avdyachenko

Our readers know that we have been big fans of various media companies, especially those which are addressing leverage, finding new avenues for growth and exploring ways to reward shareholders. Whether it is a legacy diversified media company, local television owner or terrestrial radio, if the story is good and management is delivering on promises, we want to be involved. With the tailwind of political spending this year, and the potential for an early start and large spend in 2024, along with advertisers returning to the airwaves now that supply chains are correcting, we think that any economic slowdown will be somewhat blunted as those revenues find their way into the advertising ecosystem.

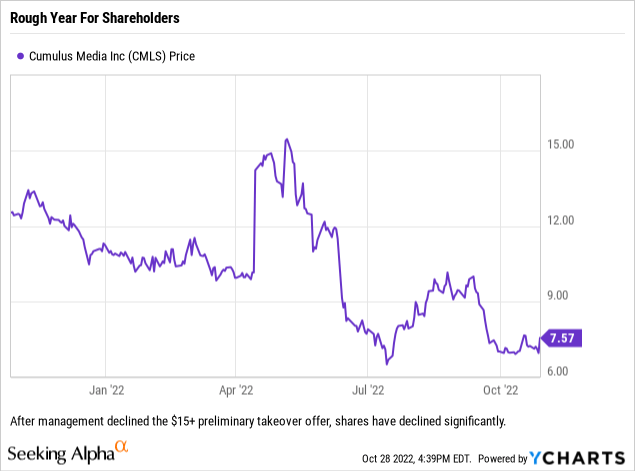

One of the names that we have found most intriguing over the last few years has been Cumulus Media (NASDAQ:CMLS), which reported earnings this morning. We have been waiting anxiously for this report because we thought that the company would report on a particular item we have noticed over the last month or two which we view as a potential gamechanger to the company’s story, and we were not disappointed.

So How Were Earnings?

‘Boring’ might be the best word to describe the current quarter’s results – and that is not a bad thing. While many ad-based businesses have reported soft demand and customers shifting purchases, Cumulus was able to keep revenues relatively stable with a decline of only 2%; news which was offset by the fact that the company was able to increase EBITDA by 2% due to expanding margins. The rest of the news, from a high-level, is exactly what you would expect to hear from this management team, and the results are what we have come to expect on execution as well.

Two items we found a little troubling, but to be expected in this economic climate, were the slow (and we mean really slow) return of auto dealers to the airwaves and the company adjusting full-year EBITDA guidance from the previous range of $175 million to $200 million to a new range of $160 million to $170 million. The auto segment is still down 40% year-over-year, which is up from being down 50% year-over-year, but with the ads we are seeing on television and online, we thought that this rebound might be a little more pronounced by now (especially considering that the lots across our state are also filling up with inventory).

With EBITDA guidance falling, management also indicated that they would miss their net leverage target of 3.5x for year-end. They will come in slightly above it, but reiterated that their target of being below 3.5x remains unchanged right now.

Any Bright Spots?

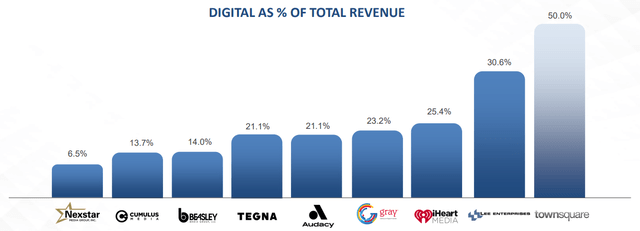

Cumulus continues its transition into a modern entertainment company, with digital revenues continuing to grow. For the quarter, digital revenues (which consist of streaming, podcasting and digital marketing services) grew 5%, with podcasting revenue down 4%, streaming revenue growing 11% and digital marketing growing 12%, even as advertising overall was under pressure. Digital revenues now make up 15% of the company’s total revenues.

Cumulus also repurchased $3.9 million of shares via their share repurchase program and retired $2.7 million of their senior notes at a discount. The retirement of debt so far this year, which totals over $65 million year-to-date, will save Cumulus roughly $3.5 million per year in interest expense.

What To Watch Moving Forward

While it would be easy to say look for a dividend to be implemented, M&A activity, debt paydown, or any number of other items, we are most excited about Cumulus’s new product, Cumulus Boost, which was launched earlier this year. We have been hearing commercials for it locally and are really excited about the potential here as it is an extension that could see significant revenue growth that delivers high margins as well. Cumulus Boost is essentially the same product offering that Townsquare Media (TSQ) has been selling to customers for years, and part of the reasons they can justify buying some of the small market stations in their portfolio.

Cumulus Boost should be able to grow quickly via Cumulus’s current customer list, and in the future make those clients more loyal as Cumulus will be running their web presence. Most importantly, it will diversify the parent company’s revenue streams, delivering relatively stable, predictable subscription revenue that will further help to stabilize the business during economic downturns. Another added benefit is that the margins should be as good, or better, than the terrestrial radio business which could benefit the company in two ways; first, high margin organic growth will be back on the table for investors and second, as the historical terrestrial radio business shrinks the growth from Cumulus Boost will be able to fill that almost on a dollar-for-dollar basis.

This chart is from Townsquare’s last quarter, and Cumulus is now at 15% of total revenue being digital. Cumulus trails its peers, but they have plenty of room to grow with future growth delivering higher margins. (Townsquare Media)

We are going to do some more digging on the Cumulus Boost news for a future article, but our initial thoughts are that this could be a $100 million to $300 million revenue business in a few years’ time. For perspective, Townsquare Media’s equivalent offering does roughly $87 million in revenues and generates about $25 million in adjusted operating income. Townsquare is in much smaller markets, so one would think that Cumulus would have an opportunity to add significantly more revenue per market (even with more competition) when starting out. Lastly, we think that the total addressable market might be multiple times larger than management has initially indicated (depending on the direction in which they take the business and how they market and target customers).

Our Takeaways

We were a bit worried about this quarter’s ad sales and how much of a hit the business might take from the current economic environment, but came away pleasantly surprised by the results even though some items came in worse than we anticipated. We think that management’s focus on cutting expenses, deleveraging the balance sheet and capital allocation have positioned the company in the pole position for any industry consolidation on the horizon, but we do believe that this quarter might mark a major pivot in their strategy. In short, our major takeaway from the conference call, although it was not said or alluded to, was that the management team is shifting from pulling financial levers to move the current business forward, to focusing on adding new business lines to move the company forward. That is good news for shareholders as it could enable for serious value creation.

We continue to believe that the shares are undervalued and that management has opened the door for growth (revenue and profit) and potentially created a scenario where the market places a higher multiple on Cumulus shares due to the new avenue for growth.

Be the first to comment