drnadig

Like many contributors and readers on Seeking Alpha, I find joy in researching stocks and managing my portfolio yet I still find it exhausting from time to time. Make it easier on yourself by choosing at least a few companies that you can buy and not worry about for years or even decades. Two companies that fit that bill are Microsoft (MSFT) and Visa (V), in a down market they are currently even more attractive.

Microsoft and Visa

Both of these companies are widely known and central to everyday life, this has led to significant outperformance for these stocks for the past decade. In most cases, continued outperformance is difficult to maintain as growth slows. However, MSFT and V are in a unique position to continue high growth well by strategically positioning themselves to lead our world into the future as we continue to move society forward.

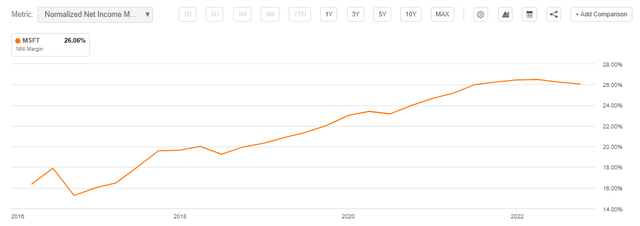

Microsoft is one of the greatest beneficiaries of the technological revolution, establishing a near monopolistic hold on essential applications for business and personal needs. Better yet, they even make the computers that use the software. Now that the company is a $2 trillion behemoth it would be fair to assume future growth may be limited, but MSFT has found a way to defy those assumptions. Continuous innovation and bold risks to charge into new markets and technology has resulted in a bright future including cloud services, gaming, and professional networking. The acceleration in revenue growth over the last 6-7 years has been astounding as the company expanded into these markets as shown below.

Revenue Growth (Seeking Alpha)

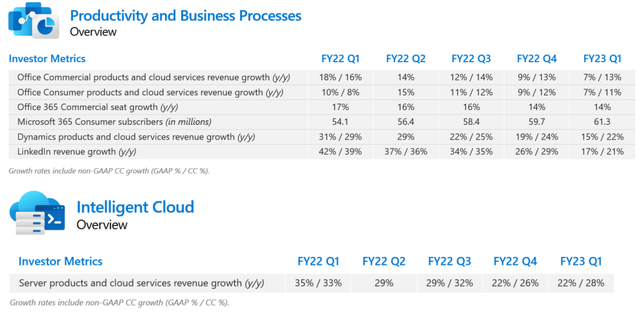

What makes this even more attractive is that this growth is showing no signs of stopping as revenue is estimated to exhibit strong double digit growth for the foreseeable future due to expansion of products and the fact that cloud services are arguably still in an early adoption phase. What really solidifies Microsoft as a portfolio cornerstone for the future is that these new products/services have significantly greater margins than legacy products, perpetually increasing cash flows as they pull in a greater share of total company revenue.

Microsoft Margin Growth (Seeking Alpha) Microsoft Product Growth (Microsoft Investor Presentation)

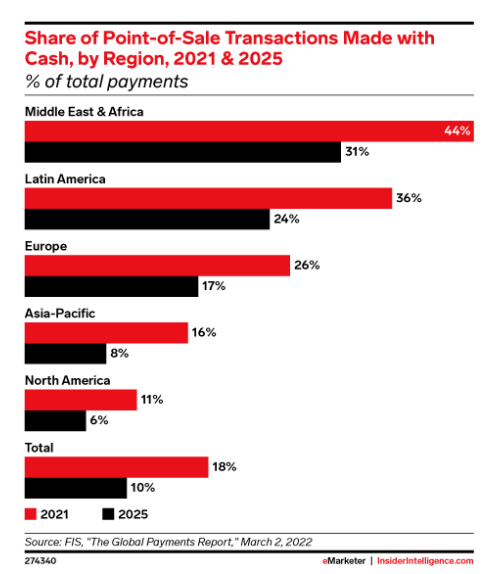

Visa has been one of the best performing stocks over the last ten years, more than doubling the returns of the S&P500. This is largely due to its world-leading profit margins and growing worldwide credit card adoption. Surprisingly, credit card and cashless payment global adoption still has plenty of room to grow as many countries across the world still use cash as a large percentage of total transactions.

Global Cashless Payments (FIS Global Payments Report)

