bymuratdeniz

All figures are in CAD as that is the company’s reporting currency.

Introduction

I wrote on Freehold Royalties (OTCPK:FRHLF) (TSX:FRU:CA) twice in 2020 and my initial conclusion in June 2020 was:

Even though the monthly dividend is highly correlated with oil prices, the 5% dividend yield at these low oil prices is nothing to balk at, which still makes this a worthy candidate for a dividend investor’s portfolio. For the free cash flow investor I believe this opportunity should be grabbed onto with both hands, as even a modest oil price recovery over the next couple years will mean a forward looking free cash flow yield that will be off the charts (at least 10%).

If FRU can realize even a 6x FFO multiple, and if oil prices can reach even $50/bbl that would mean a 71% return from the current price of $3.50/share. The stock does come with some risk with the concentration of tenants however.

Source: Freehold Royalties: Attractive Dividend Payer On Sale

These articles were called Freehold Royalties: Attractive Dividend Payer On Sale and Freehold Royalties: A Steady Eddy in the Canadian O&G Sector.

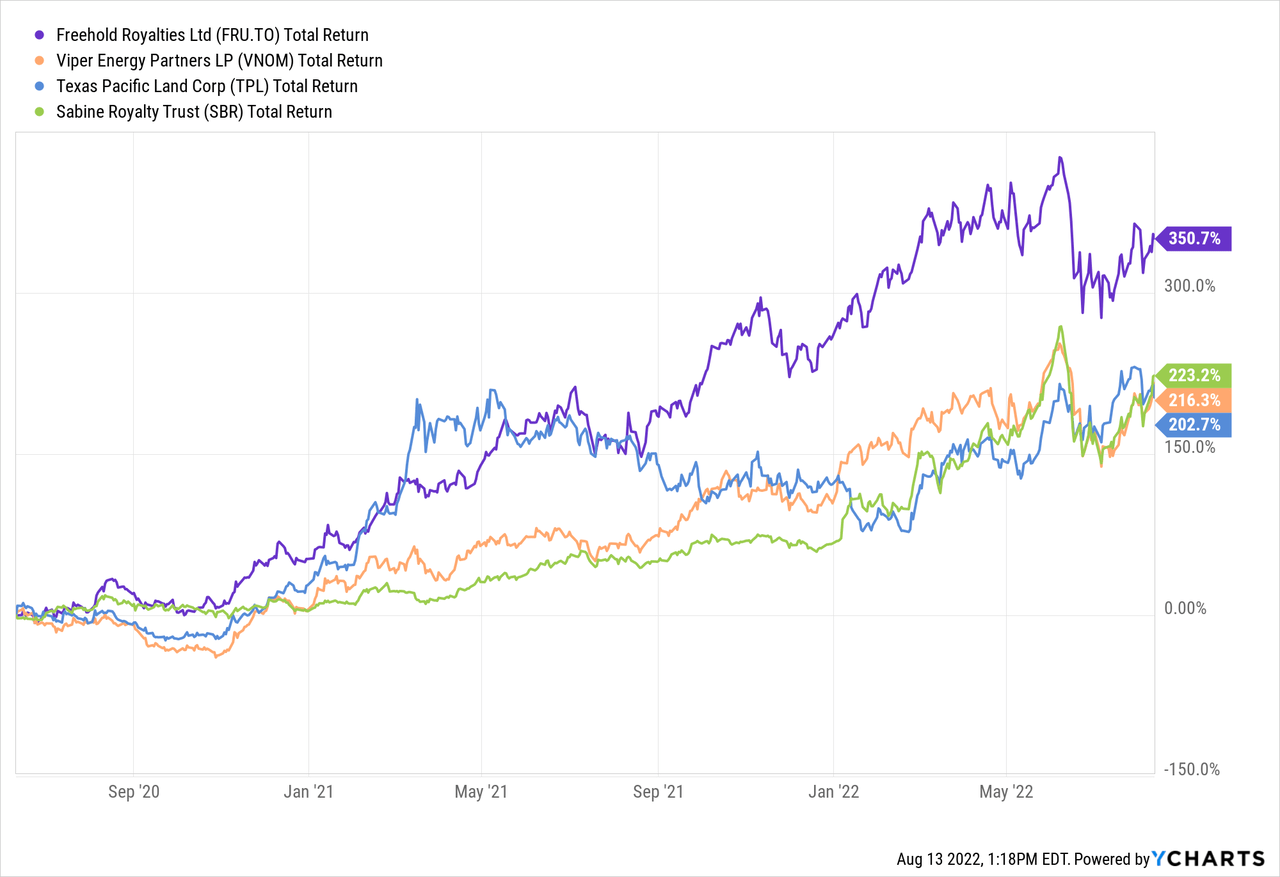

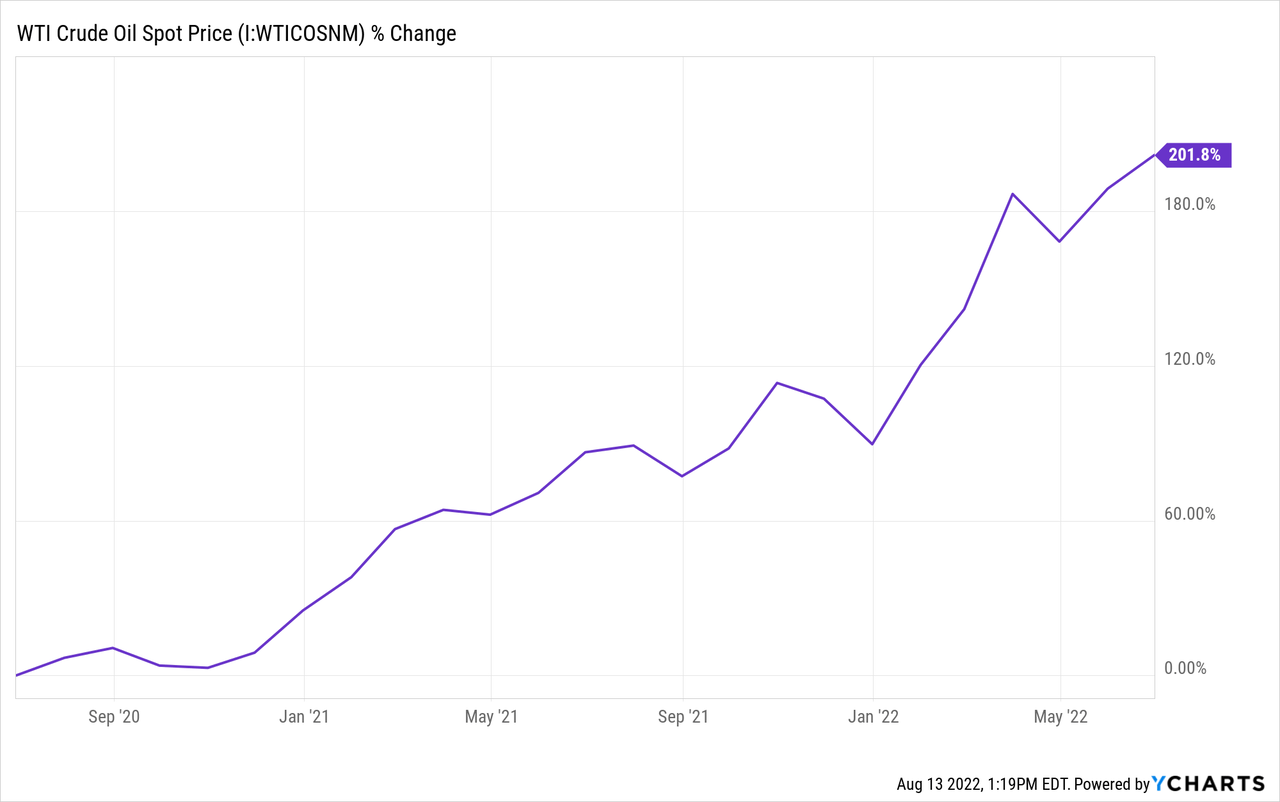

Oil and gas recovered even from its pandemic lows better than I could have ever imagined and the stock price of FRU increased even more than oil and gas (almost 150% better) and outperformed its U.S. counterparts. A US$1/bbl change in WTI increases FFO by ~$2.8MM as FRU has considerable leverage to oil prices.

