Macro:

Entertainment, hospitality, and travel-related companies are seeing their operations shut down due to COVID-19. Some which involve large groups of people congregating in tight spaces – airplanes, stadium based concerts, plays and sporting events, etc. – may not fully come back for a year or more. That is until vaccinations become widespread. Other cases where clientele also skews towards an older crowd – cruise ships, New York theatre district, etc. – could be even more problematic. Therefore, other than a very specific exception or two, we have mostly chosen not to invest in these types of firms. Some will no doubt end up being great investments at current prices, but many will also likely go under and are only not doing so now thanks to government subsidy.

Likewise, if low oil prices extend beyond their current hedges, many upstream oil-focused companies will be forced to declare bankruptcy. We have therefore mostly also stayed away from upstream firms. However, we still find some of the midstream companies attractive.

With midstream firms, which upstream firm produces the oil and natural gas is not as important as it being produced. Firm A going bankrupt and selling their assets to firm B in bankruptcy is really only a price negotiation opportunity, provided someone still produces the energy. Knowing which firms have the lowest cost to produce, therefore, isn’t just a factor for that firm, but also for midstream assets that service those particular drilling leases.

Source: RBN Energy

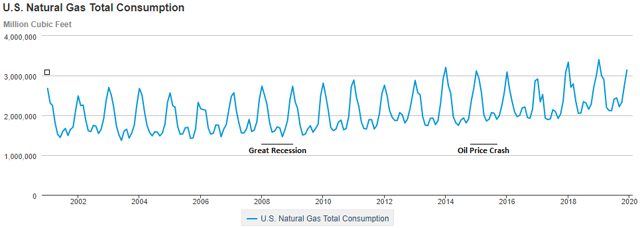

Likewise, knowing that natural gas demand has pretty much been unaffected by these challenges ends up being key. Natural gas demand has not declined. This is because most of its main uses throughout the world – electricity production, heating of buildings, cooking, fertilizer production, etc. – do not decline in a recession nor as people are shut in due to COVID-19. As you can see below, during the Great Recession, natural gas consumption followed its normal seasonal pattern in the US with barely a hiccup.

Source: US Energy Information Administration

During the oil price crash of 2015, natural gas volume consumed even went up.

Thus, the underlying cash flows of most natural gas-focused production, processing, and transport firms will not be as affected as those of firms more focused on oil. Additionally, midstream companies that have fee-based contracts with investment grade counterparties will be less affected than those that don’t. And finally, those energy firms with a lot of oil storage are actually seeing a significant benefit in the current environment as contango creates a profitable storage trade. Excess production and declining demand flood the world with oil. That oil has to be stored somewhere.

Thus, in the 20 articles in our Fear Creates Opportunity series, we have tried to identify companies that have been oversold which we think will survive COVID-19 and oil price war challenges. In the midstream space, these firms tend to fall into one of two categories:

- Companies that probably won’t need to cut their dividend despite economic challenges. These firms tend to be natural gas-focused with strong cash flows, decent balance sheets, and little near-term debt stress. Examples include Williams (WMB) and Archrock (AROC). In these firms we own the common.

- Companies that may (or may not) need to cut their dividend, but should be just fine once they do. Examples here include Energy Transfer (ET) and DCP Midstream (DCP). With these firms we try to go a bit higher on the stack, owning preferred or baby bonds when available.

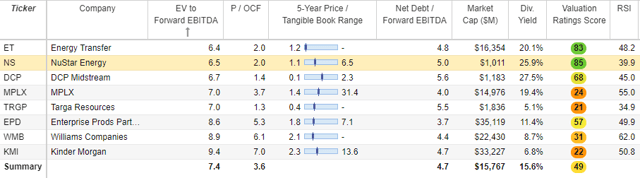

To this latter category we now add NuStar Energy (NS).

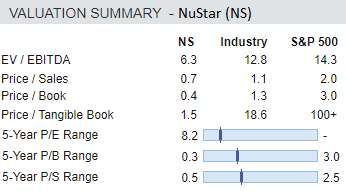

Source: Stock Rover

Source: Stock Rover

NuStar Energy: Troubled, but not an Existential Threat

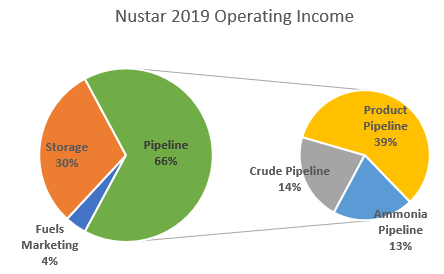

NuStar Energy is engaged in the transport, storage, and marketing of crude, ammonia, and petroleum products.

Source: Company 10K data and Author’s estimates

In 2019, roughly 53% of its operating income came from crude or petroleum pipelines. These are the segments most likely to be challenged by low oil prices and declines in production volume going forward. However, from a presentation made on March 3rd, we know approximately 63% of NuStar pipeline segment customers are investment grade and 41% of their overall contracts are take or pay.

