chaofann

This article is part of a series that provides an ongoing analysis of the changes made to David Einhorn’s Greenlight Capital 13F portfolio on a quarterly basis. It is based on Einhorn’s regulatory 13F Form filed on 8/15/2022. Please visit our Tracking David Einhorn’s Greenlight Capital Holdings article series for an idea on his investment philosophy and our previous update for the fund’s moves during Q1 2022.

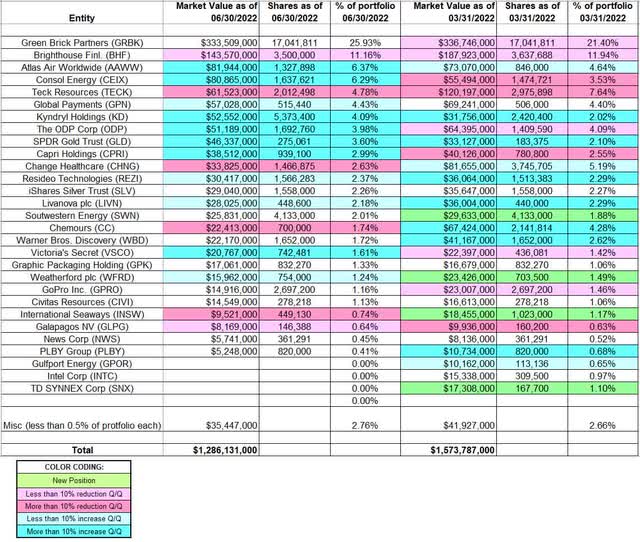

Greenlight Capital’s 13F portfolio value stood at $1.29B this quarter. It is down ~18% compared to $1.57B as of last quarter. Einhorn’s Q2 2022 letter reported that the fund returned 13.2% for H1 2022. This is compared to negative 20% for the S&P 500 Index. In addition to partner stakes, the fund also invests the float of Greenlight Capital Re (NASDAQ:GLRE). To learn about David Einhorn and the perils of shorting, check out his “Fooling Some of the People All of the Time, A Long Short (and Now Complete) Story”.

Note: It was reported in early August that Einhorn had built a merger-arbitrage stake in Twitter (TWTR) at a cost-basis of ~$37. Their estimated value if the $54.20 deal from Elon Musk doesn’t go through is ~$20. At ~17 upside & ~17 downside, it means the market at the time was assigning 50-50 odds that the deal should go through for something that should happen 95% of the time.

Stake Disposals

TD SYNNEX Corp. (SNX): The 1.10% SNX stake was purchased last quarter at an average price of $105.33. It was sold this quarter at prices between ~$90 and ~$107. It now goes for $82.84.

Gulfport Energy (GPOR) and Intel Corp. (INTC): These small (less than ~1% of the portfolio, each) stakes were disposed during the quarter.

Stake Increases:

Atlas Air Worldwide (AAWW): AAWW is a large (top three) 6.37% of the portfolio stake established in Q2 2020 at an average price of $36.28 per share. There was a ~45% selling in Q4 2021 at prices between ~$77.50 and ~$95. This quarter saw a ~57% stake increase at prices between ~$59 and ~$73. The stock currently trades at ~$98.

Note: In August, an investor group led by Apollo agreed to acquire AAWW at $102.50 per share cash.

CONSOL Energy (CEIX): CEIX is a 6.29% of the portfolio position that came about as a result of the merger with CONSOL Coal Resources that closed in December. Terms called for 0.73 shares of CONSOL Energy for each share of CONSOL Coal held. Greenlight had a position in CONSOL Coal for which they received these shares. There was a ~30% reduction in Q1 2021 at prices between ~$6.75 and ~$12.20. That was followed with a ~25% selling in Q2 2021 at prices between ~$8.75 and ~$18.70. The last two quarters had seen another ~30% selling at prices between ~$20.50 and ~$40.50 while this quarter saw a ~11% increase. CEIX currently trades at $70.30.

Global Payments (GPN): GPN is a fairly large 4.43% of the portfolio stake established in Q4 2021 at prices between ~$118 and ~$161 and the stock currently trades at ~$112. Greenlight’s cost-basis is ~$126 per share. There was a marginal increase this quarter.

Note: Their Q4 2021 letter had the following regarding GPN: the ~45% drop due to fintech disruption worries is overdone. There is also a chance that they might get acquired.

Kyndryl Holdings (KD): KD is a ~4% of the portfolio position built over the last three quarters at prices between ~$9 and ~$41 and the stock is now at $8.49.

The ODP Corp. (ODP): ODP is a ~4% of the portfolio position, primarily built over the three quarters through Q4 2021 at prices between ~$36 and ~$50. The stock currently trades at $35.33. There was a ~20% stake increase this quarter at prices between ~$29 and ~$46.

Note: Greenlight’s cost-basis is ~$44.

SPDR Gold Trust (GLD): The 3.60% GLD stake was built in Q3 2020 at prices between $167 and $194. Q1 2021 saw a ~70% selling at prices between ~$158 and ~$183. Last two quarters have seen a ~140% stake increase at prices between ~$167 and ~$192. It currently trades at ~$158.

Capri Holdings (CPRI): The ~3% CPRI position was purchased last year at prices between ~$40.50 and ~$67. Last quarter saw a ~12% trimming while this quarter there was a ~20% stake increase. The stock is now at ~$42.

Note: Greenlight’s cost-basis is ~$56.