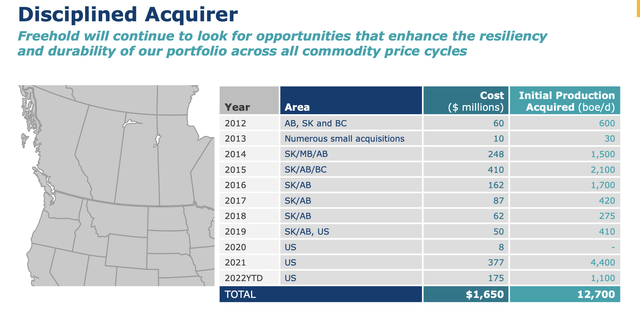

In 2015-2016, when oil prices witnessed a precipitous drop and when many of FRU’s E&P customers made drastic cuts to their CAPEX and divested of assets at nosebleed prices, the company went on one of its largest acquisition sprees in its history. In fact, in 2015, FRU spent more in acquiring land in 2015 than it had the previous five years. FRU did the same in 2021 and spent $377MM in 2021 to acquire 4,400 boe/d of producing royalties in the Eagle Ford and Midland basins in the US. The results of these acquisitions are starting to pay dividends (literally).

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

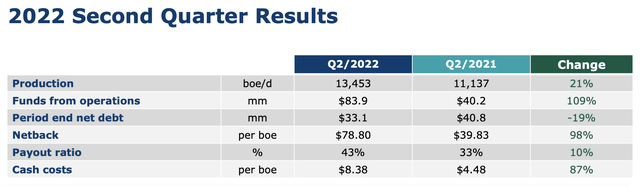

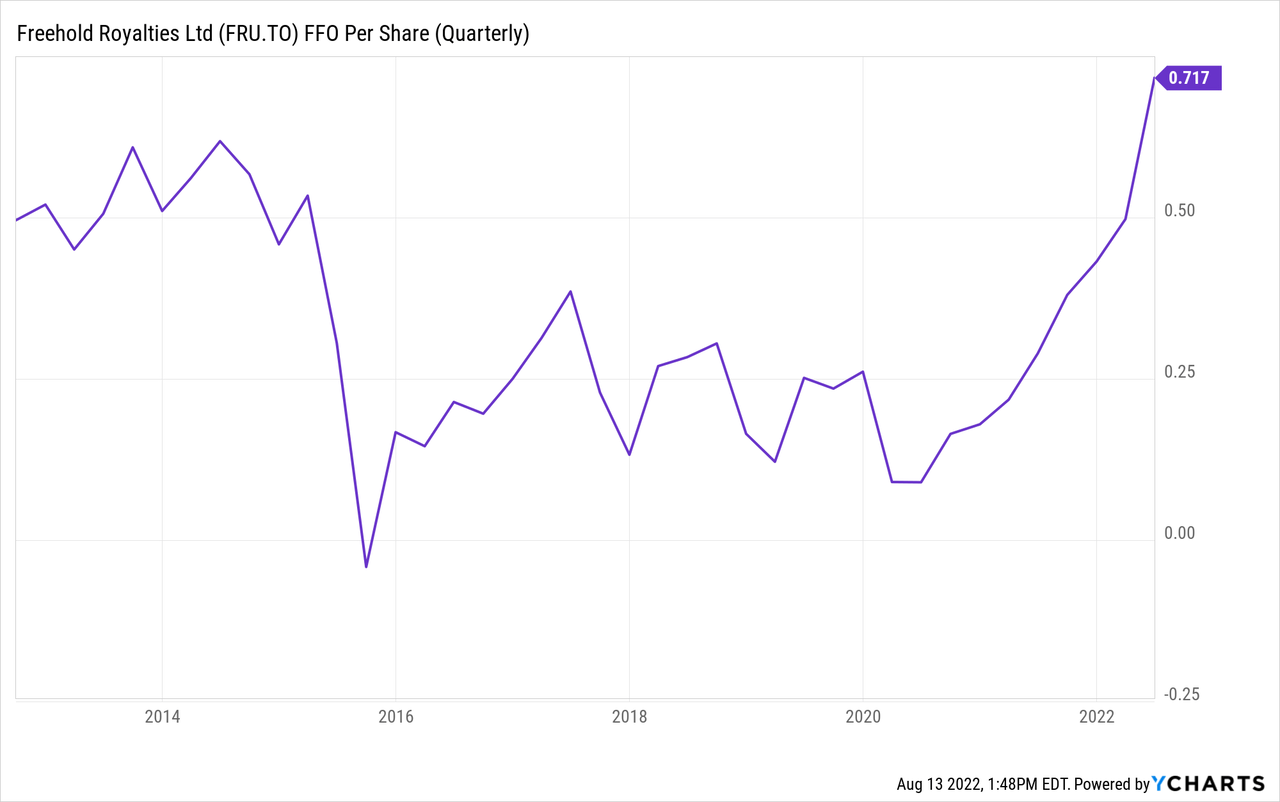

Q2 2022 results showed that FRU realized its highest quarterly FFO and FFO per share in its history as FFO rose 109% from the same period in 2021 while production only rose 21%. Royalty and other revenue totalled $108.5MM in Q2 2022, up 139% from the same period in 2021. This was driven by a favourable commodity price environment and the acquisition spree in 2021 mainly relating to US transactions.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

