lucky336

Introduction

I recently wrote an article titled “Don’t Buy These 2 Popular Dividend Stocks”, which was much better received than I expected. It was particularly fun to see the many messages from people who told me about their investment plans. In this article, I am going to tell you what I’m looking for in this tricky market. I will give you two stocks that I am incredibly passionate about. Two stocks that I believe are among the best investments to generate long-term wealth. I will tell you how I’m dealing with these companies and my portfolio as we’re about to enter what could become another challenging year for investors.

The stocks both offer what I believe are decent yields, a lot of dividend growth potential, and stellar business models protecting investors against inflation.

So, let’s dive into it!

Bear Market Investing

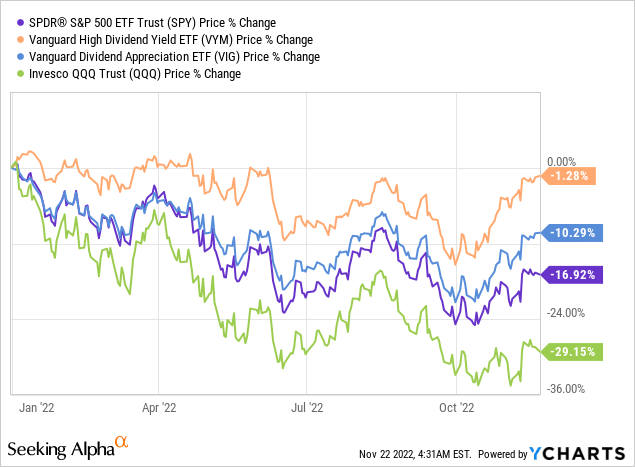

Even when excluding dividends (capital gains instead of total returns), dividend investors have done quite well this year. High-yield dividend stocks are down just 1.3% this year. Dividend growth stocks are down 10%. The S&P 500 is down 17%. The tech-heavy ETF (QQQ) is down 29%.

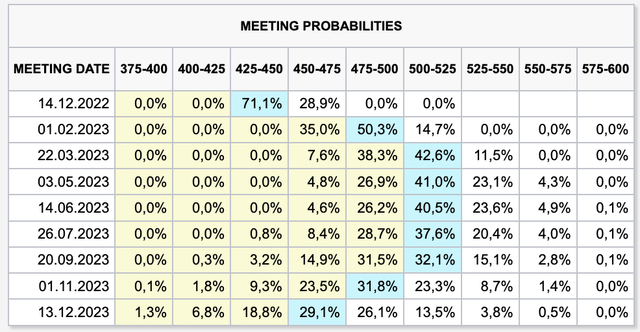

We’re in one of the most challenging investment environments in a very long time. Inflation is high, economic growth indicators are down, consumer sentiment has crashed, and yet the Fed is as hawkish as ever, aiming to suppress inflation by hiking rates past 5.00%.

At this point, the market is expecting another 50 basis points hike, followed by two 25 basis point hikes. A first cut is expected in 4Q23.

Needless to say, these numbers are subject to change. The market is trading on headlines. Good news means stock price weakness. Bad economic news indicates the opposite, as the Fed is expected to take its foot off the brake once economic data gets too bad.

Overall, we’re in a situation where the past 10-ish years of accommodative Fed policy are being undone. As the (not updated) graph below shows, almost the entire period between 2009 and 2022 was accommodative for the market. Inflation was low, yet Fed rates were even lower.

CME Group

This supported tech stocks. Hence, the stars of the green period in the chart above were companies like the FANG+ components.

In an environment of very low inflation, it becomes very attractive to buy growth stocks as it makes more sense to discount future growth rates. Moreover, with global QE programs, there’s plenty of liquidity flowing into everything that looks like an interesting growth play (growth stocks, crypto, NFTs, art, watches, cars, houses, you name it).

Now, inflation is high, the Fed is aggressive, global liquidity is eroding, and ongoing supply chain and geopolitical issues make everything so much tougher.