Resideo Technologies (REZI): The 2.37% REZI stake was established in Q2 2020 at prices between $3.95 and $12.50. H2 2020 had seen a one-third increase at prices between ~$10 and ~$22.50 while next quarter saw a ~45% selling at prices between ~$21 and ~$31.50. That was followed with a ~15% trimming in Q4 2021. Last quarter saw a ~30% stake increase at prices between ~$23 and ~$27. The stock is now at $21.38. There was a minor ~4% increase this quarter.

LivaNova plc (LIVN): The 2.18% of the portfolio stake in LIVN was built over the last three quarters at prices between ~$71 and ~$93. The stock is now well below that range at $48.50. This quarter saw a marginal increase.

Victoria’s Secret (VSCO): The 1.61% stake in VSCO was primarily built in Q4 2021 at prices between ~$47 and ~$59. There was a ~70% stake increase this quarter at prices between ~$28 and ~$51. The stock is now at $33.90.

Note: VSCO is a spinoff from Bath & Body Works (previously L Brands) that started trading in August 2021 at ~$46 per share.

Weatherford International plc (WFRD): The 1.24% of the portfolio position in WFRD was purchased last quarter at an average price of $32.27 and it is now at $34.68. There was a ~7% stake increase this quarter.

Stake Decreases:

Brighthouse Financial (BHF): BHF is a large (top three) stake at ~11% of the portfolio. The position was established in Q3 2017 and increased by ~60% in the following quarter at an overall cost-basis of $57.92. The stock is currently at ~$47. There was a ~70% selling in Q4 2018 at prices between $29 and $46.50. Last three quarters have seen minor trimming.

Note 2: BHF is a spinoff of MetLife’s (MET) U.S. Retail business (annuities and life insurance) that started trading in July 2017.

Teck Resources (TECK): TECK is a 4.78% of the portfolio position purchased in Q2 2020 at prices between $7 and $12.25. The stock currently trades at ~$32. There was a ~40% stake increase in Q4 2020 at prices between ~$12.25 and ~$18.85 while next quarter there was a ~25% selling at prices between ~$18 and ~$23.75 The two quarters through Q3 2021 had seen a stake doubling at prices between ~$19.50 and ~$26.80. There was ~55% selling over the last three quarters at prices between ~$26 and ~$46.

Change Healthcare (CHNG): CHNG was a 2.63% of the portfolio position purchased in Q1 2020 at a cost-basis of $11.40. There was a ~30% reduction in Q1 2021 at prices between ~$18.25 and ~$24. That was followed with a ~60% reduction this quarter at prices between ~$22.50 and ~$24. UnitedHealth (UNH) bought Change Healthcare in a $25.75 all-cash deal that closed earlier this month.

Chemours (CC): CC is a 1.74% of the portfolio position established in Q2 2019 at a cost-basis of $23.18. Next quarter saw a ~75% stake increase at prices between $12 and $23. The five quarters through Q1 2021 had seen a two-thirds reduction at prices between ~$7 and ~$28.75. That was followed with a ~25% selling in Q4 2021 at prices between ~$28 and ~$34. Last quarter saw a similar increase at prices between ~$23 and ~$36. There was a two-thirds reduction this quarter at prices between ~$29.40 and ~$45. The stock is currently at $26.37.

Note: Greenlight had a highly successful (4x returns) previous roundtrip with Chemours in the two-year period that ended in Q1 2018.

International Seaways (INSW): INSW is a 0.74% stake established last quarter at an average price of $15.30 and it currently trades at $34.26. There was a ~55% selling this quarter at prices between ~$19.50 and ~$25.

Galapagos NV (GLPG): The very small 0.64% of the portfolio stake in GLPG was reduced in the last two quarters. Greenlight’s cost-basis was ~$53 per share and the stock currently trades at $42.30.

Kept Steady:

Green Brick Partners (GRBK): GRBK is currently the largest position at ~26% of the 13F portfolio. The stake was acquired as a result of BioFuel Energy’s JGBL Builder Finance acquisition and rename transaction. The deal closed (October 2014) with Greenlight owning 49% of the business. David Einhorn was appointed Chairman of the Board following the transaction. Q1 2021 saw a ~28% selling at ~$20.50 per share through an underwritten offering. The stock currently trades at $22.49. They own ~38% of the business.

iShares Silver Trust (SLV): SLV is a 2.26% of the portfolio position established in Q3 2021 at prices between ~$20 and ~$24.50 and the stock currently trades at $18.50.

Southwestern Energy (SWN): SWN is a ~2% of the portfolio stake established last quarter at an average price of $6.58. The stock currently trades at $6.78.

Warner Bros. Discovery (WBD): WBD is a 1.72% of the portfolio position built over the last two quarters at prices between ~$22 and ~$31 and the stock is now well below that range at $11.98.

GoPro Inc. (GPRO): The 1.16% GPRO stake was built over H1 2021 at prices between ~$7.50 and ~$13.50. There was a ~20% selling in Q4 2021 at prices between ~$8.50 and ~$11.60. The stock currently trades at $5.01.

Civitas Resources (CIVI), Graphic Packaging Holding (GPK), News Corp. (NWS), and PLBY Group (PLBY): These small (less than ~1.10% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Greenlight’s 13F stock holdings in Q2 2022:

David Einhorn – Greenlight Capital’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Greenlight Capital’s 13F filings for Q1 2022 and Q2 2022.

Be the first to comment