shapecharge

The inability of the U.S. Congress to pass legislation that could’ve broken Big Tech monopolies before the August recess along with the release of decent earnings results give Alphabet’s Google (NASDAQ:GOOG)(NASDAQ:GOOGL) an opportunity to continue to successfully create additional shareholder value in the following quarters. While the upcoming EU regulations could nevertheless hurt the company’s ability to aggressively expand within Europe, the possible negative outcomes from those regulations would be felt no sooner than 2023, if ever. Therefore, Google for now has additional room for growth in the following quarters without worrying too much about the worsening macro-economic environment.

U.S. Congress Misses The Initial Deadline

Last month I wrote an article about Google which explained how the upcoming U.S. and EU regulations could break the company’s monopoly in the digital space. The first legislation called The American Innovation and Choice Online Act was aimed at preventing companies such as Google to give preferences to their own services and products on their platforms. In case of a violation of this rule, they could face a civil penalty of up to 10% of their U.S. revenue and even be forced to forfeit profits for continuous violations. That bill is still stuck in the Senate to this day after passing the Judiciary Committee at the beginning of the year. The second legislation is called Competition and Transparency in Digital Advertising Act, which aims to disrupt the digital advertising business by preventing companies such as Google to act as a buyer and a seller in an ad auction at the same time. That bill is stuck in the Senate Judiciary Committee to this day.

I’m writing an update about those bills since a month ago there was a real possibility that they were about to go to the Senate floor for a vote, as the Majority Leader Chuck Schumer was open to this idea in case there was a consensus among the Senators.

However, in the next couple of days, the U.S. Congress is about to enter an August recess, which makes it impossible to pass those bills this summer at the very least. While a lot of tech-related bills are about to enter the floor for a vote both in the Senate and the House of Representatives in the following days, those two bills are not on the schedule.

This is a major win for Google since the U.S. is its biggest market, which accounted for ~47% of overall revenues in Q2. While there’s a possibility that one of those bills will be passed during the fall, the chances of that happening are relatively slim. First of all, the original text of The American Innovation and Choice Online Act has already been changed. While the earlier version of the bill would’ve allowed smaller companies to bring suits against businesses such as Google if they violate the rules, the newer version of the text gives this opportunity only for several federal agencies to do so. Bloomberg reports that this was done to get Republican support behind the bill.

Even if the Senate will pass it later this year, there’s a possibility that it will be stuck in the House of Representatives for a further debate. Considering that it’s going to be a middle of an election cycle by that time, election issues will be at the center of the attention of legislators of both parties, which will make it harder to pass any new major bipartisan bill this year. There was a chance to do so before the August recess, now it’s less likely.

However, even if it somehow passes after being debated in both chambers of the U.S. Congress or passes next year under a new U.S. Congress, Google will still have several months to prepare since it will take several months for the DOJ and the FTC to issue guidance on how to implement new rules. Therefore, even in the worst-case scenario, which is unlikely to materialize at this time, Google’s financials are not going to be negatively affected in the following quarters.

The EU Doubles Down

Another major risk for Google comes from Europe. As I’ve stated in the previous article on the company, the EU is more united in its goal to regulate Big Tech than the United States. A couple of weeks after my article came out, the EU Parliament passed by an overwhelming majority the Digital Services Package, which includes two separate legislations called Digital Markets Act and Digital Services Act. Their text is similar to the text of the U.S. legislation, as it also includes provisions to prevent companies such as Google to give preferences to their own services and products on their platforms, but at the same time, it also prompts the Big Tech to better moderate content on their platforms to tackle misinformation. In case of a violation of a Digital Markets Act and/or Digital Services Act, companies face fines of 10% of their total worldwide turnover and/or 6% of their total turnover, respectively.

At this stage, the European legislations will likely be approved by the member states later this year and become laws in 2023, since the EU Parliament has already voted for them.

However, the good news for Google is that the EU Commission will likely face several obstacles, which could prevent it from fully enforcing new legislation even if they’re going to be approved by the EU member states later this year. First of all, the European Commission’s task force that will be responsible for finding the violators of the possible new digital laws will consist of only 80 officials, which is unlikely to be enough to enforce the new rules. Last month, an EU privacy chief admitted that the economic block is not even fully enforcing the GDPR law, which was passed back in 2016, against Google and its peers due to the independent actions by regulators of member states that are not aligned with Brussels. The same could happen with enforcing the Digital Services Package if a regulator of a member state prevents the EU Commission from ensuring that there are no violations.

At the same time, even if Google fails to comply with the possible new laws and the EU Commission fines it for violation, the company will be able to refuse such a decision and bring the case to the European Court. It would take years for the issue to resolve in such a scenario and Google knows it well, as some of its cases against the EU Commission fines are still being heard in court years after those fines were imposed. Therefore, while the new EU regulations are the only major risk to Google’s long-term growth at this stage, in case of any new fines the company will use an arsenal of various legal tools to try to avoid legally paying them.

