alfexe/iStock via Getty Images

Foreign stocks, both developed and emerging, have underperformed for at least the last decade. Recent events have made this situation worse. While the U.S. could rely on mega cap tech companies to not only provide services during the pandemic, and see their stocks hold up, most foreign businesses could not do the same. Now, looking forward from the backside of the pandemic, it is difficult to find opportunities in U.S. markets. Large cap U.S. tech is in a bear market, as are most U.S. stocks. There are headwinds for all markets, but many of those challenges are objectively worse for foreign stocks.

Strong Dollar Has Weakened Returns in Foreign Assets

Returns of foreign assets in U.S. dollar terms have been suffering due to the strengthening of the dollar. As the dollar strengthens relative to foreign currencies, foreign assets become less valuable when exchanged back into dollars, all else equal. When this happens, it offsets strength in foreign stocks for U.S. investors, or makes already negative returns more so. The upside to a stronger dollar is that imports to the U.S. become less expensive, providing Americans greater purchasing power for foreign goods. Unfortunately, these dynamics have not lessened the impact of inflation here and abroad.

1-year Performance of US Dollar versus International Stocks (Seeking Alpha)

The War in Ukraine, and General Global Uncertainty

The war in Ukraine has created uncertainty across Europe and global markets. The precarious availability of energy (natural gas) from Russia to Western Europe has not only added to that uncertainty, but certainly to the inflation in those markets. Undoubtedly, higher inflation impacts consumer spending, which contributes a disproportionate amount to national GDP, even outside the U.S. For context, while consumer spending represents nearly 70% of U.S. GDP, that figure is closer to 55% in the EU. The EU makes up the difference through higher government spending, investments in fixed capital, and positive net exports compared to the U.S.’s trade deficit.

While the war in Ukraine has caused significant disruptions globally (e.g. within energy and wheat production and exports), the potential issues between China and Taiwan has the capacity to add to global supply chain difficulties in a material way. A non-trivial quantity of semiconductors is manufactured and exported from Taiwan. As we have experienced over the last couple of years, a shortage of chips can cause cascading supply issues across many markets. A political and/or military conflict in that part of the world would be disruptive. Furthermore, President Biden has indicated that the U.S. would become involved militarily if China were to invade or restrict Taiwan with its navy and air force, an outcome that could have indeterminate long-term wide-ranging consequences.

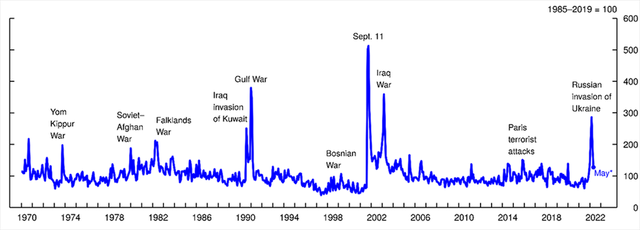

Geopolitical Risk Index (Federal Reserve Board)

[Note on graph above from the Federal Reserve:

(Note: The figure plots the Caldara-Iacoviello geopolitical risk [GPR] index from January 1970 through May 2022. The index is constructed merging the historical GPR index from 1970 through 1984, with the recent GPR index from 1985. The index is normalized to average 100 throughout the 1985-2019 period. Spikes are labeled with significant geopolitical events. *Preliminary Reading.

Source: Federal Reserve Board staff calculations based on Dario Caldara and Matteo Iacoviello (2022), “Measuring Geopolitical Risk,” American Economic Review.)]

Long-Term Underperformance and Relative Valuations

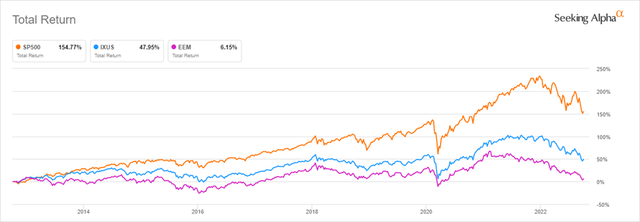

Stocks in the U.S. have outperformed foreign stocks, both developed and emerging markets, for more than a decade.

10-year Total Returns of the S&P 500, International Stocks, and Emerging Market Stocks (Seeking Alpha)

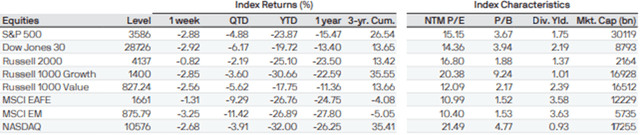

The case to be globally diversified within equity allocations has been under fire for years. That said, foreign stocks are attractive relative to U.S. stocks on valuation as well as yield. The table below from JP Morgan summarizes not only more recent performance, by current valuations and dividend yield. Year-to-date, foreign stocks, both developed and emerging, have performed in-line with U.S. small cap, while large cap growth and the NASDAQ have lagged. Looking at the 3-year cumulative performance, and longer periods as shown in the chart above, foreign stocks have far underperformed U.S. stocks. This underperformance has resulted in valuations well-below that of U.S. stocks when looking at forward P/E ratios and Price/Book, and average dividend yields abroad are approximately twice those of major U.S. indices.

Performance and Valuation Summary for Global Equity Markets (JP Morgan)

While the case for adding to foreign stocks could have been made for several years now, the current headwinds have compounded the challenges to performance, and any reversion or normalization would be expected to boost returns relative to U.S. stocks. Global markets are unpredictable, and while having a home-bias makes sense for most investors, a healthy exposure to non-U.S. equities is a relatively attractive opportunity for the contrarian investor with a long-term investment horizon.

Catalysts

The catalysts to push this from a contrarian position to a consensus bullish position include the reversal of normalization of the headwinds discussed above. Will the dollar weaken, or at least stabilize? Will global inflation fall, or at least moderate in the near term? What will happen in the war in Ukraine? Escalation would clearly be bad for Europe and the rest of the World, but would long-term impacts be localized or global? A resolution in Ukraine, a removal of Putin, and calmer nerves across the board would certainly be bullish for stocks, especially for foreign stocks that are, and have been, trading at a discount to their U.S. counterparts. In the meantime, if you believe that current headwinds will persist, but relative valuations will be stable or improve, then the current dividend yield on foreign stocks makes this an attractive area of the global market to park some capital. The question would then be how to acquire exposure to this thesis without creating any unnecessary and avoidable risks?

How To Invest

Rather than picking a single company that will benefit from these uncertain and unpredictable dynamics, gaining exposure to stocks ex.-U.S. can be accomplished through a diversified, low-cost, and liquid ETF.

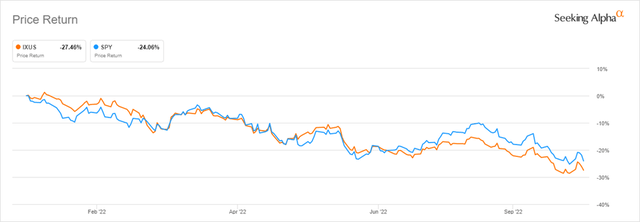

The largest option in the space is the iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS). At over $24 billion in total assets, it is over 7x the second-largest option, the iShares MSCI ACWI ex U.S. ETF (ACWX), which has about $3.4 billion in assets. The IXUS fund has a portfolio that is more than 99% outside of the U.S. with over 75% allocated to developed markets in Europe and Asia and the remaining amount in emerging markets, including 4% allocated to Africa/Middle East. IXUS provides a dividend yield of over 4% at its current valuation, compared to about 1.7% for U.S. stocks as represented by the SPDR S&P 500 ETF Trust (SPY).

Year-to-Date Performance of the S&P 500 versus Global Stocks ex-U.S. (Seeking Alpha)

Risks and Other Challenges

The challenges in foreign markets extend beyond those we are experiencing in the U.S. While elevated global inflation is a concern, frankly it is a more welcomed outcome relative to the global depression we could have experienced if central banks around the world did not respond to the Covid shutdowns. Politics aside, it is reasonable to think that low unemployment and slightly elevated inflation are preferable to a Great Depression, Part II. That said, further localized inflation caused by a tight energy market are a concern. Fortunately, with a resolution of the war in Ukraine, most of this concern would be alleviated. In the meantime, inflation will continue to be a concern here and abroad, driven by many factors.

Stocks in the U.S. have performed poorly this year, much like their foreign counterparts, with large cap tech dragging the averages down. This is both a positive and negative for the contrarian case I am making here. While tech has led U.S. stocks lower, it has played less of a role in foreign stock performance, particularly in Europe. Tech simply is not the dominant industry sector in Europe as it is here, although it is meaningful in Asian markets. Because of this, one risk factor to this contrarian position is that a broad recovery in U.S. stocks, particularly large cap tech, would likely lead to continued underperformance of foreign stocks relative to U.S. stocks. Other challenges to what I am proposing here include a worsening of conditions that I believe could or should normalize. If the dollar continues to strengthen, the war in Ukraine escalates further, and/or global inflation gets worse, then the case for foreign stocks, already contrarian, will break down.

Final Thoughts

Foreign markets have faced numerous and significant headwinds in recent months and years following an extended period of underperformance relative to U.S. stocks. It is unsurprising that U.S. investors have turned their backs on these markets, but in doing so, they may have created an opportunity. With the reversal or stalling of some recent headwinds, including the strengthening dollar and war in Ukraine, an opportunity to take advantage of depressed valuations may be here. The case I have made for international stocks is optimistic but based on the current condition, valuation, and possibility of improvements, particularly in Ukraine.

Like with any position, the near term is difficult to predict, but assuming a situation in which the worst-case scenario is avoided, current valuations would make this an attractive area of the global equity markets in which to dip your toe.

If you choose to take the most aggressive approach to this investment thesis, then focusing on emerging markets rather than all markets outside the U.S. might make sense. Given the level of risk and uncertainty across all markets and economies, I prefer the idea of broad foreign equity exposure.

Thank you for reading. I look forward to your feedback in the comment section below.

Be the first to comment