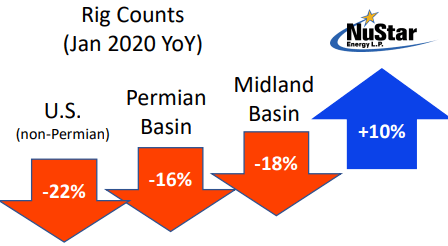

To that NuStar makes an additional claim that because its systems are over the “core of the core” “hotspot” formations, their customers are cutting back less than average. I take this with a grain of salt; however, they do provide some data to support the claim. First they point out while US rig counts were down significantly in January, rig counts in the specific areas they service were actually up.

Source: NuStar Presentation

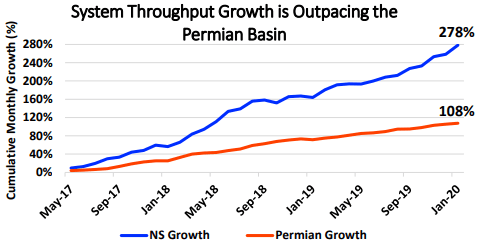

If true (I was unable to confirm on my own), that is a notable difference. Additionally, it points out that growth in its specific system has historically outpaced overall Permian growth.

Source: NuStar Presentation

For this reason the company forecast the 448 million barrels per day ‘MBPD’ throughput it averaged in December 2019 will actually continue to grow to 550 MBPD by year-end 2020.

Taking into consideration all these factors, I’m going to guesstimate 12% of NuStar’s Operating Income is going to disappear over the next year. Could it be twice that, or half that? Absolutely. We simply don’t know what OPEC+ deals are going to come about over the next year, nor how they will affect NuStar. My overall point, however, is if oil prices remain challenged and production exceeds demand, increased demand from its storage segment is going to at least somewhat offset weakness in its crude and product pipelines.

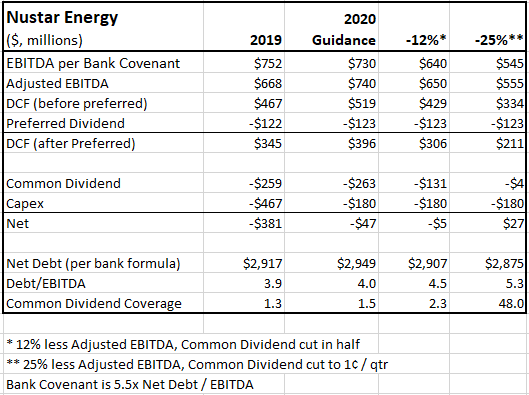

In the March 3rd presentation, NuStar guided to $740 million in 2020 Adjusted EBITDA from operations and 1.5x dividend coverage after preferred unit distributions ($396 million DCF).

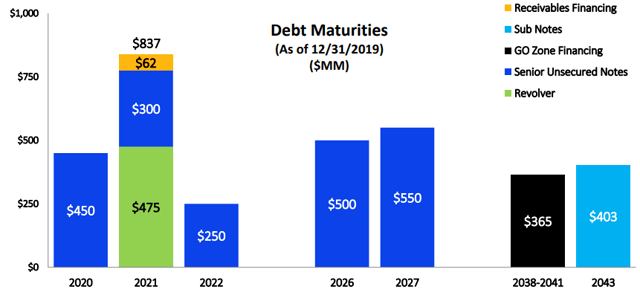

This sounds good on the surface; however, it’s not the only consideration. Under current guidance, NuStar still plans to spend $325 million in Capex in 2020, and it has $450 million in debt coming due.

Source: NuStar Presentation

So given its 2020 guidance, it will still need to access $497 million worth of financing in 2020, $450 million worth of debt coming due and $47 million for capex not covered by cash flow (see chart below). This is why earlier Monday NuStar announced it is withdrawing $500 million from a new $750 million unsecured term loan agreement from Oaktree Capital. This loan will not come cheap, it bears a 12% interest rate, but it does provide assurance that the company is still going to be around for years to come.

Switching from 2020 guidance to my most likely scenario below, -12%*, we have a 12% shortfall in Adjusted EBITDA resulting in the company cutting the common dividend in half to $131 million. This results in the new halved 2020 common dividend being covered by more than 2x, but also in the Debt/EBITDA ratio rising above 4x (this should be acceptable as its current Debt/EBITDA covenant is 5.5x).

Source: Company Presentation, Author Estimates and Calculations

However, in our 12% Adjusted EBITDA decline scenario, even though you are cutting the dividend in half, you still need to find $455 worth of financing in 2020 (the $450 debt roll plus a -$5 million shortfall).

Working backwards I’ve also created a third scenario that asks, assuming you eliminate the common dividend altogether, how much could Adjusted EBITDA fall and you still have positive net cash flow and a Debt/EBITDA ratio under 5.5x? The answer turns out to be about 25%. Expected EBITDA could fall 25% and you would still be okay provided you eliminated the common dividend and borrowed the additional $500 million already announced in order to roll 2020 debt. I therefore reason that unless you foresee an Adjusted EBITDA decline greater than 25%, the cumulative preferred will probably not be cut.

