xijian/E+ via Getty Images

Investors looking to find a safe refuge for their hard earned capital while still investing in the historically volatile renewable energy space should consider Brookfield Renewable (NYSE:BEP). Their solid Q2 2022 results, massive addressable market, growing dividend and asset portfolio, and inflation resistant funds from operations growth make them my favorite renewable energy company to invest in today.

Why Invest In Renewable Energy?

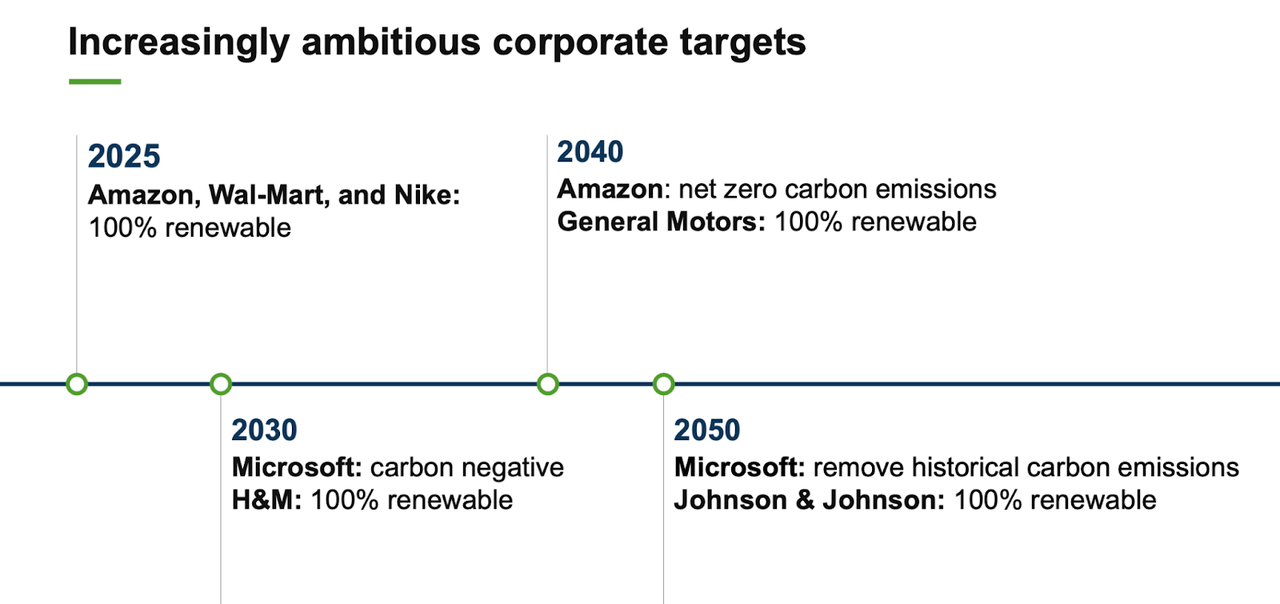

Tailwinds for the renewable energy sector continue to accelerate as energy generation costs decline and companies and countries alike set ambitious, actionable decarbonization commitments backed by policy. In fact, in the next 8 years the United States is committed to reducing its carbon footprint by 50-52% from 2005 levels. Moreover, United States’ electricity consumption is projected to increase 80% by 2050, more than 90% of which will be renewably generated. In addition, Amazon (AMZN), the largest global corporate procurer of green power, hopes to achieve carbon neutrality by 2040. I believe more countries and companies will follow suit, creating a massive total addressable market for the best-in-class renewable energy yield company: Brookfield Renewable.

Brookfield Renewable

Investing In A Historically Volatile Sector

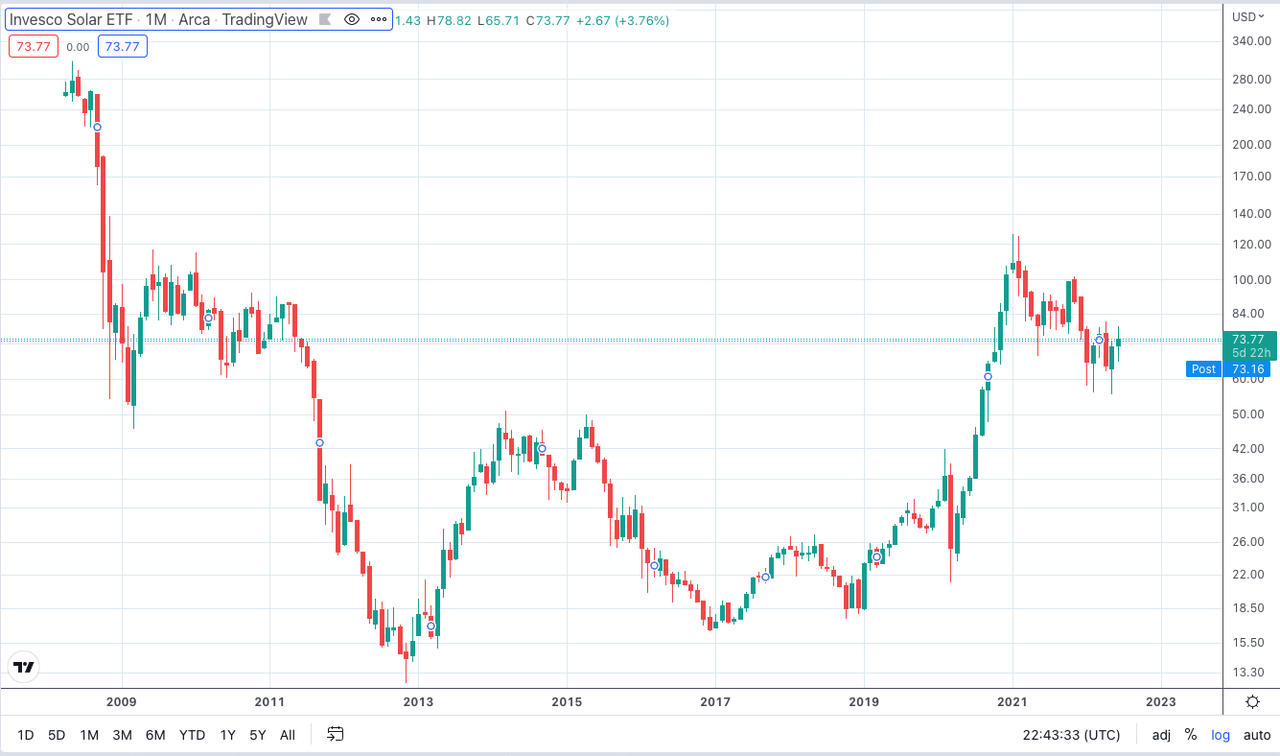

With an already massive total addressable market that will only grow larger in the coming decades, it can be tempting to think there will be nothing but clear skies ahead for clean energy investors. However, a glance in the rear view mirror would say quite the opposite. In the past two decades the renewable energy space has been filled with volatile boom and bust cycles. Euphoric highs have been followed by cascading capitulations and drawn out lows. Below is a chart of the Invesco Solar ETF (TAN). From May 2008 to November 2012, this ETF declined by a whopping 95.85%. Even after the 14 years, the current price is still down 76.28% from the 2008 highs.

TAN ETF (TradingView)

