Noureddine Belfethi/iStock via Getty Images

Introduction

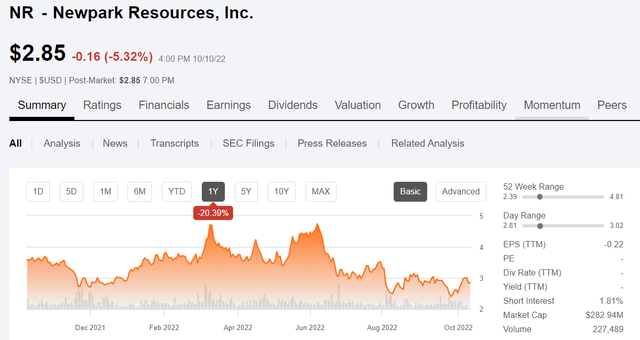

Newpark Resources, Inc. (NYSE:NR) reported a fairly decent quarter in August, and the stock did nothing. In fact it swooned afterward, only to be buoyed by the purchases by a couple of board members mid-month. It sank to the mid-$2’s in the September mini-crash, and since then has rebounded to near $3, as the oil market moved higher as the month closed out.

Newpark Price Chart (Seeking Alpha)

There was little in the call that would inspire confidence in investors, in spite of substantial improvement in revenues quarter-over-quarter from Q-1. We are looking for more than incremental improvement that is consistent with the rise in the rig count.

In this update, we will look at the investability of Newpark Resources as we exit 2022. Are there catalysts out there that might overcome all the bullets the company has fired into its own feet? Maybe. But, the clock is running down on management’s window to do something that will move the needle. Read on.

Newpark as it is today

The company is primarily a provider of advanced drilling fluids solutions. In the 2010’s, NR began to build out infrastructure along the Gulf Coast that would support its move into the surging deepwater activity in the GoM. In this time, there were some 50+ deepwater rigs in the GoM, and mud company revenues were cranking. They also hired some of the top people in the fluids business from my old company primarily, and built a state of the art formation damage lab in their (recently built, and opulent) Katy headquarters to support this move.

Then came the crash of mid-2014, from which the industry has never fully recovered. It turned this series of strategic moves into a calamity that finally sank the stock, from the $10’s in late 2018, to as low as $0.82 in March of 2020. In recent times, in what was presumably cost-cutting, they’ve purged many of the people who propelled the company to the point where Shell (SHEL) was able to give them some deepwater work. They haven’t replicated the Shell success with other deepwater operators.

The company is also in what it calls the Mats and Integrated Services business. This segment of the company provides interlocking plastic mats to minimize dirt and debris in field locations, notably rig sites and short roads through swampy areas. This business stands on its own but was meant to thrive in a much larger rig market that we have presently. The company has attempted to develop this business in civil construction and utility repair but the scenarios are not directly analogous. A rig will use thousands of mats if you count road building, whereas the other applications just don’t compare. It should also be noted that plastic mats don’t have a big “moat.” Anybody with a giant injection molding machine can get into the business. Basically, Mats is a distraction from their core business and could be part of what makes the market keep NR at a distance.

Closing out this section, we come to the core issues that keep NR stock from sustaining or breaking through the $5.00 barrier. They are actually related to a degree.

Four Reasons why Newpark can’t break $5.00

The first is the lack of deepwater activity to sustain their Port Fourchon, La Deepwater liquid storage and blending facility. The company has tens of millions of dollars tied up in this resource and has been looking for a buyer for some time. CEO Mathew Lanigan comments:

As we continue to reshape our Fluids business, our divestitures remain a key priority to reduce our capital burden, and we are committed to taking actions on every aspect of our operations that do not show a pathway to acceptable returns. The key area of focus in the near term will be on our deepwater Gulf of Mexico investments, where we have been unable to generate a consistent acceptable return. As a result, we’re exploring a range of options to optimize our capital deployment in this market, which includes more than $25 million in net working capital. We see this as another step in driving a capital-light and agile business model for our fluids business.

As an investor, nothing sends me diving for cover faster than language like that. Think about it. 10% of the capitalization of the company is tied up in an under-used mixing plant. There are no buyers for this plant. Nor are there other uses to which it could be put. Fluids plants are intended to mix and pump 10’s of thousands of barrels of mud and brine per day to offshore service boats. That’s it. All the major fluids companies – Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR) – have comparable plants at Fourchon (and would probably like to sell them in this “capital-light” era), so whatever Lanigan is talking about… a straight sale is an unlikely prospect.

