Moyo Studio/E+ via Getty Images

Consumer stocks have taken it on the chin over the last handful of weeks. The Consumer Discretionary Select Sector SPDR ETF (XLY) is down a whopping 16% from its mid-August rebound high. It’s off more than 12% just since Sept. 13.

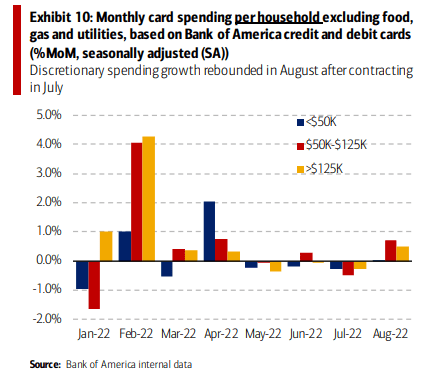

Amid so much market turmoil, there are still healthy card spending signs, though that is not what Chair Powell and the Fed want to see. BofA’s latest survey shows an August uptick in discretionary spending among its customers following a big drop in gas prices. One niche grill, stove, and fire pit maker could be a substantial value amid macro uncertainty.

Gas Prices Down, Consumer Spending Up in August

BofA Institute

According to Bank of America Global Research, Solo Brands (NYSE:DTC) is a Direct to Consumer platform that offers products through a portfolio of Leisure brands including: (1) Solo Stove (64% of 2020 Pro Forma revenue) – a provider of premium, smokeless fire pits, camp stoves, and grills, (2) Chubbies (21% of Pro Forma Revenue) – a digitally native casual & activewear brand, (3) Isle (10% of Pro Forma Revenue) – paddle board brand, & (4) Oru Kayaks (6% of Pro Forma Revenue) – origami folding kayaks that can be stored in car trunks and closets.

The company’s high margins compared to competitor WEBR should promote positive earnings in the years ahead, but the tough current macro environment could be a headwind. Another risk is the relatively new management team with, on average less than one year of tenure. Larger, more-established grill makers could weather this tough period better.

The Texas-based $390 million market cap Leisure Products industry company within the Consumer Discretionary sector has negative GAAP earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal. Seeking Alpha shows a low 4.7 operating P/E using next year’s estimates, however.

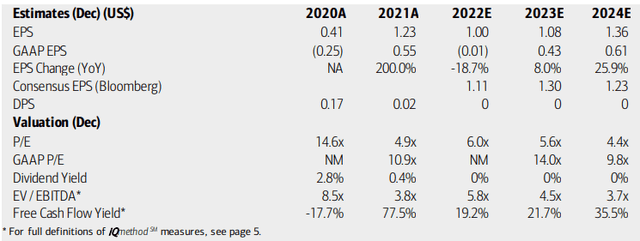

On valuation, BofA sees significant upside for this undercovered stock. Per-share earnings are expected to climb 8% next year and 26% in 2024 based on their forecast. The Bloomberg consensus EPS forecast is more upbeat in the short run but not as sanguine for 2024.

Using operating earnings, Solo’s P/E is quite attractive in the mid-single digits. Moreover, its EV/EBITDA multiple is cheap while free cash flow is high. Finally, DTC has beaten earnings estimates handily in the past three quarterly reports.

Solo: Earnings, Valuation, Free Cash Flow Forecasts

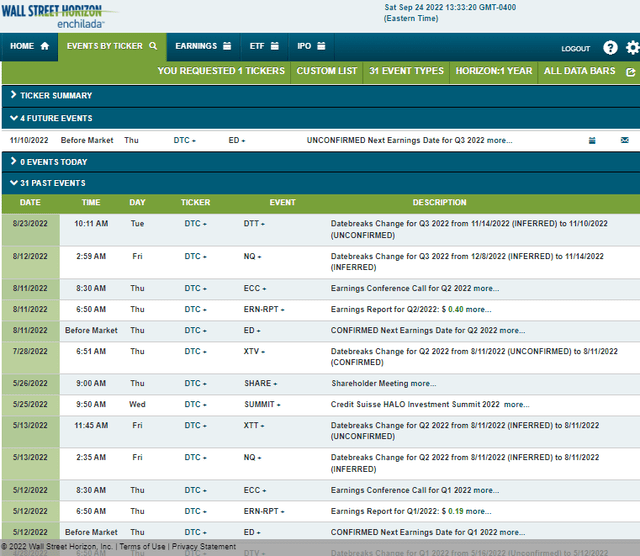

Looking ahead, DTC’s corporate event calendar is light until its Q3 earnings date, which is unconfirmed to take place on Thursday, Nov. 10 BMO, according to Wall Street Horizon.

Corporate Event Calendar

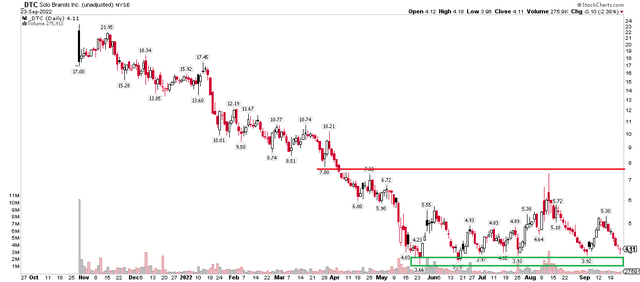

The Technical Take

Solo picked a great time to IPO – for the founders and early investors – as shares began trading right in the heart of the peak of some tech, consumer, and small-cap stocks. It has been a bruising trend lower off its all-time high which happened on its very first day of trading.

Shares eventually bottomed at $3.66 in May, and DTC has been rangebound ever since. I see support in the $3.66 to $4.02 range while resistance is in the mid-$5s and further up in the mid-$7s. It’s getting near a buy zone and could be worth a long position with a stop under the May low. The bulls should target a rebound to $7 in that scenario.

DTC: Selling Subsides After A Post-IPO Drop

The Bottom Line

Solo Brands has significant fundamental upside if earnings forecasts verify. Moreover, high free cash flow separates this recent IPO from the pack of so many non-cash flow generating new firms. It looks like a flier value pick to me, but the bulls should take caution if we see the stock make new lows – you might want to wait for the dust to settle in that event.

Be the first to comment