Earnings Results Should Give A Near-Term Boost To The Stock

At this stage, the possible implementation of new digital rules is the only major threat to Google’s growth, which the company will be required to tackle in the following years. In the meantime, Google still has time to better adapt to the new reality and the latest decent earnings results show that despite the challenging macro environment, its business is not as exposed to the declining advertising market as companies such as Snap (SNAP), which should give a near-term boost to its stock.

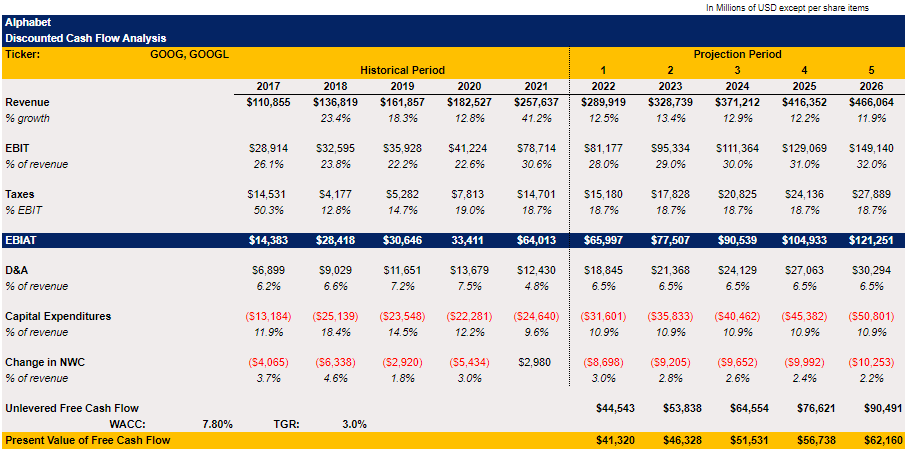

To figure out which levels Google’s stock can realistically appreciate to, I decided to do a DCF analysis. When forecasting Google’s future revenues I took the analysts’ consensus growth rate as a base case and at the same time increased the company’s EBIT in later years, as there’s a possibility that Google will be able to continue to improve its margins over time thanks to its leverage in the digital ads market. All the other metrics in the model are mostly either in-line with the latest historical period or are averages of previous periods.

Google’s DCF Model (Google’s Earnings Reports, Own Assumptions)

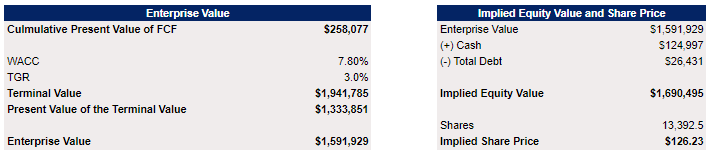

WACC in the model is 7.8%, while the terminal growth rate is 3%. The equity value of Google in the model stands at $1.7 trillion, which translates to a fair value of $126.23 per share.

Google’s DCF Model (Google’s Earnings Reports, Own Assumptions)

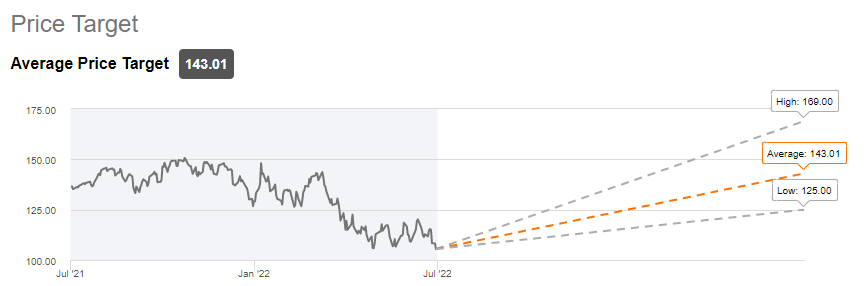

Even though my target price is below the street consensus of $143.01 per share, it still shows an upside of ~12% from the current market price. Given the latest developments, Google can reach my model’s price target in the following months due to the lack of major threats in the near term.

Google’s Average Price Target (Seeking Alpha)

The Bottom Line

Decent Q2 earnings results along with the inability of the U.S. Congress to pass legislation that targets Google before the August recess are positive developments for the company and its stock. While the U.S. will be busy with midterm elections, the EU member states are nevertheless likely to approve the new regulations that will become laws in 2023. This leaves some time for Google to prepare, although its financials are unlikely to be impacted in the following quarters due to the reasons stated above in this article. In the meantime, Google’s stock has a possibility to appreciate and create additional shareholder value, as there are no major near-term threats that could prevent its business from growing at this time.

Be the first to comment