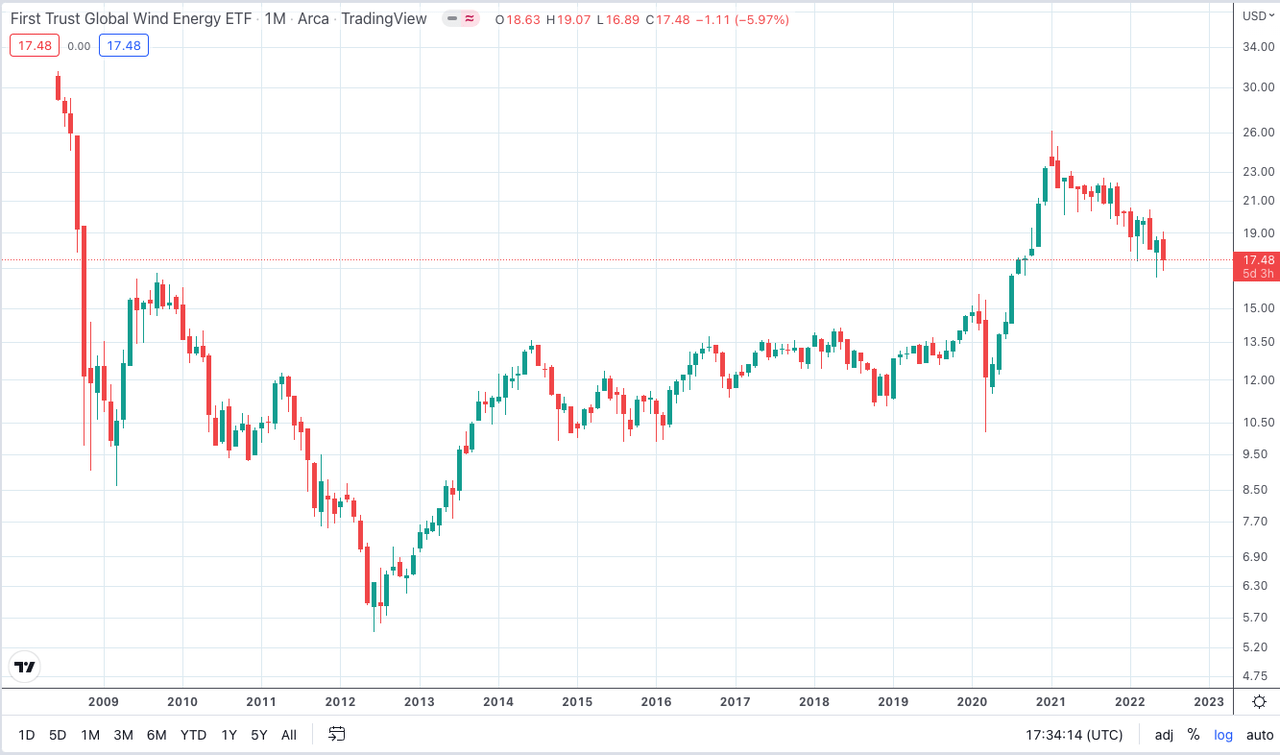

The First Trust Global Wind Energy ETF (FAN) has a very similar boom and bust pattern. To say the renewable energy space has been volatile is a gross understatement. Investors have lost billions.

FAN ETF (TradingView)

All that being said, investors might wonder why they should even consider the renewable energy space when two of the most popular thematic renewable energy ETFs have performed so poorly. Well, when diving into these ETFs, it is clear they are weighted fairly heavily towards manufacturing companies like First Solar (FSLR) or, at the time, overhyped consumer facing companies like SunPower (SPWR). Their products became commoditized and suffered from a lack of pricing power via margin compression and competition.

The decades long dismal performance of the TAN and FAN have forced me to consider lower-risk, cash generating clean energy investments like Brookfield Renewable. By investing in BEP, I believe I am doing a great service to both the planet and my portfolio while avoiding the stress of higher risk, more volatile manufacturing and consumer facing renewable energy companies.

High Risk Adjusted Returns

My favorite renewable energy yield company is the leading clean energy supermajor Brookfield Renewable. With nearly $68 billion in assets under management across all major renewable energy technologies, Brookfield Renewable is a leading owner, operator and developer of clean energy.

