Kameleon007/iStock via Getty Images

Bonds Were Uninvestable

Since the pandemic started, yields on investment grade bonds have been so low, they were essentially not investable. The word of the day has been TINA, as in “there is no alternative” to stocks. For those investing in 10-year investment grade corporate bonds, a 2.5% yield wasn’t enough to offset inflation and the risk of rising interest rates. That yield was not much higher than the average stock dividend yield with no appreciation potential. The 2.5% yield was for BBB rated bonds, the lowest rated but largest category of investment grade bonds. If you wanted a higher rated bond, you got even less.

Recent Surge In Bond Yields

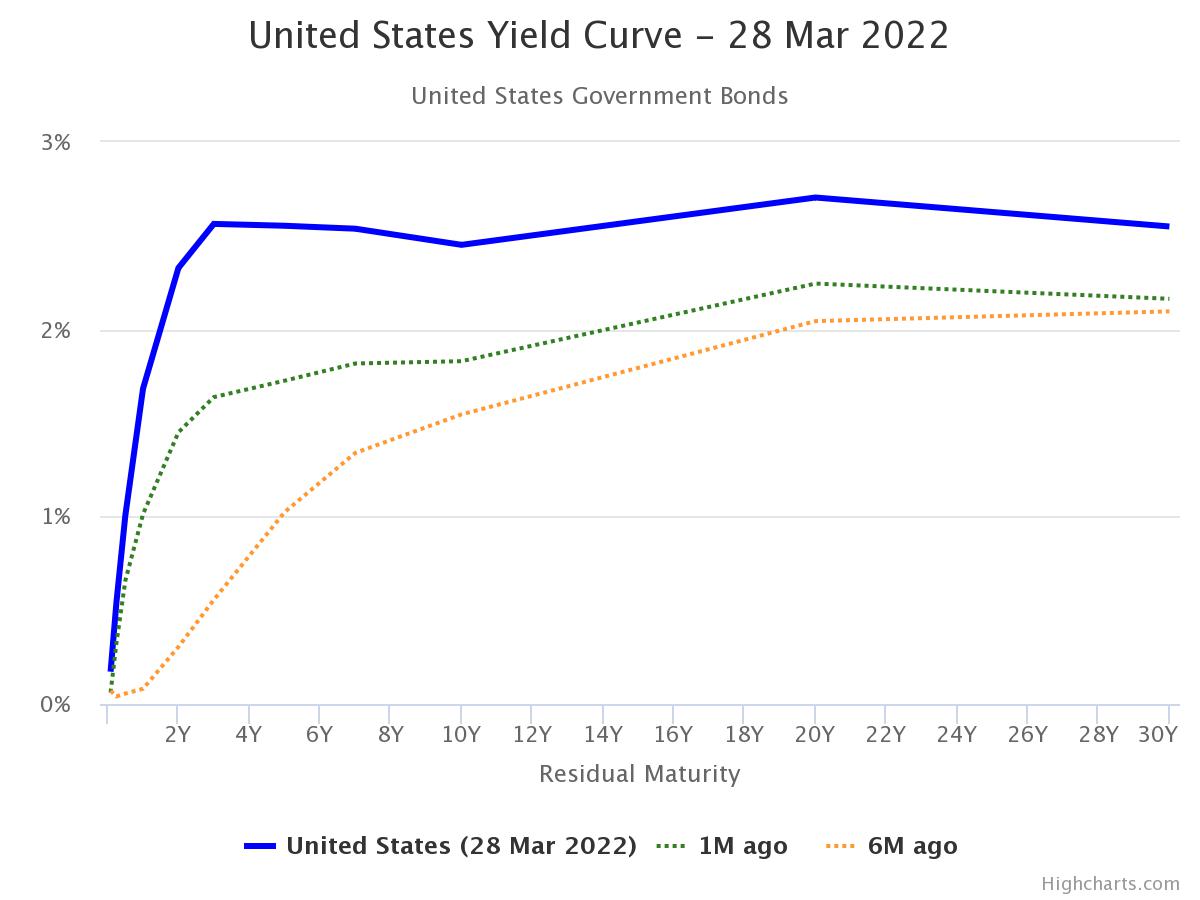

Shown below is a yield curve chart showing how much 2- to 30-year treasury bonds have risen in the past one and six months.

