Iryna Dobytchina/iStock via Getty Images

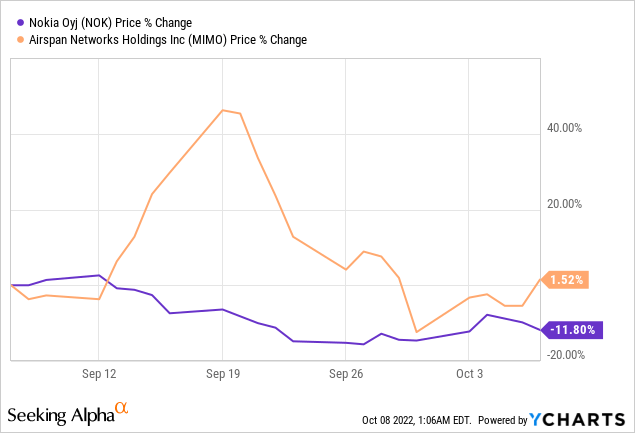

The stock market has been in a tough place during the last month with big names in 5G RAN (Radio Access Network) such as Nokia (NYSE:NOK) losing 11.8% in value as shown in the chart below.

On the other hand, investors have rewarded little-known U.S. play Airspan (NYSE:MIMO) which serves big telco customers such as T-Mobile (NASDAQ:TMUS) with an upside of 1.52%.

This upside went largely unnoticed as few analysts cover Airspan compared to Nokia which is held by many in their portfolios. Also, with a P/E Non-GAAP (FY3) of 5.32x, compared to Nokia’s 8.48x, the U.S. company remains more than 60% undervalued when future prospects are considered. This shows that investors attach more value to Nokia in the long term.

Then, going against the prevailing market sentiment and in view of the opening up of the 5G industry amid tighter monetary conditions, the objective of this thesis is to show how Airspan constitutes a viable investment, primarily as a diversifier for those invested in Nokia, or on a standalone basis.

Opening up of the Industry

Several MNOs or mobile network operators including Orange (ORAN), Vodafone (VOD), Telefonica (TEF), and Deutsche Telekom (OTCQX:DTEGY) have either ventured into or are gradually converting to Open RAN (Radio Access Networks). Verizon (VZ) targets similar deployments by 2023.

Now, to deploy a 4G or 5G mobile cellular network, these operators normally have no choice but to go through the proprietary solutions of the two major equipment manufacturers, Nokia and Ericsson (NASDAQ:ERIC), after Huawei was ousted through U.S. sanctions. Choosing a proprietary, as opposed to an open system, implies that MNOs are stuck with it for the whole product lifetime, making it impossible for another supplier to fit it.

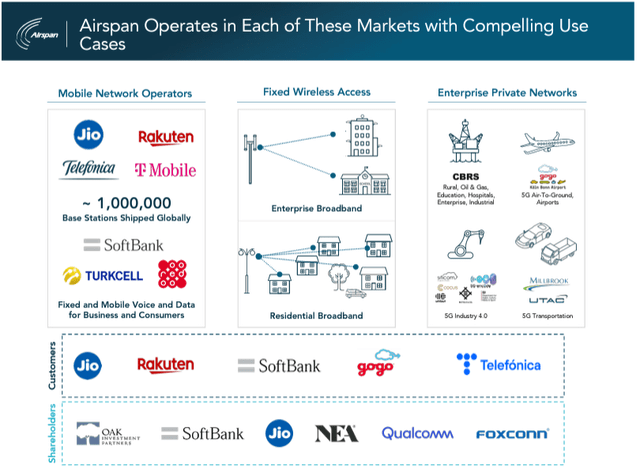

It is precisely this vendor lock-in that the Open RAN solutions proposed by Airspan attempt to break, namely by opening communication protocols to a plurality of players. The company’s shareholders include big names like Qualcomm (NASDAQ: QCOM) and SoftBank (OTCPK:SFTBY) and in addition to boasting MNOs among its customers, it is present in the FWA (fixed wireless access) and private 5G markets as shown below.