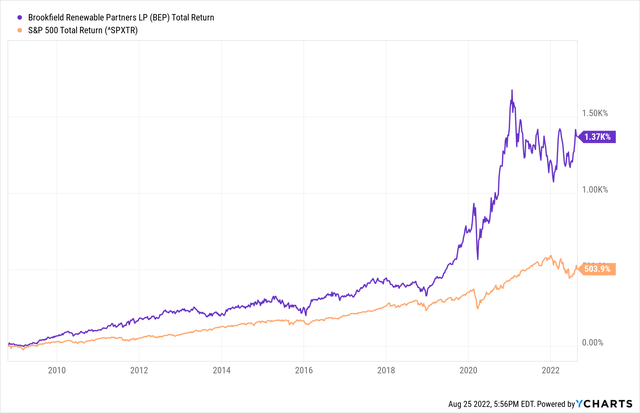

Unlike the aforementioned renewable energy ETFs and investments, Brookfield Renewable has been an incredible return on invested capital since 2008. From inception it grew at a compound annual interest rate (CAGR) of 18% absolutely trouncing the S&P 500 at the same time. That is a double every four years. While an 18% CAGR may be difficult to replicate going forward, I find solace in the fact that management guides for 12-15% returns on their invested capital for the foreseeable future.

BEP Versus S&P500 Total Returns (Ycharts)

Dependable Growth

While I know that past performance is not necessarily an indicator of future outcomes, I definitely feel comfortable owning Brookfield Renewable because, quarter after quarter, it continues to consistently grow its cashflows, dividend, and return on capital.

One of the reasons I believe this company is suitable for the long term buy and hold style of investing is their average power purchase agreement is over 14 years. What’s more, 70% of these decades long contracts have inflation escalators built in. Simply put, revenue from their assets will not evaporate overnight based on consumer discretionary trends but will increase with time. This incredible insight into the future makes me a more confident investor in the business. In addition, At 76%, Brookfield’s year to date dividend payout ratio is reasonable and gives them enough cushion to fund their FFO growth plans.