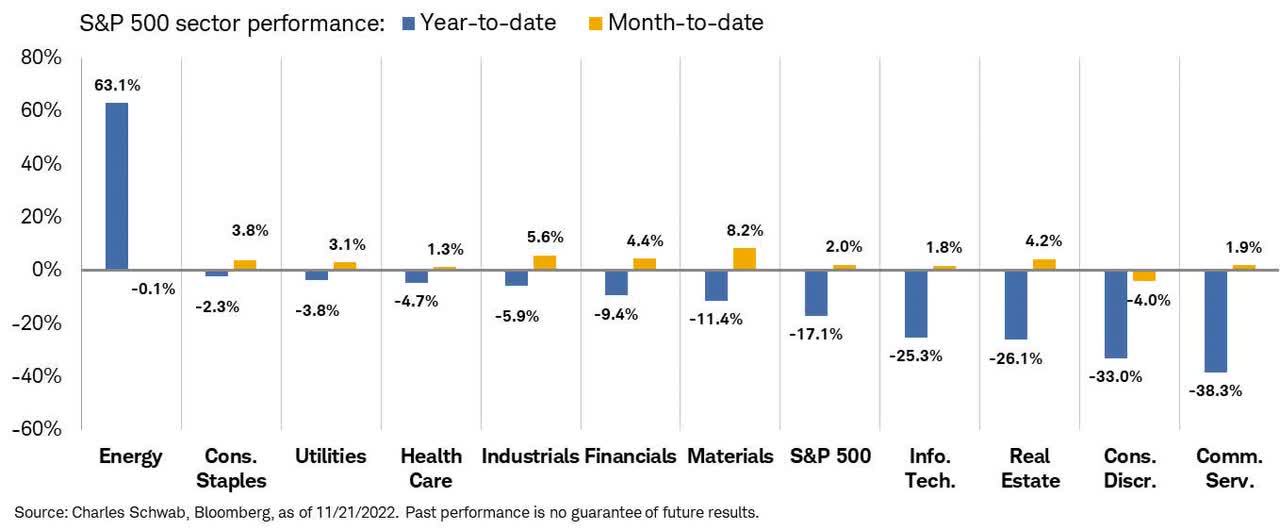

Hence, it’s no surprise that the best stocks are the companies least prone to high inflation and high rates.

Charles Schwab

With that said, my view is somewhat bearish. I do believe that the market has the potential to move lower toward the low 3,000 range (in the S&P 500). That is based on worsening economic weakness, persistent inflation, and the fact that the Federal Reserve may hike more aggressively than people expect.

Moreover, I believe that markets can go sideways for a prolonged period. For example, in the 1970s, inflation was also high due to supply issues. The Fed had to hike several times to keep inflation under control, resulting in a prolonged sideways trend until the 1980s.

I’m not saying that this is going to happen for sure, but the risks are elevated.

For example, let’s assume the Fed comes out tomorrow saying it will stop hiking rates once it hits 5.00%. The market will start to bet on lower rates. The dollar will likely decline, and rates will come down, fueling the demand side of the economy. This will fuel already elevated commodity prices.

Inflation will come up again, forcing the Fed to hike again in 6-12 months.

After all, the supply situation has changed completely due to net zero environmental policies, labor shortages (demographics), changing geopolitical structures, supply chain re-shoring, and so much more.

Most readers will be familiar with my situation. But if you’re not, let me explain that despite my views, I hold zero shorts. I have not sold a single long-term investment.

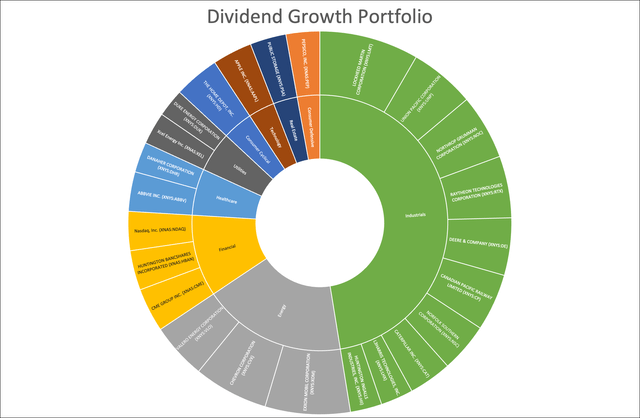

I have roughly 94% of my money invested in long-term dividend (growth) stocks.

