imagedepotpro

Co-produced with “Hidden Opportunities”

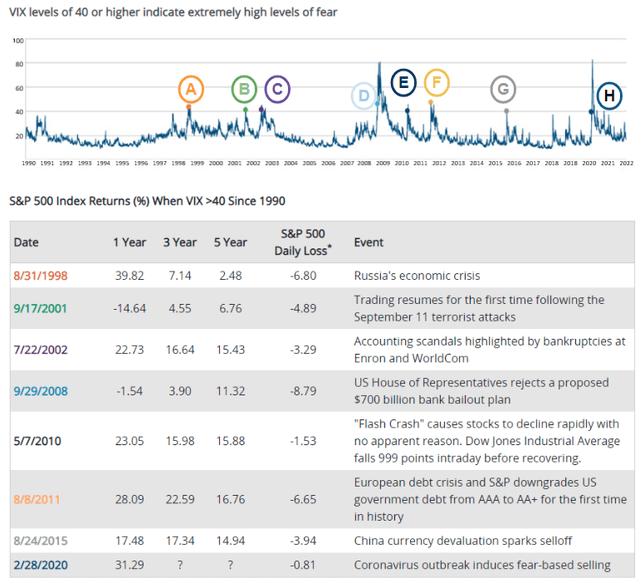

When volatility rears its ugly head, our instinct is to take our money out of the market to safeguard it. But history tells us that staying invested and buying quality stocks during volatile times can be beneficial in the long run.

During some of the past high volatility market conditions, Mr. Market behaved like the sky was falling, but in most cases, market returns were outstanding in the following 12 months. (Source: Hartford Funds)

Amazon (AMZN) founder Jeff Bezos once met Warren Buffett and had a question about his investing methods.

Jeff Bezos (to Warren Buffett) – Your investment thesis is so simple. You’re the second richest guy in the world, and it’s so simple. Why doesn’t everyone just copy you?

Warren Buffett – Because nobody wants to get rich slow.

Investors who can keep their focus on the long term when others get distracted by short-term drama will reap the rewards of that patience down the road. If the stock price drops, that doesn’t always imply that the company is performing poorly. Several of our investments are more profitable, have lower debt levels, and are increasing payments.

It’s easy to say volatility and market dips work themselves out over the longer term, but I understand that it’s hard to live through the price drops. But knowing that I can expect a certain amount of hard cash in my account at the end of the month is a priceless feeling. It gets better when I learn about an upcoming raise.

Midstream is an excellent business during uncertain conditions

Despite all the calls for clean energy, it’s clear that oil and gas will stay increasingly relevant in the decades ahead. Even Tesla (TSLA) CEO Elon Musk admits that the world needs more oil and gas.

Realistically I think we need to use oil and gas in the short term because otherwise civilization will crumble – Elon Musk

Midstream companies own assets vital for storing, transporting, and processing hydrocarbons like crude oil, natural gas, and natural gas liquids. Remember, establishing a reliable network of pipelines connecting strategic parts of the country takes years and costs billions of dollars. Existing midstream companies enjoy a strong moat governed by regulatory requirements and large capital investment. Moreover, thanks to the negative perception created by G7 political leaders, no new player is willing to step up to compete with existing players.

We consider midstream to be the income method of investing in energy, with negligible correlation with commodity price volatility and pricing power to combat inflationary pressures. We will now review two excellent midstream picks with up to 8.6% yield to load up when the market is fearful.

Pick #1 MMP, Yield 8.6%

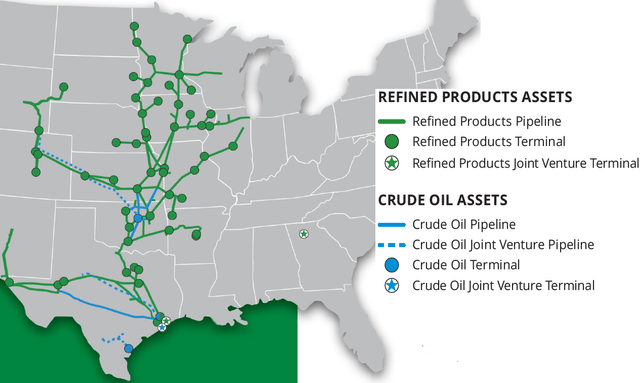

Magellan Midstream Partners (NYSE:MMP) owns the most extensive refined products pipeline system in the United States. They can tap into nearly 50% of the nation’s refining capacity and store more than 100 million barrels of petroleum products, such as gasoline, diesel fuel, and crude oil. (MMP Fact Sheet)

Note: MMP is a master limited partnership (‘MLP’) that issues a Schedule K-1 to investors. Please consult your accountant to discuss its implications for your tax situation.

