hrui

Dear readers/followers,

In this article, we will take a look at TransAlta Renewables (OTCPK:TRSWF), the daughter company of TransAlta (TAC), a Canadian giant. We’ll establish a base thesis for this company and a solid price target for the business for the long term.

Let’s get going.

TransAlta Renewables – What the company is and does.

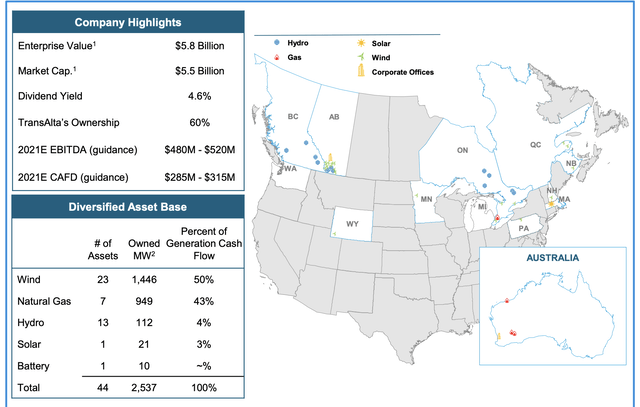

TransAlta Renewables is a business with a close to $6B enterprise value. It’s a monthly payor of dividends that currently yields around 6.6%. The company has a native listing in CA under the RNW ticker, and a US ADR ticker. As usual, when I invest, I prefer the native ticker investing which gives me the stick in Canadian dollars. The current market capitalization of the company is around $3.8B.

The company’s business is the ownership and management of a diversified renewable asset base – as the name would suggest, currently consisting of Wind, Solar, Natgas, hydro, and battery farms.

TransAlta Renewables IR (TransAlta Renewables IR)

This asset base is found in NA and Australia, respectively. It has 47 facilities across multiple regions. The portfolio is highly contracted, with a 12-average weighted contract life. It has a superbly strong balance sheet with below 2x net debt/EBITDA, uses leverage strategically for low-cost project debt, and has a long track record of proven value creation, with $3.4B of M&A’s since its 2013 IPO. The company is well-managed with good expertise in its C-suite, and has productive partnerships with market leaders in most of its segments.

TransAlta Renewables is Canada’s largest generator of wind power, and owns one of the largest wind power portfolios in all of North America, generating close to 1500 MW.

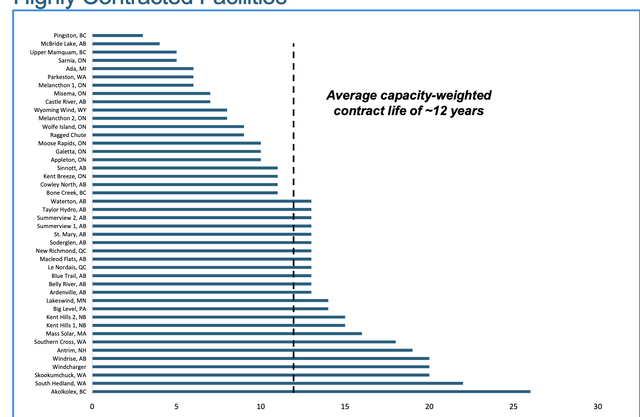

Here are some of the impressive contract lengths of its portfolio.

TransAlta Renewables IR (TransAlta Renewables IR)

The company has managed to significantly increase its available cash for distribution over the past few years. In 2014, this was $82M – today it’s closer to over $300M, while showcasing an attractive though not thesis-breaking 3% annual CAGR in dividends.

TransAlta Renewables has always been a very attractive, monthly-paying play on renewables in NA and Australia. It offers a paycheck. One of the more common concerns is whether you should buy the daughter or the parent company, in this case TransAlta. My answer to that question is that it depends.

At times, the TransAlta ticker is by far the more appealing investment due to potential buybacks. At other times, this company’s valuation gets pressured so much that it’s actually better or equally appealing to buy the RNW ticker. The logic is simple – if investing in TAC, you get a lot more diversification and non-renewables in your basket – while doing the other obviously concentrates you a bit, which may be good in some scenarios, but not in others.

