KanawatTH

Investment Overview

During the first half of 2022, it looked as though the Tarrytown, New York State-based pharmaceutical Regeneron Pharmaceuticals, Inc.’s (NASDAQ:REGN) share price would have a poor year. The reason for this was fairly easy to identify.

In 2021, Regeneron earned $5.8bn of revenues from its COVID antiviral therapy REGEN-COV, helping the company almost double its revenues year-on-year, from $7.94bn in 2020 to $15.8bn in 2021. After the therapy proved ineffective against the Omicron strain of COVID, however, the FDA restricted its use – in 2022, REGEN-COV will not make a significant contribution to Regeneron’s top or bottom line.

Taking a near-$6bn hit to top line revenues would damage most companies’ valuation, and so it proved with Regeneron. Its share price slid from an April high of $738 to an August low of $580 – a >20% downward correction.

As I discussed in my last note on Regeneron in mid-September, however, the company and its management are nothing if not resourceful, with an uncanny knack for rebounding from setbacks with a fresh bit of positive news flow.

Right on cue, good news arrived in early September, when Regeneron released positive data from studies of a higher dose version of its mega-blockbuster eye disease therapy Eylea, co-developed and marketed with Bayer (OTCPK:BAYZF), which earned the company revenues of $5.8bn, $6.1bn, and $7.2bn in 2019, 2022 and 2021, respectively.

Eylea 8mg took analysts by surprise, showing outstanding efficacy in 2 Phase 3 studies – PHOTON and PULSAR, focused on patients with diabetic macular edema and wet age-related macular degeneration (“wAMD”), respectively.

The results of the studies showed that “nearly 90% of patients with diabetic macular edema and almost 80% of patients with wet age-related macular degeneration were able to maintain a 16-week dosing regimen,” and, “aflibercept 8 mg 12- and 16-week dosing regimens achieved non-inferiority in vision gains compared to the EYLEA 8-week dosing regimen.”

In my last note on Regeneron in September, I suggested that these results were excellent news for Regeneron, not only because it helped the company stave off the challenge posed by Roche’s (OTCQX:RHHBY) newly approved Wet AMD and DME drug Vabysmo, which has a once every 4-month dosing regime, but also because it may help the company extend patent protection for Eylea. I suggested that:

if Regeneron submits a Biologics License Application (“BLA”) to the FDA for HD Eylea as a new therapy, then it may receive a fresh round of patent protection lasting well into the next decade

As a result, in my forward sales forecasts, I guided for Eylea sales of ~$8.3bn by 2030, including the collaboration revenues paid to Regeneron by Bayer, who market and sell Eylea outside of the U.S. I also guided for up to $6bn of revenues from Regeneron’s share of sales of allergy therapy Dupixent, co-developed and marketed with the French Pharma Sanofi (SNY), based on the drug achieving peak sales of $15bn – $20bn, and Regeneron’s share of revenues being ~30%, according to the agreement with Sanofi.

These 2 therapies, plus Regeneron’s Libtayo – which I pegged for peak sales of ~$1.5bn by 2030 – made up the bulk of the $19bn revenues I guided for in 2030. Given the Pharma’s ~50% operating margin, using discounted cash flow (“DCF”) analysis I set a price target for the stock price of ~$815 – a 10% premium to Regeneron’s share price today.

Recent events – such as a ruling from the U.S. Patent Trial and Appeal Board that Regeneron’s patents 338 and 069 were “unpatentable,” and a further challenge by generics giant Viatris (VTRS) to 2 more patents – have led analysts to speculate that generic and biosimilar versions of Eylea could hit the market by 2024. However, and with the prospect of new patents being secured via a new BLA submission apparently fading (despite a submission being targeted for early next year and the use of a priority review voucher accelerating the approval process), it may be the case that my forward estimates for Eylea were too high.

It may be that Regeneron’s management team are thinking along similar lines, since the main focus of the Q322 earnings call with analysts centered around its oncology pipeline. If it is the case that Eylea’s peak sales years may soon be ending, then Regeneron finds itself in a similar position to Pharma giant AbbVie (ABBV), whose ~$20bn per annum autoimmune drug Humira loses its patent protection in the U.S. next year.

AbbVie was able to successfully develop 2 new autoimmune drugs – Skyrizi and Rinvoq – to offset a fall in Humira sales, but Regeneron does not have a long-term Eylea replacement in its pipeline – instead, it is hoping to build a successful oncology franchise.

In the rest of this post, I’ll briefly review Regeneron’s Q322 earnings, before discussing the 4 new oncology drugs Regeneron is hoping it will one day bring to market, peak sales expectations, chances of approval, and whether my price target of $815 for Regeneron shares is still valid given the increasing threat to Eylea sales.

Q322 Results In Review

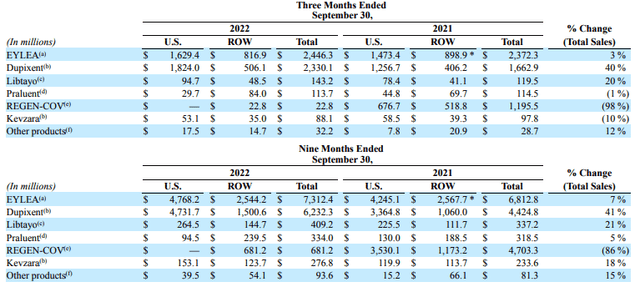

Regeneron drug product sales Q322 (Regeneron 10Q)

As we can see above, sales of Eylea increased by 3% year-on-year in Q322, although they did fall internationally. REGEN-COV sales, as discussed, will fall from $5.8bn in FY21 to just $681.2m in FY22, but the performance of both Libtayo – with sales increasing 21% across the 9m to September 30th versus the prior year period, to $409m – and especially Dupixent, with sales up 41% to $6.2bn across the first three quarters of 2022, is very impressive.

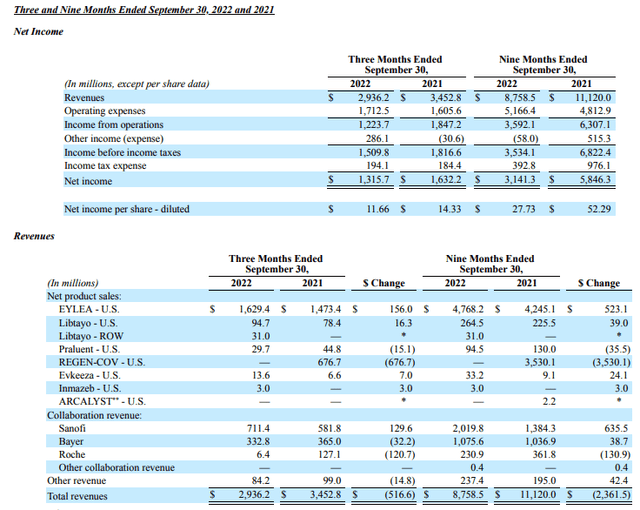

Regeneron revenues and income as at Q322 (Regeneron 10Q)

In terms of actual revenue generation, across the 9m period in 2022 Regeneron’s revenues are down $2.3bn versus last year, owing to the absence of REGEN-COV revenues, but sales of Eylea increased >$500m year-on-year, and Sanofi collaboration revenues increased >$635m. There are few concerns around Regeneron’s profitability – net profit margin is >35% – and Regeneron also boasts $15.4bn of current assets, versus current liabilities of $2.9bn, and long-term debt of just $1.98bn.

In short, Regeneron posted a very healthy set of Q322 earnings with revenues of its key assets growing substantially year-on-year, despite the lost REGEN-COV revenues.

Regeneron declines to provide revenue or EPS guidance for FY22, but if we assume revenue in Q4 is the average of the first 3 months then revenues ought to be ~$12.5bn for the year (or likely higher given how fast Dupixent revenues are growing). With an operating margin of ~41%, and net profit margin of 34% I therefore calculate FY22 EPS of ~$40, for a forward price to earnings (“PE”) ratio of ~19x, which is slightly below the average for a large pharmaceutical – another encouraging sign.

Now let’s take a look at the oncology pipeline.

Regeneron’s Oncology Pipeline Looks Promising With Libtayo The Centerpiece

On its Q322 earning call, Regeneron’s Chief Scientific Officer George Yancopoulos noted that:

The European Society of Medical Oncology or ESMO Annual Meeting in September was a truly a banner event for Regeneron with several notable oral presentations for assets in our oncology pipeline.

The CSO also promised a steady stream of data readouts in late 2022 and early 2023.

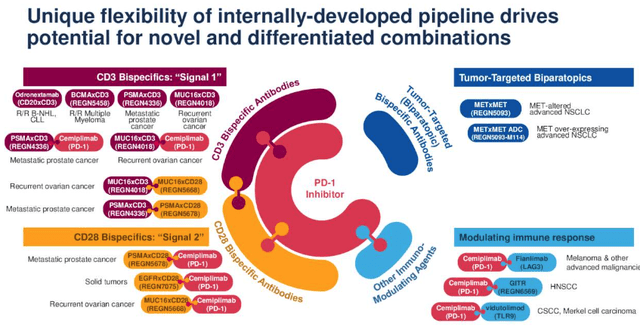

Regeneron Oncology pipeline (Regeneron presentation)

As we can see above, Libtayo, Regeneron’s PD-1 checkpoint inhibitor, is the centerpiece of the company’s efforts as it tries to enable the drug to compete with the likes of Bristol-Myers Squibb’s (BMY) $7bn per annum-selling Opdivo, and Merck’s (MRK) $17bn per annum-selling Keytruda, both of which have a similar mechanism of action to Libtayo.

In June this year, the company opted to pay Sanofi ~$900m plus milestones and an 11% royalty on all sales to obtain the exclusive rights to market and sell the drug, marking another break in the historically relationship between the two companies.

The company announced this morning that Libtayo had been approved, as expected, for first-line treatment of adult patients with advanced non-small cell lung cancer (NSCLC) with no EGFR, ALK or ROS1 aberrations, after increasing overall survival (“OS”) by a median of 22 months versus 13 months with chemotherapy alone.

The drug is also indicated in certain patients with advanced basal cell carcinoma (“BCC”), advanced cutaneous squamous cell carcinoma (“CSCC”) and advanced Non-Small Cell Lung Cancer (“NSCLC”), as well as in advanced cervical cancer in Canada and Brazil.

Fianlimab in Melanoma, Solid Tumors

Libtayo’s next approval may come in combination with Regeneron’s LAG-3 antibody Fianlimab, as a therapy for melanoma, after studies showed the combo generated response rates >60% with a median Progression Free Survival (“PFS”) of 24 months. According to Yancopoulos:

While dual LAG-3 and PD-1 inhibition has previously shown promise in advanced melanoma, response rates greater than 45% with median PFS of more than a year has not been previously reported. These initial results in melanoma suggest that Fianlimab–Libtayo combination has the potentially best-in-class profile in the setting.

Yancopoulos told analysts that a Phase 3 study is ongoing, and according to a recent Regeneron presentation, the combo will also be tested in NSCLC and breast cancer with results apparently due before the end of this year.

According to DelveInsight this combo could be worth $550m in peak sales to Regeneron, with approvals in up to 7 different markets, although the company will have to show data that compares with Bristol Myers Squibb’s already approved LAG-3 inhibitor Relatlimab combined with Opdivo. If the drug does win label expansions outside of melanoma, I would put peak sales expectations a little higher, at ~$1bn.

Ubamatamab in Ovarian Cancer

Regeneron presented data from a study of its MUC16xCD3 bispecific at ESMO, showing response rates as high as 31% in patients expressing the surface cell antigen MUC16. In a study of 42 patients, an overall response rate (“ORR”) of just 14.3% was achieved, although 57% of patients did experience stable disease and in patients with a higher expression of MUC16, the ORR rose to 30.8%.

Regeneron sees Ubamatamab working both as a monotherapy and in combo with Libtayo and there will be more ovarian cancer data upcoming in 2023 from a Phase 2 dose ranging study. The unmet need in ovarian cancer is high given it is responsible for ~14k deaths per annum in the US alone, and median survival is only ~12 months.

That also speaks to the difficulty of developing drugs to treat the disease, however. The likes of GlaxoSmithKline’s (GSK) Zejula – $395m sales in 2021 – AstraZeneca’s (AZN) Lynparza – $1.8bn sales – and Roche’s Avastin – >$5bn sales – are all indicated to treat Ovarian cancer, but the overall bar for approval is not as high as in other cancers.

Regeneron is making no secret of the fact it wants to establish a dominant market position in this indication. The early signs are promising, but realistically an approval is 2-3 years away. The chances of success are unlikely to be more than 50/50 at this stage.

REGN5678 in Prostate, REGN5093 in MET-NSCLC

Prostate cancer is another challenging target that Regeneron is hoping to take on with a combo of Libtayo and candidate REGN5678, a PSMA / CD28 bispecific.

According to CSO Yancopoulos, prostate cancer was responsible for 375k deaths globally last year, and PD-1 inhibition has proven to be an unsuccessful treatment approach as a monotherapy. Response rates are typically ~10%, yet in its first clinical study, REGN5678 and Libtayo combined generated 75% response rate at the highest dose level, with 2 patients achieving 99% PSA reduction.

Meanwhile, REGN5093 is a bispecific targeting METxMET. MET stands for mesenchymal epithelial transition, and it is often found to be mutated in certain types of cancer. Regeneron says that preclinical data shows its approach – targeting “two distinct epitopes on the MET receptor” – has led to “significantly better activity than the parental monoclonal antibodies.”

In heavily pretreated patients with NSCLC, REGN5093 showed a tumor response with “centrally confirmed biomarker selection” and an acceptable safety profile. The ORR rose as high as 50% in patients MET protein expression in >90% of tumor cells, and the trial will continue, with more data expected next year. Use alongside tyrosine kinase inhibitors (“TKIs”) may also be tested, raising the prospect of combo therapies alongside any of several approved TKIs.

