RUNSTUDIO/DigitalVision via Getty Images

One of the difficulties of analyzing the memory market is that we get data and guidance every three months, and the interim period is largely devoid of financial news. Micron (NASDAQ:MU), with its fiscal quarter differing by one month from its peer’s calendar quarter, provides an additional set of data. One modicum of succor is Micron’s annual Investor Day presentation, which fortunately was held on May 12.

In this article, I want to add granularity to any guidance provided by Micron in anticipation of its earnings call on June 30, 2022 for the fiscal third quarter ending May 2022.

Memory Exports in Korea

In March, semiconductor exports from Korea, home to #1 Samsung Electronics (OTC:SSNLF) and SK Hynix (OTC:HXSCL) soared 44.2% year-on-year to $10.8 billion, achieving the 17th consecutive month of growth. Semiconductors became the first single export item to top $10 billion. April exports of semiconductors, the country’s top foreign exchange earner, climbed 15.8%. Sales of semiconductors grew 15 percent in May.

Memory Growth Catalysts – Technology and Memory Content

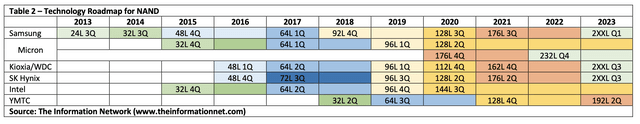

Technology is one of the greatest catalysts for Micron. Micron’s 1βnm DRAM will begin ramping before the end of 2022. MU Ranks #1 in technology for DRAM, as shown in Table 1. MU is focusing on enhanced cost competitiveness and estimates that in 2022, it ranks #2 in cost among DRAM vendors, up from #3 in 2016.

For NAND, MU announced that its next-generation 232L 3D NAND will begin ramping before the end of 2022. MU Ranks #1 in technology for NAND, as shown in Table 2. The company estimates that in 2022, it ranks #1 in cost among NAND vendors, up from #4 in 2016.

Memory Bit Demand by End Application Continues to Rise

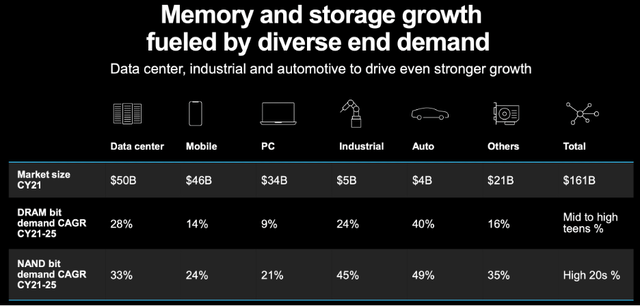

Chart 1 shows the increase in demand for memory content for Micron’s end applications.

- The Data Center bit market is estimated to grow at a +28% DRAM CAGR and NAND at a +33% CAGR.

- The Automotive bit market is estimated to grow at a +40% DRAM CAGR, and NAND at a +49% CAGR.

- The Mobile bit market is estimated to grow at a +14% DRAM CAGR, and NAND at a +24% CAGR.

- The PC bit market is estimated to grow at a +9% DRAM CAGR and NAND at a +21% CAGR.

Chart 1

Mobile Demand

In two Seeking Alpha articles, I refuted “analyst” downgrades of MU because of slowing sales in mobile and PC. I pointed out that even though unit shipments of mobile and PCs were flat or dropping, the increased bit shipments per unit would be a positive. Readers can access these articles entitled “Micron Technology: Winter May Be Coming, But Not This Year… Nor The Next” and “Micron Controls 55% Of Automotive Semiconductor Memory Market”