The simple fact is, I’ve been very hot on utilities this year and successfully so. I’ve made significant money with Fortum (OTCPK:FOJCF). I’ve invested in E.ON (OTCPK:EONGY). I’ve pushed money into Enel (OTCPK:ENLAY), and I’ve also pushed money into US utilities and Canadian alternatives – but I’ve stayed away, for now, from TransAlta Renewables for the most part. I bought a small position when the company broke through my warning barrier of $13/share briefly, but I don’t yet have a big position.

The reasoning here is that the company has been overvalued for quite some time, as I’ve seen it. The same has been true for the parent – and I’ve stayed mostly out of that one too.

Until now, this has proven to be the right choice. But now things are looking more attractive. Analysts have been beating the drum for both of these companies for some time – most of the year, actually – but I haven’t become interested until now.

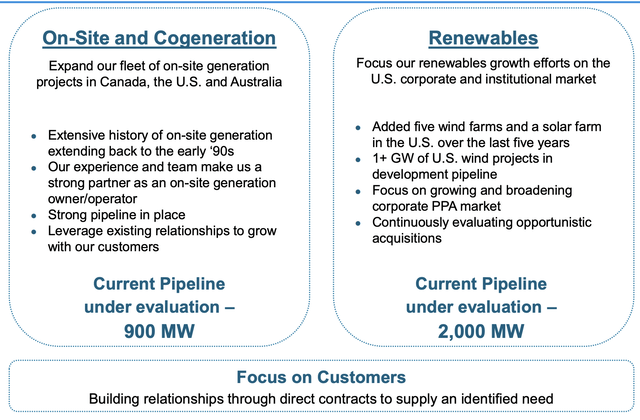

RNW has plenty of drivers for future potential growth. Governmental policies won’t change their positive perspectives on Renewables, carbon pricing, and regulatory changes. RNW is further an excellent competitor due to its access to low-cost gas at an abundant supply, and customers are requiring reliability and cost-effectiveness in a world where few players can offer it cheaply or competitively – RNW and TAC can do so.

The company has a strong pipeline in the works at this time…

…and this pipeline is found not only in Canada, but in USA, Australia, and similar areas. Hundreds of MW are slated to be coming online within the next few years, transforming this company to an even more appealing player in the field.

RNW has had some negative numbers for some time at this point, owing due to lower generation in the first quarter as well as some higher-than-expected repair costs. But short-term issues are really, as I see it, clouding what is a very attractive thesis for a very attractive portfolio of assets in the renewable space.

This company ain’t going anywhere. And while generational instability or volatility together with repair bills and increased funding costs may continue to hound the company’s quarterlies somewhat, we’re now at a stage where I believe the market is severely overestimating the negative side of the thesis for this company.

RNW has always been a play that you do not want to touch whenever it rises above 14-15x P/E. Whenever bought at such levels, returns have been poor. When I bought TransAlta and loaded up during the COVID-19 crash, I ended up selling the company as early 2021 – which proved to be an excellent choice even if the allocation was small, because the company has been mostly on a downward trajectory since that time.

However, I believe the time has come for a turnaround.

TransAlta Renewables Valuation

TransAlta Renewables is a “paycheck business”. What I mean is that its dividend is monthly. I own a few of these paycheck businesses – companies like Realty Income (O), Exchange Income (OTCPK:EIFZF), Agree Realty (ADC), and Pembina Pipeline (PBA). Some are small positions, only a few thousand dollars – others, like O, represent nearly 5% of my total portfolio.

So it’s fair to say I like the model. But at its heart, I like investing in good companies at cheap valuations – and if the valuation isn’t right, no amount of paycheck can convince me.