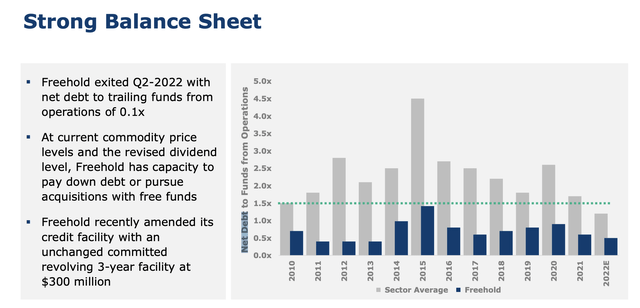

As a result of greater profitability, FRU has been able to reduce net debt by $7MM or 19% YoY and has achieved a net debt/FFO ratio of less than 0.1x, which is among the lowest in its peer group. At current FFO levels, FRU could reduce debt by 2022 YE.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

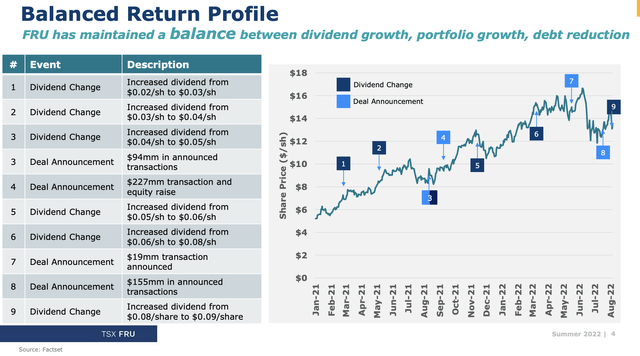

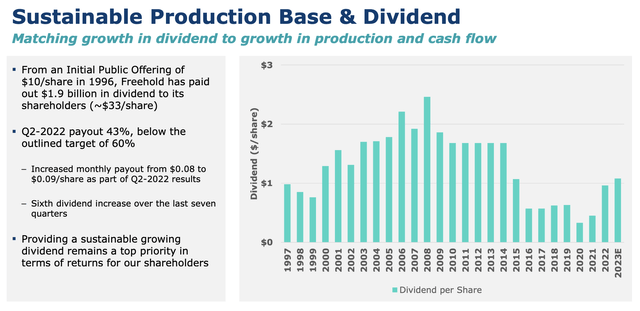

More importantly are the returns to shareholders that have resulted via dividends. Although management cut the dividend in May 2020 to preserve liquidity from $0.0525/share to $0.015/share, investors got some good news following the release of 2020 Q3 earnings, as FRU’s board approved a 33% increase to the monthly dividend to $0.02 per share (annualized $0.24 per share). Since January 2021, FRU has increased the dividend 6 times and the monthly dividend is now up to its highest level since 2015 at $0.09/share as was announced in August 2022. The payout ratio is very modest at only 43% based on Q2 2022 results and well below the target of 60%. FRU has paid out ~$130MM in dividends since January 2021.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Royalty Model

