Brandon Bell

In this article, I discuss some developments surrounding JET (OTCPK:JTKWY) (OTCPK:TKAYF) and why I think the company will turn cash flow positive in 2023.

iFood disposal

First of all, I want to discuss the iFood disposal. The iFood disposal at €1.5 billion plus €300 million in a contingent has stabilized the company’s balance sheet. Now the company’s net cash position (cash – debt) is around 0. This puts the company in a good position to pursue disposals (Grubhub to Amazon) without any time pressure to refinance the company.

I do continue to believe the iFood disposal was at a too low valuation considering the profitability of the marketplace, the very dominant position of the company and the large unaddressed TAM; as discussed in my iFood article. We will see at what price Prosus will IPO iFood in the coming years, probably multiples of the valuation JET got. Unfortunately, I believe it’s the best decision for the company to sell at this price.

Cash burn

Particularly interesting is that some authors on Seeking Alpha complain about cash burn seven times in an article:

‘However, debt servicing will have to be balanced by the company’s cash burn status – and with the company’s poor track record we do expect to see minimal cash generation for the medium term. ‘

Let me quote some more:

‘It would appear that positive free cash flow generation in FY12/2020 was a one-off. Accounting profit is fiction, but cash is cash, and no amount of restating the numbers will hide the fact that the company remains in a very poor state.’

There are multiple drivers for the decline in cash flow generation from 2020 to 2021:

- The company acquired Grubhub which was cash flow negative due to the imposed fee caps.

- The investment campaign in the UK to compete with Deliveroo (OTCPK:DROOF) and Uber drove EBITDA and so cash flows down significantly.

- The company has invested massively in the Southern Europe segment and particularly Australia to remain competitive. The Southern Europe ANZ segment had an adjusted EBITDA of -€262 million in 2021 against a total of -€350 million adj EBITDA for the entire company. This segment has been without any doubt a huge drag on cash flows.

Cash flow going forward

Just Eat Takeaway has taken significant action to drive profitability and lower cash burn in H2 2022 and it’s showing.

In 2021 the company burned €530 million in cash flow from operations plus capital expenditures (This way I purposely avoid the iFood investments that are irrelevant now). So let’s see what happened since:

During the last weeks, the NYC council proposed legislation that will amend the NYC delivery fee cap. For context, all US imposed fee caps had a negative impact on adj EBITDA of €158 million in 2021, and management stated that the NYC fee cap is a big portion of the US feecap:

‘Obviously, a lot of the business of Grubhub is in New York, so you can also assume that that’s quite a significant part of the fee caps’ ~Jitse Groen

Previously fee caps in places like San Francisco were already removed. It is quite likely the fee cap will be released in NYC, considering legislation to do so has been proposed. If so this will lower cash burn going forward by €150 million easily. In previous articles, I highlighted the fact that it is highly likely fee caps are unconstitutional (for example considering interstate commerce rules) and so unsustainable.

Management is guiding for adjusted EBITDA profitability in H2 2022 and 2023 due to increased consumer fees, increased commission rates, efficiencies in marketing, and other logistical efficiencies. So the previously discussed NYC fee cap is not taken into account, that is just an extra upside. One big driver of margin expansion is that JET has raised commission rates in some European markets showcasing it acknowledges it has significant market power; a couple of months later Deliveroo announced they were going to leave the Netherlands, clearly, they agree. The total sum of adjusted EBITDA in 2021 was – €362 million. So going forward that adj EBITDA is probably positive.

Cash flow positive

If we sum that all up I get €512 million, which is nearly the annual cash burn from 2021. As the company is growing slower; I expect capital expenditures to decrease too. Additionally, the company is guiding for positive adj EBITDA without fee caps and I am assuming 0 adj EBITDA so there is more upside there. Conclusion: from now on I expect very little cash burn. On the contrary going into 2023, it is very very likely the company will be a cash flow generator! Further actions like disposals in Australia or Southern Europe, or not organizing expensive ski trips, can further increase cash flow generation going forward. Particularly Australia is rumoured to be a huge cash burner.

JET compared to DoorDash and Uber has significantly lower SBC expenses relative to its size; stock-based compensation expenses create artificial cash flows. How can JET have a significantly shorter and more reliable path to true cash flow generation than its US-based competition while selling at a huge discount? The company’s marketplace profitability has been hidden by loss-making logistics investments. Now the name of the game is profitability instead of growth; management can easily accomplish this by decreasing losses in logistics. An example of how profitable marketplace is: in 2017 Grubhub had $142 million in hard real EBITDA on $683 million in revenues. Or look at JET’s financials before the Just Eat and Grubhub acquisition. Or consider iFood in 2018(15% real EBITDA margin).

Also, the profitable Northern Europe segment with an amazing marketplace (restaurants deliver themselves) and strong market position continues to carry the company forward. As it lowers investments in other regions like Southern Europe and the UK, the Northern Europe segment will impact the results more and more. This segment is a huge value driver as can be seen by its adj EBITDA of €256 million in 2021.

Grubhub

Next up I believe most likely is a Grubhub disposal to Amazon (AMZN) or another suitor like Uber (UBER), Walmart (WMT) or Instacart (ICART). Read my previous article on why Amazon partnered with Grubhub. Grubhub is particularly competitive in some regions like New York. The proposed minimum pay to food delivery workers in New York will only grow the value and moatedness of Grubhub’s valuable marketplace (restaurants deliver themselves). Why? logistics becomes less economical while marketplace deliveries become even more price competitive. Dollar to euro strength is another positive here. I think the market may be in for a surprise on the value of this operation…

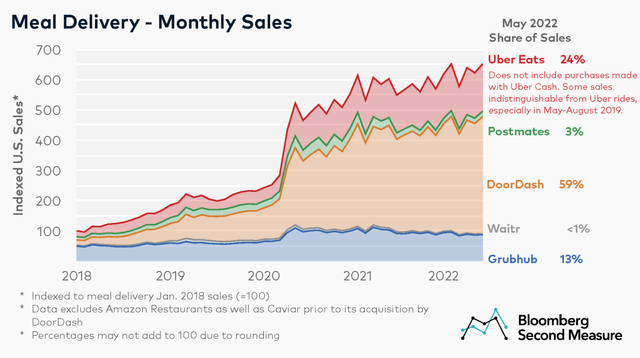

second measure (second measure)

Takeaway

Just Eat Takeaway continues to operate valuable food delivery platforms and is set to turn adjusted EBITDA positive from now and probably cash flow positive in 2023. Add to this the healthy balance sheet, it is clear the company has the flexibility to decide on the best course of action with the Grubhub asset. JET continues to be undervalued on a sum-of-parts basis considering its valuable Northern Europe segment where it operates dominant hybrid food delivery platforms, but also considering other operations like Canada and the UK. Management knows the game has changed: it is no longer about growth but about profitability; I expect the coming years further developments to drive cash flow growth. The underlying strength and profitability of the marketplaces put JET in a prime position to accomplish this.

Be the first to comment