AndreyPopov/iStock via Getty Images

Introduction

After fighting against a downturn for years, 2021 finally provided relief to the once struggling bulk carrier shipping company, Grindrod Shipping (NASDAQ:GRIN) who also initiated their first-ever dividends that if continued, would provide a very high 11.62% yield. Whilst their peers have also enjoyed this same good fortune, they see a new era putting an end to years of struggling that stands to make their shares more attractive for investors.

Executive Summary & Ratings

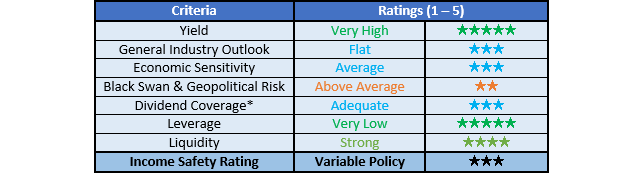

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

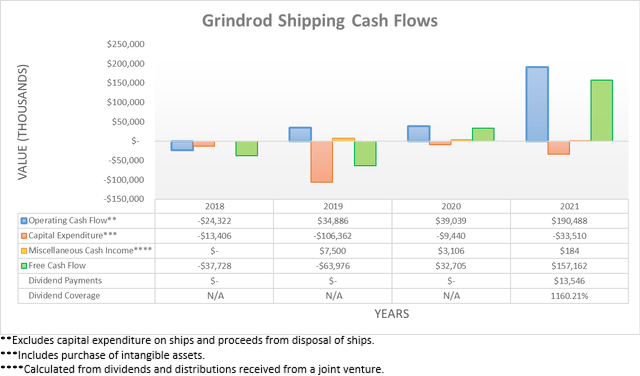

After enduring a painfully long downturn following the China-driven commodity boom that ended way back in 2012, thankfully 2021 provided relief with them no longer struggling and even initiating their first-ever dividends. Thanks to booming operating conditions, they saw their operating cash flow surge to $190.5m during 2021 versus their results during 2018-2020, which only averaged a mere $16.5m. As a side note regarding their operating cash flow, their financial statements include their capital expenditure and divestitures relating to their ships, which are virtually always considered an investing activity by other companies, not an operating activity. To account for this difference and enhance comparability within my library of analysis, the operating cash flow stated in this article excludes these numbers.

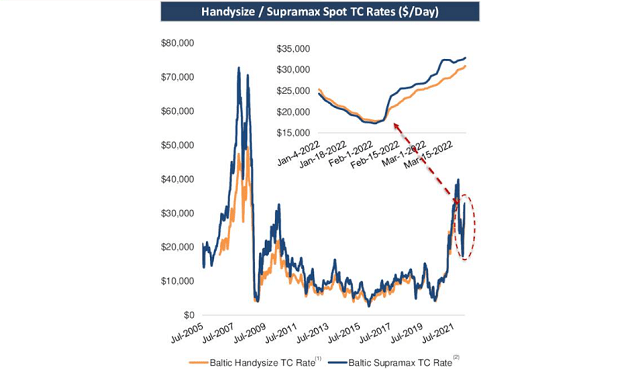

Thanks to their restrained capital expenditure during 2021, they were able to translate most of this operating cash flow into free cash flow, which ended the year at a very impressive $157.2m and thus easily capable of funding their first-ever dividend payment of $13.5m. When looking ahead, they have opted for a variable dividend policy that aims to return circa 30% of their net income, as per slide nine of their Capital Link International Shipping Forum presentation. This will see their dividends ebb and flow with their prevailing operating conditions across the years that whilst inherently volatile, appear to be strengthening once again as 2022 progresses, as the graph included below displays.

Grindrod Shipping Capital Link International Shipping Forum Presentation

It can be seen that 2021 was easily the best year in the last decade with charter rates for bulk carriers surging on the back of the economic recovery from the Covid-19 pandemic and associated commodity boom, not to mention the help from general shipping logistics constraints. Whilst charter rates were starting to revert lower in early 2022, the sanctions against Russia and their mining sector following their invasion of Ukraine have sent rates surging back towards the very strong heights of 2021 as trade routes are upended, as the graph included above displays.

Whether these very strong operating conditions last for the rest of 2022 remains impossible to know for certain given the inherent volatility of the broader shipping industry, especially given the amplified nature following this highly uncertain geopolitical shock. Although the outlook for minimal global bulk carrier fleet growth during 2022 and 2023 provides a supportive backdrop, as per slide eight of their previously linked Capital Link International Shipping Forum presentation. Even though the future is uncertain by nature and thus will likely see a downturn at some point, thankfully this boom sees lasting impacts that promise a new era for this once-struggling company thanks to their variable dividend policy and strategy to continue deleveraging, as per the commentary from management included below.

“As we said, we have fixed our balance sheet and improved liquidity with these strong earnings and obviously we’re going to be, it’s about dividend and capital return policy, we look to return cash to shareholders by way of dividends and share buybacks.”

“So, certainly, we can put our money to work and then of course, we are looking to pay down some debt…”

-Grindrod Shipping Q4 2021 Conference Call.