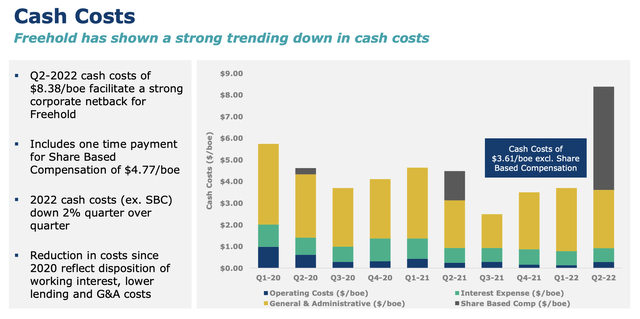

FRU’s royalty model is set to outperform in the current inflationary environment. Q2 2022 cash costs increased 87% YoY while FFO increased 109%. FRU’s cash costs only increased by this amount as a result of a one-time payment of $6MM or $4.77/boe as a result of deferred share compensation expenses paid to its employees and a non-management director that resulted due to higher share prices. While E&P companies have seen tremendous increases in revenues, they will likely feel the pinch in future quarters when inflation impacts operating costs due to supply bottlenecks with metals such as steel and copper that are heavily relied on for drilling.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

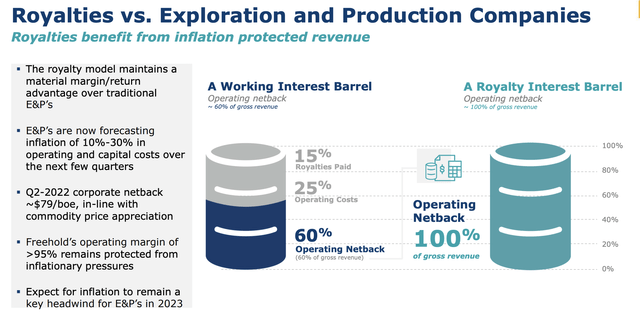

As FRU does not actually operate the wells on their lands but earns its royalty “off the top,” and with its only major expenses are G&A costs mostly for the odd geological survey and management salaries. It actually can theoretically realize 100% operating netbacks on its royalty interests where it incurs no operating expenses. Where inflation has any impact is in its working interests where it can still realize 60% netbacks. Working interests only account for less than 1% of total production and the operating margin of 95% provides ample protection from inflationary pressures.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Outlook

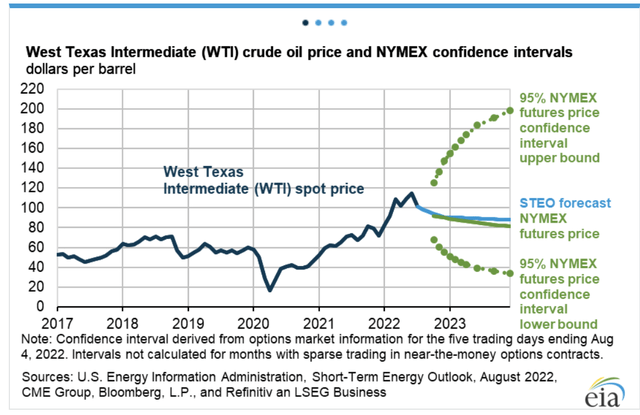

As already mentioned, crude oil prices have shown considerable momentum during Q2 2022, with geopolitical tensions and supply tightness outweighing headwinds associated with global recession fears. Overall, the West Texas Intermediate (WTI) price has averaged US$108.41/bbl during Q2 2022, a 64% improvement versus the same period in 2021. When compared to the previous quarter, WTI prices increased 15%. The upward price momentum of crude oil prices for the first six months in 2022 has largely been a result of the continued tightening of supply-side drivers, including the Russian invasion of Ukraine. In addition, there continues to remain uncertainty around global oil output above current levels, with increasing pressure from oil-consuming nations for OPEC to balance the market with its spare capacity. Thus far, there have been several OPEC members which have been unable to keep up with production, suggesting that actual capacity may be lower than peak levels observed in the past.