My portfolio composition is up roughly 8% year-to-date, which is a significant outperformance versus the market’s -17% return. This is due to high energy and defense exposure, the two biggest winners as a result of the war in Ukraine – on top of secular tailwinds in energy that are unrelated to the war.

My strategy remains incredibly simple. I have a long list of stocks on my desk. On that list are my current holdings and the holdings that I would like to add (I discuss all of them on Seeking Alpha).

Whenever I like the valuation, I invest.

So far, I was very lucky this year as I bought several stocks very low. And even if I don’t buy the lowest price, it’s fine as buying the bottom is often impossible.

I’m happy as long as I get a valuation that I am happy with. After all, my favorite holding period is forever.

Now, let me show you two stocks that I own and that I will continue to add to quite aggressively. Two stocks, I believe, offer so much potential for every single investor interested in dividend stocks – regardless of age.

Without further ado, let’s start with number one.

1. The Home Depot (HD) – 2.4% Yield

This Atlanta-based DIY superstore is an interesting stock for two reasons. Reason one is its ability to generate shareholder value, as we will discuss in this article. Reason two is the fact that housing and consumer weakness has become one of the biggest issues in the economy. That adds a whole new layer of risks – and potential buying opportunities.

Rising mortgage rates have done significant damage to the housing market. The NAHB housing market index has dropped to levels not seen since the early stages of the housing recovery in 2012/2013 – ignoring the 2020 flash crash.

Wells Fargo

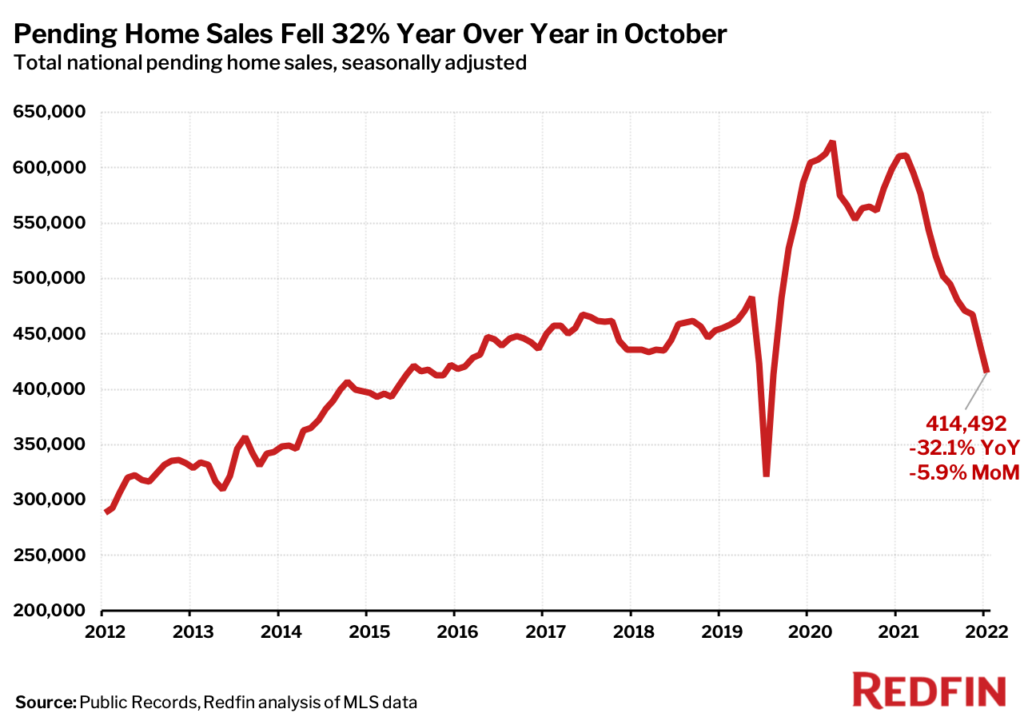

According to RedFin, the number of homes sold is down 27% year-on-year. Pending home sales are down 32%. New listings are down 24%.