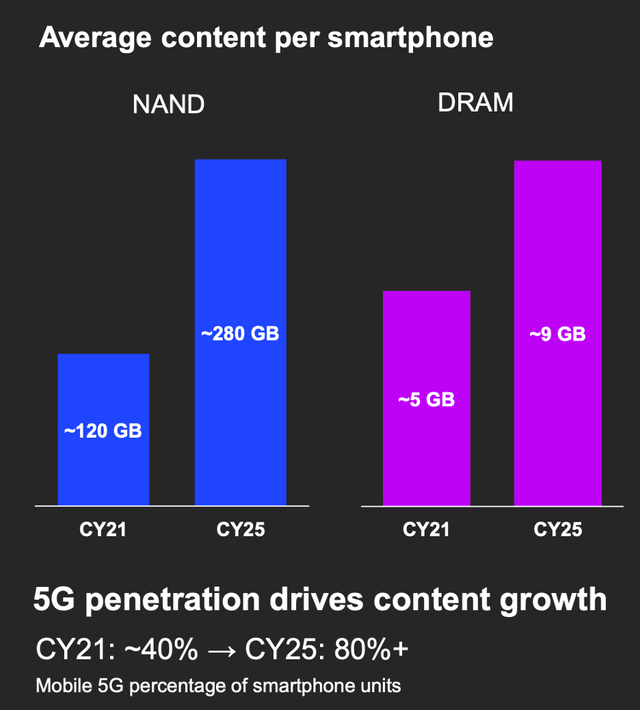

In mobile, although I expect smartphone shipments to drop 4% in 2022, 5G smartphones should grow 25%. NAND content per smartphone is expected to grow from 120GB in 2021 to 280GB in 2025. DRAM content will grow from 5GB to 9GB, as shown in Chart 2.

Chart 2

PC Demand

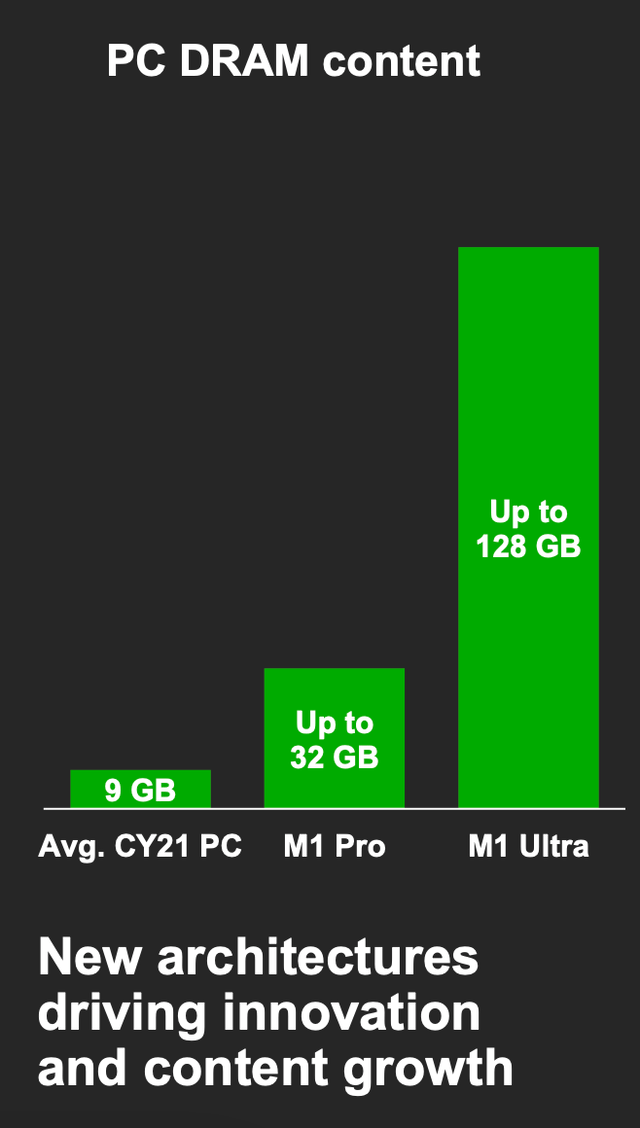

Likewise, PCs had 9GB of DRAM in 2021 but Apple’s M1 Pro incorporates up to 32GB of DRAM. Micron estimates that Apple’s M1 Ultra will contain up to 128GB of DRAM, as shown in Chart 3.

Chart 3

Server Demand

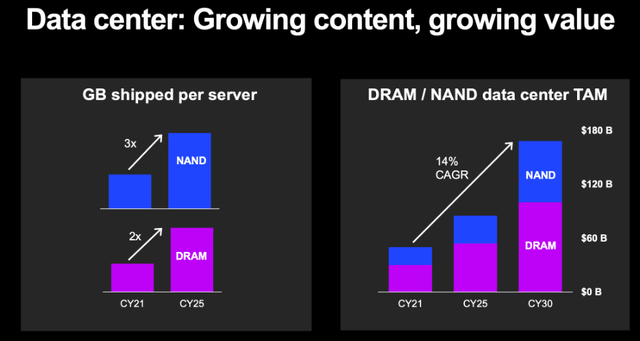

Data center is the largest market for memory and storage, and Micron reported that in its fiscal first quarter, data center revenue grew more than 70% year over year as a result of continued cloud demand and a resurgence of enterprise IT investment. In FQ1, Micron launched the 7400 SSD, the first data center NVMe SSD to utilize its internally developed controller and firmware along with its DRAM and NAND. The company expects a strong ramp in its data center SSD revenues in FQ2, driven by increased sales of its NVMe SSD products along with strong DDR5 demand as customers prepare for new server product launches in calendar 2022.

Gigabytes (“GB”) shipped per server will increase at 3X for NAND and 2X for DRAM in the next few years, as shown in Chart 4. There has been some chatter that a delay by Intel (INTC) of its 4th Generation Xeon Scalable Sapphire Rapids processor would impact server growth and hence MU. That conjecture is wrong.

Chart 4

DRAM and NAND Metrics

In March 2020, the U.S. Government initiated lockdowns and work/stay-at-home edicts resulted in exploding demand for products demanding memory. PCs were purchased for work at home, for example, and videoconferencing became the norm. Both demanded memory either at the client (PC) or at the enterprise to increase bandwidth.

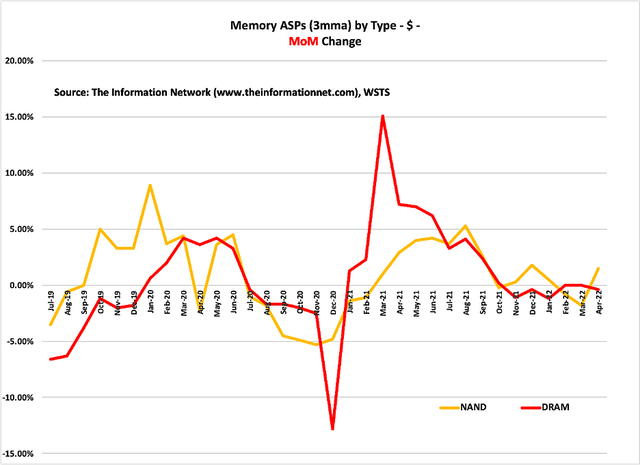

Although unit shipments in early 2021 were growing linearly, ASPs dropped dramatically following strong price increases during the peak of the Covid pandemic, as shown in Chart 5.

Since DRAM and NAND production was also somewhat impacted by Covid, unit shipments dropped slightly but ASPs increased strongly with demand. We can see this is the rise and subsequent fall of ARK Innovation ETF (ARKK) stocks during this period.

Chart 5

I plotted DRAM and NAND MoM ASP changes for the same period in Chart 5. For April 2022, we can see that there was a slight decrease in DRAMs (-0.4%) and a larger increase in (+1.5%) in NAND that followed three consecutive months of decreases.

Investor Takeaway

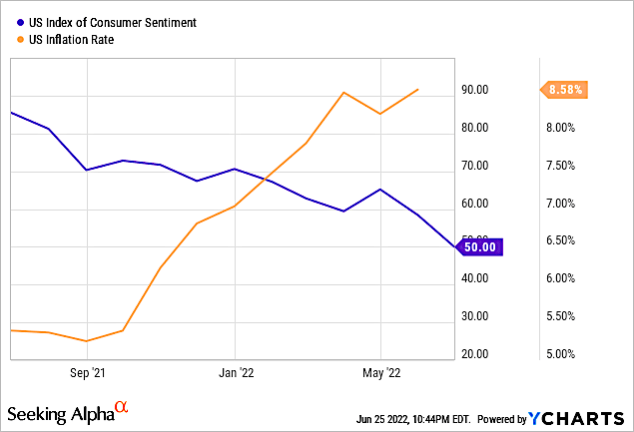

The University of Michigan’s preliminary June sentiment index fell to 50.0, from 58.4 in May. This is the lowest recorded level since the university started collecting consumer sentiment data in November 1952. Record gas prices helped push down the consumer sentiment index. Rising inflation continues to frustrate consumers – about 46% of consumers surveyed laid the blame on inflation, an increase from 38% in May.

Chart 6 shows the correlation between consumer sentiment and inflation in the U.S. over the past 1-year period.