The EIA was slightly less bullish in their August 2022 forecast, making the following forecasts:

We forecast the spot price of Brent crude oil will average $105 per barrel;(B) in 2022 and $95/b in 2023. WTI will finish the year at US $98 per barrel and average $89 per barrel in 2023. Price of natural gas will average US $14-$15/MCF through 2022 and 2023.

U.S. crude oil production in our forecast averages 11.9 million barrels per day (b/d) in 2022 and 12.7 million b/d in 2023, which would set a record for most U.S. crude oil production in a year. The current record is 12.3 million b/d, set in 2019.

Source: EIA Short Term Energy Outlook

SHORT-TERM ENERGY OUTLOOK (EIA)

North American E&Ps continue to emphasize capital discipline within their capital budgets, prioritizing capital returned to shareholders through share buybacks and dividend increases rather than production growth. This has especially been the case with Canadian E&P companies. Egress labor and equipment remain constraints against output growth for near-term production growth. The eventual refilling of the Strategic Petroleum Reserve (SPR) will serve as a floor on pricing in the near term as the US looks to replenish the 180 MMbbl of storage it withdrew through 2022.

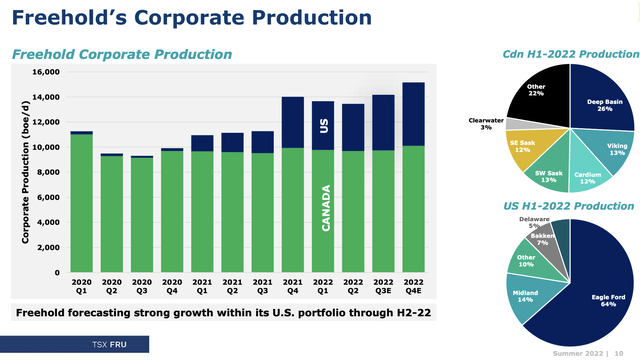

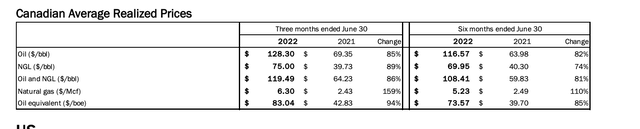

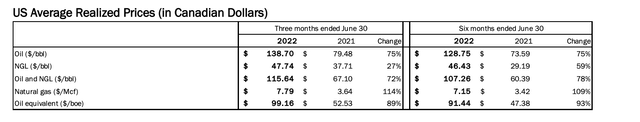

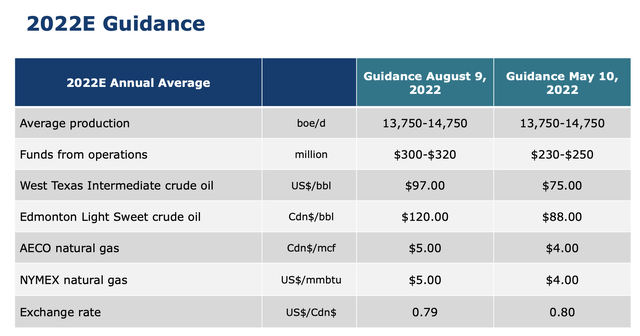

Although Freehold’s US net well additions are lower than in Canada, US wells are significantly more prolific as they generally come on production at approximately ten times that of an average Canadian well in their portfolio. FRU sees upwards of six to twelve months from initial license to first production within their US royalty assets (compared to three to four months in Canada, on average). Overall, 148 gross wells were drilled on their US royalty lands during Q2 2022, which compares to 32 gross wells during the same period in 2021. 78% of FRU’s U.S. production comes from their assets in the Eagle Ford and Midland basins where they realized prices of ~US $138 per barrel and NGL prices of ~US $7.79 per MCF in Q2 2022 relative to prices of ~ US $128 per barrel and ~ US $6 per MCF respectively on their Canadian assets. U.S. production is now up to 27% of production and expected to increase to over 40% by 2022 YE. The U.S. acquisitions made in these basins in 2022 have added C$5/boe to Freehold’s average realized price.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Q2 2022 Report (Freehold Royalties Ltd.)