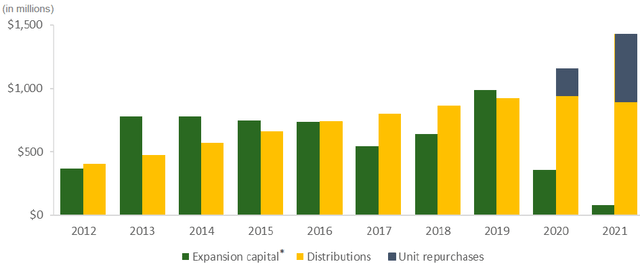

MMP is an income investor’s strongest ally. The MLP pursued disciplined capital allocation to improve its asset base’s quality and network. Along with this, they have grown their distribution for 20 consecutive years. With the U.S. hydrocarbon industry shifting to pursue less capex and increase its shareholder returns, MMP has been pursuing more stock buybacks since 2021.

MMP’s current $1.04/share quarterly distribution calculates to a healthy 8.6% annualized yield and enjoys a 1.25x coverage. If you’re worried about volatile crude oil prices but like the investment prospects of the hydrocarbon industry, look no further. MMP’s operating margins are 85% fee based, giving it a high degree of stability in a fearful market. Additionally, the fees collected by MMP are connected to the Producer Price Index, leading to the average tariff increase of ~2.5% in mid-2021 and ~6% in July 2022. These factors provide additional confidence in the sustainability of the distributions to income investors.

With a debt/EBITDA multiple of 3.7x, MMP’s balance sheet carries an industry-leading BBB+ credit rating. Additionally, the MLP has no long-term debt maturing before 2025, and only ~17% of its long-term debt is due before 2030. With a ~$1 billion credit facility, a strong balance sheet, and attractive debt maturity. MMP enjoys a tremendous advantage in this rising rate environment.

Pick #2: ENB, Yield 6.5%

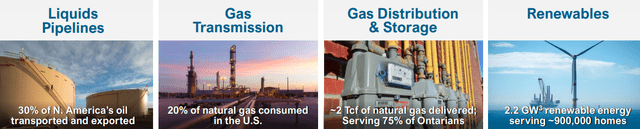

Enbridge, Inc. (NYSE:ENB) owns and operates a massive pipeline network (~95,000 miles) consisting of the Canadian Mainline system, regional oil sands and natural gas pipelines, and a regulated natural gas utility. Enbridge is Canada’s largest natural gas distribution company, transporting about 20% of all natural gas consumed in the United States. ENB also transports 30% of the crude oil produced in North America and handles 40% of total U.S. crude oil imports. Additionally, ENB has a growing portfolio of renewable energy projects (either operating or under construction) with the capacity to generate 5,179 megawatts (M.W.) gross zero-emission energy. (Source: ENB July 2022)

Enbridge July 2022 Presentation

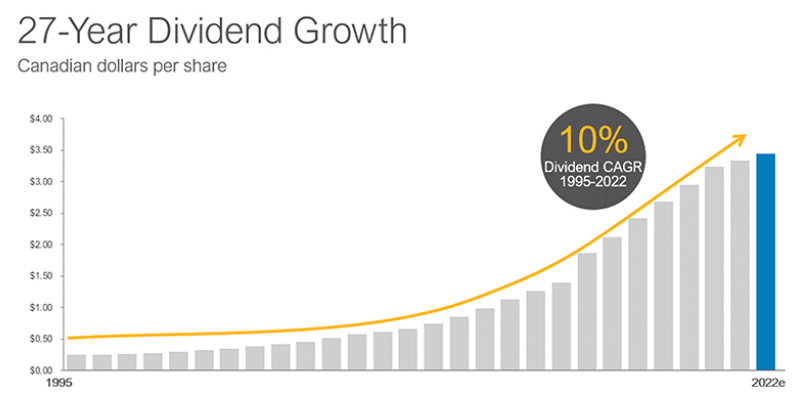

ENB has been paying steadily growing dividends to shareholders for almost 70 years. With an impressive 27-year annual dividend growth streak, ENB is a gem in the income investor’s portfolio. The company has maintained a robust 10% dividend CAGR since 1995, and there’s a lot more where that came from. (Source: enbridge.com)

Enbridge

ENB is a Canadian corporation and declares its distributions in CAD. Its most recent C$0.86/share quarterly dividend calculates to a 6.5% annualized yield. U.S. investors will receive their dividends in USD based on the foreign exchange rates, which can result in a lower yield in a market with a stronger U.S. Dollar. ENB’s YTD dividends enjoy a healthy 1.7x EPS coverage.

