Ines Fraile/iStock via Getty Images

Introductions

The brand all the moms in the late nineties and aughts were pushing, Tupperware Brands Corporation (NYSE:TUP), has dwindled as a business this decade. Over the last few years, the business has struggled to gain any growth. But with a new CEO and turnaround plan, the company hopes to change this. So far in the middle of 2022, it seems there is yet to be any turnaround happening. The same downtrend has persisted, and I believe will continue to. At the current price level and with such poor performance in prior years, I am now a buyer of this stock.

Past Financials

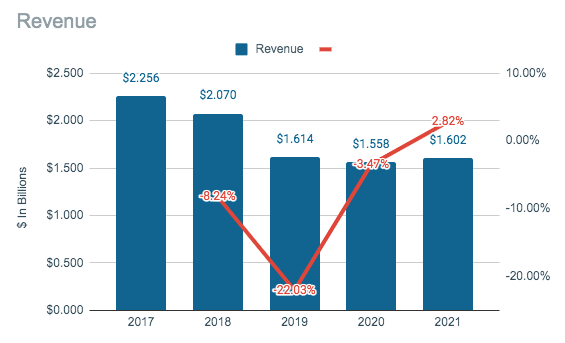

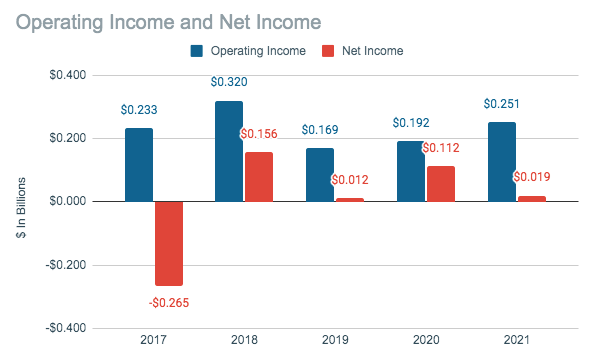

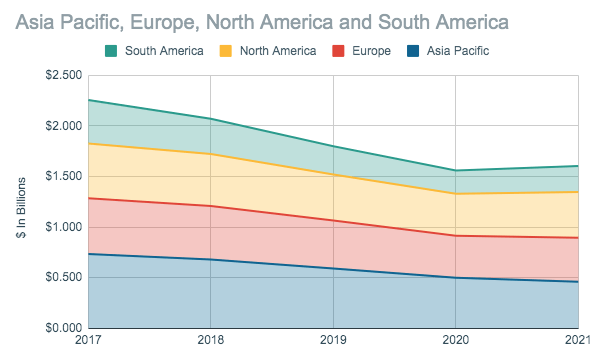

Tupperware Revenue (SEC.gov) Tupperware Operating & Net Income (SEC.gov) Tupperware Revenue By Segment (SEC.gov)

The above charts show Tupperware Brands has struggled with growth over the last five years. The company saw revenue decline by 7.09% per year since 2017. The operating income and net income have been unstable throughout this period. Likewise, each operating segment has seen significant drop-offs from 2017. Asia Pacific has declined by 9.73% per year, Europe 4.85%, North America 3.74%, and South America 10.88%. Overall, the company has struggled to generate sales.

Turnaround Plan

But in 2021, Tupperware Brands enacted a three-year turnaround plan to generate new growth and bolster liquidity. The plan consists of three goals: to sell non-core assets to improve liquidity; restructure debts; and fix core business to improve sustainability. The plan for fixing growth is to shift from a distributor push to a consumer pull model while expanding into new channels and products. It remains to be seen if this can be a successful plan to regain growth.

This Year So Far

But we have two quarters of 2022 to see how the company is reacting to this turnaround plan. And it seems it hasn’t done much for the company yet. Revenue for the midyear is down 17% when compared to last year. Asia Pacific declined 18%, Europe declined 31%, North America was down 14%, but South America increased by 6%. For the most part, the sales were down due to a lower sales active sales force in each region. Operating income took a dive, decreasing by 72%, and Tupperware Brands posted just $1 million in net income. Overall, the turnaround plan hasn’t worked in producing growth so far, and it will remain to be seen if it can.

Balance Sheet

Another key part of the growth plan is increasing liquidity in the balance sheet. As of the most recent quarter, Tupperware Brands has a current and quick ratio of 1.32x and 0.70x each. This is actually a very healthy liquidity position. The company is made up of all debt, with total liabilities of $1.265 billion and equity of -$0.159 million. The turnaround plan states the company wants to restructure debt, which is fine, but the real focus should be deleveraging the balance sheet. Overall, the company is doing well on the balance sheet portions of the turnaround plan, but the growth of the business will be instrumental in creating a health company.

Valuation

As of writing, Tupperware Brands trades around a price of $12 per share. At this price level, the business has a P/E of 7.8x using the estimated 2022 EPS of $1.53. I am skeptical this estimate can be met as the company has only posted 2 cents worth of EPS so far. I believe in the turnaround plan the stock is about fairly valued, I for one have doubts the plan will have much effect on the company long-term.

Conclusion

Tupperware Brands has really struggled to generate growth over the past five years. To change this the company hired a new CEO and implemented a three-year turnaround plan. Since this plan has been enacted, a half year has passed with no change in the trends. At the midyear, Tupperware Brands has posted just 2 cents of EPS, thus I think it’ll be unlikely the company reaches the EPS estimate. At the current price level and with the company’s continued poor results, I am staying away from this stock.

Be the first to comment