Wirestock/iStock via Getty Images

Introduction

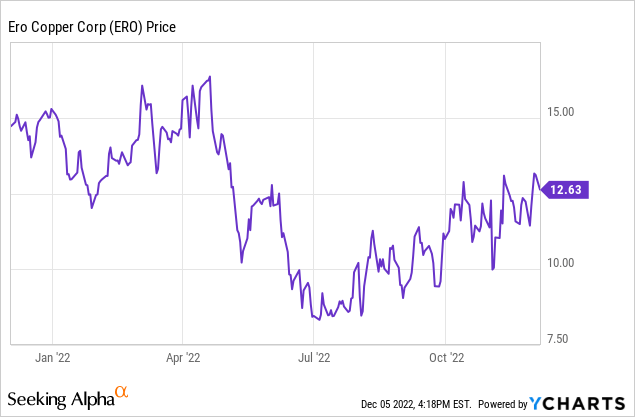

Ero Copper (NYSE:ERO) (TSX:ERO:CA) is a copper and gold producer in Brazil and the cash flow from the existing mines is helping to co-fund the development of a new copper mine which should be in production soon. Ero Copper was able to expand the reserves and resources on its Caraiba copper project and this should underpin a mine life of about 20 years based on the current resources and reserves.

A decent set of results for the third quarter

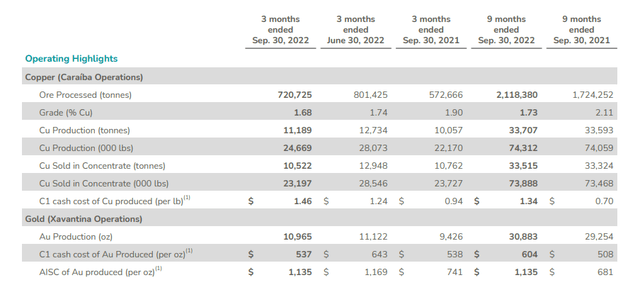

During the third quarter of this year, the company produced just under 25 million pounds of copper at a C1 cash cost of $1.46 per pound. The gold operations are also still nicely humming along with a production of just under 11,000 ounces at an AISC of just over $1,100 per ounce. While the Xavantina gold operation isn’t a big money maker, it still generates a decent cash flow.

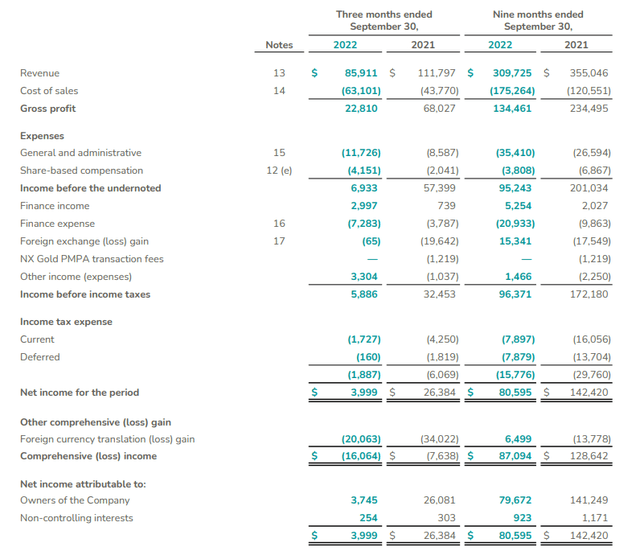

The total revenue in the third quarter was approximately $86M, which includes a negative pricing adjustment based on the provisional prices from the previous quarter to the tune of just over $4M. The gross profit during the quarter came in at $22.8M due to the combination of a lower revenue (as the copper price wasn’t very strong during the quarter) and higher operating expenses (which included a non-recurring operating cost of $6.5M related to the purchase of third party concentrate).

This weighed on the results, and the pre-tax income fell to just under $6M resulting in a net income of approximately $4M. Approximately $3.75M of that bottom line profit was attributable to the shareholders of Ero Copper and divided over the current share count of 91 million shares, the EPS was US$0.041.

