jetcityimage/iStock Editorial via Getty Images

Dear readers,

In this article, I’m providing you with an update on Safran (OTCPK:SAFRF), a superb EU defense stock. This is a French company that hasn’t seen a bounce despite the overall situation in Europe.

Let’s use this article to recap what the company does, how things have been going, and what exactly the valuation is now that Safran is 20% cheaper than it was in my last article.

Safran Article (Seeking Alpha)

Let’s recap on this company.

Safran – recent results and the company

As I pointed out in my recent article, the reason that we don’t see a huge correlation to other defense stocks is Safran’s overall sales mix – meaning it has less defense exposure than others. Safran is, in fact, a multinational aerospace company and the largest after Airbus (OTCPK:EADSY).

What it does is aircraft engines, rocket engines, aerospace components, and defense.

Where the company comes from and what it owns with its 76,000 people can be seen more in detail in my base article on the company. It generates revenue of nearly €20B per year, and it works mostly in civil aircraft engines. It owns 50% of the CFM International JV, together with General Electric (GE). However, aside from Civil Aircraft, it’s in military and space propulsion, engine pods, landing gears, brakes, power electronics, wiring, and Avionics & Optronics in its defense segments.

So, no correlation because over 70% of the current mix is civil, not military. It’s also very fair to characterize Safran as an engine business, and it relies on R&D and timing, which the company generally has been able to do. Recent share price developments would suggest that the company has stopped doing this, or has somehow failed to deliver the sort of results that the market expects.

However, this is not what I would view as the truth.

1H22 came in at the very least at acceptable levels. The company has finished divesting its arresting system business and finished the M&A of Orolia. USD FX is providing a massive tailwind at this time, and the company confirmed its forward operating margins, delivering 12.2% despite current impacts.

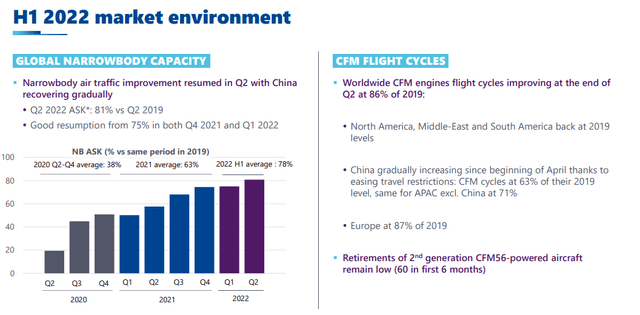

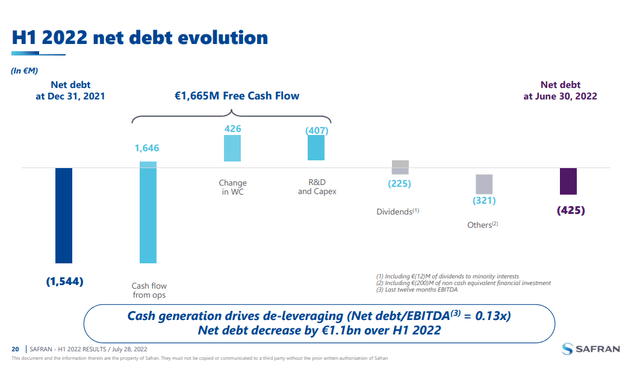

Free cash flow? At over €1.7B, supported by advance payments and strong sales. Air traffic recovery is ongoing – and Chinese market trends are improving. Challenges continue to be the major problem there, but the trends aside from these are extremely strong.

Take a look.

Safran IR (Safran IR)

The company delivered nearly 500 CFM engines, and the Civil aftermarket is up 47% in 1H22 alone. The growth is double-digit here, and it continues. The only current constraint is global supply chain issues and input challenges.

The company is also delivering significant contract wins – New Zealand Defense is ordering new engines, wheels, and brakes for the A320neo fleet, and Saudi Arabia, French armed forces, and Viva Air Columbia are ordering new parts as well. The company also released its new seats line.