Company presentation (static.seekingalpha.com)

However, to be realistic, there is strong competition due to Nokia’s and Ericsson’s towering presence in the field for decades as well as other Open RAN disruptors like Mavenir. There is also the fact that Airspan has been impacted by supply chain issues, namely, freight charges to a higher degree than either Nokia or Ericsson, as, unlike the two European equipment manufacturers, it does not have elaborate production systems in different parts of the world.

Moreover, the open option has traditionally involved more partners working together implying more diverse sourcing arrangements compared to Nokia’s more all-in-one approach. Consequently, some customers which had already envisaged implementing Open RAN solutions had to delay their plans, resulting in Airspan’s radio infrastructure business being “relatively flat to low growth” in the second quarter of 2022 (Q2).

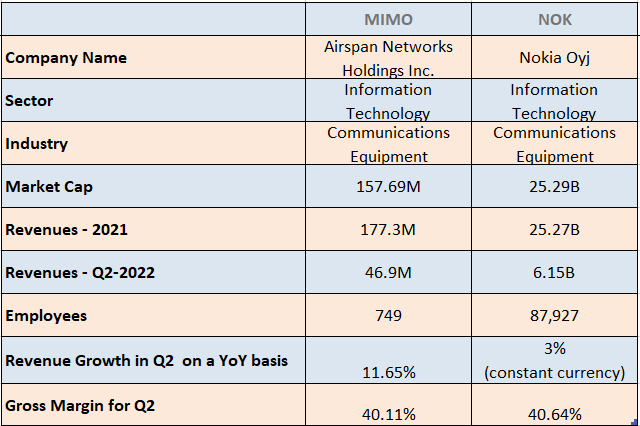

Airspan Favored by the CHIPS Act

Still, thanks to strength in private 5G with orders from hyperscalers, the company was still able to deliver revenue growth of 11.65% (table below) in Q2 on a year-on-year basis, which is higher than Nokia. Comparing profitability, Airspan’s gross margins of 40.11% is nearly the same as the Finnish company despite the latter benefiting from a much higher revenue base on which to spread its fixed costs. This shows that the U.S. company benefits from better production efficiency, which is explained by a differentiated product design, as well as the chips it uses, and its software-defined approach.

Comparison of Metrics (www.seekingalpha.com)

Thus, with more sales, its profitability should go higher.

Furthermore, increased geopolitical tensions are playing in Airspan’s favor as it can rely on the $1.5 billion committed to the network equipment industry for Open RAN development through the CHIPS Act. The company is also well-positioned to benefit from £250 million by the UK government for related large-scale deployments.

Along the same lines, the U.S. department of commerce’s recent move to further restrict the supply of advanced microchips to China. Now, these restrictions are for cutting-edge AI semiconductors used for advanced computing, and military applications, but broader rules could follow, and there is likely to be some uncertainty as RAN equipment also makes use of advanced processor chips.

Investigating the outcome for Nokia, I found that it relies on contract manufacturers in that country and was therefore also impacted by the strict COVID-19 lockdowns throughout 2022.

Nokia’s Supply Diversification and Revenues

Still, unlike Ericsson which has production plants in China, the Finnish company has been diversifying its supplier base for components since geopolitical tensions between the U.S. and China started escalating in 2016 and opened a 5G base station manufacturing in India in 2018. It also has three R&D labs and two data centers in the U.S.

Thinking aloud, a complete onshoring of the U.S supply chains, or relocating manufacturing nearer home is not likely to occur any time soon. Looking into the rear mirror, it took China decades to evolve into a manufacturing hub with its factories also processing hundreds of materials such as silicon and gallium which are used as raw materials in foundries.

This is the reason why investing in Nokia, which operates in one of the few high-tech sectors without a large U.S. stakeholder makes sense and the company is profitable too. Hence, the Finnish equipment maker reported an operating income increase of 11% in the second quarter compared to the same period in 2021 thanks to reducing costs across the board, getting rid of the end-to-end product strategy, while prioritizing R&D.