Q2 2022 Report (Freehold Royalties Ltd.)

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

In June 2022, FRU acquired US mineral title and overriding royalty interests on 220,000 gross acres (1,100 net royalty acres) for $19.4MM in the Midland basin. In July 2022, Freehold announced it had entered into a definitive agreement with a private seller to acquire high-quality US mineral title and royalty assets located in the Eagle Ford basin for $32MM. Both transactions will be funded through the utilization of Freehold’s existing credit facility and FFO. Acquisitions should add 1,130 boe/d in production and $31MM in FFO for 2023. The acquisitions were reasonably priced at $21MM/net acre and $154K per flowing barrel.

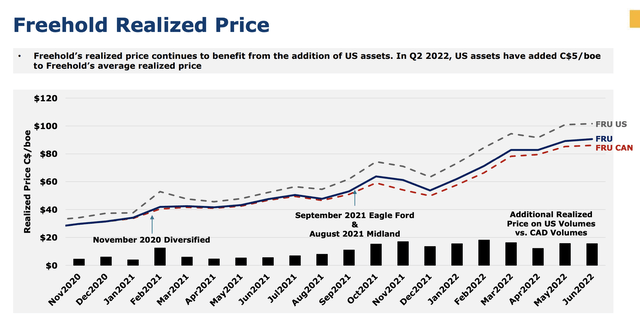

As high commodity prices are expected to persist for fiscal 2022, management has raised FFO guidance for fiscal 2023 by as much as 28%. The revised guidance is entirely based on increased pricing and is not accounting for the recent Midland and Eagle Ford acquisitions, which should be accretive in 2022 and sustain FFO through increased production in 2023 if commodity pricing drops.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Dividend

As mentioned previously, FRU has been fairly generous about returns to shareholders. Although the ~8% yield at the current $14/share price is nothing to balk at, they may be a whole lot more generous in the future. Even if the lower-end of FFO guidance is realized at $300MM, a $0.10/share monthly dividend would still only represent a 60% payout ratio and would imply an even better ~8.6% yield at the current price. I expect management to raise the dividend to at least this amount before YE.

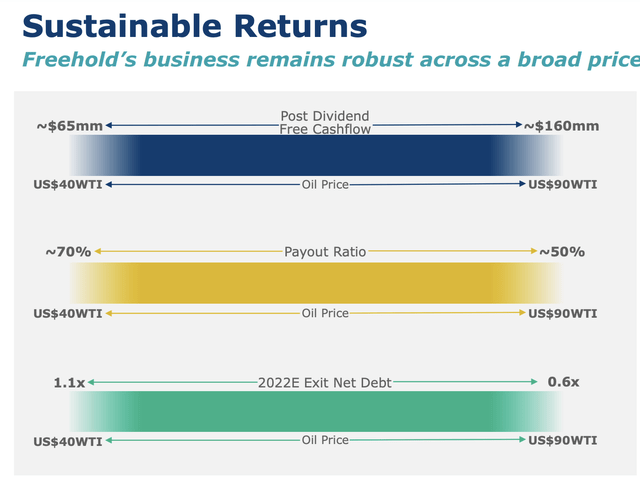

As shown above, management is no stranger to cutting the dividend through periods of instability. Although it is not out of the realm of possibilities that management will cut the dividend, I don’t see it being reduced significantly in the near term even if commodity prices fall drastically. For one, quarterly FFO was ~$28MM in Q3 2015 while the average realized price was US $34/bbl for oil and easily supported a $0.07/share monthly dividend and with a smaller U.S. portfolio (the payout ratios were 90% however). Two, leverage is at all-time lows at net debt to FFO of ~0.1x, providing substantial balance sheet strength.