RedFin

It’s truly a vicious environment fueled by the aforementioned surge in rates, high inflation doing a number on household finances, and prolonged economic uncertainty.

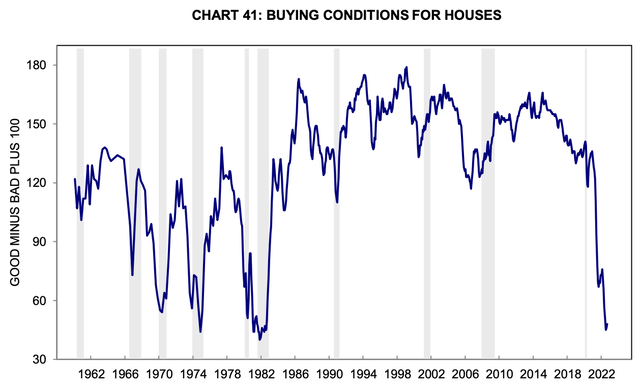

Looking at the chart below, we see that the University of Michigan’s house-buying conditions are at levels not seen since 1982. Back then, we had a similar situation where aggressive Fed hiking was needed to fight supply-side inflation.

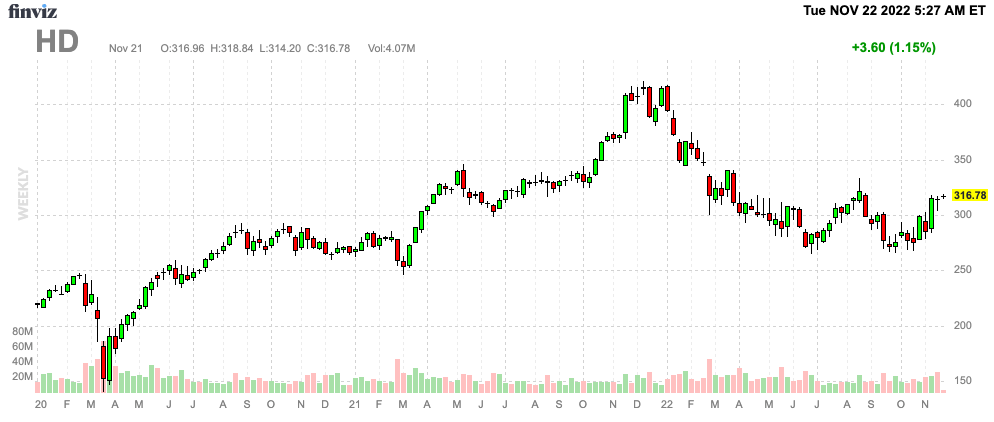

And yet, I bought more Home Depot shares this year. I expanded my position by 33% during the latest sell-off, buying more shares at $272.09, to be precise. I’m very happy with that entry. My current average is $254.20, as I started buying HD shares in 2020. That’s when I started my dividend growth portfolio.

FINVIZ

There are a few things that make HD so powerful.

Not only its massive footprint in North America but the way the company strives to provide the best customer experience, offering great products at great prices and becoming the most efficient investor of capital in home improvement.