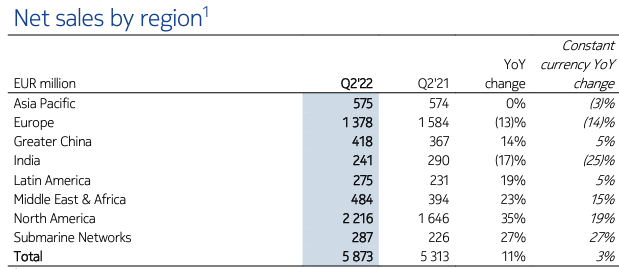

The company is now aiming for the high end of its net sales forecast for fiscal 2022, and this is amid growing uncertainty in economic conditions globally compounded by the variation in exchange rates affecting emerging markets sales. To this end, Nokia remains well diversified with shortfalls in some regions like India being mitigated by strong demand in North America. The company has also absorbed 100 million euros of losses linked to its departure from Russia.

Nokia’s sales for Q2-2022 (www.nokia.com)

Nokia also has a strong presence in fixed networks in the U.S. through optics and IP in addition to mobile remains a viable investment, as it is unlikely for telcos to stop expanding their footprint at the first signs of an economic slowdown.

In these circumstances, remaining invested in Nokia makes sense, but, in view of new financial conditions as I elaborate below, the attractiveness of Airspan becomes evident.

Market Opportunities, Risks, and Valuations

With the Federal Reserve aggressively tightening monetary policy, and propping up the greenback, and central banks around the world forced to do so in their own jurisdiction in order to contain inflationary pressures, the era of cheap money is rapidly coming to an end. In these circumstances, telcos are likely to continue optimizing expenses, considering that implementing and operating 5G is 65% more expensive than 4G, and up to 40% of savings are possible when utilizing open technologies compared to more conventional methods. For this matter, Airspan refers to a $40 billion market consisting of MNOs, FWAs, and private 5G for enterprises. Assuming that it is just able to funnel 1% of this by December 2024 (FY3), this comes to $400 million.

Additionally, with its Open RAN costing one-third the price of Ericsson’s gear, Airspan should play a key role in the Rip-and-Replace strategy, where the intent of the U.S. government is to get rid of equipment that had initially been installed by China’s ZTE. To this end, about $1.9 billion has already been approved by the FCC which should go to Airspan’s customers like in-flight operator Gogo (GOGO).

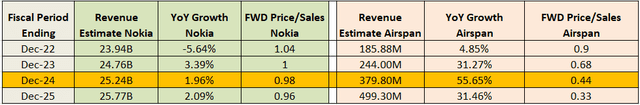

Therefore, the company could achieve the $379.8 million estimated by analysts for fiscal 2024, which would constitute a 55.65% YoY growth as shown in the table below.

Table Built using data from (www.seekingalpha.com)

According to the same estimates, FY2024 would see a positive EPS too. Thus, coming back to the forward P/E of 5.32x as I mentioned in the introduction, this translates into a share price of $3.68 (2.3 x 1.6) based on the current share price of $2.3 and a 60% undervaluation with respect to Nokia.

Investors will also note that while Airspan generates high gross margins, it is not operationally profitable currently and has been allocated an “F” score by SA. However, it had cash of $36.3 million and receivables of $48.3 million at the end of Q2. Also, current assets are double current liabilities, and with an improvement in the supply chain, less money should be spent on expedited shipping in the second half of this year, while cash used for operations is planned to be cut by around 10% by Q4. Furthermore, the company, which adopted the SPAC route for public listing in 2021 remains highly leveraged and has an agreement with Fortress for debt refinancing.

Conclusion

Therefore, Airspan which is also flagged as being “at a high risk of operating badly” may not fit with the investment objectives of value investors. On the other hand, it has more of a disruptor status, fit to form part of a portfolio that has a long-term investment objective.

It also makes sense as a diversifier for those holding shares of Nokia, whose growth for FY2024 as highlighted in the above table should stall to around 2%. In sharp contrast, Airspan should grow by a staggering 55%, which is feasible through the CHIPS act and the Rip-and-Replace strategy.

Finally, Airspan’s shares went up by 7.3% on Thursday, October 7 when the more restrictive measures on chip exports to China were announced signifying that something big may be on its way. This said, uncertainty reigns and it is better to wait for the dust to settle before investing.

Be the first to comment