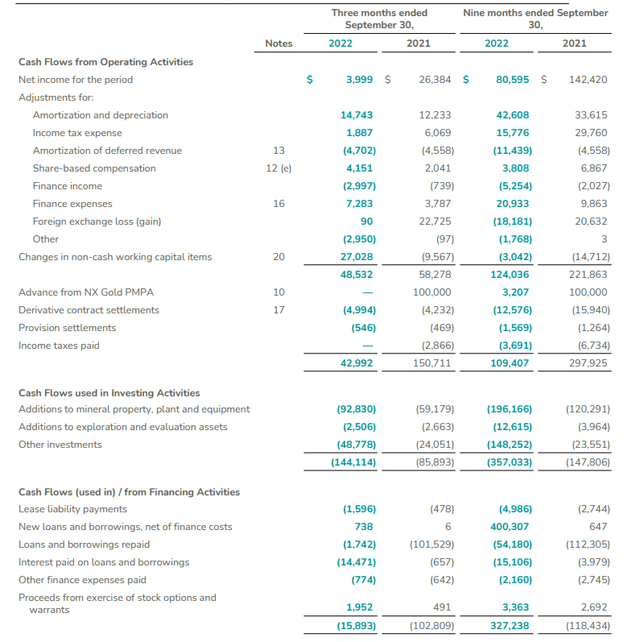

Fortunately the cash flow statement was a bit better although it’s clearly noticeable how the $27M working capital release had a very positive impact on the reported operating cash flow, which came in at $48.5M. On an adjusted basis (and after deducting the normalized quarterly interest and lease expenses), the adjusted operating cash flow was just $13M.

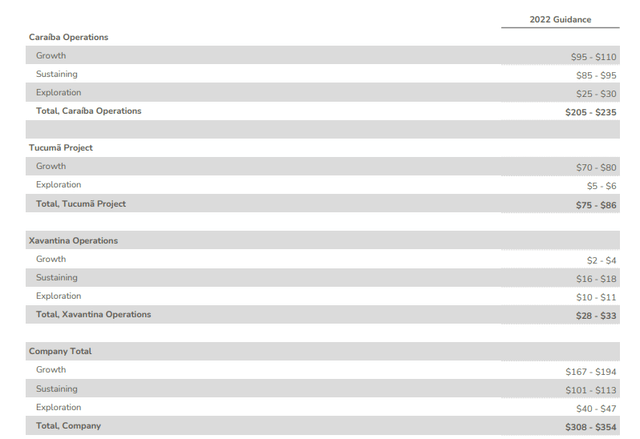

The total capex came in at in excess of $95M but the vast majority of the capex bill was related to the expansion program. The full-year sustaining capex is estimated at $101-113M while Ero also expected to spend $40-47M on exploration for a total sustaining capex of $140-160M, including capitalized exploration expenses.

As the copper price is currently trading at approximately $3.80 per pound, I would expect the financial performance in the current quarter to be better as every $0.25 increase of the copper price will boost the operating cash flow by about US$5-6M per quarter.

The investment in exploration is paying off

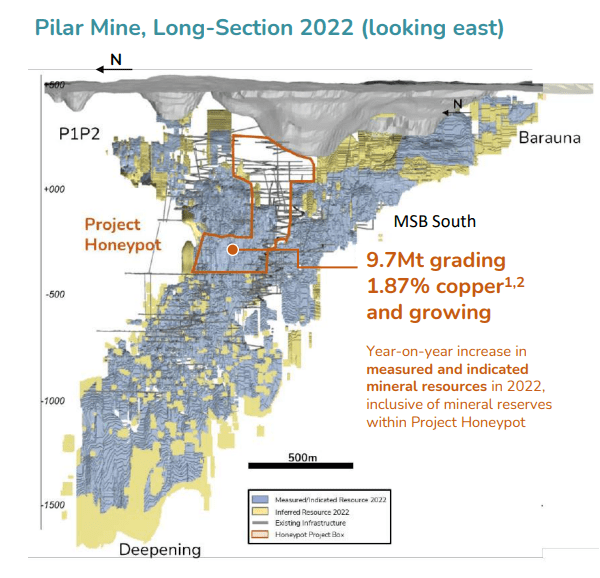

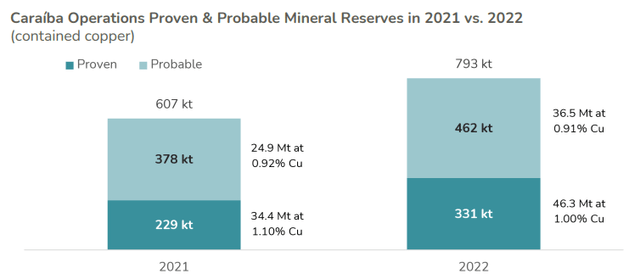

Ero Copper has never neglected its exploration activities, and that usually is a good move, and a business decision I fully support. The company recently released an updated reserve estimate for its Caraiba operations, and the total amount of contained copper has increased from 607,000 tonnes to 793,000 tonnes.