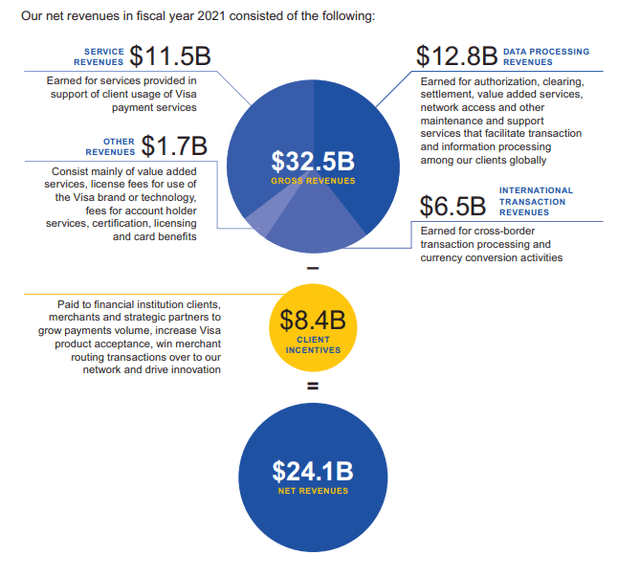

Not only does this mean there is potential for hundreds of millions of new customers in the next couple of years, but there will be an additional major benefit that could be a major tailwind. Visa will gain service and data processing revenues from these new users but this is will also significantly boost the number of cross-border revenues that are garnered via transactions completed in which the buyer and seller are located in different countries. This powerful network effect could lead to exponential revenue growth, cross-border transactions only accounted for 27% of total revenues last quarter. Additionally, the ease of scaling will lead to greater profit margins as total payment volumes increase.

Visa Revenues (2021 Visa Annual Report)

One item to address when discussing Visa is the threat of new technologies. While cryptocurrency is most commonly noted as a major threat to legacy payment processors like Visa, this concern is at least somewhat misplaced. Instead of rivaling crypto, V has chosen to partner with it by adopting payment options with cryptocurrency and embracing the transfer of funds between crypto exchanges. While there still is the long term threat of becoming obsolete due to rising popularity of this new currency and reduced need for payment processors, it is encouraging to see there is a willingness and desire to adapt. Furthermore, I believe we are still several years away from a serious threat from this technology.

Metrics

It should be no surprise that these two trade at higher than average multiples but justifiably so. If you want higher quality and better returns you’ll have to pay more for it. In order to paint a clear picture, let’s compare the Visa and Microsoft to the S&P 500 average for several metrics. Important ones to look at include revenue growth, earnings growth, net income margin, and free cash flow yield. For those unfamiliar with free cash flow yield, it is simply the annual free cash flow divided by the market cap for a given company. It is a useful tool in evaluating the operating strength and financial health of a company. All data is sourced from Nasdaq.com, Seeking Alpha, and New Constructs LLC.

| SPY | MSFT | V | |

| Revenue Growth (5y CAGR) | 7.75% | 15.66% | 9.94% |

| EPS Growth (5y CAGR) | 12.13% | 28.92% | 20.11% |

| Net Income Margin (TTM) | 11.04% | 29.84% | 51.03% |

| Free Cash Flow Yield (TTM) | 2.04% | 3.32% | 3.94% |

It is apparent that both of these blue-chips have greatly outperformed the weighted average of S&P 500 companies. With projected strong growth in the years ahead for each Microsoft and Visa, it seems reasonable that a level of outperformance could continue into the future. The row that sticks out the strongest to me is the free cash flow yield due to the fact that this value reflects the percentage of additional returns that a company can offer outside of net income growth. If Visa decided to return the entire free cash flow to shareholders they could do so via dividends, share buybacks, or a combination of both and deliver 3.94% in total returns to shareholders even if net income growth was flat. Of course, there are other great uses for free cash flow that can greatly benefit the company such as paying down debt, expanding operations, and making acquisitions. Either way you slice it the higher a company’s free cash flow yield is, the greater their ability is to deliver returns to their shareholders.

Potential Future Returns

I would be the first to one to say that we should take analyst estimates with a grain of salt but for the sake of looking at potential future returns I will take current analyst estimates into account. In the last 5 years, reported revenues were actually largely in line with analyst predictions for both Visa and Microsoft with 4 beats and 1 miss each so that adds some confidence to this exercise.

Assumptions:

- Both V and MSFT grow revenues in-line with current 3-year analyst estimates

- Net income margins for both companies stay flat and net incomes reflect growth that is identical to revenue growth. In reality NI margins have been consistently expanding, making this a conservative model

- Free cash flow yields remain unchanged and are fully returned to shareholders

- S&P 500 CAGR is assumed to be 10%, consistent with historical returns

| V | MSFT | SPY | |

| Revenue Growth (3y Fwd. CAGR) | 10.49% | 11.44% | —– |

| Free Cash Flow Yield | 3.94% | 3.32% | —– |

| Total Returns (Annualized) | 14.43% | 14.76% | 10% |

| 3-year Cumulative Total Returns | 49.9% | 51.2% | 33.1% |

If revenues estimates and free cash flow yields remain relatively unchanged, the next three years may be very rewarding for owners of these high quality stocks with substantial outperformance of the market benchmark.

Conclusion

Personally, these are two of my largest positions and I intend to further increase my concentration in each over the coming years to make a solid base for future returns. Knowing that I have high-quality stocks at the center of my portfolio, it makes it easier for me to scoop up a more speculative pick or to tailor the rest of my portfolio towards other goals such as increasing my dividends by adding high yield stocks or REIT’s. Everyone has different opinions and strategies but it is hard to deny the value Microsoft and Visa can add to a portfolio especially since they appear to be rather common inhabitants of nearly all major hedge funds and legendary investor portfolios.

Be the first to comment