Second, we have the continuing trauma of the structure of the company, led by an activist investor- Bradley Radoff. Radoff owns about 4.9% of Newpark, and lists himself as among their top five investors. About this time last year, he sent an urgent letter outlining his proposals for restructuring the company to NR management and board of directors. He is of the view that Drilling Fluids is a dying business and should be spun off or sold to free up growth in the Mats business. Radoff’s comments on Fluids Systems:

Fluid Systems segment is an unprofitable business operating at the opposite end of the energy transition spectrum.

He obviously sees things in Mats differently than I do, hence his comments. So far, crickets have been heard in reply. There was nothing in the call that addresses Mr. Radoff’s solutions directly. Here is his summary:

Rather than continuing to oversee an unjustifiable structure that is punishing shareholders, the Board should publicly commit to splitting up the Company right away. The Board has a tremendous opportunity in front of it that it should want to promptly embrace. If the Board publicly commits to separating the businesses, this can allow for the creation of focused businesses that yield significant long-term benefits for Newpark’s shareholders, employees, customers and other societal stakeholders. Notably, the Industrial Solutions segment can be the foundation of a world-class infrastructure services business with the potential to be a market leader and trade at a significant premium.

I agree with Radoff that there is no synergy between Fluids and Mats. I am not willing to agree that Fluids is the company that should be spun off. While growing and profitable, Mats is a company that would fit best with other companies doing on-remote location, site work.

The final bone I have to pick with Newpark is the selection of Mathew Lanigan as president and CEO. Lanigan is an alumnus of GE Capital in Australia, with stops in Europe, the UK, and the USA. Way far back in his past, he has experience with Esso (a Far East subsidiary of Exxon Mobil (XOM)) as a drilling and completions engineer, 1993-2000.

Contrast that with the experience of David Paterson – President of the Fluids Systems Division, a twenty five-odd year Schlumberger hand with global experience in their Mi Swaco division-fluids, and category leadership roles as President of their Geoservices and Artificial Lift divisions. Paterson has run divisions of SLB that are many times the size of Newpark. If that wasn’t enough to distinguish him from Lanigan, Paterson has walked the pits as a mud engineer. It boggles the mind that he isn’t CEO of Newpark.

The fourth reason it can’t gain traction is a complete lack of analyst coverage. None showed up for the quarterly call, and when I searched for it on my usual site, no reports or price estimates were revealed. That is instructive on its own.

In other words, spin off Mats to shareholders of NR, and send Lanigan in that direction – it’s where he came from after all – and put a real mud man in charge of Newpark. And finally, get those execs out on the road telling the story, like TETRA (TTI) has done. It makes a difference, as we have seen in TETRA’s stock action.

Some glimmers of hope

Newpark has always been strong in the North African and EMEA market generally. A couple of key wins with Sonatrach – the Algerian NOC – and ENI (E) for the Algerian market bode well for NR. Algeria is gassy and positioned advantageously to Italy, which is reputed to be in the hunt for new sources, and looking at the country favorably as a source. In the Q-2 call, management noted nearly $120 mm of new multi-year contracts with Sonatrach and ENI.

The Gulf of Mexico (“GoM”) is coming back to life. The big three deepwater drillers have all noted an increase in tendering and interest in securing drilling fixtures in the Gulf. To kick that off, a two rig project for the GoM that was deferred from Q-2 should occur. If these are drill and completes, the revenue and EBITDA should pump up Q-3 revenues nicely. For those who don’t know, GoM wells involve thousands of barrel of oil-based mud to drill the build angle. These muds are filled with high tech goop to minimize pressure spikes from kicking on the pumps in deepwater. These are called “flat-rheology” muds, and improve performance and the bottom line. For anyone who’s interested I wrote a long article about their technology a few years back. Give it a read for color. Some of my optimism from 2017 hasn’t worn well, but it should make interesting reading nonetheless.

They have also scored a $20 mm deal in Saudi for their Cleansorb line. This is big contract in this product line and will bring a lot of ancillary sales along with it.

So good things are happening as the industry gains momentum. If Newpark can just resolve these long-running structural issues, the stock may become investable again.

Your takeaway

Newpark is a speculative trade in its current state. I rated it as a “Hold” for the last several articles. There are just too many distractions at present for investors to take normal financial metrics – which have begun to improve over the last couple of quarters – and calculate a multiple that would lead to growth in the stock.

Once the items I mentioned above are resolved, then if we continue to see sequential growth in revenues and new contracts, taking a position might make sense.

For now, I would say put NR on your watch list for news of resolution of any of the points I’ve mentioned above. Clearing the decks, so to speak, for this company could be all the catalyst it needs to move higher with the rest of the industry.

Be the first to comment