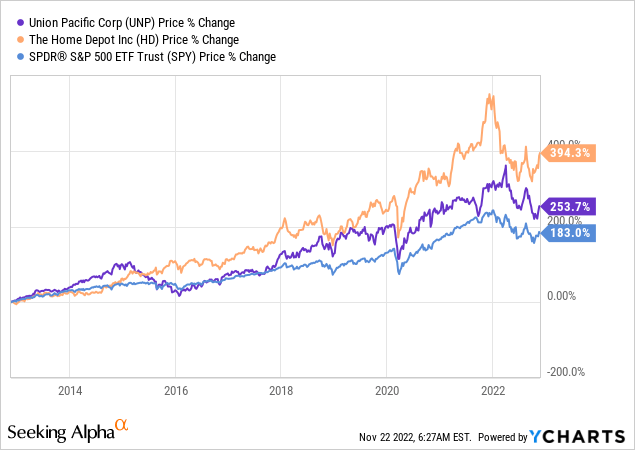

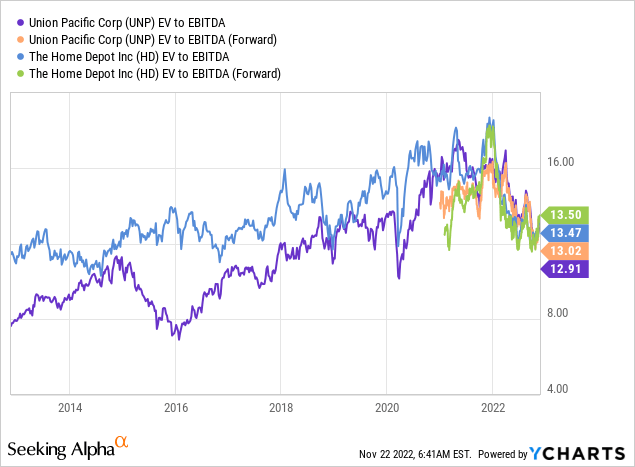

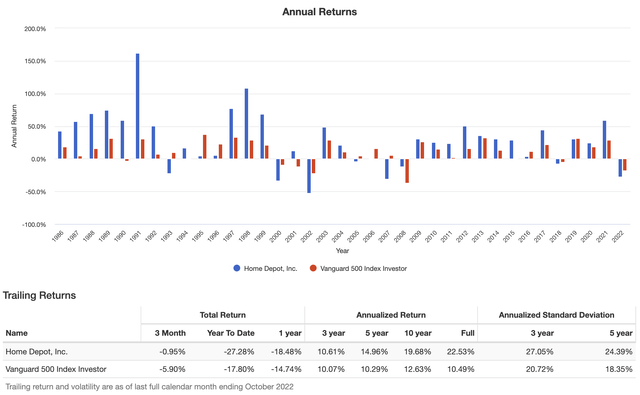

Home Depot is a superstar when it comes to generating shareholder value. The company has returned 22.5% per year since 1986. However, that’s not the main takeaway. The company has consistently outperformed the S&P 500, as the chart below shows. Over the past five years, the stock has still returned 15.0% per year, beating the S&P 500 by almost 500 basis points. Even better, all of this happened with subdued volatility. The standard deviation is just 600 basis points higher compared to the S&P 500. That’s a stellar number, given that the S&P 500 is a huge diversified basket of stocks.

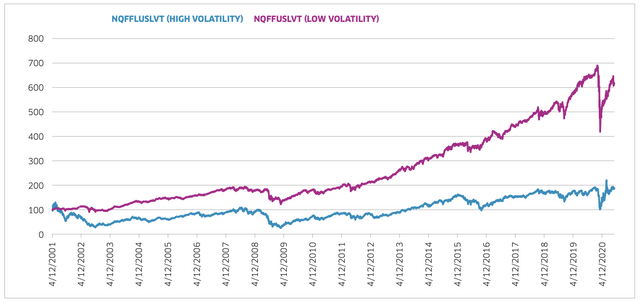

As I wrote in my article covering the two dividend stocks I would NOT buy, low-volatility outperformance is somewhat of the holy grail of long-term dividend investing.

To show you a chart I used in that article, low-volatility stocks have outperformed high-volatility stocks by a mile since 2001 for two reasons. Number one is the fact that low-volatility stocks tend to hold up quite well during recessions. That alone is enough to provide long-term outperformance. Yet, some high-quality stocks also outperform during bull markets. That’s why HD is so powerful.

