PM Images/DigitalVision via Getty Images

This bear-market rally, as the consensus is calling it, has now extended to 13% off the low for the Nasdaq Composite and 9% off the low for the S&P 500 (SPY). If we don’t cap this enthusiasm soon, we may have a new bull market on our hands. Investors are finding value in growth stocks again, with the technology sector leading the way in recent days, but we are also seeing leadership in consumer cyclicals, which comes as no surprise to me, given the strength of the consumer I have been discussing in the face of higher prices.

Finviz

We have also received a lending hand from a weakening dollar, which is a new tailwind that I was not accounting for a month ago. Yesterday, the European Central Bank raised short-term rates by 50 basis points in an effort to join the Fed in fighting inflation. It was the first increase in 11 years and larger than expected. That strengthened the euro, weakening the dollar on a relative basis. The dollar has risen 11% against a basket of other currencies so far this year to hit the highest level since 2002. That has been a hit to S&P 500 profits, as the 40% of revenues derived overseas are worth less when converted into dollars. If the dollar reverses course during the second half of the year, the headwind will become another tailwind.

Finviz

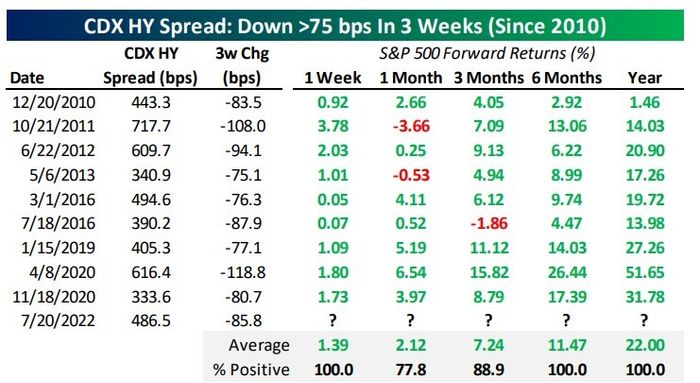

Bespoke offered up an interesting data set for the bears to chew on yesterday. Astute investors know that the bond market usually sniffs out trouble in the economy and markets well before the stock market. That is because bond investors are focused on credit and preservation of principal. When spreads widen between low-quality credit, or junk bonds, and risk-free Treasury yields, it is a warning sign of economic deterioration. The opposite is true when spreads narrow.

Spreads started to widen at the beginning of this year and continued to do so into June, but we have seen a meaningful narrowing of 85 basis points for high-yield debt over the past three weeks. That has been a powerfully bullish sign for the S&P 500 following the previous nine times we saw high-yield spreads narrow more than 75 basis points in less than a three-week period. In fact, the market has been higher every time over the six- and 12-month periods that followed.

Bespoke

This fits like a puzzle piece into my outlook for a second-half recovery, so this development in the bond market obviously gives me a lot more confidence that I will correct. We will avoid a recession this year, and the rate of inflation will decline more rapidly than the consensus is now expecting, allowing the Fed to be less aggressive in tightening monetary policy. This should further weaken the dollar, which would result in greater profits from the 40% of S&P 500 revenues that are accrued internationally.

It has been interesting to see the reaction stock prices are having to mediocre earnings reports followed by soft guidance. While stock prices may dip in the early morning on news, they are closing higher by the end of the day. We are seeing the same dynamic in the broad market, with a weak open followed by a strong close. This tells me that investors are starting to look forward, and the market is properly functioning as a discounting mechanism.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment