peterschreiber.media

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 28th.

The Global X Uranium ETF (NYSEARCA:URA) is a simple uranium index ETF, focusing on uranium miners, with smaller holdings in physical uranium. Uranium is a key input for nuclear energy. As such, URA’s underlying holdings should see strong revenue and earnings growth as the global nuclear energy industry expands to meet rising energy needs while meeting emission targets. Industry growth is dependent on favorable regulatory and political conditions, which are always in doubt.

In my opinion, although URA’s fundamentals and growth prospects are quite strong, political and regulatory risk seem excessively high. Predicting how politics and regulations will play out seems like a fool’s errand, in my opinion, at least. As such, I rate the fund a hold.

URA – Overview

URA is a simple uranium index ETF, tracking the Solactive Global Uranium & Nuclear Components Index. Said index focuses on uranium miners, with smaller investments in nuclear component producers, uranium technology developers, and physical uranium investments. These investments are all related to the uranium / nuclear energy industry, and so are thematically appropriate. Security weights are dependent on market-cap and liquidity. There are various caps and floors to ensure the index focuses on uranium miners, while maintaining some diversification.

URA’s largest holdings are as follows.

As can be seen above, URA focuses on uranium miners, as expected. The fund’s largest holding is Cameco (CCJ), with a 26.9% weight, the largest publicly traded uranium producer in the world. URA’s second-largest holding is a trust investing in physical uranium, which encompasses the fund’s entire physical uranium allocation. URA also invests a small portion of its assets in companies within the global nuclear energy industry, including Hyundai Engineer & Construction.

The performance of the fund’s underlying holdings is strongly dependent on the nuclear energy industry. Industry growth should lead to greater demand and higher prices for uranium, resulting in revenue and earnings growth for uranium miners. Said growth should ultimately result in higher share prices for URA’s underlying holdings, and hence capital gains for the fund and its investors.

URA’s dependence on the global nuclear energy industry is, I think, pretty self-explanatory, but very important, and instrumental to the fund’s investment thesis. Let’s have a look.

URA – Investment Thesis

URA’s investment thesis is quite simple and focuses on the strong growth prospects of the fund’s underlying holdings, underpinned by a booming nuclear energy industry.

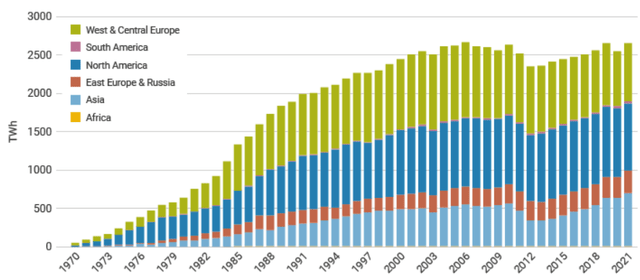

Nuclear energy had stagnated for decades, starting from the ’70s, due to fears of nuclear meltdowns. The Three Mile Island Incident effectively froze the U.S. nuclear energy industry, with no new nuclear reactors built since the incident. Fukushima led to rising anti-nuclear sentiment around the globe, and to nuclear plant shutdowns in Germany and Japan, as well as bans on new reactor construction in several countries.

Nuclear energy seemed dead, until 2022. The Russian invasion of Ukraine, and the West’s response to said invasion, have led to significantly decreased supply of several energy sources, including natural gas and oil. Countries need energy, but there are simply fewer energy sources available right now. Energy prices have skyrocketed as a result, leading to widespread inflation, and to talk of rationing in Europe.

Skyrocketing energy prices, inflation, and (potentially) rationing are a self-inflicted wound, but one with a simple solution: nuclear. Planned reactor shutdowns can be postponed, and mothballed reactors can be restarted. Doing so means greater energy production, which can be used for industrial production, commercial use, even, sometimes, heating. Doing so also means lower demand for natural gas, oil, and other energy sources, which are in short supply. Countries can choose nuclear energy over skyrocketing prices, rationing, and widespread industrial and social disaster, and they seem ready to make said choice. France plans to restart all nuclear reactors by winters. Japan is doing the same, and plans to develop and build new reactors as well. Even Germany, one of the most strident anti-nuclear countries right now, plans to delay its nuclear phaseout for a couple of years.