Highcharts.com

Finally, a window of opportunity to buy bonds again has emerged. Yields on many BBB rated bonds have risen to over 4%. Corporate bond rates usually are higher than treasuries due to having credit risk. This surge in rates was caused by several factors such as a surge in inflation, and actions by the Fed such as increasing the Fed Funds rate and stopping its quantitative easing (QE) program. The fact that 2- to 10-year yields rose sharply as soon as the Fed stopped its QE program indicates that played a big part. Recall that the Fed was buying a massive $120 billion of bonds a month starting in early 2020 through late 2021. Bond purchases were then scaled down until they were stopped completely this month. Pricing of anything is a function of supply and demand and a huge demand for bonds just got removed. Not surprisingly prices went up.

TINA

Some measurements of how strong the economy is are shown below;

1. Consumers are sitting on about $2.5 trillion of excess savings.

2. Brick and mortar retailers who were failing prior to the pandemic are soaring.

3. Corporate America has record profits, well above the pre-pandemic levels.

4. Imports are way above pre-pandemic levels.

5. The unemployment rate is 3.8%, considered full employment by most economists.

6. A large inventory build late last year.

7. Employers are begging for workers, there has never been a better time to look for a job as proven by a huge jump in resignations.

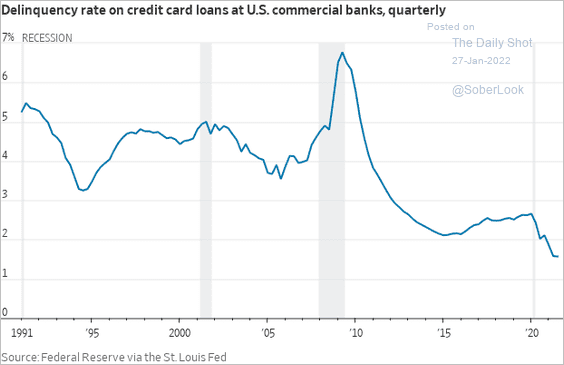

8. Delinquencies are close to record lows as shown in the chart below.

9. Foreclosures were deferred and are at record lows.

10. Corporate debt defaults have dried up and bankruptcies are low.

11. Housing prices have gone through the roof as inventory has dried up.

12. GDP was 7.0% last quarter.

Federal Reserve Bank of St. Louis

This was never going to be sustainable as most of the reasons for the strong economy are temporary. The Fed is now raising interest rates and has stopped QE. It is even talking about reversing QE. The impact of the massive fiscal stimulus is fading and pent-up demand from the lockdowns is mostly gone.

Emerging Headwinds For Stocks

Meanwhile, the economy has suddenly run into a number of headwinds. These headwinds are already slowing the economy and risk putting it into recession if they continue for much longer.

1. Inflation – Prices for rent, energy, home purchases, commodities and food are all way up and showing no signs of slowing. Inflation is now exceeding wage gains resulting in the average consumer losing ground. Gasoline and food prices in particular are having a major impact on low to moderate income people.

2. Interest rates – Fed Funds which were effectively close to zero a few weeks ago are now expected to be between 2.25% to 2.50% by year end by the futures markets.

3. War in Ukraine – This has significantly increased certain commodity prices, and added uncertainty regarding cyber attacks, and possibly nuclear attacks.

4. Demand pulled forward – The massive fiscal stimulus resulted in a consumer spending surge. Many brick and mortar retailers that were near insolvency have come back strong. But history shows consumer stimulus not only doesn’t last, it often leads to a pullback once gone. The government had three consumer stimulus programs in the 2007-2009 recession. All three ended up pulling forward demand resulting in a large drop off. The first stimulus was the tax refunds (stimulus checks) in the summer of 2008. The economy fell off a cliff immediately after these refunds stopped. The next large stimulus was housing tax credits. These drove up home sales a bit and slowed the decline of home prices. Once the tax credits ended, home sales resumed their decline at an even faster rate. The government also tried “cash for clunkers” to stimulate car sales. Automobile purchases immediately returned to their former depressed rate once this stimulus ended.

5. Stimulus fade – The stimulus checks sent to consumers ended a year ago and the impact continues to fade.

6. Treasury yield inversion – An inversion of treasury yields has preceded most recent recessions. By some measures this has already happened.