The company is expanding its capacity as well.

Safran IR (Safran IR)

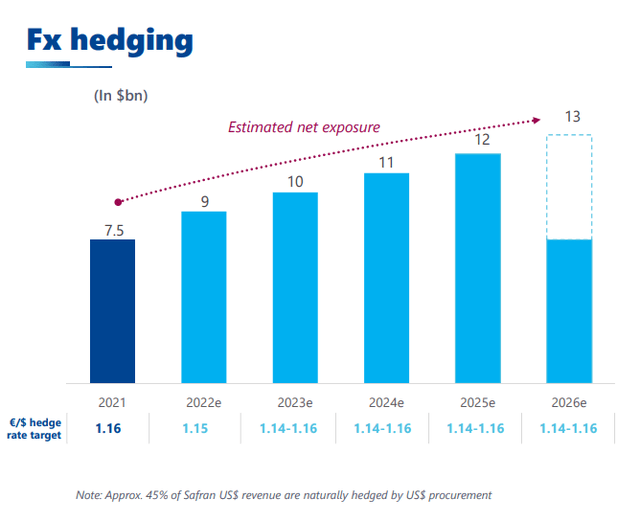

Revenue is up. Margins are up, income is up, and FCF is more than doubled. FX is a major theme here, and Safran is hedging against most of the current issues with a rate hedge target of 1.16 on the high end for the EUR/USD pairing.

Safran IR (Safran IR)

The simple fact is that every single segment in the company’s lineup delivered growth and positive numbers – and that is the major reason FCF is up like it is. There are also positive cash impacts from WC, higher inventories, selective CapEx, and stable D&A. Every part of the company is currently working together to deliver solid results.

Debt is down as well, with cash generation driving de-leverage. As I mentioned in my previous article, the company has a very attractive debt situation. This has grown even more attractive over the past few months. Take a look at this.

Safran IR (Safran IR)

The company is one of the lowest-debt defense/aerospace businesses on the planet that’s privately owned/publicly listed. And what’s even better, the company’s current outlook remains a very positive one. FY2022 outlook sees revenue reaching €18.2B, with margins reaching 13% and FCF of just around €2.4B for the year.

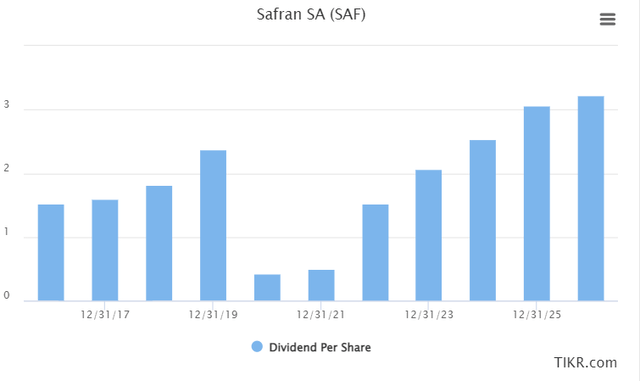

The company is investment-grade rated and offers investors a dividend of between 0.6-1% – so relatively low. The expected dividend bumps have been delayed by COVID-19, and the dividend for Fiscal 2021 is only suggested at a €0.5/share level. The visibility for increases at this time remains low, the company has not addressed this. However, the company is BBB+ rated, so I would give it a “beyond merely safe” consideration in the context here.

Also, remember that the company’s largest shareholder comes in the form of the French government at around 11% and about 17% of the voting rights. Another large shareholder is BlackRock (BLK).

Risks remain present, and they are likely the continued driver on some of the current pressures. Due to Russia, and the ongoing macro, there will be limited tourism in many of the company’s geographies now, and the impact on the company’s aftermarket business will be significant. In addition, the aerospace industry relies heavily on titanium and superalloys, which is also why Safran has joined forces with Airbus to acquire Aubert & Duval and secure its supply – that agreement was finished this quarter.

