MagioreStock

Thesis

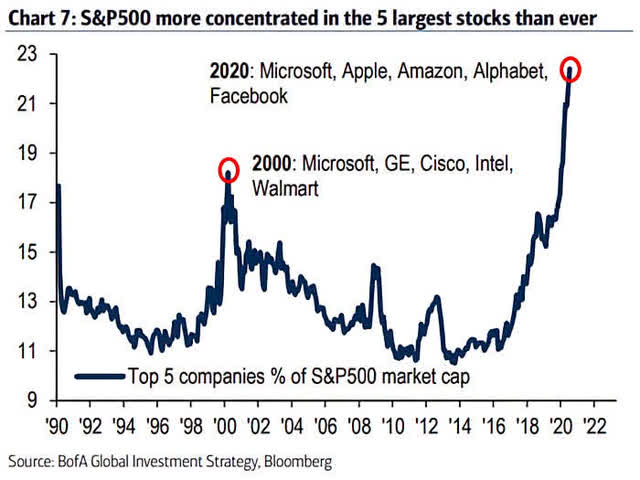

In every bull-market, a few companies take a disproportionate large share of the US’ market capitalization. In the 60s and 70s, it was the Nifty Fifty’s. In early 2000, the 5 largest companies (Microsoft, GE, Cisco, Intel and Walmart) claimed almost 20% of the S&P 500’s market capitalization. And in 2021, the FAANGs rushed well above the 20% hurdle.

BOFA global investment strategy

But since the chart above has been created, some FAANGs sold-off brutally: Intermittently, Netflix (NFLX) lost more than 70% and was cancelled from the FAANG universe, Facebook (META) changed its name to META and at some points lost almost 60%, and Microsoft (MSFT), Google (GOOG), Apple (AAPL) and Amazon (AMZN) lost between 20% to 40%.

Accordingly, one of the most stimulating intellectual exercises when thinking about the stock-market in Q3 2022 is asking the question if FAANGs have peaked?

I do not think so.

(Please note that I count Microsoft as a FAANG stock and cancel Netflix out. Thus, technically it would be FAAMG)

Valuation Still Attractive

Despite their enormous size and scale, accompanied by a multi-trillion dollar valuation, the FAANG stocks are arguably still cheap. True, an investor might look at the multiples compared to the S&P, and conclude that FAANGs are expensive–given that the P/E, P/B and P/S for the leading tech companies are elevated as compared to the broad market. But I argue there is much more that an investor should consider. In order to accurately think about a company’s valuation, an investor must also account for growth.

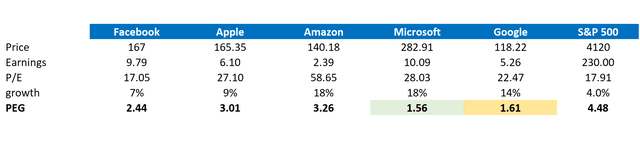

That said, I personally use the PEG ratio, which is broadly accepted as an informative valuation metric to capture the relative tradeoff between a company’s current stock price, current earnings and the expected growth. The PEG ratio is calculated by dividing a stock’s one-year forward P/E by the three-year CAGR expectation as estimated by analyst consensus.

Please refer to the table below, where I list all the FAANGs P/E, price and growth metrics. Dividing, P/E ratios by growth expectations, I calculate a x2.4 PEG for Meta Platforms, a x3 for Apple, a x3.2 for Amazon, a x1.56 for Microsoft and a x1.61 PEG for Google. The PEG for the broad market index S&P 500 is x4.5.

Most notably, on a relative comparison all FAANG companies have a cheaper PEG than the S&P 500. And Microsoft and Google have a discount of greater than 50%! Given this analysis, investing in FAANGs is bargain shopping.