Chart 6

YCharts

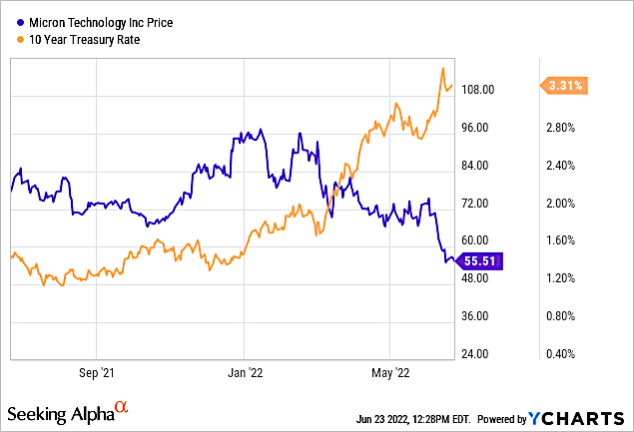

There is also a correlation between the 10-year treasury rate and MU share price. As seen in Chart 7, since the beginning of 2022, the 10-year treasury rate has increased while MU share price has decreased. This inverse correlation is not just associated with MU, but with most technology stocks, which I discussed in several recent Seeking Alpha articles.

Chart 7

YCharts

According to an article in Nasdaq.com:

“The most crucial factor driving tech stocks in 2022 has been the 10-year Treasury yield. This is the yield investors earn for buying 10-year notes issued by the U.S. Treasury. It’s the rate of annual return investors can expect when buying a risk-free bond from the U.S. government. And it’s widely considered the U.S. economy’s “risk-free rate.”

This relationship has been exceptionally strong in 2022. As you can see in the chart below, the sharp ascent in the 10-year throughout this year has directly led to a strong drop in tech stocks. So, if you’re looking to buy the dip in tech stocks, you want to wait for the 10-year to top out.”

In Micron’s March 29, 2022 F2Q 2022 earnings call, the company guided that for F3Q 2022, DRAM bit growth would be flat at 8% QoQ while NAND would increase 11% versus flat QoQ growth in F2Q. Since that time, Barron’s reported the slowing sales of smartphones and PCs. Even though memory content increases per generation of end markets, the slower sales will impact earnings.

Micron has a 55% exposure to PC and mobile consumer products, which the company expects will drop to 38% in FY2025. This high exposure raises some uncertainty as to whether MU will meet earnings at the upcoming earnings call on June 30.

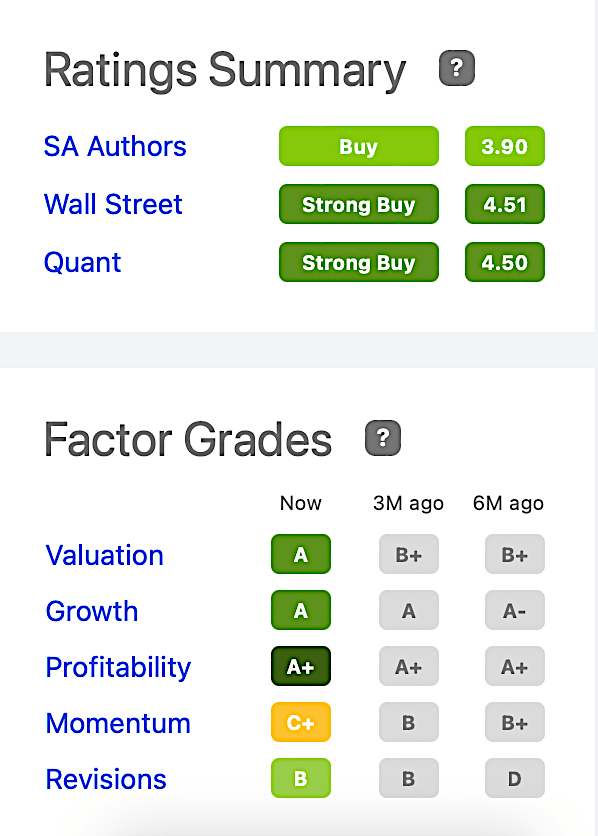

Chart 8 shows that MU has a strong buy rating by both Wall Street and Seeking Alpha’s Quant. Factor Grades are also strong, with Momentum degraded because of the drop in stock price and recent downgrade.

Chart 8

Seeking Alpha

Currently, I rate MU a buy. When macro and geopolitical issues moderate, they will in turn moderate the 10-year treasury note. Concerns of slowing consumer end-products and “spot” ASPs are overblown, as are delays in Intel’s server processor.

Be the first to comment