Valuation

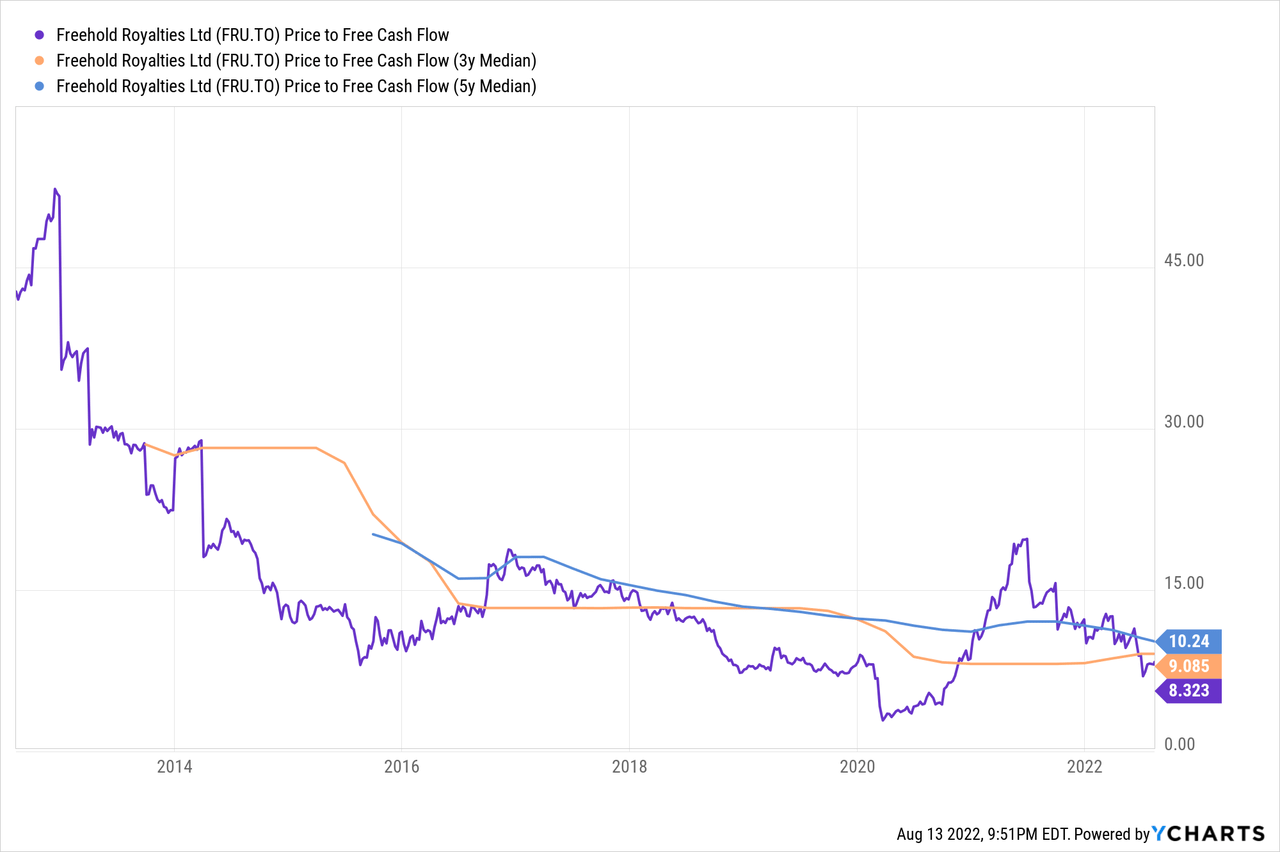

Current guidance of at least US $90/bbl would suggest a respectable free cash flow yield of ~14-16%. The FCF yield would still be 9-10% even at $75/bbl based on previous guidance, which is in line with the three- and five-year median, and therefore, FRU’s current multiple is still at a discount even with commodity prices being at 10-year highs. Therefore, it would appear that there is plenty of room for multiple expansion.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Concluding remarks

Despite operating in a cyclical industry, FRU should benefit greatly in the current inflationary environment and provide stable returns to shareholders. Investors can enjoy a safe minimum 8% yield in the near term as commodity prices remain at record highs and should benefit from multiple expansion. Therefore, double-digit returns are not unreasonable to expect. FRU’s operators are all reputable companies, most of which are considered “investment grade” and like FRU have made tremendous efforts to deleverage as a result of excess cash flows in the current commodity price environment.

Summer/Fall 2022 Investor Presentation (Freehold Royalties Ltd.)

Be the first to comment