Analyst Consensus EPS; Author’s Calculation

The Best Businesses

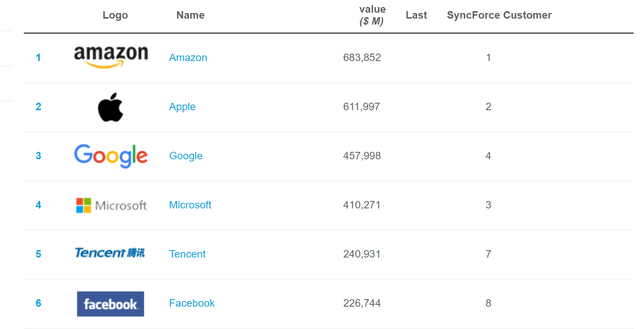

In my opinion, the FAANG stocks are still the best businesses in the world and there is no reason to think that their fundamentals are deteriorating. Investors should consider four key arguments: First, all FAANGs have sustained industry-leading profit margins for multiple year, given an arguably monopolistic position and impenetrable competitive moat. Secondly, the FAANGs have lots of financial resources: All FAANGs, except Amazon, have a net cash position. Third, these companies are also rich with human capital, attracting the smartest and most ambitious employees. Forth, according to Kantaar BrandZ’s brand ranking for 2021, all FAANGs lead the ranking. Given the high-brand equity, which is not necessarily connected to a single product or category, FAANGs have the pole position to expand and gain trust in new business opportunities (see next paragraph)

In short: whatever the dimension to judge a business’ quality, the FAANGs are likely to lead the discipline.

New Market Opportunities

If an investor argues that a business has peaked, he is likely to take the view that the business’ respective market/product opportunity has peaked as well. However, nothing could be further from the truth with regards to the FAANGs, who all invest heavily in R&D and push forward exciting new business verticals.

Amazon is the leading players in the global cloud infrastructure and smart logistics. Also Google and Microsoft are strong cloud-players, but both have additional product initiatives. Google, for example, is the world’s leading AI player and is exploring opportunities in autonomous driving (Waymo), IoT connectivity and AI-related PaaS. Apple is reportedly working on AR/VR technology, which the company and many investors deem as one of the world’s most exciting business opportunities. An electric, connected, and likely also self-driving car could also be announced anytime within the next 1 – 3 years. Finally, Meta Platform has started to profoundly re-position the company for the metaverse opportunity, arguably a 13 trillion market opportunity. With Oculus, the company is the leading player in Virtual Reality Technology as of today and interest for Horizon World is accelerating.

The Bear Case for FAANGs

So, why have FAANGs sold-off YTD? Arguably, much has been driven by non-idiosyncratic exposure to the global economy. After investing in FAANG stocks, here is what I advise investors to monitor.

First, all FAANGs are leading actors in the global economy and their financial performance is correlated to the macro-environment. Accordingly, a worsening macro environment, including inflation, rising interest rates, geopolitical risks and slowing consumer sentiment, could negatively impact the FAANGs. Although these factors are likely transitory (they always have been), any material headwinds will likely be reflected in the FAANGs market capitalization.

Secondly, and as a function to my first risk-related argument, arguably most of the FAANGs current share price volatility – especially to the downside – is driven by investor sentiment towards stocks. Thus, it’s likely that FAANG stocks experiences significant volatility even though Google’s business outlook remains unchanged.

Thirdly and perhaps most notably, it is no secret that FAANGs hold a monopolistic position in their respective business vertical. Accordingly, the size and scale of FAANGs has been noted by anti-trust regulators across the world. While the FAANGs have managed to fend-off past lawsuits in the EU and the U.S., the anti-competition allegations could accumulate and eventually be successful. For interested readers, I advise to read this article written by a Seeking Alpha analyst: Google Stock: This Regulatory Pressure Is A Disaster (NASDAQ:GOOG). This article is about Google, but the same situation could also apply to all other FAANGs.

Investor Implications

Finding the winners is hard. But holding on to the winners might be equally as hard. There is simply no stock that only goes up. Since 1995, there have been three times when Apple stock lost more than 50%. Amazon once lost even as much as 95% and has appreciated by more than 25.000% since then. Microsoft was already a giant winner in 2000 and investors were worried about ‘the upside’ potential.

That said, most FAANG stocks have already started to appreciate again in valuation, having gained between 20% – 35% since the June 2022 lows. And in my opinion, it is only a question of time until these companies reclaim their old ATH and venture for new records.

Do you think FAANGs have peaked? Would be excited to engage with SA readers in the comments.

My in-depth articles about specific FAANGs:

Be the first to comment