But wait! There’s more.

Home Depot is a mind-blowing dividend growth stock.

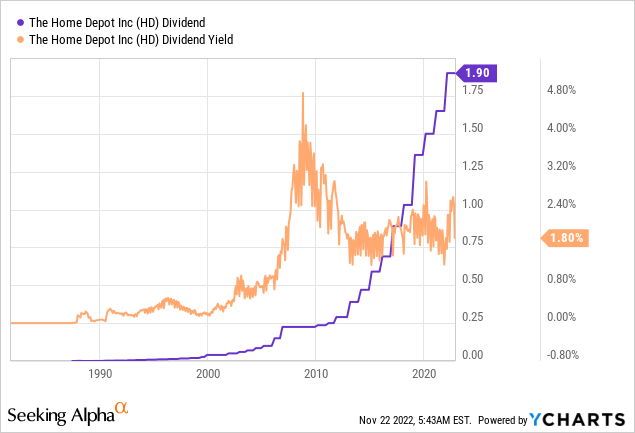

The company currently yields 2.4% based on a $1.90 per share per quarter dividend.

2.4% may not sound like a lot. However, I beg to differ. Especially given its ability to grow that dividend.

On a quick side note, I’m not showing you the Seeking Alpha dividend scorecard as I’ve found that some outlier numbers give a wrong picture of the company’s true dividend power.

Over the past ten years, the average annual dividend growth rate was 20.2%, which is a stunning number. Over the past five years, that number is still 17.0%. Please note that the yield has not been updated by YCharts in the chart below.

These are the most “recent” hikes:

- February 2022: +15.2%

- February 2021: +10.0%

- February 2020: +10.3%

- February 2019: +32.0%

Moreover, using FY2024 estimates (the fiscal year starts in February of 2023), the company is expected to do $16.7 billion in free cash flow, indicating a 5.2% FCF yield. Meaning the payout ratio of roughly 50%.

So, even if HD were to stop growing, there is plenty of room to maintain strong dividend hikes.

Moreover, so far, the company is withstanding economic weakness. In its October quarter, the company saw 4.3% fewer customer transactions. That makes sense. However, pricing was able to boost the average ticket by 8.8% to $89.67. Sales per retail square foot improved by 5.3%.

It shows that the company’s operating performance is indeed a blessing in this environment.

However, please be aware that horrible housing fundamentals are the reason we get to buy HD at these levels. I believe that further deterioration offers new buying opportunities – below current prices.

Now, onto number two.

2. Union Pacific (UNP) – 2.4% Yield

This is one of my largest holdings and a stock I’m incredibly passionate about.

