hapabapa

From the outside, C3.ai (NYSE:AI) is increasingly difficult to value based on the shift to the consumption-based pricing model. The enterprise AI application software company will now boost the amount of customers while reducing the total contract values, with the goal of boosting revenues over time. My investment thesis is Bullish on the stock trading close to the lows, loaded with cash to build the new pricing model out.

Good Start

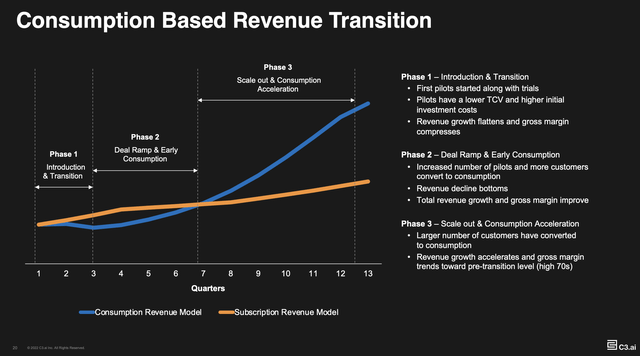

Back in FQ1’23, C3.ai switched the business to a consumption pricing model, with the initial phase involving early adopters and high investment costs. The company is now quickly shifting into Phase 2 where deals start to ramp and early consumption builds with a major inflection point in a few quarters.

Source: C3.ai FQ2’23 presentation

In FQ2’23, C3.ai signed 25 new customers, up from 12 customers in the prior year period. Last FQ2, the AI company singed a massive $10+ million deal, but C3.ai had limited contract flow with the average contract value at a very large $19 million.

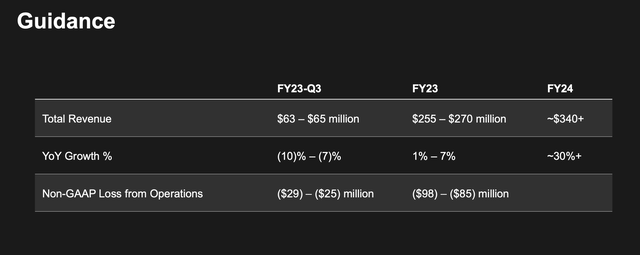

The company reported FQ2’23 revenue of only $62.4 million, up 7% from $58.3 million last year. The amount fell far below peak revenues $72.3 million in FQ4’22 and were down sequentially. C3.ai even guided to FQ3’23 revenue of $64.0 million, down up to 10% from last year.

Source: C3.ai FQ2’23 presentation

The important aspect here is the guidance for revenues to sequentially start growing again. As C3.ai builds up the consumption revenue base, the AI software company will start building a growing revenue funnel again versus the need to sign large subscription deals. The new customer onboarding expands with the much smaller initial contracts without the large commitments.

On the FQ2’23 earnings call, CEO Tom Siebel discussed the accelerating growth inherent in ramping up the new consumption-based pricing model:

We’d expect in the other quarters, I mean, this should be in order of magnitude larger than we’re doing now. I think we did, what, 13 or 15 last quarter in roughly half a quarter, because we announced the transition to this model about halfway through the quarter, and we did 15 in about half a quarter.

So basically, it’s really number — we’re really looking at a number of customers, Brad, and then we’re looking at how far we — how rapidly they grow the use of the products. If in fact, we get in order of magnitude more customers, and they continue to grow their use as our customers have in the past, and you know we’ve modeled this very carefully, I mean, we get out there three, four, five quarters. This revenue line should accelerate pretty dramatically.

Nearly 70% Cash

C3.ai ended the quarter with a massive cash balance of $859 million. The stock only has a market cap of $1.3 billion, leaving the enterprise value at ~$500 million.

Not only is the cash position at nearly 70% of the market cap, the management team remains comfortable with the prior guidance for FY24 revenue of $340 million for 30% growth. A lot of corporate business model shifts take far longer to sort out, but C3.ai already forecasts being full speed ahead by next year.

The company lost $15.0 million in FQ2, but the forecast is for a bigger FQ3’22 loss of $27.0 million. The large cash position won’t be fully credited to the valuation as long as the company is forecasting annual losses of $100 million.

With gross margins of 77%, C3.ai should be able to substantially cut the operating losses in the year ahead as forecast. The company has a goal of being profitable and cash flow positive by the end of FY24. To achieve the profit goal, the company would have to cut the losses in half by next year and drop around 60% of additional revenues to the bottom line.

The best part of the story here is that the cash position provides downside protection while a business that returns to 20%+ growth could obtain a far higher EV/S multiple as follows with an assumption the cash balance dips to $750 million:

- 6x EV/FY24 revenues of $340M = $26

- 8x EV/FY24 revenue of $340M = $32

With the stock at just $12, C3.ai has substantial upside potential from executing on the AI growth opportunity. The company has long projected these fast growth rates since going public without hitting his target lately causing the stock to fall over 93% from the peak price at $184 shortly after going public.

The stock could face a lot of overhead resistance with investors buying at much higher levels unloading C3.ai on any rallies. Not to mention, the macro environment could reduce demand below the forecasts for 30% growth.

Takeaway

The key investor takeaway is that C3.ai is an intriguing enterprise AI software company led by a software industry legend in Tom Siebel. The stock has been obliterated with the business model shift during a downturn in technology demand.

As the company rebuilds the revenue funnel, investors should load up on C3.ai, with the large cash balance providing a substantial cushion to downside risk even with the company burning a lot of cash now.

Be the first to comment