We Are/DigitalVision via Getty Images

Advertising, marketing, and other related activities can be rather complex and expensive. Because these functions rarely relate to the core products or services that any particular business might produce and sell, one popular option is to outsource that work to a company that is more experienced and that focuses on such offerings. A sizable player in the space is a firm called Omnicom Group (NYSE:OMC). Over the past several years, fundamental performance for the company has been a bit mixed. Having said that, cash flows have mostly been robust and shares of the company are trading at rather cheap levels.

All things considered, the firm likely does offer some decent upside potential for long-term, value-oriented investors. However, that picture can change at a moment’s notice. Because of this, investors would be wise to keep a close eye on important developments for the enterprise. And perhaps the best time to do so would be when the business reports financial performance covering the first quarter of its 2022 results. Currently scheduled to take place on April 19th after the market closes, analysts expect fundamental performance at the company to worsen slightly year over year. Should management surprise in a positive way, the low share price of the business could offer attractive upside in the near term. And even if management does miss expectations, shares are priced cheap enough today that anything other than a large miss might not impact shareholders all that much.

A Major Play On advertising

According to the management team at Omnicom Group, the company provides advertising, marketing, and corporate communications services to its clients. It accomplishes this through its branded networks and agencies that dot the globe. Services provided by the company’s network include advertising functions, precision marketing, commerce and brand consulting, experiential, execution and support, public relations, and healthcare. It’s worth digging a bit deeper into these individual activities. For instance, the company’s advertising functions include creative services across digital and traditional media. It also includes things like strategic media planning and buying, as well as data analytics services.

The company’s precision marketing activities involve both digital and direct marketing and other similar functions. Its commerce and brand consulting services involve brand consulting, strategy, research, and more. On the experiential side, the company works with live and digital events. Execution and support activities involve field marketing, sales support, and both digital and physical merchandising and point of sale activities. On the public relations side, the company helps to facilitate corporate communications, offers crisis management solutions, and to provide media relations services. Meanwhile, its healthcare operations include advertising and media services aimed specifically at its global healthcare and pharmaceutical clients. Operationally, the company is quite large. It has operations all across the globe, but the Americas is still its main area of focus. During its 2021 fiscal year, that region accounted for 56% of the firm’s overall revenue. By comparison, the EMEA (Europe, Middle East, and Africa) segment made up 31.4% of sales, while the Asia Pacific region accounted for the remaining 12.6% of sales.

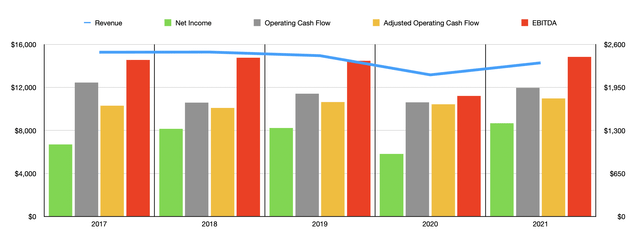

As one might expect, the fundamental performance achieved by the company has been rather mixed in recent years. The COVID-19 pandemic threw a wrench in the plans of many companies involved in advertising and marketing. But it would be a mistake to say that the 2020 fiscal year was the only year in which the company saw volatility. After seeing revenue rise from $15.27 billion in 2017 to $15.29 billion in 2018, it then dropped to $14.95 billion in 2019. The drop in 2020 was even larger, with sales dropping to $13.17 billion before rebounding some to $14.29 billion last year.

From a profitability perspective, the picture has been a little more consistent. Net income rose consistently between 2017 and 2019, climbing from $1.09 billion to $1.34 billion. The company then saw its profits plunge to $945.4 million in 2020 before rebounding in 2021 to $1.41 billion. Another profitability metric for investors to look at is operating cash flow. This has been more volatile, ranging from a low point of $1.72 billion in 2018 to a high point of $2.02 billion just one year earlier than that. In 2021, this metric came in at $1.95 billion, representing the second-best year for the business of the past five. If we adjust for changes in working capital, the range for the company has been narrower, ranging from a low point of $1.64 billion to $1.79 billion. That high point reading came in 2021. Meanwhile, EBITDA for the company has been fairly consistent. Excluding 2020 when the company saw this metric drop to $1.82 billion, EBITDA ranged from a low point of $2.35 billion to a high point of $2.41 billion. Just as was the case with adjusted operating cash flow, the 2021 fiscal year marked the high point for the company.

When the company reports financial results for the first quarter of its 2022 fiscal year on April 19th, after the market opens, investors will have a fresh look at the company’s fundamental performance. Although the 2021 fiscal year proved to be solid for the business, analysts are anticipating a slight worsening year over year. At present, they see revenue coming in at $3.29 billion. That’s down modestly from the $3.43 billion generated one year earlier. Meanwhile, earnings per share are forecasted at $1.30. That stacks up against the $1.33 per share the company generated in the first quarter of 2021. In absolute dollar terms, this translates to net profits of $271.7 million. That’s down from the $287.8 million the company reported one year earlier.

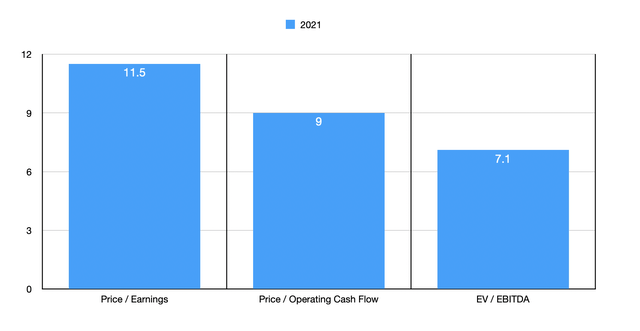

When it comes to pricing the company, shares look to be rather cheap at this point in time. On a price-to-earnings basis, using the company’s 2021 results, the firm is trading at a multiple of 11.5. The price to operating cash flow approach gives us a reading of 9. And the EV to EBITDA multiple for the company is 7.1. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 14.4 to a high of 144.7. Our prospect was the cheapest of the group. Using the price to operating cash flow approach, the ranges from 4.8 to 27.8. In this case, three of the five companies were cheaper than Omnicom Group. And using the EV to EBITDA approach, the range was from 5.9 to 42.8. Here, two of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Omnicom Group | 11.5 | 9.0 | 7.1 |

| Publicis Groupe S.A. (OTCQX:PUBGY) | 16.3 | 4.8 | 5.9 |

| WPP plc (WPP) | 17.7 | 5.6 | 6.6 |

| The Interpublic Group of Companies (IPG) | 14.4 | 6.6 | 7.9 |

| TechTarget (TTGT) | 144.7 | 27.8 | 42.8 |

| Advantage Solutions (ADV) | 36.4 | 15.6 | 8.4 |

Takeaway

The data presented today shows me a company that, on the whole, is a solid operator with attractive cash flows. Shares of the company are cheap on an absolute basis and between fairly priced and cheap on a relative basis. Analysts are anticipating a slight worsening in this upcoming quarterly release, but some volatility for a business like this is not shocking given its operating history. Though I don’t think the enterprise will result in tremendous upside over an extended period of time, I do think that shares are priced low enough that they might warrant some consideration right now.

Be the first to comment