Ronald Martinez

An enormously good buying situation has been created for AT&T (NYSE:T) whose shares cratered 7.62% on Thursday after the telecom submitted its earnings sheet for the second quarter. Because the market’s reaction to the phone company cutting its FY 2022 free cash flow guidance seems overblown, I am buying shares of AT&T hand over fist: AT&T’s 5.8% distribution yield and valuation are simply too attractive to miss!

Q2’22: Why did shares of AT&T plunge?

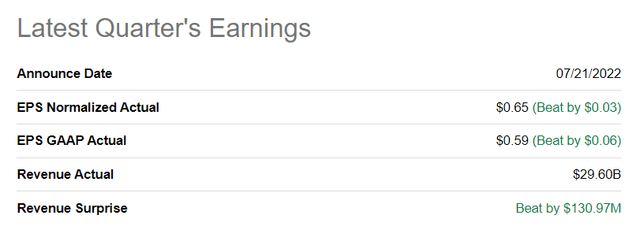

AT&T’s second quarter earnings card quickly turned into a little bloodbath for shareholders on Thursday: although AT&T submitted an earnings sheet that was better than expected, regarding EPS and revenues, investors took issue with the company’s new free cash flow guidance. With customers apparently taking longer to pay their AT&T bills, investors have become more concerned about FCF risks and ditched the company’s shares.

With exception of AT&T’s new FCF guidance for FY 2022, the firm’s second quarter earnings card was not bad: it showed normalized earnings of $0.65 which was higher than the consensus of $0.62. AT&T’s standalone revenues, excluding AT&T’s former video business and other dispositions, were $29.64B which was also better than consensus.

Seeking Alpha – AT&T Q2’22 Results

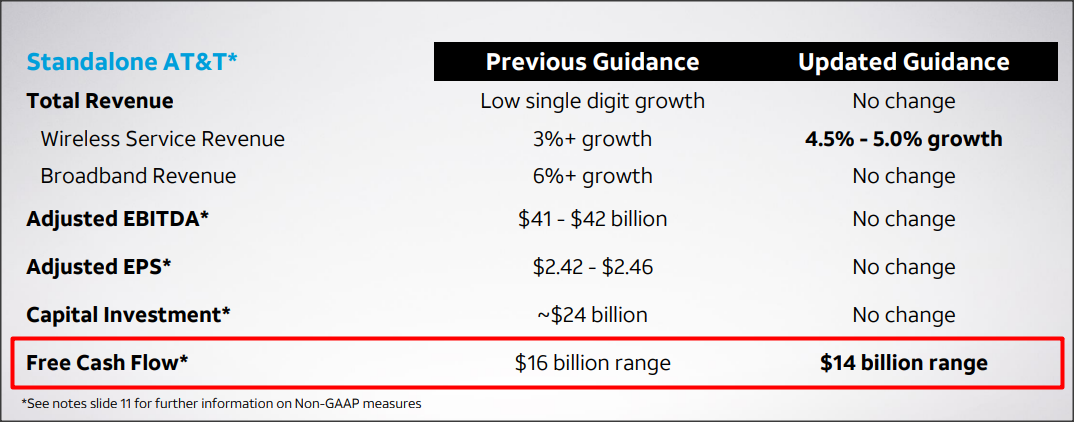

AT&T’s solid EPS and revenue performance, however, was overshadowed by the phone company announcing lower free cash flow expectations for the current year. Before earnings, AT&T expected free cash flow of $16B in FY 2022 and $20B in FY 2023. The free cash flow outlook for FY 2022 has now been lowered by $2B to $14B due to delays in customer bill payments while there has been no official update on AT&T’s free cash flow outlook for next year.

AT&T: Updated FY 2020 FCF Guidance

The reason given by AT&T for the lower FCF prediction is that some customers are stretching out their payments, possibly to help deal with inflationary pressures that are putting a strain on families’ budgets. This does not mean, however, that AT&T’s customers will ultimately not pay their bills, it simply means they are taking longer to collect.

Why you should consider buying the bloodbath

I believe that AT&T’s free cash flow prospects have slightly deteriorated after earnings, but a nearly 8% down-move in AT&T’s shares is not justified, especially because AT&T was already cheap before the earnings report.

AT&T will likely have to lower its FCF prediction for FY 2023 and I estimate that the company could see free cash flow of $17-18B next year, instead of $20B which was guided for earlier.

The drop in AT&T’s share price creates a buying opportunity for investors looking for a decent free cash flow yield and high dividend income. Based off of $16B in free cash flow this year and $17-18B in free cash flow next year, shares of AT&T have a very attractive P-FCF ratio of 8.4 X (FY 2022) and 7.5-7.9 X (FY 2023).

While AT&T’s free cash flow will be lower than initially guided for, AT&T will still generate a significant amount of FCF this year and in the foreseeable future.

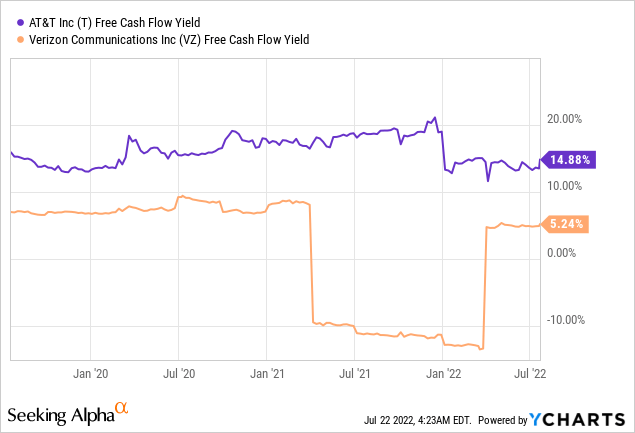

AT&T’s and Verizon’s (VZ) FCF prowess is reflected in their high free cash flow yields and from an FCF yield point of view, both telecoms are attractive to own. I like AT&T more than Verizon, due to its lower valuation and higher yield, although I believe Verizon also has deep recession value. AT&T’s current dividend yield is 5.9% while Verizon has a yield of 5.4%.

AT&T has about 7.1B shares outstanding and has reset its dividend at $1.11 per-share, meaning the dividend costs the telecom firm about $7.9B annually. With free cash flow of $16B and an FCF payout ratio of 49%, AT&T’s dividend is safe.

Updated risks with AT&T

Telecom markets are mature and saturated and while segments like 5G/fiber offer an opportunity for niche growth, telecom firms like AT&T and Verizon are set to see only single-digit top line growth going forward. However, the strength of telecom firms like AT&T lies in their enormous free cash flows which support a healthy dividend to shareholders. Because AT&T just lowered its free cash flow outlook due to customers taking longer to pay their bills, FCF risks have increased, especially when considering that the US economy may be on the brink of a recession.

Final thoughts

Be greedy when others are fearful. This is one of those situations where you wished you just had more money to buy a brutalized stock. AT&T was forced to cut its free cash flow outlook for the current year, but the market is overreacting to the new guidance and Thursday’s bloodbath is not justified.

AT&T may see lower free cash flow this year, but will continue to generate highly competitive free cash flow yields going forward and the valuation is very attractive now. AT&T’s dividend is safe and the firm’s considerable free cash flow should limit the stock’s down-fall in the short term!

Be the first to comment