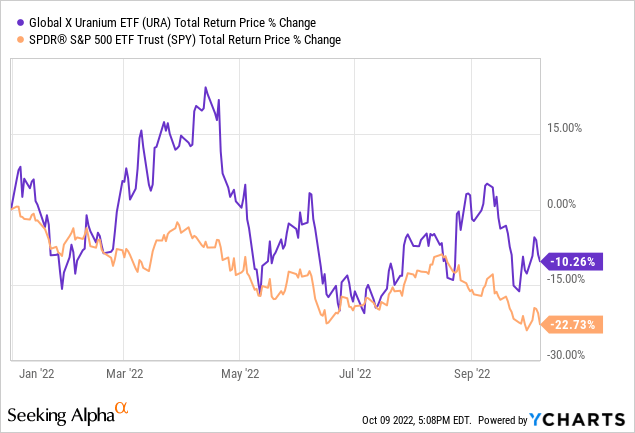

Increased nuclear energy production means increased uranium demand and prices, which should ultimately lead to higher share prices for URA, and capital gains for its shareholders. The entire process could take decades, nuclear reactors are not easy or quick to build, but the effects of said process could materialize soon, contingent on investor sentiment. URA itself has significantly outperformed YTD, as investors reassess the value of uranium miners in the wake of recent events. On the other hand, URA’s performance is quite volatile, so outperformance will not necessarily last. I think the graph below explains the situation much better than I could.

In any case, insofar as nuclear energy continues to experience strong growth, uranium miners should significantly outperform. Simple, yet potent, investment thesis.

URA – Bear Case

URA’s investment thesis is quite simple, but so is the fund’s bear case.

URA’s returns and capital gains are dependent on the continued existence and growth of the global nuclear energy industry, one of the most feared, even loathed, industries in existence. Civilians fear nuclear due to the (perceived) risk of nuclear meltdowns. Governments prefer renewable energy, or to outsource energy production (out of sight, out of mind). Environmentalists oppose nuclear due to safety concerns, and due to a preference for renewables. These issues have caused nuclear to stagnate for more than two decades, and to experience below-average growth for decades prior to that.

Sentiment around nuclear energy has markedly improved as of late, but sentiment could just as easily reverse itself. Nuclear meltdowns remain a (perceived) risk, environmentalists mostly continue to oppose nuclear, and governments remain committed to renewables. Sentiment around nuclear has mostly improved due to the ongoing energy crisis. Once said crisis is resolved, sentiment could turn negative once again, and nuclear energy could stagnate once more.

Importantly, the issues above are almost entirely political, and so are not necessarily amenable to material realities or circumstances. Nuclear is a safe and clean energy source, but it has been a safe and clean energy source for decades. That didn’t stop governments and civil society groups from effectively freezing the industry before, and it might not necessarily stop them in the future. As mentioned previously, the ongoing energy crisis serves to bolster the nuclear energy industry, and more or less prevents a shutdown of the same. Once the crisis is resolved, however, the industry might be targeted once again.

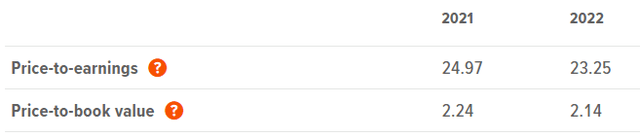

The issues above are particularly important considering URA’s valuation. The fund trades at a premium relative to broader U.S. equity indexes, with a PE ratio of 23.3x, quite a bit higher than the S&P 500’s 19.8x metric. URA’s 2.1x PB ratio is quite a bit a lower than the 3.7x of the S&P 500, but that is mostly due to the fund focusing on industrials with heavy CAPEX and investment. In any case, URA’s valuation means returns are strongly dependent on future growth. Returns should lag if growth stagnates, a distinct possibility.

As the risks above are almost entirely political in nature, they are very difficult to forecast or analyze. In my opinion, the fundamentals clearly point towards further nuclear energy growth, but governments could simply choose to ignore the fundamentals, and focus on public sentiment and environmentalist groups instead. Due to the difficulties in forecasting issues political in nature, I’m rating the fund a hold. There is a very clear, strong investment thesis here, but I’m simply not certain that it will come to pass. Although this is something of a cop out, would like to add that the current market downturn presents a buying opportunity in many different funds or investments, so there is value in a hold rating.

As an aside, I lean towards the bear case. The push towards renewables is very strong, especially in younger generations. Improved nuclear sentiment seems like a short-term phenomenon, and should dissipate once the energy crisis abates. Still, could very much be proven wrong in the coming years.

Conclusion

URA is a simple uranium index ETF, which could see strong capital gains and market-beating returns if the nuclear energy industry expands. Said expansion is ultimately dependent on governments, with all the political issues and risks that entails. As I’m not confident that the nuclear energy industry will see sustained growth moving forward, I rate the fund a hold.

Be the first to comment