NuStar finished 2019 at a solid 3.9x Net Debt/EBITDA (vs. 5.5x covenants). It also has $720 million of remaining liquidity available on its credit facility and the $750 million in debt announced Monday. This plus the scenarios modeled above make me confident it is not facing an existential threat, nor do I see it needing to dilute common shareholders. However, because I see a 12-25% reduction in Adjusted EBITDA a somewhat likely scenario, I am more comfortable moving up the stack than investing in the common.

Trading Considerations:

NuStar has three preferreds – NS.pA, NS.pB, NS.pC – and an exchange traded baby bond, NSS. All the preferred are fixed to floating and cumulative. The notes have already moved to their floating stage. The preferred provide tax deferral advantages in a taxable account, while the NSS baby bonds pay interest and thus are best held in an IRA. Thus, which might be best for you is going to depend on what kind of account you are utilizing, your particular risk tolerance level, and the relative pricing of all four choices at the time you are making a decision.

I strongly favor floating and fixed to floating securities as I see long-term inflation a real risk when the US and other governments around the world are doing this:

At time of writing, NS.pC can be bought for $15.15. This is a 9% cumulative preferred which goes floating in December 2022 at L + 6.88%. That represents a 14.9% simple yield on current price, and a 13.3% yield if Libor happened to be the same in 1.18% in December 2022 as it is now. On top of this, there is a potential 65% capital gain to par. You do however get a K-1 when holding the preferred (or common).

NSS* has already gone to a floating rate, and as a baby bond is considerably less risky than the preferred. Payments can only be modified or canceled by agreement with note holders or in bankruptcy. Furthermore, should a bankruptcy ever occur as an unsecured note, you will get a lawyer representing your interests and is classified as part of the debt settlement (not the equity group). My experience is bankruptcy debt holders typically get all the assets while equity holders, including preferred equity holders, usually get the shaft.

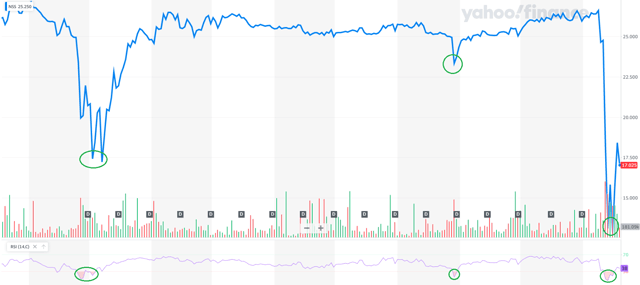

Currently, NSS trades for $17.30. Historically, picking them up whenever they trade below a 30 Relative Strength ‘RSI’ has been opportune.

Source: Yahoo Finance

Since these notes are already floating at L +6.374% (=7.6% or $1.89 per year), they currently represent a 10.9% yield, and 45% potential price gain to par. Thus, they offer 4% less yield and 20% less potential capital gain than the preferred. Whether that is worthwhile to you depends on your personal situation.

*Note: The notes are not due until 2043, so the yield to maturity isn’t particularly meaningful. You will not receive a K-1 on NSS as it is interest. The income on NSS is fully taxable for US citizens at their marginal tax rate, so these securities are best held in an IRA.

Is This an Income Stream Which Induces Fear?

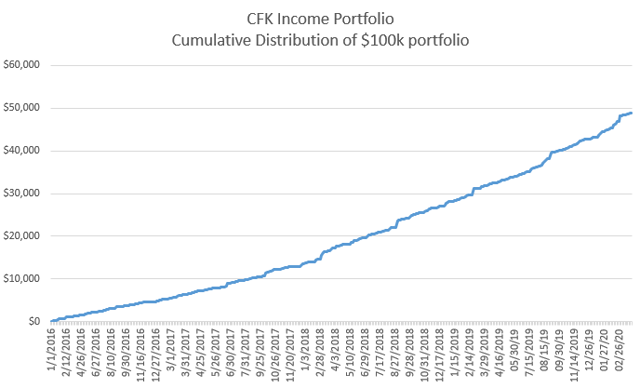

Data verified by E*TRADE

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7-10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. Portfolio’s prices fluctuate, the income stream not so much.

By focusing on underlying corporate cash flows, and management capital allocation and alignment, then overlaying sound money management strategy, we help reduce portfolio income volatility. Capture an income stream that helps you stay logical when times are tough. Start your free two-week trial today!

Disclosure: I am/we are long NSS, NS.PC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was released earlier on Cash Flow Kingdom with NS, NSS, and NS.PC at lower prices. I have attempted to update all figures as of close 4/20/2020 but may have missed something. I do not know your goals, risk tolerance, or particular situation; therefore, I cannot recommend any specific investment to you. Please do your own additional due diligence.

Be the first to comment