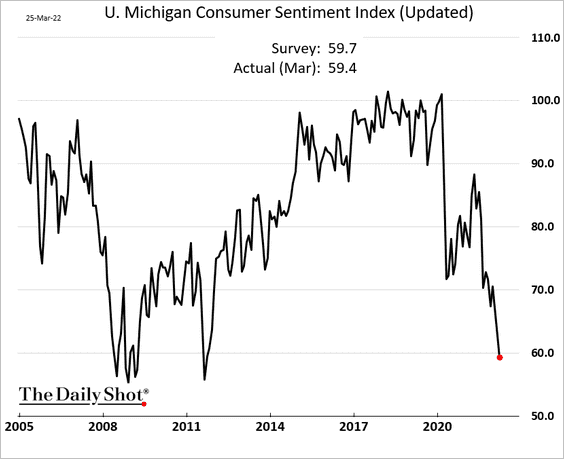

7. Consumer sentiment – Changes in consumer sentiment often translates to changes in economic activity. As shown below, it is dropping rapidly currently.

University of Michigan compiled by The Daily Shot

8. Slowdown in China

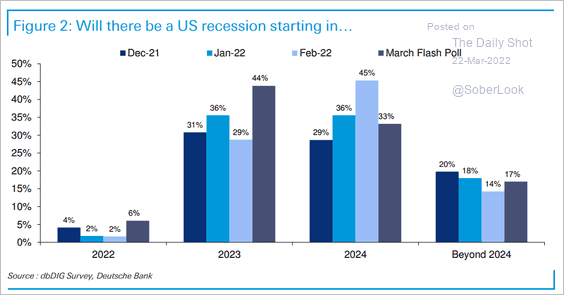

These headwinds not only are slowing the economy, they add to the risk of a recession in the next year or two. In fact, this recent survey by Deutsche Bank on March 22, 2022, shows many are already expecting a recession soon.

Deutsche Bank

Tailwinds

It’s not all doom and gloom. There are several tailwinds holding up the economy. These include housing demand. Most housing experts believe the housing stock is insufficient to meet demand after years of underbuilding. Consumers are still sitting on much more cash and investments than they did before the pandemic. This can be used to sustain spending levels. Supply chain problems should eventually get worked out. As they do, that makes the economy more efficient and lowers costs and inflation. A number of workers have not yet re-entered the workforce they left after the pandemic started. As they do it will add to wealth and business capacity.

Takeaway

Stocks have been the only place for most investors since the pandemic started due to a strong economy and stock market versus historically low yields on bonds. After a recent surge in interest rates, bonds are finally investible again. Investment grade longer term corporate bonds now yielding over 4%. Meanwhile, the economy is facing an increasing number of headwinds and fading tailwinds. This will likely dampen the stock market.

While rates can go much higher, there is only so high the Fed can let them go. At some point higher interest rates on our huge Federal debt gets too onerous. Another factor keeping rates from getting too high is currency competition with the Europeans and Japanese who have much lower interest rates. Much higher rates can make the dollar too strong. Further, as I said earlier, bond pricing is a function of supply and demand. There is not a lot of demand right now. Bank lending growth is picking up but banks still have a high ratio of deposits to loans. That means supply of money is exceeding demand, which keeps rates lower.

Recommendations

I recommend buying longer term corporate bonds of 10-15 years to maturity by rotating money out of stocks. I do not recommend a full rotation into bonds yet as interest rates can go significantly higher without QE to hold them down. This window of opportunity could be open a while but not indefinitely. I plan to steadily increase my bond holdings. Longer term bonds are better than short term as who knows when we will get this opportunity again. We have been in a 40-year era of declining interest rates. This trend has been primarily due to the supply of money exceeding demand from borrowers. It’s best to lock in reasonable interest rates while you can. Consider getting bonds with call protection for the same reason. Who knows when this window will open again. You’ll want what you are buying today to stick around when rates go down and not get called away.

Avoid junk bonds at this time as the risk of a recession is rising quickly. I am not necessarily predicting one yet, but the amount of headwinds increases that risk.

Diversify your bond holdings. Just like stocks, if you are concentrated in a few bonds, one bad one can cause a lot of damage. If you don’t want to buy individual bonds, buy a low-fee longer-term bond ETF or mutual fund.

The yield curve is currently unusually flat from two years on out. For the cash portion of your portfolio, consider 2-year treasury notes instead. They currently yield 2.33% (as of March 28, 2022). That is well above the rate on any 2-year CDs. If you need the money, they are very liquid and can be quickly sold at little discount.

Be the first to comment