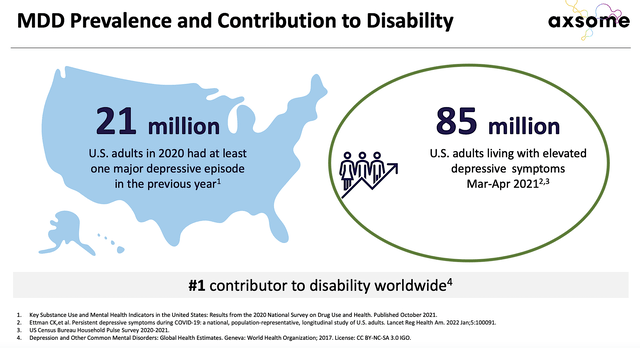

Figure 4: Rising prevalence of MDD

AXS05 – Triumphant Against The Odds

On June 24, Axsome issued a press release, stating that the company was in discussion with the FDA about the post-marketing label for MDD. As you can appreciate, the post-marketing label discussion prompted me to believe that approval was forthcoming. I noted in the prior article:

You might be thinking what exactly does that mean? Well, it’s important that you read the tea leaves to stay ahead of the market. Accordingly, you can anticipate that approval is coming soon. For labeling discussion to occur, it’s logical to say that the FDA must have already made its decision to approve AXS05. As such, it seems like the rest is now simply paperwork for labeling requirements.

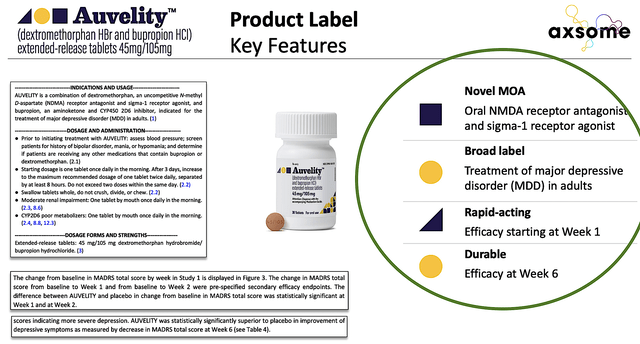

As you’d expect, the great news came to shareholders and patients on August 19. Simply put, the company received FDA approval of Auvelity for MDD. Remarkably this is a highly significant approval because Auvelity is the first and only rapid-acting oral treatment approved with labeling of statistically significant improvement in depressive symptoms compared to placebo as early as Week1.

Figure 5: Auvelity’s product label

While this might not seem much to you, most antidepressant drugs take over four weeks to begin showing efficacy. The fact that Auvelity can improve depressive symptoms as early as the first week of treatment is a huge “market differentiation.” More importantly, it’s life-changing for patients because depression is a debilitating condition that reduces the patient’s quality of life.

Figure 6: MDD as a major contributor to disability

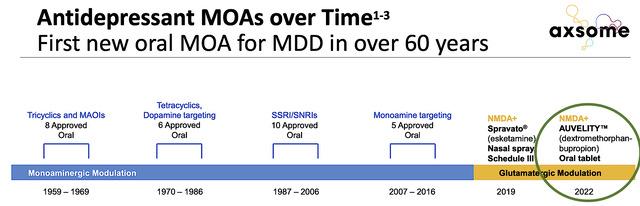

In addition to having the Breakthrough Therapy Designation (and evaluated under Priority Review), Auvelity has the new oral mechanism of action approved for MDD. This is something that has not been done in over 60 years! As you can see, when it comes to sales/marketing, the more differentiated the drug the better. Thrilled by Auvelity prowess, the Professor of Psychiatry at the NYU School of Medicine (Dr. Dan Iosifescu) commented:

Major depressive disorder is disabling and potentially life-threatening, causes profound distress for patients and their families, and leads to substantial healthcare resource utilization. Auvelity’s oral NMDA receptor antagonist and sigma-1 receptor agonist activity, which targets glutamatergic neurotransmission, provides clinicians a long sought after new mechanistic approach which may benefit the millions of patients living with this serious condition. In clinical trials, Auvelity has demonstrated rapid and statistically significant improvement in depressive symptoms as early as Week 1, and increased rates of remission at Week 2 compared with placebo. This early benefit with Auvelity was maintained and increased with continued treatment, and was accompanied by a favorable safety and tolerability profile.

Figure 7: Auvelity differentiated MOA

Commercialized Assets

As you know, Axsome now has two approved medicines: Auvelity and Sunosi (with Sunosi being a recent acquisition from Jazz). As a dual-acting dopamine and norepinephrine reuptake inhibitor, Sunosi was FDA approved back in 2019 to treat excessive daytime sleepiness in adults with narcolepsy or obstructive sleep apnea (OSA). Due to the huge OSA prevalence (i.e., 10-30%), you can bet that Axsome is in a promising market.

For Fiscal 2021, Sunosi garnered $57.9M which represents a 104% year-over-year (YOY) growth. Given the fact that Axsome is a smaller company than Jazz, you should not expect that similar sales growth. However, Sunosi should deliver significant revenues for Axsome. After all, the drug already has an existing fan base of patients and prescribers.

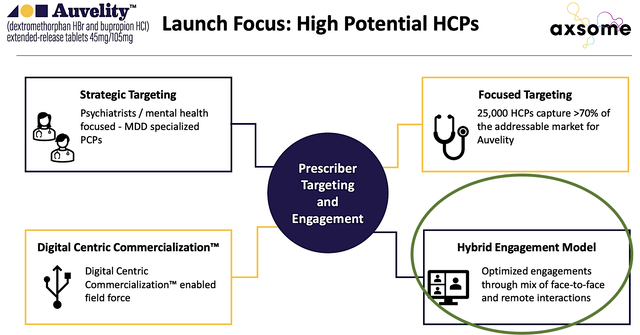

As to Auvelity, Axsome is poised to launch the drug in 4Q this year (i.e., next few months). Viewing the figure below, you can see that Axsome prudently leverages on the so-called hybrid engagement model. Instead of solely relying on the shoes/leather approach in getting the drug to patients, Axsome also banks digital campaigns. Due to the pandemic, the digital approach could play a more significant role than what you anticipated.

Figure 8: Upcoming Auvelity launch

Future Growth

In addition to Sunosi for excessive daytime sleepiness, Axsome is expanding Sunosi’s label for attention deficit hyperactivity disorder (i.e., ADHD). Given that Sunosi works for excessive daytime sleepiness, the drug has an excellent chance to conquer the ADHD market. Growing at the 6.4% CAGR, Grandview research estimated that the ADHD market is expected to reach $24.9B by 2025.

Regarding Auvelity, Axsome is expanding its label for agitation associated with Alzheimer’s dementia and for smoking cessation. If either one of those two indications become a hit, you’re looking at a mega-blockbuster in the making. Now Auvelity’s Alzheimer indication is already in its Phase 3 (ACCORD) trial. Moreover, the good news is that ACCORD is concluding, thus posting results in 4Q this year. I forecast 65% (i.e., more than favorable) chances of positive data results. I based my forecast on decades of experience, my intuition and prior Auvelity success.

That aside, Axsome recently launched another high quality Phase 3 (ADVANCE-2) trial to assess Auvelity for Alzheimer’s. Already received the Breakthrough Therapy Designation for Alzheimer’s, Auvelity now has another Phase 3 study to back its efficacy/safety. If results are positive as I anticipated, Auvelity is in a great position to capture the lucrative Alzheimer’s market.

Beyond Auvelity, AXS07 and AXS12 are advancing for migraines and narcolepsy, respectively. Though AXS07 recently received a CRL, you can expect that it’ll eventually gain approval like Auvelity. And Axsome is on track because on September 1, the company commenced the Phase 3 (EMERGE) study for AXS07 for migraines.

Of AXS12, the drug is special as it is an “orphan drug,” which commands premium reimbursement to foster the lengthy innovation and costly process. Altogether, there is a flurry of catalysts stacked together to deliver years of massive growth for Axsome.

Competitor Analysis

Competition in the psychiatric medicine niche is intense because there are many established and emerging innovators. Intra-Cellular Therapies (ITCI) is one such example. Riding its stellar medicine (Caplyta), Intra-Cellular delivered robust and differentiated solutions to patients. Jazz Pharmaceutical is another powerhouse psychiatric medicine innovator with a strong track record.

Though the competition is strong, Axsome offers differentiated and superb medicines like Auvelity. That aside, there is plenty of room in this space for many successful innovators.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that ended on June 30.

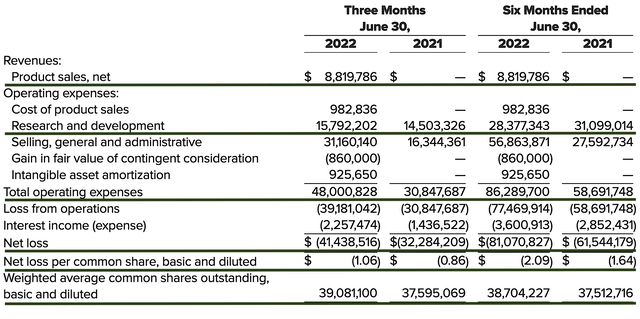

As follows, Axsome procured $8.8M in revenues compared to none for the same period a year prior. As you know, the Sunosi acquisition gave Axsome immediate revenues. As Auvelity is now approved, you can bet that revenues would gap up in the coming quarters.

That aside, the research and development (R&D) registered at $15.7M and $14.5M, respectively. I viewed the 8.2% R&D increase positively, as the money invested today can turn into blockbuster results. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $41.4M ($1.06 per share) net losses compared to $32.2M ($0.86 per share) declines for the same comparison. On a per-share basis, the bottom line depreciated by 23.2%. As the company is ramping up its sales/marketing efforts, you’d expect more capital to be spent there. Though the increasing sales/marketing cuts into the bottom line now, it’ll deliver more sales/net earnings in the future.

Figure 9: Key financial metrics

About the balance sheet, there were $73.4M in cash, equivalents, and investments. On top of the “at-the-market facility,” the total cash position increased to $102M. With the $8.8M revenue (and against the $48.0M quarterly OpEx), there should be adequate capital to fund operations into year-end. Therefore, it’s likely that Axsome would raise capital via an offering soon.

Valuation Analysis

It’s important that you appraise Axsome to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 37.7M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

AXS05 for MDD |

$1B (estimated based on the $16B global depression market and $7.9B MDD market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| AXS05 for Alzheimer’s agitation | $2B (estimated based on the $25B global Alzheimer’s market) | $500M | $132.62 | $66.31 (50% discount because the drug is still in Phase 3 trial) |

| AXS05 for smoking cessation | Waiting for it to advance before valuing | N/A | N/A | N/A |

| AXS07 for migraines | $1B (estimated based on the $78B US migraines market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| Sunosi for EDS | $250M (Estimated 25% actualization of the $1B peak sales) | $62.5M | $16.57 | $14.08 (15% discount) |

| AXS12, AXS14, etc | Will wait for more development | N/A | N/A | N/A |

|

The Sum of The Parts |

$186.47 |

Figure 10: Valuation analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Axsome is if the company can quickly ramp up sales for Auvelity.

The risk here is significant because Axsome is still a small company that is “going at it alone” in commercialization. As such, it would take time for Axsome to build its sales/marketing team. More importantly, it’d take time for the professional reps to build/solidify their relationship with prescribers. That aside, the same commercialization risks apply to Sunosi. Moreover, there is a chance that additional data reports won’t be strong.

Concluding Remarks

In all, I maintain my buy recommendation on Axsome with a 4.8 out of five stars rating. Axsome is a story of investing success. As it conquered the uncertainty relating to Auvelity, Axsome emerged victoriously in the form of approval for MDD. Coupled with Sunosi, Axsome is eager to deliver hopes to countless patients. Consequently, that would translate into increasing revenues. Over time, it would mean organic share price appreciation for shareholders.

Looking ahead, you can expect Axsome to publish positive news regarding Auvelity’s ACCORD trial trials for Alzheimer’s dementia in the next few months. There are also other catalysts like the upcoming trial data for AXS12 as a treatment for narcolepsy in 1H2023. You also get to see AXS12 advancement for fibromyalgia as the company is poised to file an NDA next year.

Be the first to comment