fotostorm

Thesis

MercadoLibre, Inc. (NASDAQ:MELI) stock has been consolidating at its near-term support since May. Even though the market attempted a further sell-off in June and July, the buying support has been resilient.

However, macro headwinds in LatAm have continued to dampen the likelihood of a re-rating in the near term. High inflation and surging energy costs in Brazil have destabilized the political climate. Also, it could further impact MELI’s FinTech and lending business if inflation or inflation rates continue to rise.

Notwithstanding, we believe that a medium-term re-rating could be in the works, given MercadoLibre’s expected operating leverage gains. Therefore, investors are urged to sit tight and layer in their exposure over time at critical support levels, given its bearish bias. MELI also seems to be at a potential long-term bottom (not validated yet), which further supports our medium-term re-rating thesis.

As a result, we reiterate our Buy rating on MELI and urge investors to be patient.

Brazil’s Inflation Is Concerning But Could Peak Moving Forward

Given the surging inflation, exacerbated by rising energy costs, companies with sizeable LatAm exposure have been battered in 2022. It has also complicated Brazilian President Jair Bolsonaro’s bid to be reelected this year, which also caused further political uncertainty in the country.

However, Kapitalo Investimentos Ltda (a leading Brazilian hedge fund) thinks that the surging inflation rates in Brazil could slow moving forward. It has also been executing positions to capitalize on the potential of falling inflation rates, as the firm accentuated (edited):

We think investors are overestimating inflation, and we are taking positions that will profit when those expectations come down. Five-year breakevens — the inflation rate implied by prices in the bond market — reached 7.58% last month, the highest since 2016. Premiums look attractive. – Bloomberg

Therefore, we believe the market has been pricing in such headwinds since early 2022. MercadoLibre’s FinTech and lending portfolio could be further impacted, worsening the impact of e-commerce’s growth normalization. It added in its filings (edited):

Like other businesses with significant exposure to credit losses, we face the risk that Mercado Credito merchants and consumers will default on their payment obligations, making the receivables uncollectible and creating the risk of potential charge-offs, which could impact our liquidity. Any of these events could adversely affect our business and the results of operation. The funding and growth of our Mercado Credito business are directly related to interest rates; a rise in interest rates may negatively affect our Mercado Credito business and the results of operations. (MercadoLibre 10-Q)

But MercadoLibre Could Gain Operating Leverage Rapidly

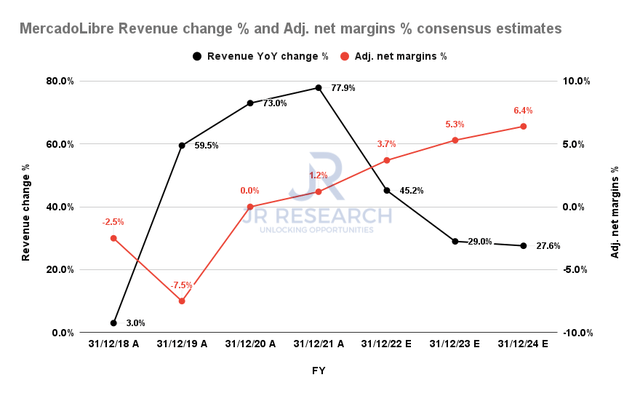

MELI revenue change % and adjusted net margins % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) suggest that the company could continue gaining leverage markedly, even though revenue growth is expected to moderate further through FY24.

The company has been investing aggressively in its FinTech and logistics/fulfillment business which has impacted its operating profile in the near term. However, if the company can continue executing well, such leverage gains could drive the market to re-rate MELI.

Furthermore, if the inflation environment in Brazil improves further, we believe it will drive the recovery in its topline growth and margins and help undergird its valuation.

Notwithstanding, we believe the market sentiments toward MELI remain weak, given the uncertainties currently.

MELI’s Valuation Is Supportive Of A Medium-Term Outperformance

| Stock | MELI |

| Current market cap | $39.76B |

| Hurdle rate [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4.5% |

| Assumed TTM FCF margin in CQ4’26 | 11.5% |

| Implied TTM revenue by CQ4’26 | $19.33B |

MELI reverse cash flow valuation model. Data source: S&P Cap IQ, author

MELI is a highly volatile stock. Therefore, parsing its valuation is a challenging endeavor, given its inherent risks.

But we think the market has likely formed a long-term bottom in June, even though it has not been validated. Notably, the market rejected further selling downside at an FY24 FCF yield of 6.4%. Also, the market rejected buying upside decisively in March at an FY24 FCF yield of 3.07%.

Therefore, our model used an FCF yield of 4.5% and a market-perform hurdle rate of 11%. If MercadoLibre can continue gaining leverage accordingly, we are confident that the company can meet the revenue target implied in our model.

However, given MercadoLibre’s high-growth cadence, the market could re-rate it higher when the political uncertainties and inflation challenge subside. But don’t wait till then to add exposure.

Is MELI Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on MELI.

We believe the stock is likely at a long-term bottom, even though it has not been validated. Even though near-term challenges persist, the set-up looks increasingly constructive for a medium-term re-rating.

Be the first to comment