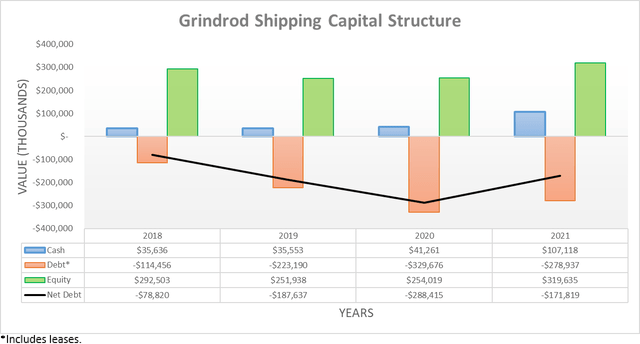

Thanks to their surging cash flow performance, they ended 2021 with net debt of $171.8m and thus down a massive 40.43% year-on-year versus the $288.4m where it ended 2020, thereby finally putting an end to their years of brisk debt growth throughout 2019-2020. This very impressive improvement still occurred despite making a $46.6m acquisition of the now-former non-controlling interest in their IVS Bulk subsidiary, thereby further highlighting the transformational strength offered by 2021. When looking ahead, their variable dividend policy should ensure that the positive outlook for their financial performance translates into even lower net debt by the end of 2022 and likely beyond, unless they make any sizeable acquisitions.

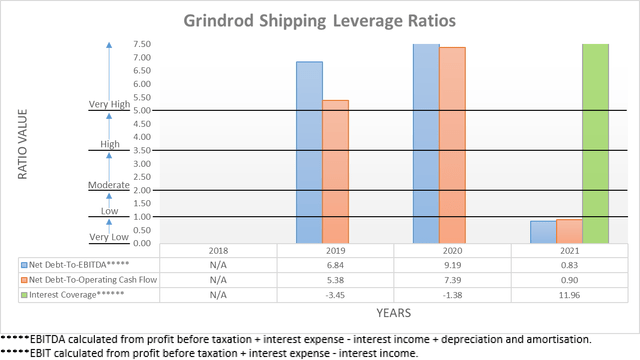

After years of struggling with troublesome leverage, they ended 2021 with their leverage within the very low territory given their net debt-to-EBITDA and net debt-to-operating cash flow of 0.83 and 0.90 respectively. This marks a world of difference versus their previous results of 9.19 and 7.39 respectively, which were so far above the threshold of 5.01 for the very high territory that they were effectively off the charts. Following this day and night difference thanks to the powerful combination of stronger financial performance and lower net debt, their financial position no longer threatens their ability to remain a going concern.

Even more importantly and crucial to this article, since their already significantly reduced net debt should be reduced even further during 2022, they see their company enter a new and far more resilient era than previously. Due to the inherent volatility of the broader shipping industry, it would not be surprising to see a downturn in the future, quite possibly a severe one and thus if not for their now lower net debt, their leverage would shoot right back to dangerous levels and they would be struggling once again.

Thankfully management opted for a longer-term strategy by reducing their net debt and thus even if they were to face a downturn in the future, their leverage would no longer be dangerously high and as a result, they could still afford to reward their shareholders, albeit to a lesser extent, thereby decreasing risks and helping support their share price. Alternatively, if they were to instead opt to utilize their strong cash flow performance to fund acquisitions or ramp up capital expenditure to build new vessels, these should still theoretically help in a comparable manner by lifting the earnings and thus provide higher earnings to support their net debt, thereby permanently lowering their leverage for any given operating conditions.

This stands in contrast to some of their peers, such as Star Bulk Carriers (SBLK), who as discussed within my other article, have instead opted for higher short-term shareholder returns. Whilst these have seen massive 20%+ dividend yields for their shareholders to enjoy, they also risk once again being left overleveraged once this boom ends and rough seas emerge, metaphorically speaking, which as a result, would see them struggling when longer-term focused companies, such as Grindrod Shipping are still enjoying far easier sailing.

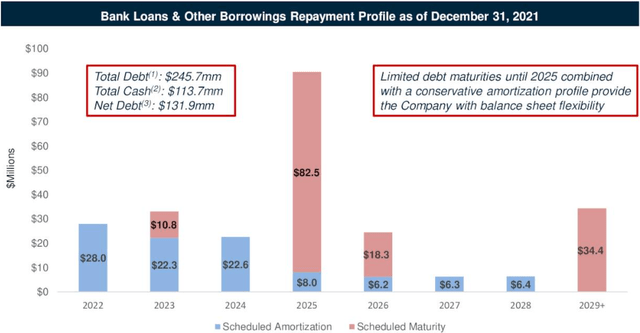

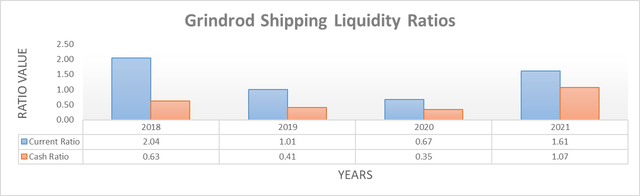

Apart from reducing their leverage, their surging free cash flow also helped boost their liquidity with their current and cash ratios both increasing to end 2021 at 1.61 and 1.07 respectively, thereby noticeably higher than their previous results of 0.67 and 0.35 respectively at the end of 2020. Since they opt for a variable dividend policy, this should ensure their liquidity remains strong and ready to navigate any future downturns that their volatile industry may face, plus if required, they also have six credit facilities that in aggregate have a further $158.9m of availability to help support their liquidity. Whilst they see a wave of debt maturities throughout 2022-2024, as the graph included below displays, these total $83.7m and thus can still be repaid from their current cash balance of $107.1m and thus pose no risks with there still being ample time to address their much larger maturity during 2025.

Grindrod Shipping Capital Link International Shipping Forum Presentation

Conclusion

Even though their dividends will continue fluctuating with the prevailing operating conditions, their now healthier financial position will provide long-term benefits that are tantamount to a new era that puts an end to their years of struggling. Thanks to their strategy to deleverage, they can enjoy higher resilience in the future, which is especially important in their inherently volatile industry, thereby lowering risks and by extension, making their shares more attractive for any given operating conditions and thus as a result, I believe that a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Grindrod Shipping’s SEC filings, all calculated figures were performed by the author.

Be the first to comment