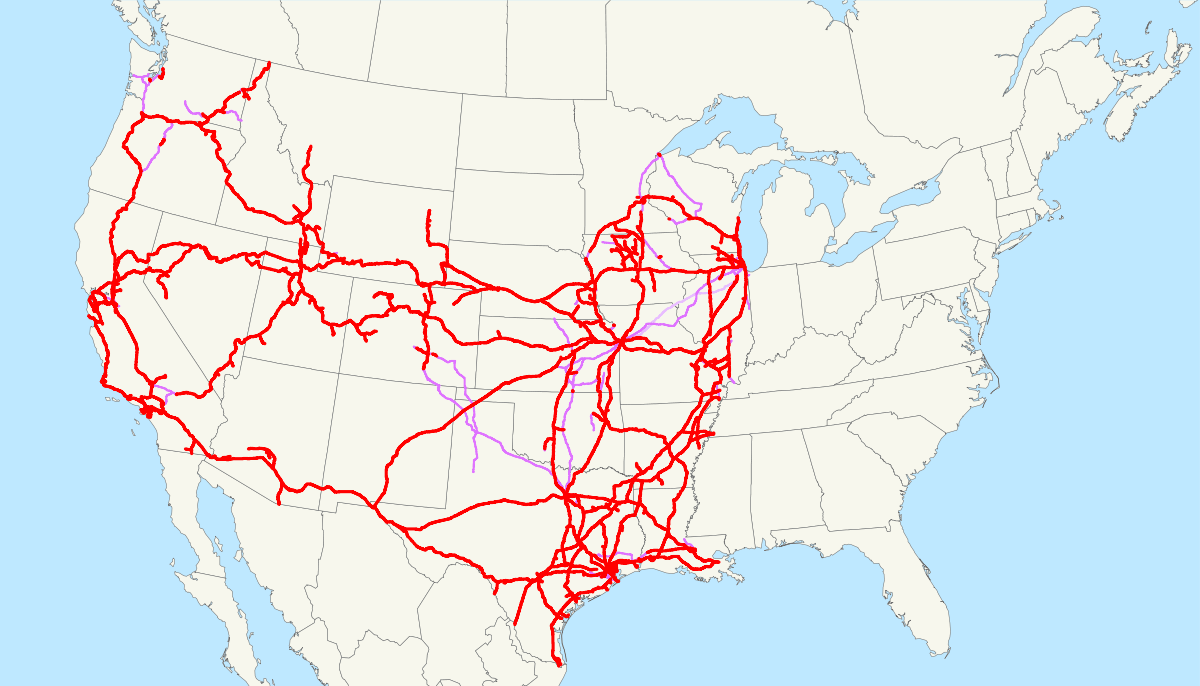

This railroad giant covers all major supply chains between the West Coast and the imaginary vertical line between Chicago and New Orleans.

Union Pacific

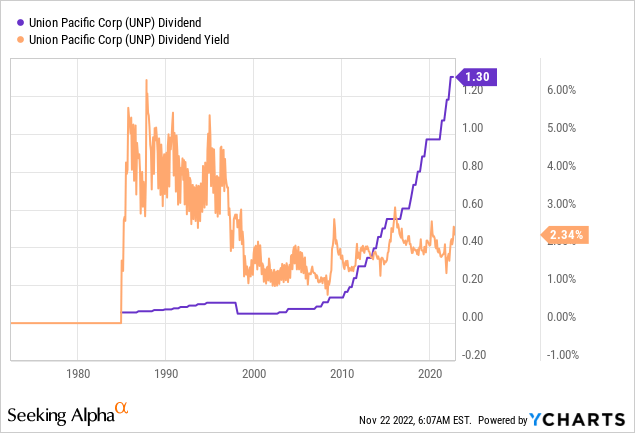

Like HD, Union Pacific offers a 2.4% yield. This is based on a $1.30 per share per quarter dividend.

The company is my fourth-largest holding. It used to be my second-largest holding, yet the strong energy performance has caused that to change.

However, I’m fine with that as I’m looking to consistently add to my position. Recessions are the best way to get that done at good prices.

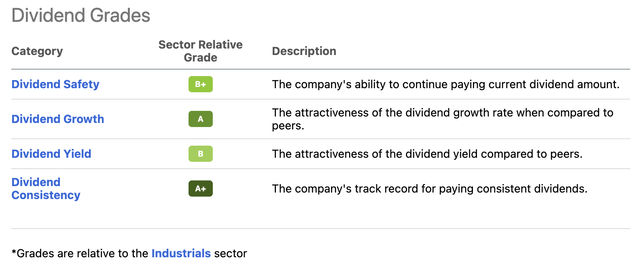

Looking at the dividend scorecard below, UNP is a juggernaut in its industrial sector. The company scores high on dividend growth and dividend consistency. Dividends safety and dividend yield are both fine.

Over the past ten years, the average annual dividend growth rate has been 15.3%, which is terrific. Even better is that the average is still 12.0% over the past three years.

These are the latest hikes:

- May 2022: +10.2%

- December 2021: +10.3%

- May 2021: +10.3%

- July 2019: +10.2%

Moreover, the cash flow payout ratio is 33%, allowing for more future hikes – based on unchanged free cash flow.

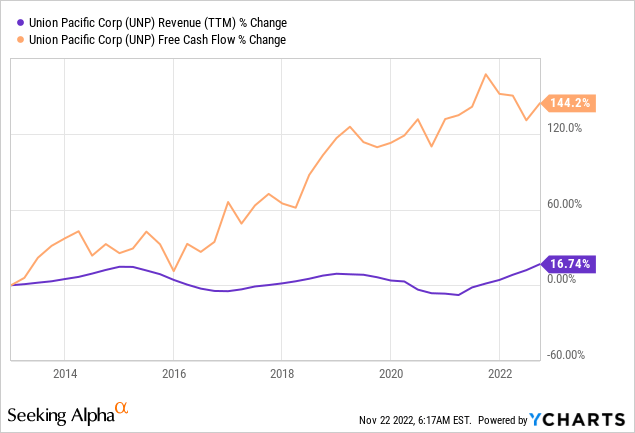

The power of railroads is pricing and improving operations. Fuel surcharges and related pricing methods allow investors to do well in times of high inflation. The company’s ability to make its operations more efficient benefits shareholders as well, as it has boosted free cash flow.

Over the past ten years, revenue has grown by just 17%. Free cash flow, however, has risen more than 140%.

While 2022 is challenging in terms of operations due to labor issues and the lasting impact of the pandemic, the company is positive that it can lower the operating ratio to 55.5% in 2023 after 2022 is likely to end up with an OR of 60%.

If shipments can rebound in 2023, the company is set to continue its revenue and free cash flow expansion.

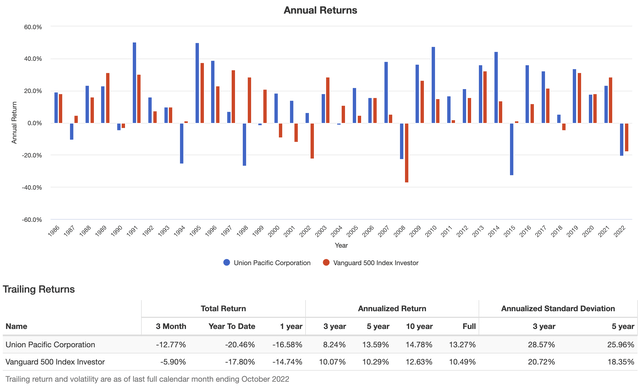

Over the past ten years, UNP has outperformed the market by a significant margin (capital gains only).

However, UNP is more volatile than HD. Over the past five years, for example, the stock has returned 14.8% per year (including dividends). The standard deviation was 26.0%. While that is slightly higher compared to HD, it doesn’t keep the company from beating the S&P 500 on a volatility-adjusted basis as well.

With that said, here’s the bottom line.

The Bottom Line

We’re in a vicious macro environment. All asset classes are volatile, and market movements are highly driven by Fed comments and related macro headlines.

While I believe that the market is in for more weakness and long-term headwinds, I am a buyer of my favorite dividend growth stocks. Both Union Pacific and Home Depot are now trading at attractive levels. Both stocks have tremendous dividend growth power, and both can withstand high inflation and consumer weakness.

However, I’m not buying at any price. I believe these stocks are tremendous buys once the market gives us another 5-10% sell-off opportunity – and anything worse than that.

Moreover, I would make the case that the 2.4% yields these stocks offer are good yields, given the dividend growth power of the two companies. Ignoring dividend hikes, a 10% stock price decline makes these yields even juicier.

So, long story short, if you’re looking for quality stocks in this market environment, look no further!

That said, going forward, we’ll discuss more investment opportunities, especially for higher-yielding portfolios and niche markets that are often overlooked.

The main aim of this article was to present two stocks that I believe offer tremendous long-term potential. Stocks that make recessions fun, as it means getting new buying opportunities we usually don’t get outside of recessions.

(Dis)agree? Let me know in the comments!

Be the first to comment