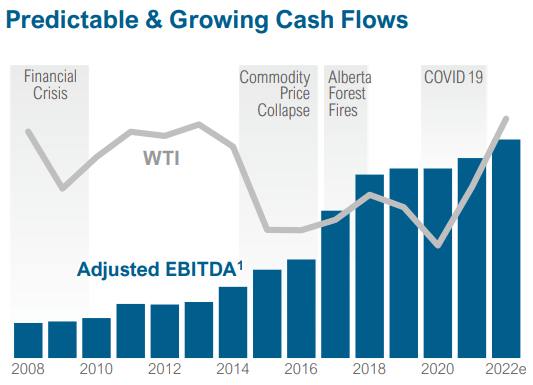

Similar to its midstream peers, ENB is relatively immune to hydrocarbon commodity prices. The company has grown its EBITDA through thick and thin over the past 10-plus years, making it a great bargain during this sell-off. (Source: Enbridge July 2022 Presentation)

Enbridge July 2022 Presentation

80% of ENB’s EBITDA has inflation protection, and the company maintains strong counterparty credit, with ~95% of customers having an investment-grade rating. ENB itself has a sector-leading BBB+ credit rating across all agencies, and the company projects below 4.7x debt/EBITDA multiple by the end of the year.

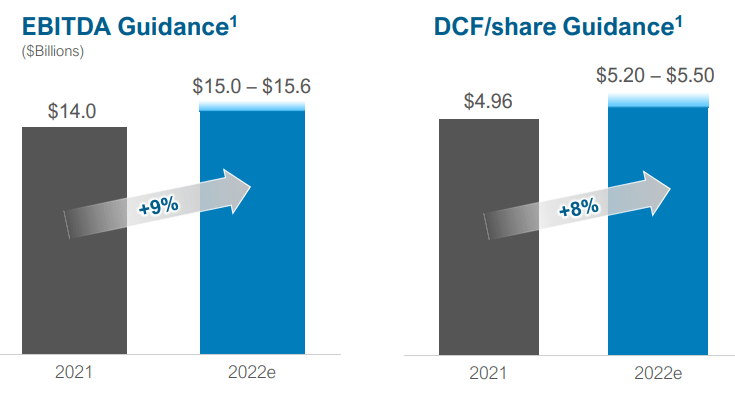

This market is selling off without giving any consideration to company fundamentals. ENB is firing on all cylinders, and the company projects a 9% free cash flow (‘FCF’) and 8% distributable cash flow (‘DCF’) growth this year, putting it on track to gift investors with another raise in December.

Enbridge July 2022 Presentation

Take advantage of this sell-off. This is your chance to pick up this 6.5% yield (and growing) from a high-quality Canadian midstream company.

Risks and considerations

All investments come with risks, and investors must understand what they are buying into.

While the midstream industry is immune to commodity price volatility due to its fee-based contracts, its stock prices don’t necessarily move with that rationality. Suppose energy continues to sell off due to fears of demand destruction from an upcoming recession (a logic we disagree with since global oil demand dropped over 3% only in two out of the past 10 recessions). In that case, the prices of midstream names could irrationally correlate with the equity markets. As buyers of quality income, we will continue to use such opportunities to grow our position.

Tangible assets in the form of pipelines, storage terminals, etc., are the backbone of the midstream business. However, they require significant capital for preventative maintenance (planned), reactive maintenance (unplanned), and upgrades. Additionally, pipeline expansion, maintenance, and upgrade projects often come under the scrutiny of mainstream media, environmentalists, and politicians, creating unnecessary publicity for the companies which have the potential to weigh in on the stock price, but not necessarily the fundamentals.

Dreamstime

Conclusion

From time to time, markets will be volatile. They can happen during summers or winters, election years and inauguration years, and Republican or Democratic administrations. If you’re waiting for the volatility to end before you can invest, you may be waiting forever.

Dividends are not the coolest method of investing. They won’t make you rich overnight, but they will give you something more valuable than that – peace of mind and financial freedom. Do you want the stock market to be a part of your life, or do you want it to take over your life? I’m using it as a tool to generate passive income through dividends. And when I say passive, I really mean passive – I’m not involved in the drama of trying to predict what the market will do next week. My portfolio pays me the dividends they are supposed to, and I feel comfortable holding them, knowing that the next payment is around the corner.

This bear market has evaporated years of unrealized capital gains and has left investors on the edge of their seats. But U.S. dividend payers have raised their payments in 2022, and our income is growing strong. With over 40 securities targeting a yield of over 8%, the HDO model portfolio has seen several dividend increases and special distributions. I’m not saying that these dividends compensate for capital losses – they aren’t meant to. But as a dividend-paying shareholder, you won’t be a bag holder. With an adequately diversified portfolio of fixed-income securities and equities from robust sectors, prudent income investors are swimming in dividends without fearing Mr. Market’s hasty reaction to the Fed, recession fears, and doomsday predictions. Two picks with up to 8.6% yields ensure the stock market doesn’t take over your life.

Be the first to comment