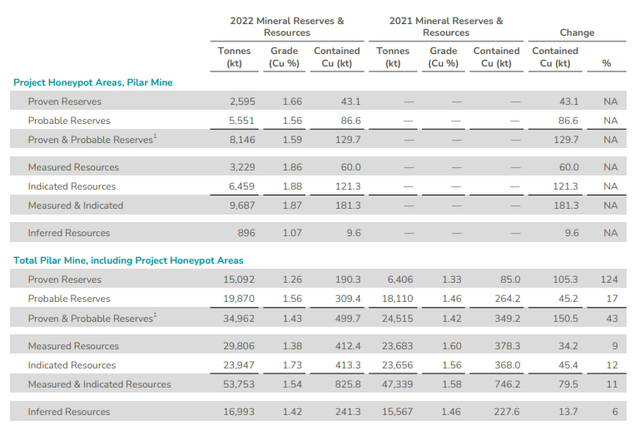

The updated resource estimate now contains just under 54 million tonnes at an average grade of 1.54% copper in the measured and indicated resource, with an additional 17 million tonnes at an average grade of 1.42% copper in the inferred resource category. And of the 54 million tonnes in the M&I resources, almost 35 million tonnes made it to the proven & probable reserve category.

That’s mainly thanks to the Honeypot areas which added just over 8 million tonnes of reserves based on just over 10.5 million tonnes in resources (across all categories).

Ero Copper Investor Relations

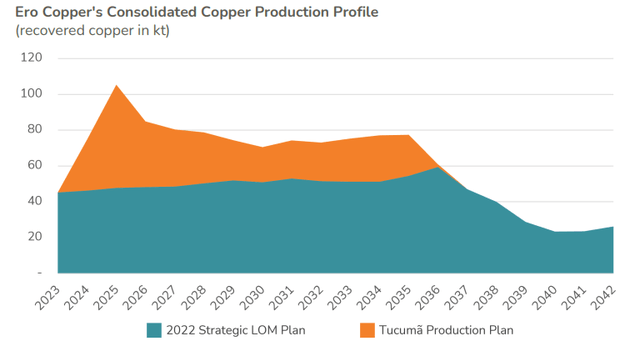

Considering the mill will be running at a capacity of 4.2 million tonnes per year from 2027 on, the current reserves underpin an 8-9 year mine life and the total mine life based on the current strategic plan, is now extended to 2042

The copper production profile will soon be expanded when the new Tucuma mine (previously called Boa Esperanca) will come online.

Investment thesis

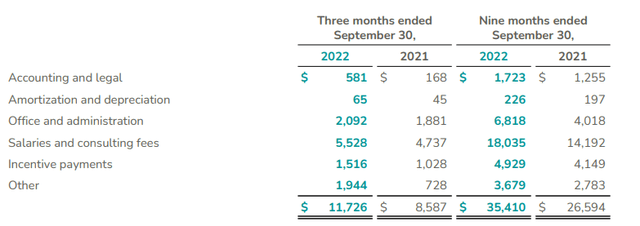

I currently have no position in Ero Copper. While I appreciate the company is a well-run entity and while I like to further increase my exposure to copper, Ero’s high overhead expenses are the main reason why I still have no long position in the company. I don’t know a lot of companies of Ero’s size with a G&A expense of in excess of US$10M per quarter. As the company increases its output and thus boosts its cash flows, the percentage of the gross profit going to G&A should decrease but in the third quarter, in excess of half (!) the gross profit was needed to cover the overhead expenses. Even when you look at the 9M 2022 performance, in excess of 25% of the gross profit was needed to cover the G&A related cash outflow.

And sure, a portion of the G&A is related to non-cash payments like share and option awards, but in my previous article I already explained why I wasn’t too keen on seeing the CEO and chairman each take home US$1.35M in cash and in excess of US$500,000 in share-based payments in 2021. Just to compare it with a larger mining company: Lundin Mining (LUN:CA) (OTCPK:LUNMF) produces 6 times more copper, yet the G&A expenses are only 30% higher. Capstone Mining (CSFFF) (CS:CA) produces 4 times more copper, yet its G&A expenses are 40% than Ero Copper.

I like the assets and the near-term production increase but the high overhead expenses are the main reason why I have no position in Ero Copper.

Be the first to comment