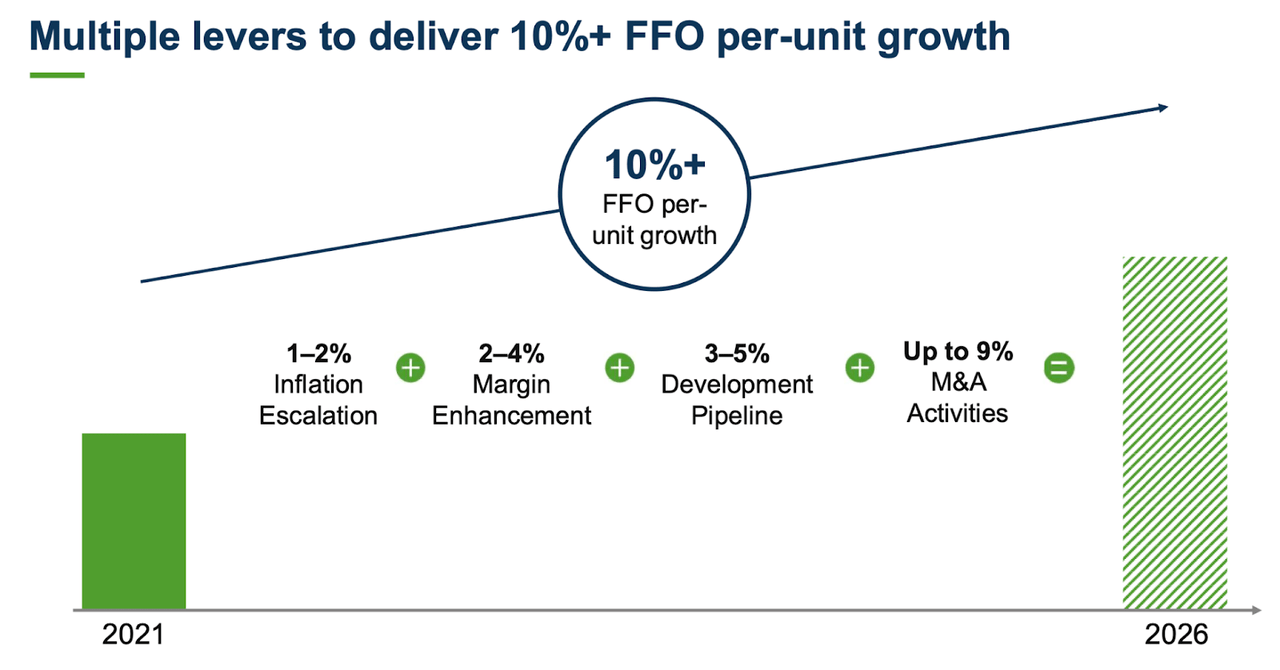

Moving forward, management plans to achieve 10-20% funds from operations (FFO) growth through 2026 by utilizing inflation escalations in their contracts, margin enhancement strategies, executing on their development pipeline, and through mergers and acquisitions. I believe their goals are achievable. For reference, in the most recent quarter Brookfield Renewable reported FFO of $294 million $0.46 per Unit, an 10% increase.

FFO Growth Segments (Brookfield Renewable)

Development Pipeline

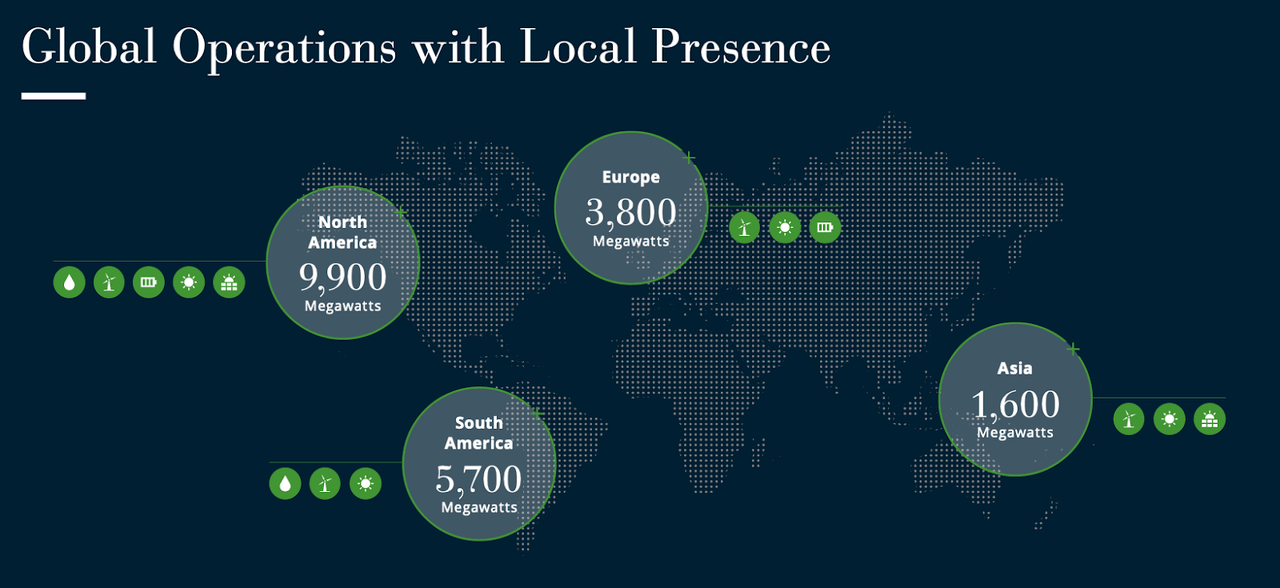

In the Q2 2022 earnings call, COO Ruth Kent stated they have 75,000 megawatts of capacity in the development pipeline. Brookfield Renewable currently has about 23,000 megawatts of capacity online. If they can execute on their project pipeline, they will more than triple their capacity.

