General Photographic Agency/Hulton Archive via Getty Images

When Gladstone Commercial (NASDAQ:GOOD) reported earnings, I was shocked to see that they had beaten consensus estimates. As I outlined in my last piece on GOOD (Gladstone Commercial: My Calculations Imply Rising Rates Will Show It Is Swimming Naked), their interest expense was going to go up in Q3 due to their exposure to variable rate debt and being in the net lease industry there are very few opportunities to dramatically grow revenues as their properties are subject to long-term leases. Given that interest rates in Q3 rose more quickly than the market or I was expecting, the beat in Q3 was particularly surprising. With a quick review of the 10Q it became clear that the source of the beat was a one-time, non-recurring item. Excluding this one-time item, GOOD missed numbers badly. Additionally, a large impairment charge and banks exiting their Line of Credit highlights the challenges their business model is facing.

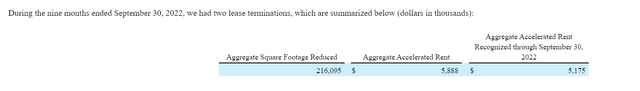

Accelerated Rents

During the 3rd quarter, GOOD received $5.175 million in Accelerated Rents Payments.

During the first six months of 2022, they received no Accelerated Rents.

Based on their Diluted Share Count for the calculation of FFO/Share of 40.141 million (GOOD 3Q22 10Q p. 43), Accelerated Rents contributed $0.13 cents to FFO/Share in Q3.

Without this item GOOD would have missed consensus FFO/Share by $0.09. Accelerated Rents are simply a tenant paying their rent early, typically at a discount. Based on the disclosure on page 37 of GOOD’s 3Q22 10Q, it looks as though almost all of GOOD’s Accelerated Rents came from one property where they worked out an arrangement whereby a tenant who had already vacated a property that GOOD was selling agreed to pay their remaining rent early at discount. It is very similar to a Termination Fee, a one-time boost to revenues. Either way, going forward GOOD cannot expect to benefit from Accelerated Rents consistently.

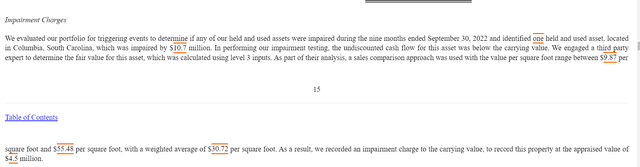

$10.7 Million Impairment

In my last piece on GOOD, I discussed one of the near-term challenges for the company would be a lease expiration for an office building near Columbia, South Carolina where the tenant had already moved out. The lease expired on October 31st and the property is currently vacant. JLL has the property listed for sale. As such GOOD needed to reevaluate the asset and concluded an impairment was required as its estimated value is now only $4.5 million.

This is a property that GOOD bought for $29.2 million in 2012. (GOOD press release 12/3/12) For a REIT of GOOD’s size, this is a tremendous amount of value destruction.

Not only will the impairment hurt GOOD’s book value, but the lost rent will decrease FFO/Share by $0.015 in 4Q22 (2 months vacancy) and by $0.023 in 1Q23 (3 months vacancy.) (These numbers are based on the Annual Budgeted NOI for the property of $3.678 million as shown in Schedule 6.25 on page 1 in the 4th Amendment to the Credit Facility which was included as Exhibit 10.1 with GOOD’s 8-K filed with the SEC on 08/18/22) It should be noted these numbers only account for the lost rent and do not include the expense reimbursements that GOOD will also lose as the REIT will now be responsible for paying for insurance and taxes.

Banks leaving the Credit Facility

In August GOOD amended its credit facility and increased its size. I believe this was done so it would be large enough to allow them to repay mortgages on properties like the one in Columbia, SC that could no longer support a mortgage on their own. I think Goldman Sachs, Wells Fargo and US Bank National all exited the line rather than extend additional credit to GOOD. (Signature Pages to 4th Amendment to the Credit Facility which was included as Exhibit 10.1 with GOOD’s 8-K on 08/18/22)

While GOOD was able to beat consensus numbers in 3Q22 due to Accelerated Rents, rising interest rates and lease expirations will eventually take its toll on GOOD’s FFO per share and its ability to pay its dividend. Clearly, Goldman Sachs, Wells Fargo and US Bank National have all decided to move on from the credit. Investors should also be reviewing their tolerance for the risks associated with a REIT that beat consensus estimates through the use of a one-time non-recurring item.

Be the first to comment