hallojulie

Harbor Diversified (OTCPK:HRBR) recently released Q3 2022 results. These were a mixed bag, providing some details on the coming American Airlines (AAL) contract starting in 2023, but highlighting that various payments from United Airlines (UAL) are disputed. The profitability of the American contract may not be known until mid/late 2023. There is also a danger that in late Q1 and early Q2 the company hits an air pocket if there isn’t a seamless transition from servicing United to servicing American.

Historical Context

Harbor Diversified is a regional airline called ‘Air Wisconsin’ that operates under contract for the major airline (currently United, soon to be American). It is potentially an attractive investment given assets on the balance sheet covering most of the share price.

There was a fear that with the ending of the United contract in early 2023, the company’s aircraft might be idled or scrapped. However, a new contract with American starting around March 2023 is expected to keep their planes flying for another 5 years.

Valuation

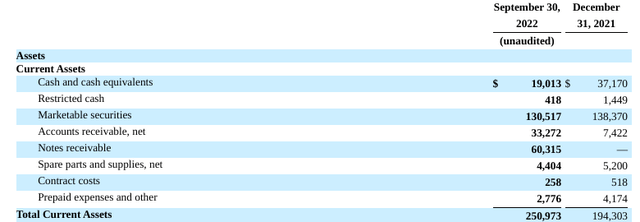

One attractive element to HRBR is that it has $250M of current assets relative to $145M of total liabilities. With 61M shares out (fully diluted) that is $1.72/share. Current assets, as below, are generally liquid assets and exclude the valuation of the aircraft.

On November 4 (after the date below), United paid HRBR $50M of notes receivable. However, United disputes a further $33M of payment under the contract which is going to arbitration. So if United wins arbitration the value of HRBR’s liquid assets could be just over $1.18/share.

Also, in the current interest rate environment, interest on marketable securities could add roughly $0.10/share over value over 12 months.

Source: HRBR 10-Q

Contract Value

Then the big unknown is the value of the upcoming American contract. A lot of contractual details were disclosed with the Q3 filing, but the economics are not known and we may not have a way to firmly gauge them until Q2 2023 numbers are reported, which should include some profits from the new contract.

The book value of the aircraft is $106M or $1.74/share. It appears likely that the American Airlines contract has some value, otherwise why would HRBR have entered into it rather than selling their aircraft?

Overall Valuation

| Bull Case | Bear Case | |

| Liquid Assets receive full value | $1.72/share | |

| Liquid assets less United winning arbitration | $1.18/share | |

| American contract reflects book value of aircraft | $1.74/share | |

| American contract at +50% premium to book value | $2.58/share | |

| Interest received on marketable securities | $0.10/share | |

| Resulting estimated value | $4.40/share | $2.92/share |

source: author’s estimates

I think it’s reasonable to value HRBR in a range of $2.92-$4.40/share depending on your optimism about the American Airline contractual terms and the outcome of arbitration with United on past payments. Either way that’s a premium of approximately 40% to 100% to the current share price of $2.22/share. Within a year or less we should have clarity on most of the uncertainties listed above.

Risks

Still there are risks. First off we don’t know the terms of the American contract. Maybe it’s so bad that HRBR will fail to earn an economic return on the new contract, and the company will under-earn in 2023 as aircraft are relocated and repainted to fulfill the terms of the American contract.

Second cash on the balance sheet is not cash in hand. Maybe management will find a way to benefit themselves rather than shareholders. The shares appear cheap, but no recent share repurchases have occurred. Maybe the funds will be spent on new aircraft as the current ones approach the end of their useful lives since their aircraft are, on average, 20 years old. This is perhaps my main concern because the contract already refers to potentially bringing new models of aircraft into the American contract, though without a firm agreement or timeline to do so.

Also, this investment will take some patience. We are unlikely to get a sense of the economic terms of the American contract until we see results in the Q2 2023 income statement, and even then, things may be opaque due to the new contract ramping up.

Finally, HRBR is relatively small and illiquid. It was also slightly late reporting its most recent 10-Q.

Conclusion

HRBR appears a reasonably investment and we may see the shares trade closer to $3-$4/share over the coming year assuming that the United arbitration is somewhat favorable and the terms of the American contract are reasonable. Both these issues would have to go against HRBR for investors to lose money on my estimates. My main fear is that the cash and marketable securities on the balance sheet go to spending on new aircraft rather than to shareholders, but even if that occurs the earnings power of the business may support a greater valuation than the current share price.

Be the first to comment