Looking Ahead – How Does A More Pessimistic Outlook Offset By Potential Oncology Pipeline Affect Target Share Price

To summarize the oncology pipeline, we can definitely highlight some areas of genuine potential and reasons to be hopeful.

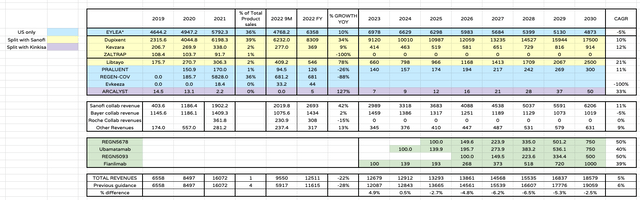

As a checkpoint inhibitor, provided it can match the incumbents Opdivo and Keytruda for efficacy and safety – admittedly no easy feat – Libtayo’s peak sales potential really ought to stretch into the low single-digit billions of dollars at least, in my view. As such, in my modelling I have upgraded peak sales in 2030 from $1.5bn, to $2.5bn.

The promise of Fianlimab alongside Libtayo in melanoma ought to be confirmed with an approval next year, provided final trial data supports it, and there is NSCLC and breast data to come. However, I am not comfortable guaranteeing this Fianlimab more than $1bn in peak sales due to breast and NSCLC being congested markets and without strong proof of a best-in-class profile.

I will assign $750m in peak sales for Ubamatamab given Regeneron’s focus on ovarian cancer – the company has no shortage of funds to spend on R&D, even if some shareholders would doubtless like to see management introduce a dividend.

For the other 2 biospecifics, I will assign $750m and $500m in peak sales by 2030, which is nothing more than a placeholder until there is more concrete data, but again reflects Regeneron’s strong focus on oncology.

Meanwhile, now that I am less certain Eylea will maintain its patent exclusivity much beyond 2024, I increase the drug’s sales by 10% between 2022 and 2023, but reduce them by 5% in each subsequent year, as opposed to assuming a 3% CAGR, as I had done previously.

Regeneron forecast product sales – my estimates (my table and estimates)

As we can see above, by doing this I am ultimately projecting a less-optimistic scenario than formerly. The decrease in Eylea sales is not quite offset by the launch of 4 new oncology drug products, but Regeneron’s revenues experience strong growth nevertheless – a 5% CAGR as opposed to a 6% CAGR.

When looking at discounted cash flow analysis, I have also adjusted my operating margin, however, so that total operating expenses are 55% of total revenues, which is more in line with results across 2022 after three quarters of earnings.

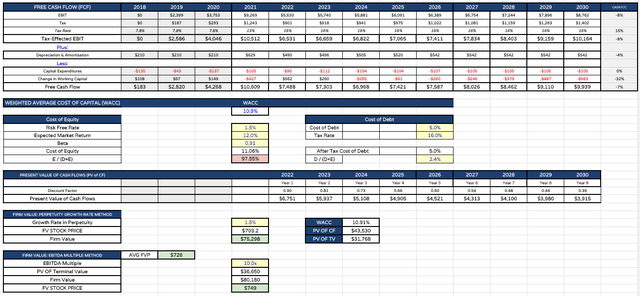

That has additionally reduced my target share price for Regeneron, which now falls to $726, as shown below.

Regeneron DCF analysis (my table and calculations )

Conclusion – Not The Right Time to Buy Regeneron, But Keep a Close “Eye” On This Enterprising Company

Naturally, none of the above revenue forecasts or new drug approval assumptions are set in stone, but hopefully they prove a useful guide for anyone who wants to know what the long-term picture looks like at Regeneron.

In my view, it would be almost miraculous if Regeneron secured approvals for all 4 of the drugs discussed above. But, with that said, I would imagine that management’s goal would be to develop an oncology portfolio that can generate >$5bn in annual revenues by 2030, whether that be in prostate, ovarian, breast or NSCLC, in order to offset falling sales of Eylea and give the company a new generation. One drug may outperform my forecasts, whilst another may not be approved at all.

Regeneron certainly won’t give up on eye disease, either, having recently signed an agreement with RNA-interference specialist pharma Alnylam to develop new therapies targeting the complement system, amongst other targets, investing $800m upfront.

Regeneron management always seem capable of pulling a rabbit from a hat when they need to, so I would not necessarily say that shares are presently overvalued, but I would argue, based on my analysis, that the upside opportunity may be limited.

$750 for Regeneron would be a likely upper limit for me, but the next time the volatile share price drops below $600, I would consider that a strong buying opportunity. I hope to examine Dupixent and the next generation eye disease pipeline in more detail in a future post.

Be the first to comment