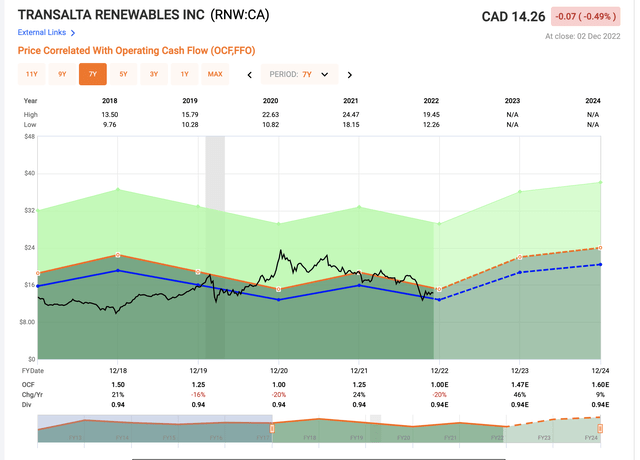

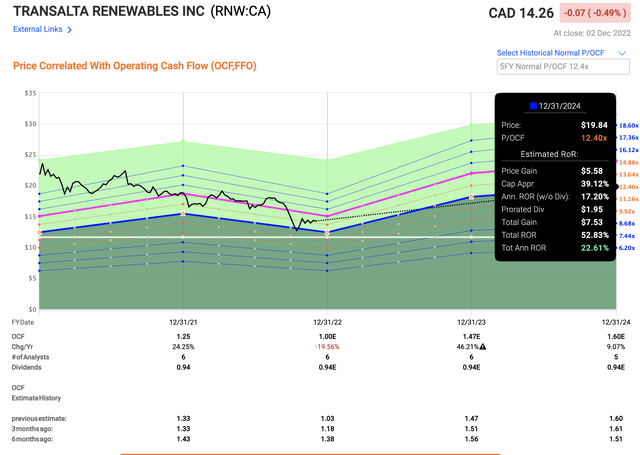

However, a single glance at this may explain some portion to you as to why I now believe this company is starting to look interesting.

TransAlta Renewables Valuation (F.A.S.T. Graphs)

RNW is now trading close to the valuation it was when I bought my last sets of stock. It can go far lower – see how far down it went in 2018 – which is why I’m not “pounding the table” here.

I am saying though that after being on the sidelines for almost 2 years, I’m starting to become quite interested in RNW here again, and may indeed start allocating capital to the stock.

RNW yields a very impressive 6.5%+ yield, paid monthly, which is very well-covered even if it might not grow that far in the near term. Current estimates are for the company’s results to turn around and go to a positive direction in 2023-2024. Likely?

Analyst accuracy from a historical basis would suggest that this is the case. The company either positively beats or hits analysts’ estimates 88% of the time on a 2-year basis with a 10-20% MoE (Source: FactSet) suggesting a decently high degree of confidence in these numbers.

To me, it is enough to shift my previously neutral thesis to the company.

The upside at this juncture is quite simple, as I see it.

RNW for the native ticker typically trades at a 12.5-13x P/FFo discount on a 5-year average basis. It currently trades at around 13.5x normalized. This is still above where we would want it, but this is also heavily impacted by non-recurring costs for this year – again, this is not likely to repeat next year.

Therefore, the upside to a 12.4x 2024E P/FFO is now solidly in the double digits. This was not the case only 2 months ago.

It’s not just F.A.S.T graphs either. 13 S&P Global analysts follow RNW’s ticker, and they give the company a range of $13.5 to $18.5, with an average PT of $16.5, implying a 16% upside at today’s valuations, with 5 of the analysts either at a “BUY” or an “outperform”.

This is a break from how the analysts have felt about the stock for the past 1-2 years – which is close to how I personally view the company’s potential. At current pricing, we’re valuing the company’s portfolio at a NAV of just south of 1x, which is what I like to see when investing in something like this.

There is much to like about RNW and similar companies – provided you don’t make the mistake of buying them at too expensive levels. I believe that at this level, you’re generally safe for the coming years, once the company normalizes and starts generating more money again.

For that reason, I’m finally shifting my thesis on RNW.

Thesis

- RNW is a class-leading renewables operator, that is the daughter of a solid company, namely TransAlta. At times, the parent is the better buy – but now I view TransAlta Renewables, with its monthly “paycheck” and a 6.59% yield to be the better choice, giving the company a double-digit upside until 2024E.

- The company is fundamentally sound, has an attractive pipeline, and is very well-managed.

- I give the company a $16CAD price target for RNW and consider it an appealing “BUY”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills all of my criteria, despite currently lacking a credit rating. However, I view it as safe despite this.

Be the first to comment