However, Russia is the number one supplier of titanium, with just below 50% market share – so there’s a question of supply/demand here.

That means that on a continued basis, even if Safran could secure some of its raw materials, the pricing is now still likely to be broken. The company operates its backlog on a contract basis which does not necessarily allow for indexation or increases based on such events – so it’s likely that not all will be secured. Even if Safran is likely to secure some of these supplies, the prices will be higher, and these costs are unlikely to be passed along to customers in their entirety.

So we still need to be conservative when valuing Safran for an investment thesis.

But here is the current valuation of the company.

Safran valuation

Safran’s valuation remains complicated.

The company’s valuation is based on a substantial order book and a leading market position in the civil market, which is bound to benefit from a long-term linear growth rate in terms of sales revenue and service revenue.

There are also substantially, appealing assets in landing gear, brake, and other segments that provide cushions in the case of issues in the engine market. Outside of the company’s raw material and cost issues, the LEAP engines provide strong cash flows.

With its relatively recent sale of non-core assets and down payment of debt, the company is entering 2H22 at almost record levels in terms of appeal – but a low valuation overall.

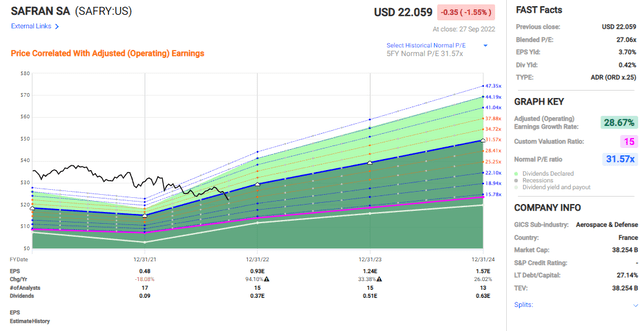

However, this must be seen in context. The ADR is SAFRF/SAFRY, and these ADRs are trading at around 20-30x P/E, with a normalized average of around 30-31x. Today’s valuation is closer to 27x P/E, which is a level both in valuation and in share price that we have not seen for some time.

Safran Valuation (F.A.S.T graphs)

The growth estimates here are more likely than you might expect. 1 or 2-year accuracy is well over 70% on a positive basis with a 10-20% margin of error. The current trends also very much support the expected share price growth.

You’ll also notice that the company is expected to significantly increase its payout. This is expected by the current set of native analysts and forecasts as well.

Safran Dividend Forecasts (TIKR.com/S&P Global)

The current averages of valuation targets come at an average range of €62.6 for the low range and €174 for the high, with an average valuation target of €130/share, which denotes an upside of no less than 41.3%.

17 analysts follow the company, and 13 of them are at a “BUY” or “outperform” rating here. For the company’s WACC, we have around 9%. I’m assuming a 2-3% sales growth rate, with a WC and CapEx ratio in line with its historicals, which assumes a 2024E sales number of around €23.4B and an outlying EBITDA of over €5B. Based on this calculation, the PV of 10 years of the company’s cash flows is between €23-€25B based on those growth estimates and the aforementioned WACC; coming to a per-share EV value of €120-€140/share. On a DCF basis, the company is currently substantially undervalued. This remains the case at this time.

As before, I’d cut this target significantly and say that Safran deserves no more than a €115 average target, which means weighing that growth/DCF perspective smaller than some of the other ratios.

However, at this price target, we now have a very appealing upside for Safran – and I’m buying more.

Thesis

- Safran isn’t the most immediately profitable or exciting investment opportunity with what’s happened in Russia, but it’s a solid aerospace company with a market-leading position in appealing segments. The delayed earnings growth will likely materialize in 2023-2025.

- If the company becomes cheap enough – then I’m interested, and at the current price either for the ADR or for the native share. I invest in the native French shares.

- I give the company a PT of €115/share, and it’s a “BUY” here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative.

This company is fundamentally safe/conservative & well-run.

This company pays a well-covered dividend.

This company is currently cheap.

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment