krblokhin

EOG Resources (NYSE:EOG) is an American energy company with a $60 billion valuation. The company has dropped almost 30% over the past two months, however, with a strong position of financial assets the company has a unique ability to generate strong returns in a variety of markets. That makes the company a strong investment on recent weakness.

EOG Resources Overview

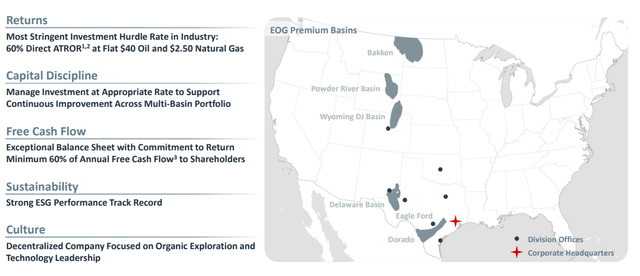

EOG Resources continues to have an impressive portfolio of assets.

EOG Resources Investor Presentation

EOG Resources is focused on generating substantial production which is primarily focused on the Delaware Basin. The company is focused on 60% returns at $40 oil and $2.5 / mmBtu natural gas. The company expects to generate significant FCF and its continued plan is to return a minimum of 60% of FCF to shareholders.

EOG Resources 2Q 2022 Results

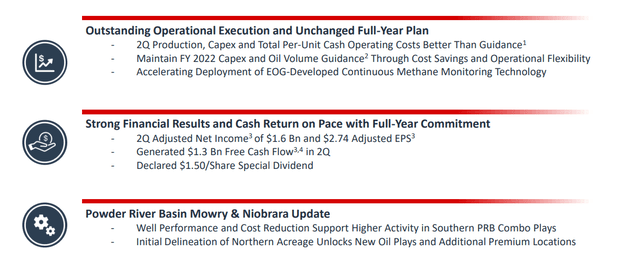

Financially, EOG Resources generated incredibly strong 2Q 2022 results showing its financial strength.

EOG Resources Investor Presentation

The company’s production, capex, and operating costs were all better than the company’s guidance. The company is planning to maintain its capital spending and volume guidance showing the strength of its assets. Financially, the company generated $1.6 billion in net income and $2.74 in adjusted EPS with FCF at a massive $5.2 billion annualized.

The company declared a $1.5 / share special dividend, a high single-digit dividend yield. The company is continuing to explore new assets and their potential development potential.

EOG Resources Capital Spending Plan

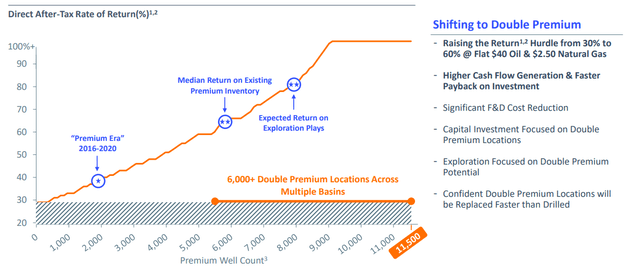

EOG Resources is focused on continuing to develop its assets. The company’s 2022 plan is for a substantial $4.5 billion in capital spending.

EOG Resources Investor Presentation

The company has 6000+ double-premium locations, a substantial inventory of valuable assets. The company’s media return on existing premium inventory is expected to be more than 60% and the company expects a high double-digit return on exploration plays. The company has consistently raised its production hurdle showing the strength of its assets.

The company has reduced its finding and development costs to $5.81 / barrel down from $13.25 over the past 5 years. Over the same time period, cash operating costs have dropped by 24% to just over $10 / barrel.

EOG Resources Investor Presentation

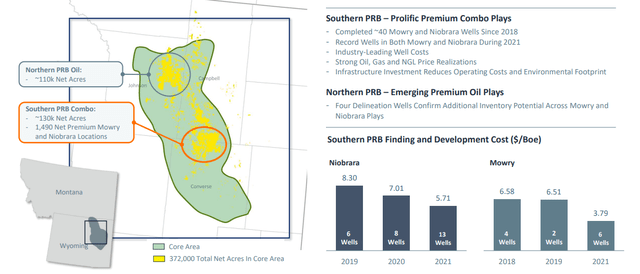

Out of the company’s assets one worth looking at is the Powder River Basin. It’s an example of how the company has continued to improve its assets, and it makes up 14% of the company’s premium well count. The company’s assets are significant, not only does it have 370 thousand total net acres, but they’re well connected together.

The company has drilled 40 wells in the region since 2018 and is continuing to produce record well counts. As it has done so, the company’s finding and development costs have dropped significantly. We expect the company to continue to maintain strong production and reduce costs here, enabling continued returns.

EOG Resources Cash Flow

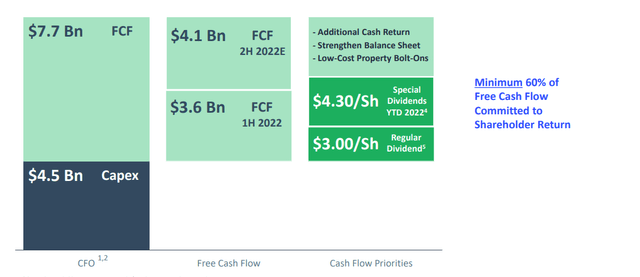

Putting this all together, the company has incredibly strong cash flow and the ability to generate strong returns. It’s worth noting that this plan is at $95 WTI, which is roughly 5% above current prices.

EOG Resources Investor Presentation

The company expects more than $12 billion in operating cash flow, which will be broken into $4.5 billion of capital expenditures and $7.7 billion of FCF. From that the company expects $3.6 billion in 1H 2022 FCF increasing to $4.1 billion in 2H 2022. The company has announced a massive $7.3 / share in dividends YTD (~7% yield).

The company is committed to a minimum 60% FCF shareholder return. Its FCF for the year after an impressive capital program is expected to be 12-13%. The company has a lower FCF yield than most but it has an incredibly strong overall portfolio of assets. The company also has one of the strongest balance sheets in the industry.

EOG Resources Shareholder Return Potential

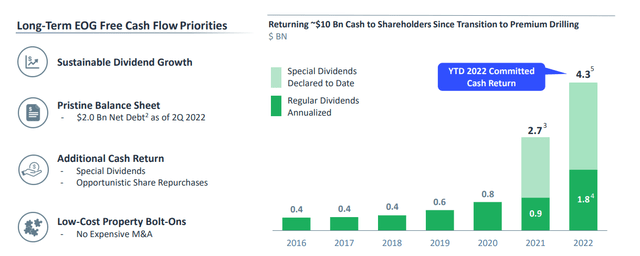

The company has a stronger balance sheet than almost every company so despite the lower FCF yield, we expect incredibly strong shareholder returns.

EOG Resources Investor Presentation

The company has an almost negligible $2 billion in net debt showing the strength of its balance sheet. As result the company has been able to rapidly grow its dividend yield through a combination of sustainable regular dividend growth and massive special dividends that enable the company to return cash in a volatile environment.

The company has continued to hold back production growth, but still expects roughly 4% in 2022 production from its budget. That all comes to shareholder returns at the end of the day. At the end of all this, the company also has a $5 billion share buyback program, one that’s comfortably manageable and can lower dividend expenses.

Overall, we expect the company to generate strong returns that can continue growing.

Thesis Risk

The largest risk to the thesis here is crude oil prices. The company’s FCF guidance is based off of $95 / barrel WTI, roughly 5% above current prices after recent weakness. If prices drop, that’ll hurt the company’s ability to drive shareholder rewards, which is a risk worth paying close attention to. however, the company’s continued cost improvements will help it.

Conclusion

EOG Resources has an impressive portfolio of assets with a mere $2 billion of net debt and one of the strongest overall operations. The company’s assets are well integrated and the company has been able to consistently reduce costs after its focus on premium wells. That cost reduction will enable margins to grow at fixed oil prices.

The company’s low net debt will enable strong shareholder returns. The company’s base regular dividends are roughly 3% which the company can comfortably afford. The company has also announced several % of special dividends. On top of this the company is focused on share buybacks and modest growth making it a valuable investment.

Be the first to comment