We Are

A few weeks ago, I had the privilege of interviewing Pete Mavoides, President & CEO of Essential Properties Realty Trust (NYSE:EPRT), a triple-net lease REIT that focuses on sale leasebacks to private, middle-market businesses.

The interview, which can be found at this link, is exclusive to subscribers of High Yield Landlord, but in this article, I want to highlight some of my high-level takeaways from the interview and explain why I’m building EPRT into a much larger position in my portfolio from the midsized position it is currently.

Some Background

Not too long ago, STORE Capital (STOR) was a large holding at High Yield Landlord. With the recent announcement of STOR’s $14 billion take-private deal, we immediately began looking around for where to reinvest the proceeds.

Naturally, one of the options we considered was EPRT. After all, the two REITs share an almost identical strategy, and some of the executives at EPRT formerly worked with some of the current executives of STOR as well as with Chris Volk, the former CEO of STOR who was an outspoken apologist for the REIT’s unique net lease investment strategy.

What became clear to me through the interview with Mr. Mavoides is that EPRT is no mere clone of STOR. I highlighted some of the superficial differences such as in the lease terms and leverage ratios in “STORE Capital Vs. Essential Properties: A Head-To-Head Comparison” back in August 2020. But Mavoides explained a few deeper, more fundamental differences in the investment criteria of the two REITs.

Now, it’s important to acknowledge that it is the job of a CEO to speak persuasively about their company and investment strategy to investors. They probably wouldn’t have made it up the corporate ladder to that role unless they had that skill set.

But it was clear to me when talking with Mavoides that this is a man who deeply understands net lease real estate investing and believes in his particular form of it. Though he spoke in “we” terms like most leaders, it seemed evident to me that EPRT is largely his brainchild, along with EPRT’s COO Gregg Seibert.

Mavoides and Seibert’s time working together at Spirit Realty Capital (SRC), a veritable shapeshifter of a REIT, were formative of the strategy they ultimately landed on.

A little history lesson might be helpful.

In 1981, Morton Fleischer founded a real estate company called Franchise Finance Corporate of America (FFCA), which specialized in providing real estate financing to chain restaurants.

In the early 1990s, Gregg Seibert worked as VP of Underwriting and Senior VP of Acquisitions at FFCA, which provided real estate financing to chain restaurants, convenience stores, and auto service and parts stores. From 1994 until its take-private acquisition by GE Capital in 2001, FFCA was a publicly traded REIT.

The CEO of FFCA was Morton Fleischer, and the President was Chris Volk. After the GE Capital take-private of FFCA, Volk and Seibert went on to co-found Spirit Realty Finance Corporation in 2003. Their business model was to invest in “single-tenant, operationally essential real estate.” Sound familiar?

Spirit Finance was the spiritual predecessor to STORE, which stands for “single-tenant operational real estate.” Volk was the CEO of Spirit Finance, while Gregg Seibert was the Chief Investment Officer. The company went public in 2004 under the ticker symbol “SFC,” and in just three years, the company was taken private in 2007.

Volk left Spirit Finance at that point, but Seibert stayed on.

Later, in 2011, under a new CEO named Thomas Nolan, Spirit Finance brought on Mavoides as President & COO. Mavoides played an active role in reshaping and growing the portfolio. SRC’s real estate assets tripled in size from around $3 billion in 2011 to $9 billion in early 2015.

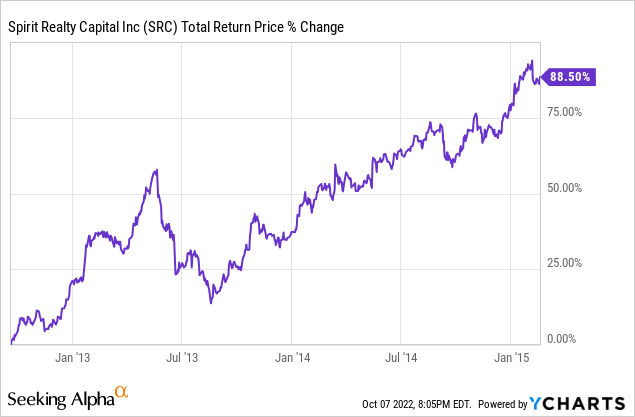

In the 2.5 years of SRC’s 2010s publicly traded era over which Mavoides presided, the REIT enjoyed spectacular returns. When Mavoides left in February 2015, SRC had achieved total returns of 88.5% since going public in 2012 – an annualized rate of about 35.5%!

When Mavoides left at the end of his contract, SRC enjoyed a strong cost of capital as well as strong underwriting and credit controls. Some weak tenants still remained in the portfolio, most notably SRC’s top tenant at the time of Shopko (which would later go bankrupt), but Mavoides insists that he had worked hard to minimize exposure to weaker tenants like Shopko and that these were vestiges of the era when Chris Volk had been CEO.

(Whether Gregg Seibert, the Chief Investment Officer of SRC during these years, had any part to play in the accumulation of a large exposure to Shopko during the 2000s is unclear.)

If this is how well Mavoides could do with an inherited net lease portfolio over the span of a few years, imagine what he could do with a portfolio he could make from scratch. Well, when he joined up with Gregg Seibert and a few other top management employees poached from SRC in 2016, they did start a portfolio of their own from scratch, and they called it Essential Properties Realty Trust.

You can see the “operationally essential” theme play through the experiences of Volk, Mavoides, and Seibert. It plays a big part in the investment philosophies of every company these men have led.

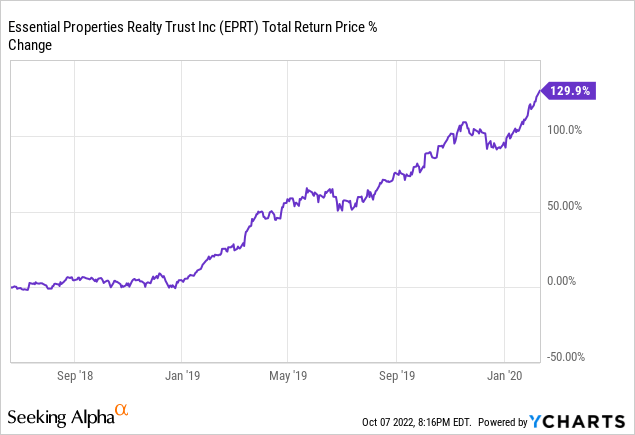

In the first year and a half of EPRT’s publicly traded life, before the onset of COVID-19, the REIT enjoyed a similar growth pattern as SRC’s reemergence under Mavoides and Seibert in the 2010s, only stronger:

This time, Mavoides and Seibert had full control over portfolio construction, credit underwriting, tenant selection, and preferred lease terms.

The Fundamental Difference With STORE

When Mavoides and Seibert were constructing the investment criteria for EPRT, they knew there were some things they wanted to avoid. The main thing they wanted to avoid was being stuck with a hot potato property.

By “hot potato property” (my phrase, not Mavoides’), I’m referring to a property that, upon suffering a vacancy, whether due to tenant default or non-renewal, would be extremely difficult to re-lease to another tenant at anywhere near one’s previous rent rate.

Mavoides and Seibert were (and are) well aware that the risk of tenant bankruptcy and lease default is always there, no matter how good your underwriting is. Thus, they didn’t merely want to invest in properties under the assumption that everything would go as planned. They wanted to invest with the worst-case scenario in mind, limiting the downside as much as possible.

They wanted to avoid big, specialized buildings with unique uses and users. Think of a shuttered steel mill. There are good reasons those properties don’t get converted into other uses. For one, they are usually in rural locations, and for another thing, the buildings are so specialized that it would take a prohibitively large amount of money to convert it into another use if another steel producer didn’t want to lease it.

In other words, EPRT doesn’t want to compromise on real estate fundamentals in order to achieve a higher asset yield (or acquisition cap rate).

Here’s Mavoides from the interview:

What we experienced, Gregg Seibert and I, in managing the Spirit portfolio, was that when you take outsized risks on the real estate side with special use assets or big, chunky, 500,000 square foot industrial facilities in $20-30 million boxes, like steel mills and manufacturing plants – if you have special use assets like that, and you have a specialized user in place that goes out, your recovery can be 20 cents on the dollar versus 80-90 cents for a smaller, more fungible building.

So, when we sat down in 2016, we decided we don’t want to own any of that stuff, because that’s where you suffer outsized losses.

This is a big reason why EPRT has historically acquired properties at cap rates at least 50 basis points below STOR’s acquisition cap rates.

While STOR is willing to buy the big, specialized properties like Bass Pro Shops, Cabela’s, and AMC megaplexes, EPRT steers clear of these types of properties, because they would be difficult to re-tenant at anywhere near their current rent rates.

Indeed, Mavoides’ mention of the “big, chunky, 500,000 square foot industrial facilities in $20-$30 million boxes” seems like a subtle reference to STOR’s 5.8% base rent exposure to tenants in the metal fabrication industry.

The fungibility of buildings is important. The smaller and more generalized a building is, the easier it will be to re-lease it to another tenant at a similar rent rate. Contrast EPRT’s average property cost of $2.4 million to STOR’s $3.6 million. This makes properties more liquid (easier to sell because of a larger pool of potential buyers) and should, in theory, make recoveries higher in the downside scenario.

Don’t get me wrong. There are many similarities in the types of tenants EPRT and STOR have in their respective portfolios. But this seemingly subtle difference would likely result in EPRT’s outperformance during a recession in which bankruptcies tick up and vacancies rise.

Of course, since STOR is being taken private, we may never be able to test the difference in performance between EPRT and STOR through a normal (non-pandemic) recession.

Bottom Line

I mentioned previously that Mavoides struck me as a genuine believer in his particular net lease investment model. Recently, the CEO put his money where his mouth is. Back in June, Mavoides made an open market purchase of 20,000 shares of EPRT stock at a price of $20.68 apiece. That amounts to a total purchase of $413,600.

I am following Mavoides’ lead in buying EPRT every chance I get.

Like the EPRT investment philosophy, I am personally more interested in achieving solid, steadily compounding returns without huge drawdowns than buying the highest yielding opportunities and hoping for the best-case scenario to play out. Sometimes things don’t go according to plan, and in those cases, I’d prefer my downside to be limited.

EPRT is a great investment because management is focused on achieving strong growth while also limiting downside as much as possible. Over the long term, I think this strategy will provide the best returns.

Be the first to comment