Current Energy Generation Capacity (Brookfield Renewable)

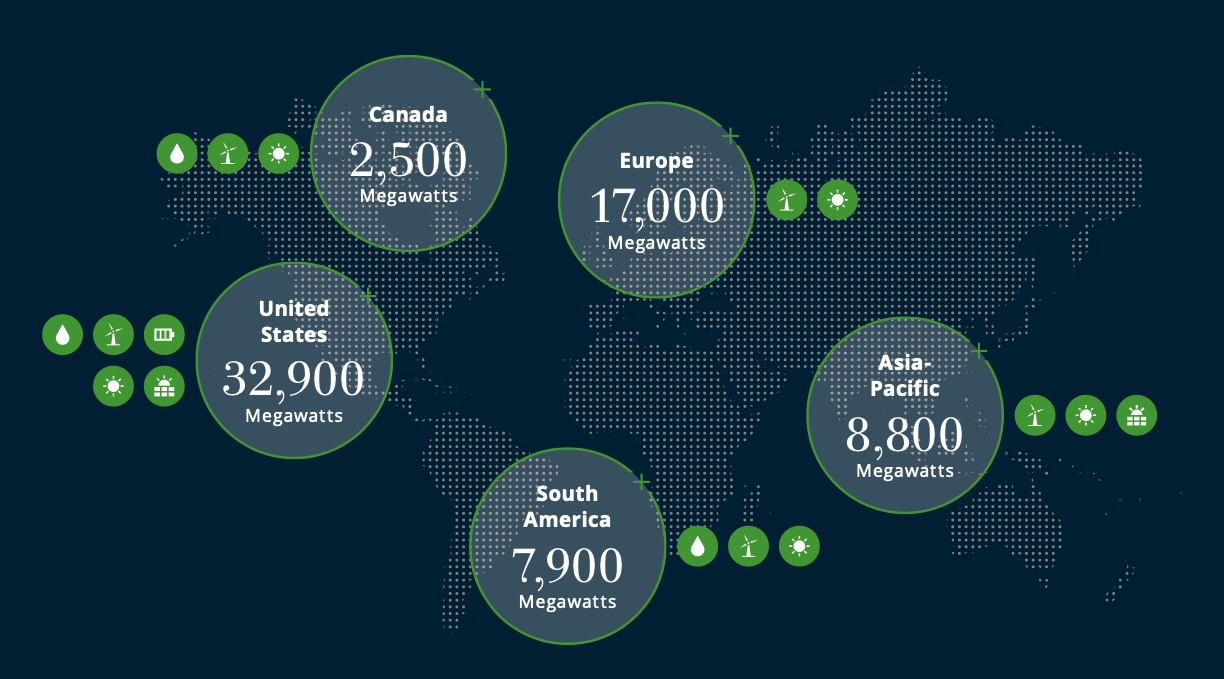

I believe the breadth of their development pipeline will fuel growth for decades to come. And, based on their current backlog, Brookfield Renewable will increase their energy generation in North America, Europe, Asia, and, South America by 258%, 347%, 450%, and 39%, respectively.

Future Energy Generation Capacity (Brookfield Renewable)

Capital Deployment

BEP has deployed more capital into growth assets in the past 5 years than in the 25 years prior. Their BBB+ investment grade credit rating, the highest in the renewable energy space, and close connection to Brookfield Asset Management (BAM), which has $750 billion of assets under management, allows them to obtain the ample liquidity needed for continued growth and execution of their project pipeline. For example, they currently have about $4 billion of total available liquidity. In the Q2 2022 shareholder letter, management emphasizes they have committed to deploy $4.5 Billion this year alone in battery storage, carbon capture, distributed generation, and utility-scale wind and solar. As the capital Brookfield deploys continues to increase along with clean energy transition tailwinds, I expect revenue, FFO, and distributions to grow.

Conclusion

Investors seeking to enter the lower risk and less volatile side of the renewable energy space should consider buying and holding shares of Brookfield Renewable today. It may not be the flashy business model that get-rich-quick investors from the stimulus fueled post-covid stock market boom would gravitate towards, but it is a tried and true compounder that you can hold for a decade without losing sleep. With nearly 23,000 megawatts of clean energy capacity and 75,000 megawatts in its pipeline, Brookfield Renewable is the world’s leading owner, operator and developer of in demand clean energy assets. That, paired with their strong track record of dividend increases and consistent inflation resistant funds from operations growth makes them my favorite way to invest in the historically volatile renewable energy sector.

Be the first to comment