cemagraphics

Most all asset classes have been hammered in recent months, but growth stocks have been the hardest hit. It’s easy to paint this sector with a broad brush, especially in the current high interest rate environment. However, I believe that investors who quietly layer capital back into this segment are setting themselves up for potentially market beating returns in the long run.

This brings me to the Vanguard S&P 500 Growth ETF (NYSEARCA:VOOG), which has allocation to some of the biggest names in tech, pharmaceuticals, and other growth sectors. In this article, I highlight why VOOG is looking attractive for bargain hunters, so let’s get started.

Why VOOG?

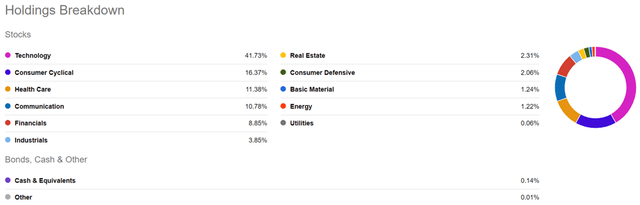

The Vanguard S&P 500 Growth ETF focuses on U.S. large cap growth equities, with 240 total holdings. As one would imagine, VOOG has high concentration in technology stocks, followed by consumer cyclical, healthcare, communications, and financials. At the same time, it has low exposure to slower growing (but higher yielding) industries such as real estate, energy, consumer defensive, and utilities. As shown below, the tech segment represents 42% of total portfolio holdings.

VOOG Sectors (Seeking Alpha)

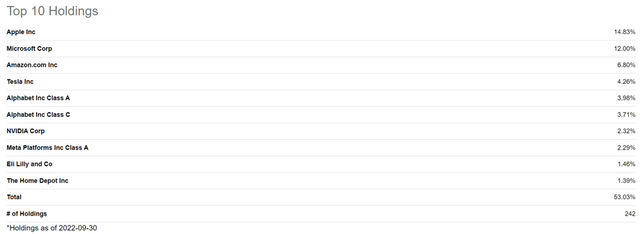

As one can imagine, VOOG’s top 10 holdings is made up of a who’s who list well recognized household names, with Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) making up one-third of the portfolio total.

VOOG Top 10 (Seeking Alpha)

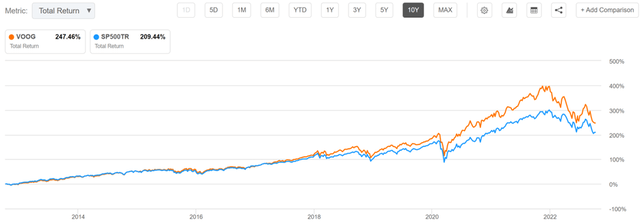

Notably, VOOG’s focus on growth has enabled it to post market beating returns over both the trailing 5 and 10 year period, despite the recent market turmoil. As shown below, VOOG has given investors an impressive 247% total return over the past decade, far surpassing the 209% return of the S&P 500 over the same time period. That comes as no surprise, as VOOG isn’t weighed down but slow and steady stocks such as utilities and consumer staples that give investors decent returns but at the same time do not vastly outperform the market.

VOOG Total Return (Seeking Alpha)

Risks to VOOG include potential for more share price declines in its top holdings with continued pressure from the Fed to raise interest rates, especially with the recent announcement of a strong September jobs report. However, I see these headwinds as being temporary, as there are far worse things than the very low unemployment rate that the American economy is seeing. As such, I believe the Fed will remain cognizant of not swinging the economy in the other direction with too aggressive rate hikes down the line.

Plus, it’s hard to go wrong with VOOG’s top 3 holdings, which each have their own enduring moats that should last for at least a generation. Plus, they come with very strong cash flow and balance sheets that should enable them to continue to expand and innovate. Also encouraging, Eli Lilly (LLY), one of VOOG’s top 10 holdings, is coming out with an obesity drug that could be a blockbuster drug.

Meanwhile, VOOG earns high marks from analyst firms, including a 5 rating from Lipper (on a scale from 1 to 5, with 5 being the highest) for its 3-, 5- and 10-year performance. Also, true to form with Vanguard being the asset manager, VOOG charges a very low annual expense ratio of just 0.1%, sitting far below 0.45% median across all ETFs. Moreover, this expense ratio is more than offset by VOOG’s 0.9% dividend yield over the trailing 12 months.

Lastly, I find VOOG to be attractive at the current price of $210, sitting well below its 52-week high of $306, and just a hair higher than its 52-week low of $208. This is considering VOOG’s high exposure to industry leading names with the potential for a strong rebound after negative market sentiment around interest rates turns.

Investor Takeaway

In conclusion, I find VOOG to be an attractive investment at the current price. It boasts a portfolio of some of the biggest and most innovative companies in America. The dividend yield is low, but it more than offsets the expense ratio while giving investors a small kicker on what is otherwise a growth holding. While interest rate hikes may continue to put pressure on growth stocks in the near term, I believe this presents a bargain opportunity for long-term investors to scoop up shares at a discount.

Be the first to comment